Conservative manifesto state pension plan: what is the triple lock plus? Rishi Sunak policy explained

The triple lock plus policy has been touted by Rishi Sunak as a tax cut for pensioners. But experts say it could still lead to retirees paying tax, and push the state pension age up.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The state pension triple lock plus was one of the Conservative Party's first policy announcements of the 2024 general election campaign.

A key commitment in Prime Minister Rishi Sunak’s manifesto, the pledge promises that pensioners will get a tax cut on top of the existing triple lock, if the party forms the next government. It comes as experts have predicted the state pension could grow to a level that will leave many pensioners having to pay income tax, should fiscal drag continue.

But pension experts have disputed that it will shield all pensioners from tax. There are also concerns that the triple lock on its own is unsustainable, with respected non-partisan think tank the Institute for Fiscal Studies (IFS) calling for it to be scrapped. Meanwhile, the bill for state pensions could be pushed even higher if the next government opts to meet the £10bn Waspi women compensation package in full.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Most of the major parties, including the Conservatives and Labour, have committed to the triple lock. You can see exactly what another Tory government or a Labour-led administration would mean for your money in our separate guides to the manifesto commitments they've made. We've also covered the SNP, Lib Dem, Green Party and Reform UK policies.

What is the triple lock plus?

On 27 May, the Conservatives promised they would extend the triple lock if they get elected back into government after the 4 July election.

Under the current triple lock policy, the state pension increases once a year. The amount it goes up by is determined by which of the following has the highest percentage: inflation, wage growth, or 2.5%.

In April, it increased 8.5% (up to £17.35 a week) in line with average earnings. The exact amount you receive depends on how many years of National Insurance contributions you’ve made - a figure you can top up online through the Check Your State Pension forecast tool.

At present, the maximum amount you can get from the state pension comes in at more than £11,500 a year - £1,000 below the top of the tax-free personal allowance for income tax (£12,570). It means that if any of the UK’s 12 million state pensioners supplement their income with part-time work or another income stream, they could find themselves paying tax.

Under the Conservative Party plans, the personal allowance pensioners get will diverge from that of the working population from April 2025. It would rise by whatever's highest out of: 2.5%, wage growth or inflation. The party's website claims it would mean that pensioners "NEVER pay tax on their state pension".

It said the triple lock plus would save retirees an immediate £100 a year, rising to £275 a year by 2030. The cost of the policy to the Treasury in the 2025/26 tax year would be £800m, but would balloon to £2.4bn a year by the end of the decade. These figures would be paid for by more efficient tax collection, and a crackdown on tax avoidance and evasion, the Tories have claimed.

What's been the political reaction to triple lock plus?

Rishi Sunak said the policy showed his party was “on the side of pensioners”. The prime minister added: “The alternative is Labour dragging everyone in receipt of the full state pension into income tax for the first time in history."

However, Labour has said the triple lock plus - along with the Conservative manifesto's other tax cuts - would leave a “Corbyn-style” black hole in the public finances. Speaking to broadcasters on 28 May, shadow Business Secretary Jonathan Reynolds described the move as “desperate” and added that the costing of the plan was “not credible”.

In an interview with the BBC, the SNP's Westminster leader Stephen Flynn said the policy would "ring hollow" in Scotland, where people have been "watching on as the economy collapsed beneath them".

Meanwhile, the Liberal Democrat’s Treasury spokesperson Sarah Olney claimed the tax savings pensioners would get through the pledge would be dwarfed by “stealth tax hikes” of £1,000 by 2027.

How have experts reacted to triple lock plus?

Triple lock plus has received a sceptical response from experts. Paul Johnson, director of the IFS, said that while there was a case for the state pension to have its own tax-free allowance, it was not the tax giveaway Rishi Sunak was portraying it as.

He said: “The proposal to ‘triple lock’ the income tax allowance for pensioners is another example of Conservatives proposing to undo their own tax policies. Pensioners used to have a higher tax allowance than working-age people.

"But since 2010, the tax allowance for pensioners has been cut by more than 10 per cent while that for working age people has risen by 30 per cent. Going forward, about half of this proposed tax cut is simply not following through with plans for tax rises pencilled in for the next three years.”

