Labour manifesto 2024: Keir Starmer's money policies

The Labour manifesto has been launched in Manchester. Here's how its general election policies could affect your tax, savings and pensions.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Keir Starmer has launched the Labour manifesto in Manchester.

The man who pollsters expect will be living in 10 Downing Street after the 4 July general election, said his party would "rebuild our country" and promised to "lay a new foundation of stability". He also sought to position Labour as the party of wealth creation.

Key policies the Labour Party is standing on include the Freedom to Buy scheme, plans to remove a VAT tax break from private school fees, and a commitment to keeping the state pension triple lock. However, what the party - and its key rivals the Conservatives - have not mentioned is that working tax hikes are baked in for the next Parliament.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Alongside this policy prospectus, Starmer has set out six steps his party would take if it forms the next government. These promise to deliver economic stability, cut NHS waiting lists, set up a publicly-owned clean power company, and more.

The opposition has consistently held a polling lead of around 20 points over the Conservative Party during the election campaign. In a bid to turn around the Tories' dire poll ratings, which put them only narrowly above Nigel Farage's Reform UK in some polls, Rishi Sunak has sought to attack Labour on its tax plans.

Sunak launched the Conservative Party manifesto on 11 June. We have also seen manifestos from the Liberal Democrats and the Green Party.

This article will be updated throughout the day.

Labour manifesto 'six pledges'

The Labour Party has made six pledges in its manifesto that it says would be its first steps if it wins the next election. The party has a history of presenting its policy ideas in this way – from Tony Blair’s five pledge cards in 1997 to Ed Miliband’s notorious “Ed Stone” tablet in 2015. Starmer’s promises include:

- Delivering economic stability

- Cutting NHS waiting times

- Launching a new Border Security Command

- Setting up a Great British Energy company

- Cracking down on antisocial behaviour

- Recruiting 6,500 new teachers

The party plans to deliver economic stability by following “tough spending rules”, it explains. The idea is to “grow our economy and keep taxes, inflation and mortgages as low as possible”, it adds.

Meanwhile, NHS waiting times will be cut by the introduction of 40,000 more evening and weekend appointments each week, the party promises. It plans to pay for this by cracking down on tax avoidance and non-dom loopholes.

Non-doms have also been a target for the Conservative Party. In his Spring Budget on 6 March, Jeremy Hunt announced plans to abolish the current tax regime for non-doms from April 2025. Labour has promised to “raise £2.6 billion over the course of the next parliament" including an initial £1 billion, by "closing the loopholes" in the Tories' non-dom plan.

Labour has also outlined plans to set up a Great British Energy Company – a publicly-owned clean power company. The party had also planned to introduce a £28 billion green investment pledge, but has scaled it back due to public spending concerns.

Labour says that its publicly-owned energy firm would “cut bills for good and boost energy security”. It plans to pay for it using a windfall tax on oil and gas companies.

Alongside these initial steps, the party has set out five "missions to rebuild Britain". These include kickstarting economic growth, making Britain a "clean energy superpower", cracking down on violent crime, "breaking down barriers to opportunity" and ensuring the NHS is "fit for the future".

What else is in the Labour manifesto?

Labour and tax policies

Given the Conservatives have repeatedly insisted that a Starmer government would push up taxes for working families by £2,000, there has been a lot of speculation about what the Labour Party’s tax plans actually are. Its manifesto promises to raise £7.4bn from closing down tax loopholes and tax breaks to fund a modest £4.8bn in spending commitments.

Pointing out that it’s the Tories that have upped the UK’s tax burden to a record high, Labour has insisted it will “not increase taxes on working people”. It says National Insurance, the basic, higher, and additional rates of income tax, as well as VAT, will not be hiked. But, it makes no mention of unfreezing income tax thresholds, which means people could still expect to be paying more in the tax due to fiscal drag.

Among the more eye-catching announcements that are in the manifesto but weren’t trailed beforehand are clampdowns on inheritance tax (IHT) and capital gains tax (CGT). Labour says it will “address unfairness in the tax system” by stopping people from using offshore trusts to avoid paying IHT. It says this would ensure that “everyone who makes their home here in the UK pays their taxes here”.

In terms of CGT, the party says it will close a loophole for private equity workers that allows them to treat performance-related pay as capital gains. It would mean the sector faces paying higher rates through income tax. The party has also recommitted to abolishing non-dom status and replacing it with a new scheme for those who are “genuinely in the country for a short period”.

