Green Party manifesto 2024: key personal finance general election policies

A Green Party government would introduce a wealth tax, increase National Insurance Contributions for high earners, and move towards a universal basic income.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The Green Party manifesto for the 2024 general election has been launched, with the party making several eye-catching pledges.

Speaking from Sussex County Cricket Club’s ground in Hove, co-leaders Carla Denyer and Adrian Ramsay promised that a Green government would give nature legal rights and would renationalise water companies and the railways. Other pledges included plans to end the “hostile environment” faced by migrants and refugees, and to bring in a four-day working week.

The party also made several commitments that would affect personal finances, if it gets elected. As well as a wealth tax, it wants to implement a “maximum 10:1 pay ratio” for businesses and bring in a universal basic income.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The news comes after the Conservative Party unveiled its manifesto. On Tuesday (11 June), Rishi Sunak announced £17bn in tax cuts, including a further cut to National Insurance and the introduction of the state pension triple lock plus.

It also follows the Liberal Democrat manifesto launch on Monday (10 June), during which Sir Ed Davey’s party promised to make the UK a fairer place to live and work. Key pledges included closing capital gains tax loopholes and taxing share buybacks.

Labour is set to publish its manifesto on Thursday (13 June). Sir Keir Starmer’s party has already revealed a Freedom to Buy scheme and plans to add VAT to private school fees.

What’s in the Green Party manifesto?

Taxes

The Greens believe they can raise an extra £50bn to £70bn a year by reforming personal taxes. Pointing out that the number of billionaires in the UK has risen from 29 to 171 since 2010, they say they want to “fairly tax excessive concentrations of wealth” to fund public services and simplify the wider tax system.

One of its main policies is a new wealth tax. This levy would come in at a rate of 1% on all assets above £10m and 2% on assets over £1bn. The party has also targeted the wealthy by pledging to align the rates of income tax and capital gains tax (CGT). It also wants to align tax rates on investment income with income tax and National Insurance Contribution (NIC) rates for employees.

A further change to NICs that would be brought in if the party gets elected would see the main 8% rate extended beyond the upper earnings limit (£50,270). At present, anything above the threshold is taxed at 2%. This would mean that somebody earning £55,000 a year would pay £5.46 a week more in tax (£283.74 extra a year), while a worker on £65,000 a year would pay an extra £17 a week (£883 a year).

The Greens also want to equate the rate of pension tax relief with the basic rate of income tax. It says this means that everyone would only get a tax relief of 20%. The manifesto also includes a vague pledge to close inheritance tax loopholes that are exploited by the wealthy. Frequent flyers would face a punitive levy on their fares, while the party would seek to ban domestic flights where the journey can be undertaken in less than three hours by train.

But the manifesto does include one non-punitive tax measure. It says it would end VAT on cultural activities. This measure would lower the prices of, for example, museum admission and tickets to gigs in pubs.

Away from personal finance, the party's tax pledges include the introduction of a carbon tax. Set at £120 per tonne of emissions before climbing to a maximum of £500 per tonne over a 10-year period, it expects the levy would raise an extra £80bn. The policy, which is aimed at making decarbonisation a cheaper alternative for business compared to continuing with the status quo, would also initially align with other fossil fuel taxes, such as fuel duty and payments under the emissions trading scheme.

The manifesto promises to not hike the main rates of corporation tax, and says the Greens would continue a windfall tax on energy companies as well as bring in one on banks, which have benefited from high interest rates. These measures would raise £9bn a year by the next election, they claim. The Greens would also advocate for further windfall taxes in other sectors if extra profits caused by “market distortions” come in as being “risk free”.

As with the other parties, the Greens have earmarked more funding for HMRC to tackle tax avoidance and evasion. But, unlike the other parties, it has not set a figure for how much it plans to raise through this crackdown.

Pensions

The Green manifesto suggests the party would move away from the triple lock to a double lock system. It says it would ensure that pensions are “always uprated” in line with inflation and would keep pace with wage rises. It comes amid warnings that the triple lock system is unsustainable in its current form.

