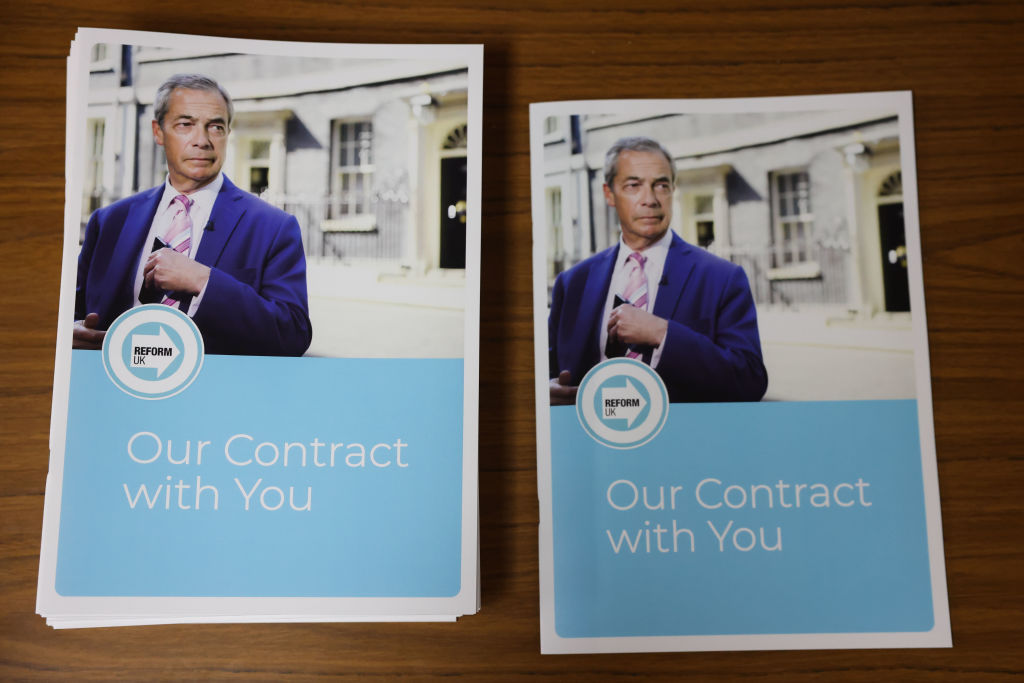

Reform UK manifesto: what money pledges are in Nigel Farage’s 'Contract'?

The Reform UK manifesto - which has been called a 'contract' by Nigel Farage - includes tax cuts, Bank of England reform and immigration policies.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Nigel Farage launched the Reform UK manifesto on Monday (17 June).

The controversial former UKIP leader and MEP, who is trying to become an MP for the eighth time, is targeting the constituency of Clacton, Essex at the 4 July general election. He has put Reform within touching distance of Rishi Sunak's Conservative Party in voter surveys.

One YouGov poll has put Reform UK ahead of the Tories. But others still have the Conservatives slightly ahead. To counter the threat to their right, the incumbent party of government has targeted their core vote. The Conservative manifesto includes pledges to reintroduce national service and bring in a triple lock plus.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In terms of Reform's own manifesto, which it calls a 'Our Contract With You', Farage wants to reduce net migration to zero. His party also aims to implement a major income tax cut - a key dividing line from the Conservatives and the Labour Party - and to reform the Bank of England.

But what else is in the manifesto? Here's a round up of what Reform has announced. We've also published pieces on the Liberal Democrat and Green Party manifestos.

What's in the Reform UK manifesto?

We already had an inkling about what the Reform manifesto would contain thanks to the party's website, which has had a 'working draft' of its ‘contract’ with voters available for several weeks.

The party’s main policy is to get net migration down to zero. If this happened, the number of people arriving in the UK would not exceed the number of people leaving the country. The party also wants to completely stop small boats from crossing the Channel.