Former pensions minister Steve Webb, who served in the 2010 to 2015 coalition government, said the Tory claim that the triple lock plus would mean people "never" get taxed on their state pension was incorrect. Consultancy LCP, where Webb is now a partner, found that nearly 2.5 million retirees would still pay tax on the state pension, even if the policy was implemented.

It said: “The ‘triple lock plus’ policy will, of course, deliver a lower tax bill for millions of pensioners compared to a policy of continuing to freeze personal allowances for pensioners. But our analysis shows that for around one in five pensioners it will not deliver the stated objective of ensuring that their state pension is completely free of income tax.”

But research by AJ Bell has suggested that the electoral ploy could help the Conservative Party win over some older voters. A survey of 2,000 people it commissioned that was run by Opinium in early May found 41% of those aged 65+ said they would be less likely to vote for a party that had plans to ditch the triple lock, and replace it with an inflation-linked policy. This compared to 12% who felt the opposite.

However, the findings also suggested there would be a backlash from younger voters. Of those surveyed, 37% of 18 to 34-year-olds said they would be more likely to support a party that wanted to scrap the triple-lock, compared to 17% who would be less likely to do so.

Tom Selby, director of public policy at AJ Bell, said: “The next government should really be reviewing the state pension triple-lock and setting out a clear goal for the policy. Instead, Rishi Sunak has doubled down by promising not only to keep the pledge but extend it to the personal allowance for those over state pension age.

“The fact Sunak has not promised to increase the personal allowance for younger voters at the same time means he would effectively be driving a wedge between generations via the tax system. Creating a separate tax threshold for older people would also add unwelcome complexity to the income tax framework.”

Selby added that the policy would also be likely to mean that the “state pension age will need to rise faster” to cover the increasing cost of the triple lock. He said this would leave those below state pension age “paying the price again”.

According to Kirsty Anderson, retirement specialist at Quilter, the triple lock plus has also raised questions for Labour. She said that if Sir Keir Starmer’s party maintains the triple lock - something it has committed to do - “they too will need to raise the personal allowance”.

She added: “Our previous analysis found that pensioners could need to pay back a proportion of their state pension in income tax in just two years’ time. Simply from an administrative point of view this would prove difficult for HMRC, so it seems unlikely - if Labour were to get in - that they would not be forced to act in some way.”

Anderson called for a “more sensible approach” to the triple lock, more generally, which would “link pensions more closely to average earnings”. She said: “This would represent a good alternative as it would create a more predictable and sustainable pension system. This model not only aligns pension growth with national economic performance, but also fosters a fairer distribution of wealth across generations.

“This approach would mitigate the financial unpredictability associated with the triple lock, creating an easier way to effectively budget and ensure that pension increases do not disproportionately benefit one demographic at the expense of another.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

General election 2024: who’s in the Labour cabinet?

General election 2024: who’s in the Labour cabinet?A new Labour cabinet has been appointed by Keir Starmer after his party won the general election. Here’s the latest on who’s in it

-

What does the Labour election win mean for your money? Key manifesto points after landslide

What does the Labour election win mean for your money? Key manifesto points after landslideNews The Labour election win was not as large as some polls had predicted. But the new government’s majority will mean it can enact significant changes.

-

What would a Labour supermajority mean for capital markets?

What would a Labour supermajority mean for capital markets?The Conservative Party has warned that a Labour supermajority would be bad for democracy. But what impact could a big win for Keir Starmer have on the markets?