Public finances

In terms of a Green Party government’s stewardship of the economy, its manifesto says it’s “prepared to borrow to invest. It suggests the other major parties are “trapped in a self-imposed fiscal straitjacket” and following a “false economy”.

Justifying its stance, the party says investing in the climate now would “save vast costs in the future”. It adds that raising public services to a “decent” standard and ensuring infrastructure is “fit-for-purpose” are crucial for the future.

But, it also acknowledges that public spending can only go so far before it triggers “dangerous levels of inflation”. So, the party’s “overriding fiscal rule” would be to ensure inflation is not unduly increased by a Green government’s expenditure.

Green Party co-leaders Adrian Ramsay and Carla Denyer

Property

Since the Lib Dems made several ambitious green housing pledges in their manifesto, all eyes have been on what the Green Party would announce. Its manifesto goes slightly further.

The party wants all new homes to meet Passivhaus - or equivalent - standards, and says new builds must come with solar panels and heat pumps “where appropriate”. Existing properties will go through a 10-year “street-by-street” retrofitting programme to boost insulation to EPC B standard or above (at a cost of £29bn). They will also be able to benefit from incentives to install low-carbon heating systems (costing £9bn). The party says it will create 150,000 new social homes a year through new construction and refurbishing older housing stock, whilst ending ‘Right to Buy’ so that social housing is kept “in perpetuity” for local communities.

For renters, the Green Party plans to allow local authorities to be able to control rents if they become unaffordable for local people. It wants to ban no-fault evictions, and to give tenants the right to demand energy efficiency improvements. These improvements would be funded by taxpayer loans, which would be repaid by landlords. The party has also committed to creating “private residential tenancy boards” that would provide an “informal, cheap and speedy” forum to resolve disputes between tenants and landlords.

In terms of property taxes, the party aspires to move away from “regressive” council tax and towards a Land Value Tax, which would ensure that owners of the “most valuable and largest land holdings” would pay the most. It would progress towards this goal by first re-evaluating council tax bands and then undertaking a survey of all landholdings.

Banking and investing

The Green Party says it wants to make the financial services sector “a force for good” by directing finance towards progressive businesses. It says all UK banking licence holders will have to present an investment strategy that will set out a clear route to divestment from fossil fuel-related assets by 2030. Non-bank financial institutions, such as pension funds, will also have to remove fossil fuel assets from their portfolios by the end of the decade.

It also wants to alter the Bank of England’s mandate so that its efforts are centred on funding a transition towards a sustainable economy and mapping out a greener banking system - alongside its existing responsibility to keep inflation in check.

Individual investors would also be encouraged to move away from fossil fuel equities under a Green government. The Financial Conduct Authority (FCA) would be tasked with developing goals to eliminate all fossil fuel-related stocks from the UK stock market. It would also bar any new fossil fuel listings or share allocations.

Elsewhere, the party says it would set up regional mutual banks in a bid to “drive investment in decarbonisation and local economic sustainability”. Communities would also be given ownership of “local sustainable energy infrastructure”, like wind farms.

Energy

As you’d imagine from the Green manifesto, there are a lot of commitments to move the UK towards a “zero-carbon society”. For example, the party wants wind to provide around 70% of the nation’s energy by 2030.

The party also wants to bring nuclear power to an end and invest in the country’s energy storage capacity and more efficient electricity distribution. Its community ownership model (see above) would lower energy bills, it claims, by allowing local areas to sell excess energy.

However, its energy bill cutting measures are almost-entirely focused on household energy efficiency measures (see property).

What’s been the reaction to the Green Party manifesto?

According to the Institute for Fiscal Studies (IFS), the Green Party’s manifesto would increase the size of the state to “unprecedented” levels.

The non-partisan think tank’s deputy director, Helen Miller, said: “By the end of the next parliament they want to increase taxes by over £170 billion per year to fund a £160 billion boost to day-to-day public service spending. Even taking their figures at face value, overall borrowing would end up around £80 billion a year higher and we could expect debt to be rising throughout the next Parliament.”

