Conservatives pledge to raise high income child benefit threshold – how much could you save?

The high income child benefit charge threshold could be doubled to £120,000 if the Conservative Party wins the general election, Chancellor Jeremy Hunt has pledged.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

High-earning families could be able to keep more of their child benefit payments under a new Conservative government, Chancellor Jeremy Hunt has revealed.

Unveiling the latest sweetener to woo voters ahead of the general election on 4 July, Hunt said the Conservative Party would raise the high income child benefit charge (HIBC) threshold to £120,000, helping around 700,000 families hold on to more of the payments.

It comes after Hunt already raised the threshold from £50,000 to £60,000 during his Spring Budget. The Chancellor also said the system would move to an assessment based on household, rather than individual, income.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

“Raising the next generation is the most important job any of us can do so it’s right that, as part of our clear plan to bring taxes down, we are reducing the burden on working families,” Hunt said.

The Conservatives claim this could save the average family £1,500 earners from keeping more of the payments and paying less or no tax on them. But there are already questions around the cost of moving to a household assessment system, or whether the HIBC should just be scrapped.

What is the high income child benefit charge?

Under the current system, child benefit starts to get withdrawn if one parent earns more than £60,000 a year. The parent has to repay the benefit at a rate of 1% of the amount for every £100 they earn above the threshold.

The threshold was increased in April 2024 from £50,000. The top of the taper is also now £80,000, which is the point where all the benefit is repaid.

The policy has attracted criticism as it focuses on one higher earning parent. This means one spouse could earn £65,000 and the other £30,000, and this would mean losing some of the child benefit payments. But another couple earning just under £60,000 each wouldn’t be hit.

This is why Hunt has also committed to moving to a system based on household income. “Unfairness has been baked into the current system which allows two-parent households with combined earnings of up to a penny under £120,000 to keep their full entitlement, whilst others lose the benefit entirely because one parent tops £80,000,” said Danni Hewson, head of financial analysis at AJ Bell.

How much could families save from child benefit threshold changes?

The savings will depend on how much each parent earns and, of course, if the Conservatives are re-elected. So far, it is unclear what the Labour Party would do about the charge.

According to calculations by Quilter, a couple with two children where one person earns £80,000 and another earns £20,000 would be able to keep all £2,212.60 of their child benefit when they previously would have kept none.

Similarly, one parent earning £70,000 while the other earns roughly the average salary in the UK of £35,000 will be more than £1,106.30 better off and receive all the payments.

“The Tories’ announcement that they will peg the high income charge to household income will be music to many parents' ears,” said Shaun Moore, tax and financial planning expert at Quilter.

“However, this is not a new problem, and it has taken years for the penny to drop in government that the current rules create a perverse environment where a high earning single parent could lose their full child benefit entitlement, despite having a much lower household income than two parents earning just below the lower threshold.”

| Parent one salary | Parent two salary | Household income | Current £60k CB threshold | HICB Charge under current rules | New proposed £120k threshold | HICB Charge under proposed rules |

|---|---|---|---|---|---|---|

| £90,000 | £20,000 | £110,000 | £0 | £2,212.60 | £2,212.60 | £0 |

| £75,000 | £65,000 | £140,000 | £553.15 | £1,659.45 | £1,106.30 | £1,106.30 |

| £70,000 | £35,464.00 | £105,464 | £1,106.30 | £1,106.30 | £2,212.60 | £0 |

There is uncertainty over the administrative issues of moving to a household income assessment though. It is unclear how long this would take to implement by HMRC, which is already struggling with issues such as running its own self-assessment helpline.

“The administrative practicalities of moving to household based assessment is going to be challenging because our tax system - by which child benefit withdrawal is administered - is based on individual income,” said Tom Waters, an associate director at the Institute for Fiscal Studies.

“Indeed, this may well be why child benefit has been withdrawn in the rather odd way hitherto. In any case, we already have a means-tested benefit for families with children that is based on household income - universal credit. It's not clear what the point is of having a second one, means-tested in a different way."

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Marc Shoffman is an award-winning freelance journalist specialising in business, personal finance and property. His work has appeared in print and online publications ranging from FT Business to The Times, Mail on Sunday and the i newspaper. He also co-presents the In For A Penny financial planning podcast.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

General election 2024: who’s in the Labour cabinet?

General election 2024: who’s in the Labour cabinet?A new Labour cabinet has been appointed by Keir Starmer after his party won the general election. Here’s the latest on who’s in it

-

What does the Labour election win mean for your money? Key manifesto points after landslide

What does the Labour election win mean for your money? Key manifesto points after landslideNews The Labour election win was not as large as some polls had predicted. But the new government’s majority will mean it can enact significant changes.

-

What would a Labour supermajority mean for capital markets?

What would a Labour supermajority mean for capital markets?The Conservative Party has warned that a Labour supermajority would be bad for democracy. But what impact could a big win for Keir Starmer have on the markets?