Given the various Conservative governments we’ve had over the past 14 years have tried to bring net migration down in different ways - and with the numbers having gone up in recent years - this target appears to be implausible.

Farage's party adds that it would implement an 'Employer Immigration Tax', which would hit firms hiring foreign workers with a 20% National Insurance rate and raise £4bn a year, it says. The equivalent rate for British workers would stay at 13.8%. Reform also wants to slash NHS waiting lists by cutting "back office waste" and dishing out tax breaks to doctors and nurses.

And, in a clear dividing line from Labour, it would cut VAT from private school fees to incentivise those who can afford to send their kids to private school to do so, in a bid to reduce pressure on state schools. Another of its education policies is to scrap interest on student loans - but extend repayment periods to 45 years instead of the current 40-year term.

Reform UK personal finance commitments

Taxes

In terms of its main financial priorities, Reform says it wants to “cut taxes to make work pay”. Should it make it into government, it says its first priority would be to lift the income tax personal allowance threshold from £12,570 to £20,000.

Doing so would mean up to seven million people wouldn't pay the tax and would save the average worker £1,500, it claims. The party says the policy would get people off benefits. The Lib Dems have made a similar pledge. Farage's party adds that it wants to see the higher rate kick in from a threshold of £70,000, instead of the current £50,270.

It also wants to scrap VAT on energy bills and lower fuel duty by 20p per litre. It would raise the 0% stamp duty threshold to £750,000, with a rate of 2% applied to properties priced between this figure and £1.5m, and 4% for anything above £1.5m.

Abolishing inheritance tax is another key goal for Reform. It wants to free all estates valued below £2m - around 98% of the UK total - from the tax. It says that it would apply a 20% rate to anything above this figure - unless the money is given to charity. This is another big dividing line from the Conservatives.

Reform also claims two million tourists have been put off coming to the UK by the country’s VAT tourist tax, denying the economy £10bn. So, it wants this tax abolished too.

Another policy the party hopes to enact is to give married couples tax breaks in a bid to encourage more people to tie the knot - when the public finances allow. The manifesto suggests a Reform government would replace marriage allowance with a "transferable marriage tax allowance" that would mean the first £25,000 earned by either spouse would not be taxed.

It also wants to slash corporation tax to 20% and then cut it to 15% by year three of its five-year term. The party says it would take 1.2 million SMEs out of the tax altogether by lifting the corporation tax profit threshold to £100,000.

Meanwhile, Reform has suggested it wants to slash the UK tax code from 21,000 pages to somewhere closer to Hong Kong’s 500-page tax code. The party hasn’t outlined the specifics of how it would do so.

Pensions

Reform UK suggests it would adopt a pensions system akin to that of Australia, and describes the UK’s current system is “riddled with complexity, huge cost and poor returns”.

Farage's party also wants to end the 'mineworkers pension scandal' by implementing the Business, Energy and Industrial Strategy Committee's 2021 recommendations "in full". In its first 100 days in Downing Street, it says it would stop care home providers from avoiding tax "on hundreds of millions of profits" by using offshore structures.

Property

Reform wants to reform the planning system in its first 100 days so that home building can be accelerated - particularly in Wales, the north, the Midlands and in poorer coastal areas. Its manifesto says it would fast track new housing on brownfield sites and adopt a "loose fit" planning policy for larger developments.

Its other key housing priorities are to reform social housing so that foreign nationals "go to the back of the queue". The party wants to abolish the Renters' Reform Bill in favour of a bolstered monitoring, appeals and enforcement process for unhappy renters. It also wants to scrap section 24 for landlords to encourage them to invest in the buy-to-let market. It would restore their rights to deduct finance costs and mortgage interest from the tax they pay on their rental income, if it gets elected.

Longer-term housing priorities for Reform are to protect leaseholders by giving them a greater say in the charges they have to pay, and make it "cheaper and easier" to extend their leases. Plus, it wants to get construction companies to use innovations, like modular construction, to speed up house building. All of these pledges are cost neutral, Reform claims.