While Miller said some of the Greens’ pledges “look sensible”, such as the plan to shut down inheritance tax loopholes, she was critical of others. She said it was “doubtful” a carbon tax would raise £90bn, given that “the more successful the tax is at changing behaviour, the less it would raise”. She said the party would have to introduce “additional tax raising measures” if it were to fund the permanent public spending hikes it's set out.

The senior IFS spokesperson said: “It is clear where the Green Party’s ambitions lie - a much bigger role for the state, better funded public services, and, of course, a swifter transition to net zero. It is unlikely that the specific tax raising measures they propose to help achieve all this would raise the sorts of sums they claim - and certainly not without real economic cost.”

In terms of specific policies, Laura Suter - director of personal finance at AJ Bell - said the capital gains tax reforms outlined in the manifesto would hit many investors and business owners. But, she added: “The government’s own estimates show that if the highest CGT rate rose by 10 percentage points it would actually cost the government £2 billion by 2026-27. That’s because big increases in tax tend to impact investor behaviour. For example, investors may hold onto assets for longer rather than realising gains, find different ways to shelter their gains from the taxman, or own second homes through companies to avoid the tax altogether.”

Suter said the stated changes to tax on investment income could “have a huge impact on self-employed people who pay themselves through dividends” and pensioners who draw an income from investments, as well as the wealthy investors the Greens are targeting. It currently sits at 8.75% compared to 20% for the basic rate of income tax, which the Greens want to equalise it with.

AJ Bell’s director of public policy, Tom Selby, also drew attention to the party’s pension tax relief proposal. He said it amounted to a “colossal pension tax raid” which would “fundamentally upend the UK retirement system”.

He added: “The proposal appears to have been put forward with little thought to the challenges it would create. Billions of pounds of higher and additional rate tax relief is paid to members of defined benefit schemes, with most of these workers now employed in the public sector.

“If a flat rate of pension tax relief at 20% was introduced, these employees – including doctors in the NHS – would presumably need to be clobbered with a tax charge of thousands of pounds in order to shift them to the proposed flat rate. This would inevitably lead to huge unrest, the potential for key staff exiting public sector roles and new waves of strike action.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

General election 2024: who’s in the Labour cabinet?

General election 2024: who’s in the Labour cabinet?A new Labour cabinet has been appointed by Keir Starmer after his party won the general election. Here’s the latest on who’s in it

-

What does the Labour election win mean for your money? Key manifesto points after landslide

What does the Labour election win mean for your money? Key manifesto points after landslideNews The Labour election win was not as large as some polls had predicted. But the new government’s majority will mean it can enact significant changes.

-

What would a Labour supermajority mean for capital markets?

What would a Labour supermajority mean for capital markets?The Conservative Party has warned that a Labour supermajority would be bad for democracy. But what impact could a big win for Keir Starmer have on the markets?