Labour says it will be investing £855m a year into HMRC by 2028/29 to crack down on tax avoidance and evasion. This investment, coupled with its clampdown on tax loopholes, would raise £5.2bn a year by the end of the Parliament, it claims. Meanwhile, closing the carried interest loophole would raise £565m for commitments, such as recruiting 8,500 new mental health staff.

The ending of the VAT exemption and business rates relief for private schools would raise more than £1.5bn, Labour says. This money would be put towards 6,500 new "expert" teachers, Ofsted reform, and 3,000 new nurseries, it claims.

Other tax announcements include capping corporation tax at 25% for the entire Parliament to give investors “certainty”, a new business rates system that would “level the playing field” between high street and online firms, and a business taxation “roadmap” that would be published soon after the election. It also says it will do just one major fiscal event per year - the first of which could take place in mid-September.

Labour's pension plans

Labour had already pledged to retain the triple lock on state pensions before it published its manifesto. The state pension is one of the clear dividing lines between the party and the Conservatives, who have committed to introducing the triple lock plus if they win.

Starmer’s party has also said it will reform workplace pensions in a bid to “deliver better outcomes” for savers and retirees. It plans to launch a pensions review that will be tasked with working out how “security in retirement” can be improved, and how pension funds could be incentivised to boost investment in the UK economy.

In its Financing Growth document, published in January 2024, it said it would work with industry and consumer groups to ensure savers are getting the best possible returns. This document also suggested Labour could look into a scheme that would get defined contribution pension schemes to invest a proportion of their assets into UK growth assets – split between venture capital, small-cap growth equity, and infrastructure investment. This would be modelled on the French Tibi scheme.

While it wasn’t mentioned in their manifesto, the Conservatives have previously said they would move private pensions to a ‘pot for life’ model. They recommitted to the measure in the 2024 Spring Budget as part of a bid to simplify workplace pensions.

Sir Keir Starmer features heavily in Labour's manifesto

Property - what Labour is promising

Labour targeted first-time buyers in the run up to its manifesto launch. Its Freedom to Buy scheme aims to extend the existing mortgage guarantee scheme, while the party has also set a target to build 1.5 million homes during the next Parliament - 100,000 fewer than the Conservatives.

When announcing Freedom to Buy, the party said it would tax foreign buyers to fund extra capacity in the planning process. The manifesto has provided extra detail on this plan. It says Labour will increase the rate of the stamp duty surcharge, which is paid by non-UK residents. Although this move would only raise £40m a year, it says this would be double the amount needed to hire 300 new council planning officers. The Conservatives say they would make existing first-time buyer stamp duty tax breaks permanent if they are elected back into power.

In terms of new builds, the manifesto does not go as far as the Lib Dems and Green Party with its ambitions to create new standards. Instead, it says a Labour government would push for quality housing to be the “norm not the exception”. It insists it will move to ensure new homes are high-quality, well-designed, and sustainable, as well as create places that bolster climate resilience and boost “nature recovery”. Unlike the Tories, who say they would scrap nutrient neutrality, Labour makes a more vague promise to “unlock the building of homes affected by nutrient neutrality without weakening environmental protections”.

For the renting sector, Labour says it would “immediately” abolish Section 21 ‘no fault’ evictions. Legislation to scrap this clause in rental contracts was lost when Parliament was dissolved on 30 May, despite having been a key Conservative pledge from its 2019 general election manifesto. Private landlords will also need to meet minimum energy efficiency standards by 2030, although what this minimum will be is unclear.

One of the other stand-out rent policies the party has come up with is the extension of Awaab’s Law to the private sector. This would require landlords to investigate tenant complaints of damp and mould in their homes within a certain timeframe. The manifesto also says it wants to stop private renters from being exploited and discriminated against, “empower” them to challenge “unreasonable rent increases”, and move to “decisively raise standards”.

Finally, Labour says it will shut down the leasehold system. Commonhold will become the “default tenure” for flats, while “unfair” maintenance costs would be ended. Watered down leasehold reforms made it through Parliament just before it was dissolved in May.

Public spending commitments

The manifesto promises that Starmer’s party will only make spending commitments that are based on “sound money and economic stability”. It also accuses the Conservatives of having made unfunded tax cuts and spending promises “at a scale beyond the mini-Budget.