Cost of living

As well as chopping VAT from energy bills and scrapping green levies, Reform wants to scrap the UK's net-zero target and get rid of £10bn-worth of renewable energy subsidies in a bid to bring bills down. The party claims that over the last 15 years, bills have "increased dramatically in line with the huge increase in renewables capacity".

Instead, it wants to up fossil fuel production by granting new "fast-track" North Sea oil and gas licences, and allow fracking. The latter process, which can generate shale gas, would only be able to be scaled up "when safety is proven", it says.

Alongside its energy pledges, Reform says it would stop supermarkets from "price fixing". It would give the Competitions and Markets Authority powers to "ensure fair pricing" for consumers.

Nigel Farage's party published its manifesto in South Wales on Monday 18 June

Public finances

Overall, Reform claims its manifesto would cost £141bn a year - but would raise £160bn. Around £10bn of what it plans to raise would come from the extra taxes it would collect thanks to a 1% increase to GDP per year that's unlocked by its agenda.

Its tax policies would cost £70bn a year, the party says. This figure would be paid for by the £91bn a year it believes it can free up by slashing what it calls “government waste”.

It claims £35bn of this total would come from putting a halt to the Bank of England paying out interest to commercial banks on its quantitative easing reserves. Party Chairman Richard Tice has previously described the status quo as "gross negligence" and said it meant voters' cash was being used to "enrich the City of London". Governor Andrew Bailey has previously said scrapping the measure would limit the central bank's ability to change the economy through interest rates.

Reform also reckons £50bn could be saved if every public sector manager was forced to find £5 in savings for every £100 of spending, and through the scrapping of “dozens” of arms-length public bodies. It believes these savings can be achieved without affecting frontline services. A further £6bn would come from cutting foreign aid by 50%.

Reform manifesto reaction

While the Conservative, Labour and Lib Dem manifestos have kept their spending promises relatively low, both the Greens - and now Reform - have gone big. Equally large are both parties’ plans to raise revenues in a bid to pay for their respective agendas.

As with all the other manifestos we’ve seen so far, Reform’s Contract has been met with a sceptical response by experts - particularly when it comes to how much it reckons it can grow the economy and slash public spending. Nigel Farage himself has conceded that it’s “impossible” to know whether his manifesto is economically viable, adding that no party has ever got it right.

Carl Emmerson, deputy director at the Institute for Fiscal Studies said Reform’s plans “would represent a big cut to the size of the state”, adding that - regardless of the politics of doing so - the plans were “problematic”.

“Spending reductions would save less than stated, and the tax cuts would cost more than stated, by a margin of tens of billions of pounds per year. Meanwhile the spending increases would cost more than stated if they are to achieve their objectives,” he said.

One example Emmerson pointed to was Reform’s commitment to cut the government’s “wasteful” spending in a bid to raise £50bn a year for the Treasury. He said saving this amount would “almost certainly” require measures beyond streamlining Whitehall departments, and ditching quangos and commissions. Instead, Farage’s party would likely have to rely on making “substantial cuts” to public services.

He added: “Even with the extremely optimistic assumptions about how much economic growth would increase, the sums in this manifesto do not add up. Whilst Reform’s manifesto gives a clear sense of priority, a government could only implement parts of this package, or would need to find other ways to help pay for it.”

Tax expert Dan Neidle has calculated that the Reform manifesto would result in £33bn of unfunded spending - a fiscal black hole that would be roughly twice the size of the one created by Liz Truss’s mini-Budget. Much of this revenue shortfall would come as a result of an overestimation about how much changing Bank of England reserve rules would raise - something the IFS has also pointed out. Neidle added that he was disappointed by Reform’s “lack of detail” when it comes to setting out costings, with the manifesto only providing totals for each policy area rather than breaking things down policy-by-policy.