-

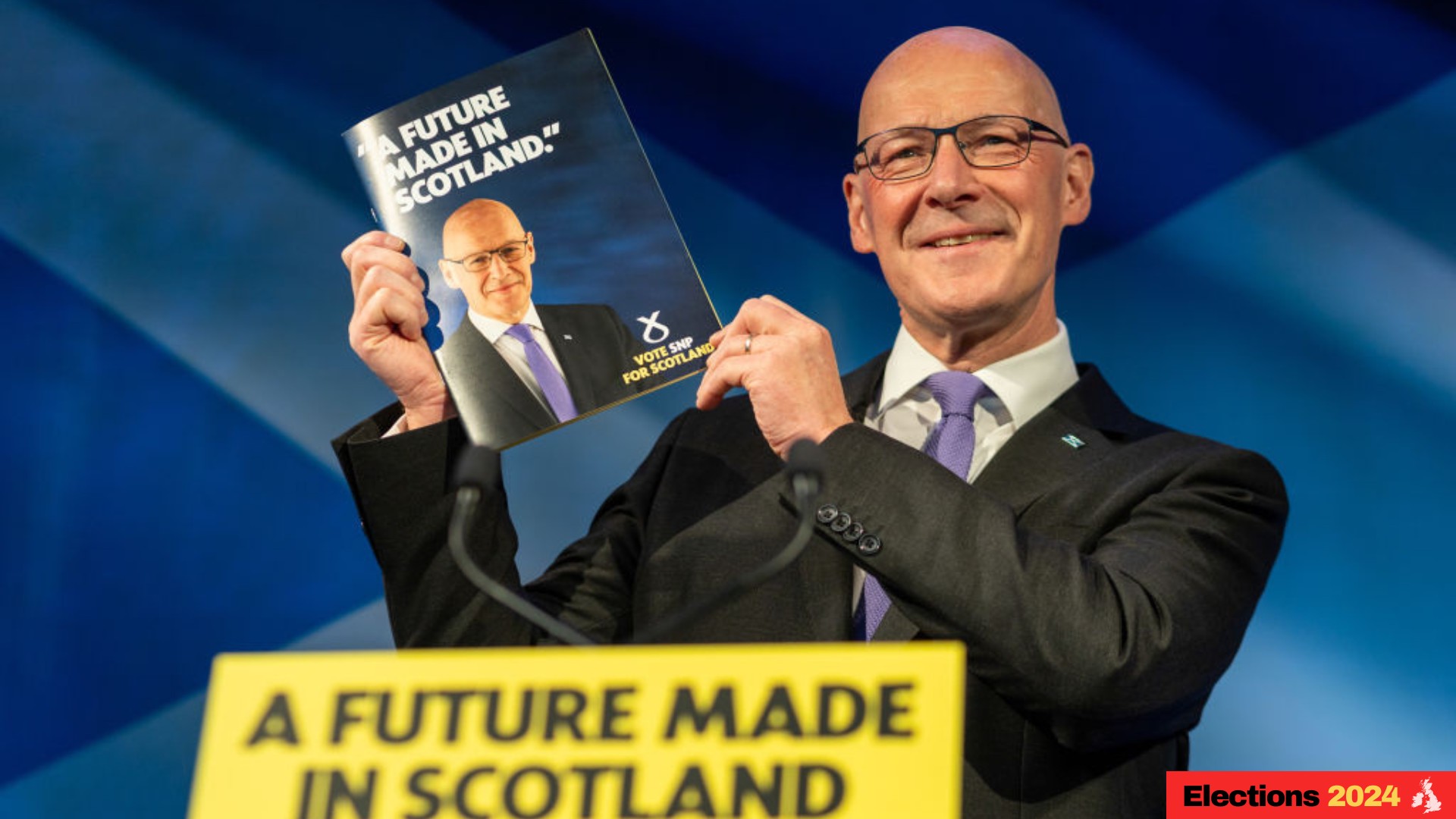

SNP manifesto 2024: what money policies did John Swinney announce?

SNP manifesto 2024: what money policies did John Swinney announce?The SNP manifesto has been launched in Scotland, and makes several key commitments, including a pledge to end austerity and a commitment to rejoin the EU.

-

Labour pledges to open 'at least' 350 banking hubs over next Parliament

Labour pledges to open 'at least' 350 banking hubs over next ParliamentNews The Labour Party claims it will ‘bring banking back to the high street’ if it forms the next government after the 2024 general election.

-

What does the Labour manifesto say about property? Key 2024 general election pledges

What does the Labour manifesto say about property? Key 2024 general election pledgesNews The Labour manifesto has made several promises around rental reforms, the leasehold system and housing market support. Here’s what a Keir Starmer government means for property.

-

Green Party manifesto 2024: key personal finance general election policies

Green Party manifesto 2024: key personal finance general election policiesA Green Party government would introduce a wealth tax, increase National Insurance Contributions for high earners, and move towards a universal basic income.

-

Conservatives pledge to raise high income child benefit threshold – how much could you save?

Conservatives pledge to raise high income child benefit threshold – how much could you save?News The high income child benefit charge threshold could be doubled to £120,000 if the Conservative Party wins the general election, Chancellor Jeremy Hunt has pledged.