Labour says it will implement a series of fiscal rules that will abide by when making decisions in government, should it get elected. These rules are: a pledge to ensure day-to-day costs are covered by revenues, and a requirement that the national debt is falling as a share of the economy by the year of the next election. It adds that it will not employ an austerity agenda.

Other plans include strengthening the role of the Office for Budget Responsibility (OBR), and a commitment to keeping mortgage rates “as low as possible”. The manifesto underlines the independence of the Bank of England, adding that the UK central bank will continue to have a 2% inflation target.

Banking and investment

As well as saying that, Labour will create economic certainty to encourage investment in the UK, the manifesto adds that Labour wants to “support innovation and growth” in the financial services sector. It says it will do so by supporting new tech developments, such as open banking and open finance, as well as ensuring that regulation is “pro-innovation”.

To get more investment into the UK, the party says it will create a National Wealth Fund - an idea it had previously announced. This mechanism will get £7.3bn over the next five years, or around £1.5bn a year on average, and will have a target of raising three pounds in private investment for every one pound of public investment. The money will then be put towards national infrastructure projects.

Labour says this measure will be funded by a time-limited, 'loophole-free' windfall tax on fossil fuel giants that it estimates will raise an average of £1.2bn a year. It says it will also borrow £3.5bn “within fiscal rules” to meet other green spending commitments, such as its Great British Energy and Warm Homes plans.

In terms of measures for individual investors, there had been an expectation that Labour would bring in a ‘Tell Sid’ style campaign to boost retail ownership of British businesses akin to the NatWest share sale. However, nothing along these lines has been mentioned in the manifesto.

Elsewhere, the party wants to get the financial services industry to play a big role in getting "trillions of pounds in private capital" to address climate change. It also wants to make the UK the "green finance capital of the world". Part of this will see UK-regulated financial institutions – like banks, asset managers, pension funds, and insurers – as well as FTSE 100 companies, required to "develop and implement credible transition plans" that align with the aims of the Paris climate agreement.

Great British Energy set up

Labour’s biggest energy policy is to set up Great British Energy (GBE). Costing £8.3bn (£1.7bn a year, on average) over the course of the next Parliament, the publicly-owned clean energy producer will invest in new technology alongside industry and trade unions, the party says. It will also help to support capital-intensive projects.

The manifesto claims GBE will create jobs and supply chains across the UK, with Scotland being a “powerhouse” for the company. As has already been announced, the nation will also be the headquarters of GBE.

One of the other key energy measures Labour plans to implement is its Warm Homes plan, which - in tandem with its other energy measures - will cut energy bills by “hundreds” of pounds, it says. At a cost of £1.1bn a year, the party wants to upgrade the energy efficiency of five million homes over the course of the next Parliament. It will do so through grants and low-interest loans, which will go towards improving insulation and installing solar panels, batteries and low-carbon heating systems.

The party adds it also wants to work with banks and building societies to provide additional private finance that will allow homeowners to bring in home upgrades and green heating systems.

In terms of energy bills themselves, Labour wants to introduce a “much tougher system of regulation” to protect consumers. For example, it says it will ensure “automatic customer compensation for failure” is paid out. Standing charges are also in the party’s firing line.

What’s been the reaction to the Labour manifesto?

The manifesto has generally been viewed as a cautious document that’s light on detail. Furthermore, most of the major personal finance announcements had already been unveiled before it was launched. For example, the manifesto’s sections on Great British Energy, Freedom to Buy and the triple lock only added a little bit of extra detail on what had already been announced.

But the document’s tight fiscal constraints and big spending plans for some key areas, like the NHS, has raised questions about how Labour will avoid imposing austerity on at least some public services. The Institute for Fiscal Studies (IFS) director, Paul Johnson, accused the party of joining the Conservatives and Lib Dems in a “conspiracy of silence” on the economic difficulties they will face if they get elected into government.

He said: “On current forecasts, and especially with an extra £17.5 billion borrowing over five years to fund the green prosperity plan, this leaves literally no room – within the fiscal rule that Labour has signed up to – for any more spending than planned by the current government. And those plans do involve cuts both to investment spending and to spending on unprotected public services. Yet Sir Keir Starmer effectively ruled out such cuts. How they will square the circle in government we do not know.