Reacting to Reform’s stamp duty plans, Laura Suter - director of personal finance at AJ Bell - said the “big tax break” would mean many people would never have to pay the property tax in their lifetimes. She added: “Someone buying a property worth £750,000 at the moment [excluding first-time buyers and those buying additional properties] would pay £25,000 in stamp duty – a huge chunk of money that homeowners have to find in cash, rather than being able to add to the mortgage. Those buying more expensive properties would benefit from a reduction in rates, and the move would save someone who is buying a £1.5 million property more than £76,000 in stamp duty.

“We know that stamp duty is a disliked tax among the UK population and can prevent people from moving, as the levy represents a huge chunk of money in comparison to their deposit or other moving costs. Raising the threshold to be universal for all takes away the price advantage that first-time buyers currently have, as they get a stamp duty break on properties worth up to £650,000.”

Meanwhile, Reform’s vague promise that it would seek to replicate Australia’s pension system has been welcomed - but experts say it wouldn’t be straightforward to implement. Simon Kew, head of market engagement at independent consultancy Broadstone, said: “While Australia’s system is commendable, it is important to recognise the significant structural and contextual differences between the UK and Australia. Implementing Australia's pension model in its entirety here would entail substantial financial implications and logistical challenges.

“Furthermore, the effectiveness of any proposed pension reforms will depend heavily on the thoroughness of their implementation strategies. The critical challenge for the Reform Party, as with all political parties, lies in translating these proposals from theoretical concepts into practical, effective actions.

“It is not enough to outline broad aspirations, policymakers must map out concrete, actionable steps to ensure meaningful impact and consider the unique characteristics of our existing pension framework and the needs of both members and trustees. This will require detailed planning, stakeholder engagement, and a clear understanding of the financial and administrative demands involved. Only through such diligent efforts can we hope to see genuine improvements in our pension system that will benefit all stakeholders involved.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

General election 2024: who’s in the Labour cabinet?

General election 2024: who’s in the Labour cabinet?A new Labour cabinet has been appointed by Keir Starmer after his party won the general election. Here’s the latest on who’s in it

-

What does the Labour election win mean for your money? Key manifesto points after landslide

What does the Labour election win mean for your money? Key manifesto points after landslideNews The Labour election win was not as large as some polls had predicted. But the new government’s majority will mean it can enact significant changes.

-

What would a Labour supermajority mean for capital markets?

What would a Labour supermajority mean for capital markets?The Conservative Party has warned that a Labour supermajority would be bad for democracy. But what impact could a big win for Keir Starmer have on the markets?