-

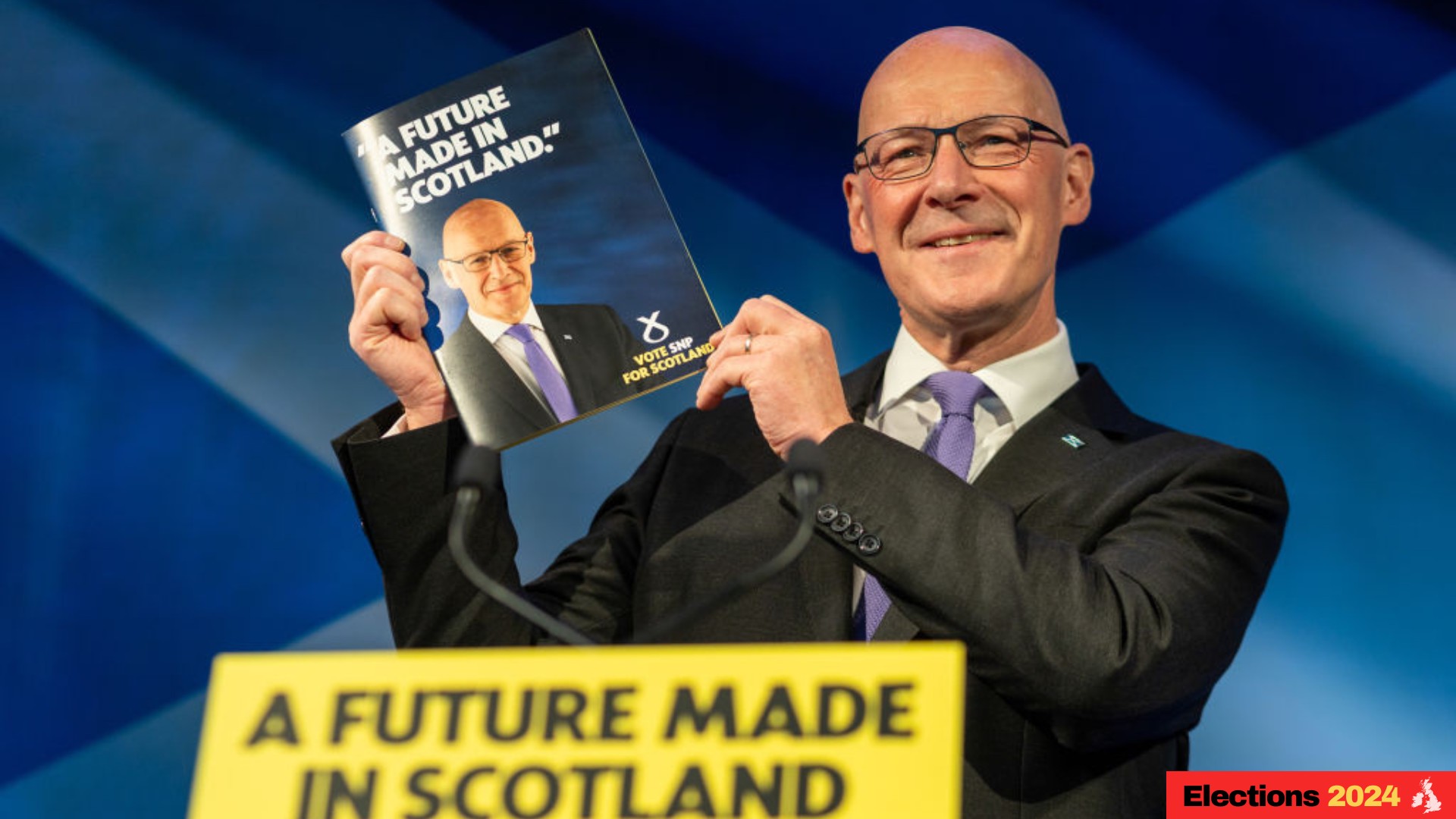

SNP manifesto 2024: what money policies did John Swinney announce?

SNP manifesto 2024: what money policies did John Swinney announce?The SNP manifesto has been launched in Scotland, and makes several key commitments, including a pledge to end austerity and a commitment to rejoin the EU.

-

Labour pledges to open 'at least' 350 banking hubs over next Parliament

Labour pledges to open 'at least' 350 banking hubs over next ParliamentNews The Labour Party claims it will ‘bring banking back to the high street’ if it forms the next government after the 2024 general election.

-

What does the Labour manifesto say about property? Key 2024 general election pledges

What does the Labour manifesto say about property? Key 2024 general election pledgesNews The Labour manifesto has made several promises around rental reforms, the leasehold system and housing market support. Here’s what a Keir Starmer government means for property.

-

Conservatives pledge to raise high income child benefit threshold – how much could you save?

Conservatives pledge to raise high income child benefit threshold – how much could you save?News The high income child benefit charge threshold could be doubled to £120,000 if the Conservative Party wins the general election, Chancellor Jeremy Hunt has pledged.

-

Labour unveils 'Freedom to Buy' pledge to get young people on housing ladder

Labour unveils 'Freedom to Buy' pledge to get young people on housing ladderNews Freedom to Buy will get 80,000 young people onto the housing ladder by the next general election, Keir Starmer's party has claimed