-

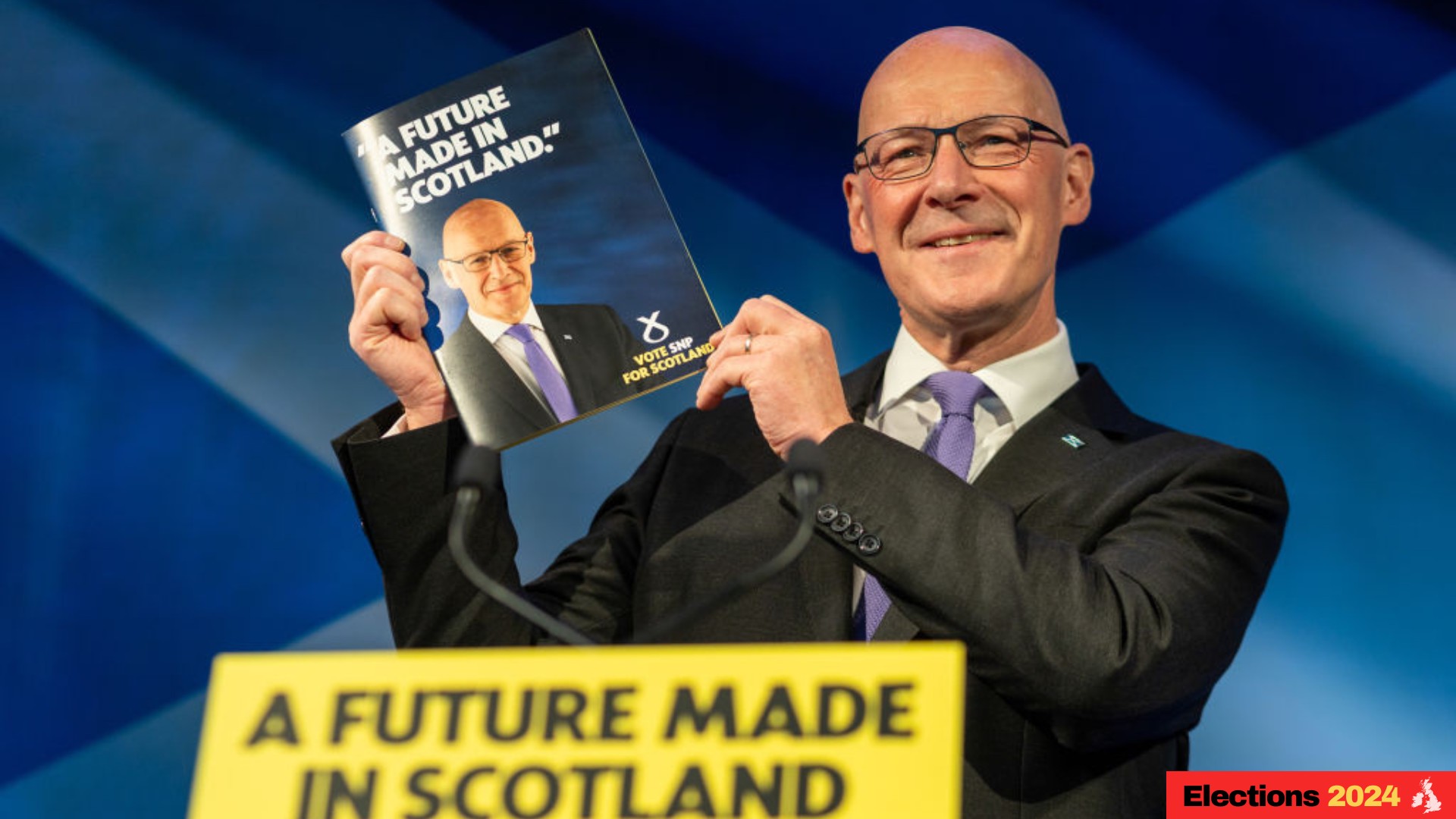

SNP manifesto 2024: what money policies did John Swinney announce?

SNP manifesto 2024: what money policies did John Swinney announce?The SNP manifesto has been launched in Scotland, and makes several key commitments, including a pledge to end austerity and a commitment to rejoin the EU.

-

Labour pledges to open 'at least' 350 banking hubs over next Parliament

Labour pledges to open 'at least' 350 banking hubs over next ParliamentNews The Labour Party claims it will ‘bring banking back to the high street’ if it forms the next government after the 2024 general election.

-

What does the Labour manifesto say about property? Key 2024 general election pledges

What does the Labour manifesto say about property? Key 2024 general election pledgesNews The Labour manifesto has made several promises around rental reforms, the leasehold system and housing market support. Here’s what a Keir Starmer government means for property.

-

Green Party manifesto 2024: key personal finance general election policies

Green Party manifesto 2024: key personal finance general election policiesA Green Party government would introduce a wealth tax, increase National Insurance Contributions for high earners, and move towards a universal basic income.

-

Labour unveils 'Freedom to Buy' pledge to get young people on housing ladder

Labour unveils 'Freedom to Buy' pledge to get young people on housing ladderNews Freedom to Buy will get 80,000 young people onto the housing ladder by the next general election, Keir Starmer's party has claimed