-

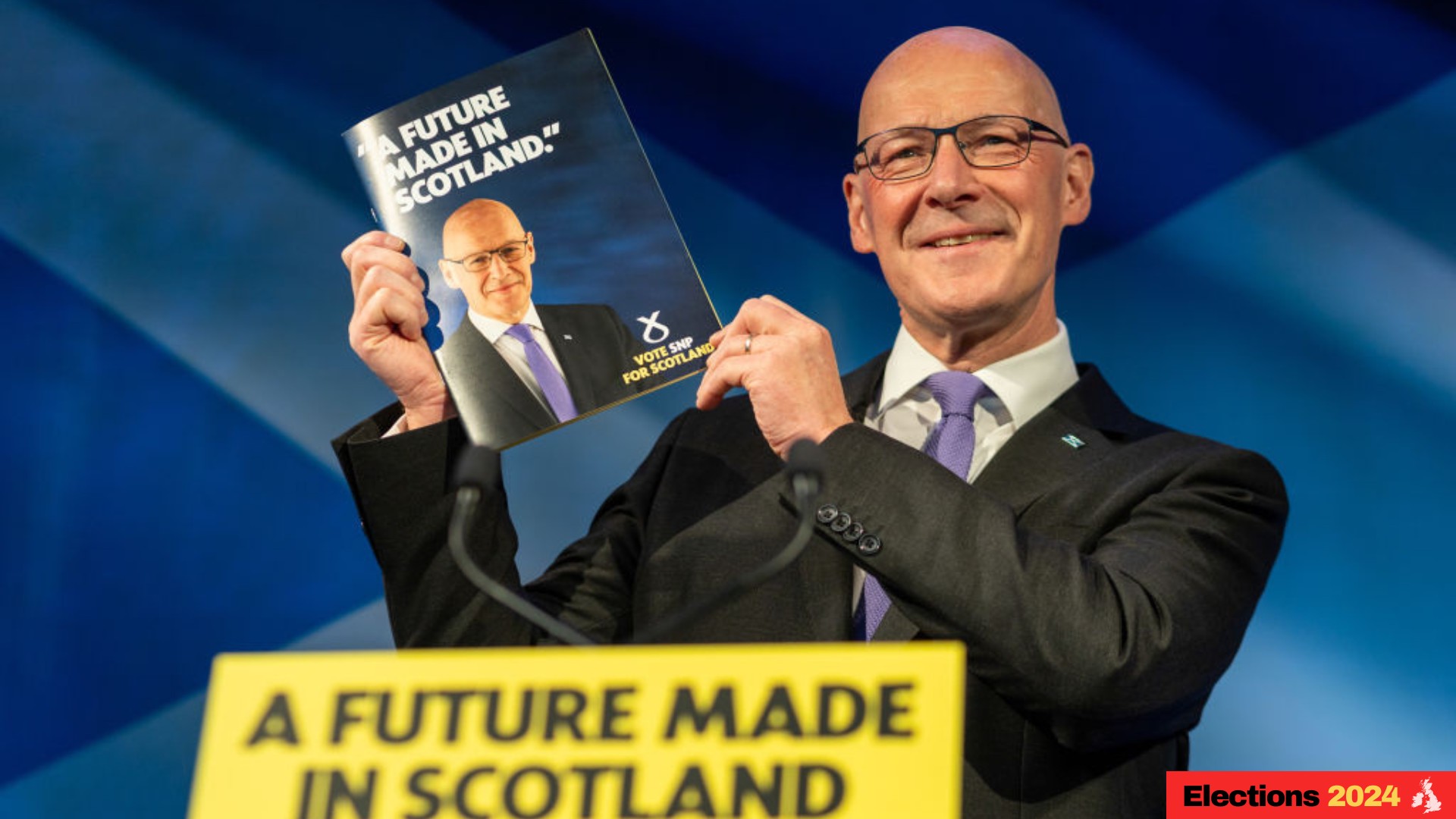

SNP manifesto 2024: what money policies did John Swinney announce?

SNP manifesto 2024: what money policies did John Swinney announce?The SNP manifesto has been launched in Scotland, and makes several key commitments, including a pledge to end austerity and a commitment to rejoin the EU.

-

Labour pledges to open 'at least' 350 banking hubs over next Parliament

Labour pledges to open 'at least' 350 banking hubs over next ParliamentNews The Labour Party claims it will ‘bring banking back to the high street’ if it forms the next government after the 2024 general election.

-

What does the Labour manifesto say about property? Key 2024 general election pledges

What does the Labour manifesto say about property? Key 2024 general election pledgesNews The Labour manifesto has made several promises around rental reforms, the leasehold system and housing market support. Here’s what a Keir Starmer government means for property.

-

Green Party manifesto 2024: key personal finance general election policies

Green Party manifesto 2024: key personal finance general election policiesA Green Party government would introduce a wealth tax, increase National Insurance Contributions for high earners, and move towards a universal basic income.

-

Conservatives pledge to raise high income child benefit threshold – how much could you save?

Conservatives pledge to raise high income child benefit threshold – how much could you save?News The high income child benefit charge threshold could be doubled to £120,000 if the Conservative Party wins the general election, Chancellor Jeremy Hunt has pledged.