“Yes, growth could surprise on the upside – and if it does, then the fiscal arithmetic would be easier. But if it doesn’t – and it hasn’t tended to in recent years – then either we will get those cuts, or the fiscal targets will be fudged, or taxes will rise.”

Johnson added: “This is a manifesto that promises a dizzying number of reviews and strategies to tackle some of the challenges facing the country. That is better than a shopping list of half-baked policy announcements.

“But delivering genuine change will almost certainly also require putting actual resources on the table. And Labour’s manifesto offers no indication that there is a plan for where the money would come from to finance this.”

Experts have also picked up on some of the pension announcements - or lack thereof - that have been included in the manifesto. While Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, said the document contained “no real surprises”, she said the lack of a mention for pension tax allowances could be a concern.

She said: “A notable absence from the manifesto is any detail regarding pension tax allowances. The Conservative manifesto says there would be no changes, allowing people to plan ahead and make full use of the allowances available to them. As yet, Labour has made no such promise, raising the prospect of things like the annual allowance or pension tax relief to be pruned back.”

Meanwhile, on capital gains tax, Myron Jobson, senior personal finance analyst at interactive investor, said: “The Labour manifesto did little to dispel speculation that capital gains tax could rise if the party comes to power.

“Regardless of what might or might not happen to the tax, making the most of tax efficient ISA and SIPP wrappers, which shields any interest, dividends, or capital gains earned from income and capital gains tax, remains a good strategy. This means your investments can grow without being eroded by taxes.”

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said Labour will “have to tread carefully on CGT” if it's serious about incentivising wealth creation. She added: “Starmer made it clear that nothing in the manifesto will need additional tax rises, but Labour has not ruled out changes to capital gains tax. At this stage, it’s difficult to know exactly what these changes might be, or whether they would be needed, but for investors with holdings outside tax wrappers, there could be an extra cost.”

In terms of the tax crackdown the Labour manifesto has committed to, Jason Hollands - the managing director at wealth management and professional services group Evelyn Partners - said: “In part this is about beefing up HMRC resources to investigate claims and crack down on evasion. But it looks like it could be accompanied by some sort of review into how tax reliefs are being used by savers, investors and households passing on wealth.

“Some quite legitimate tax reliefs tend to get portrayed as ‘loopholes’ when a government is in need of money, and it’s not unthinkable that a crackdown segues into a sally against reliefs that seeks to get rid or water down many of them. Labour has already suggested in the recent past that it regards some of the reliefs available from inheritance tax are too generous, particularly business and agricultural reliefs, so although there is nothing in the manifesto we could see some movement in that direction in the next Parliament.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

- Marc ShoffmanContributing editor

- Katie Williams

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

General election 2024: who’s in the Labour cabinet?

General election 2024: who’s in the Labour cabinet?A new Labour cabinet has been appointed by Keir Starmer after his party won the general election. Here’s the latest on who’s in it

-

What does the Labour election win mean for your money? Key manifesto points after landslide

What does the Labour election win mean for your money? Key manifesto points after landslideNews The Labour election win was not as large as some polls had predicted. But the new government’s majority will mean it can enact significant changes.

-

What would a Labour supermajority mean for capital markets?

What would a Labour supermajority mean for capital markets?The Conservative Party has warned that a Labour supermajority would be bad for democracy. But what impact could a big win for Keir Starmer have on the markets?

-

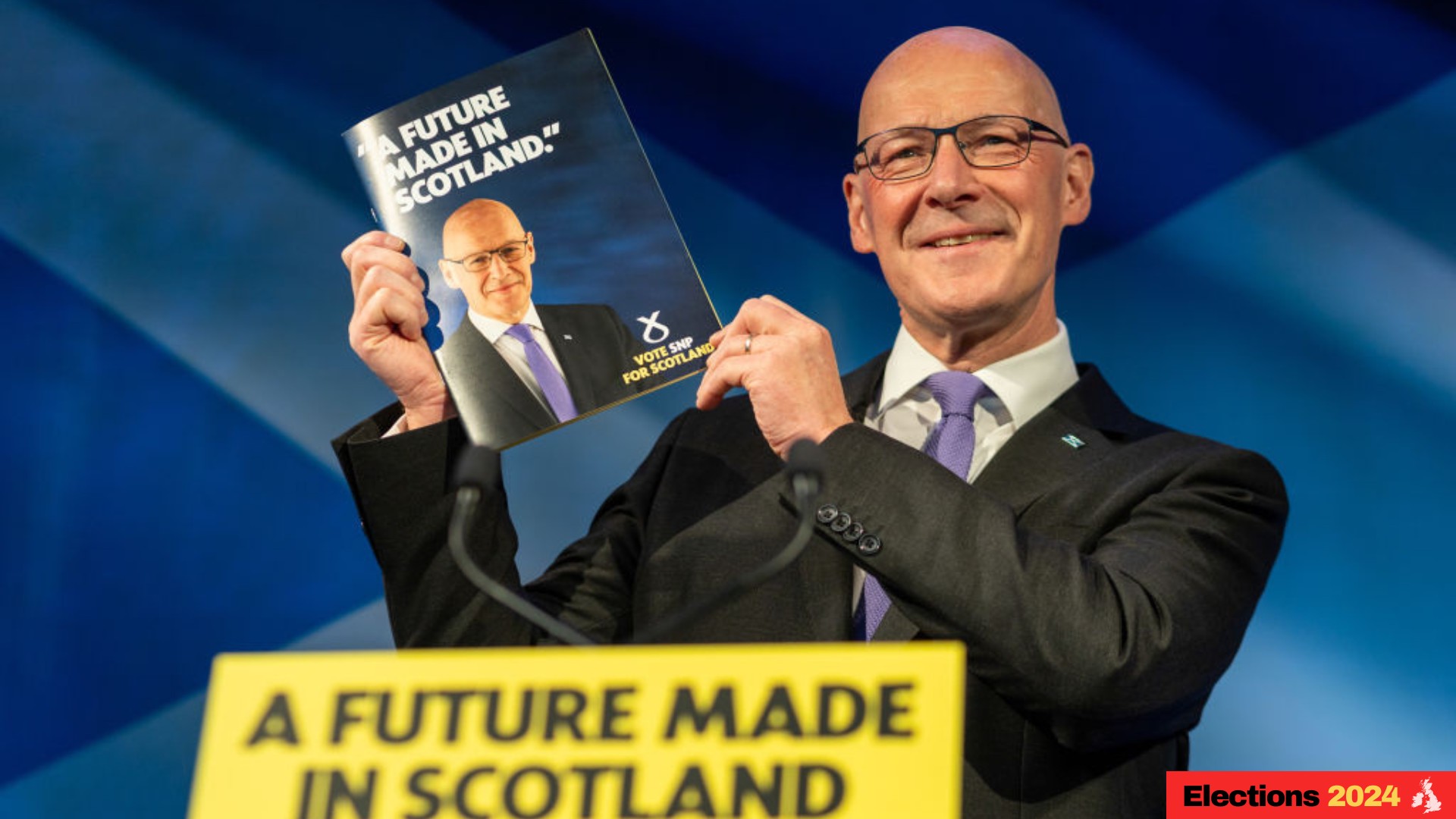

SNP manifesto 2024: what money policies did John Swinney announce?

SNP manifesto 2024: what money policies did John Swinney announce?The SNP manifesto has been launched in Scotland, and makes several key commitments, including a pledge to end austerity and a commitment to rejoin the EU.

-

Labour pledges to open 'at least' 350 banking hubs over next Parliament

Labour pledges to open 'at least' 350 banking hubs over next ParliamentNews The Labour Party claims it will ‘bring banking back to the high street’ if it forms the next government after the 2024 general election.

-

What does the Labour manifesto say about property? Key 2024 general election pledges

What does the Labour manifesto say about property? Key 2024 general election pledgesNews The Labour manifesto has made several promises around rental reforms, the leasehold system and housing market support. Here’s what a Keir Starmer government means for property.

-

Green Party manifesto 2024: key personal finance general election policies

Green Party manifesto 2024: key personal finance general election policiesA Green Party government would introduce a wealth tax, increase National Insurance Contributions for high earners, and move towards a universal basic income.

-

Conservatives pledge to raise high income child benefit threshold – how much could you save?

Conservatives pledge to raise high income child benefit threshold – how much could you save?News The high income child benefit charge threshold could be doubled to £120,000 if the Conservative Party wins the general election, Chancellor Jeremy Hunt has pledged.