Jeremy Hunt: ‘income tax thresholds to remain frozen if Conservative Party wins general election’

The Chancellor said income tax thresholds will be kept as they are until 2028. It could mean millions of workers will be dragged into higher tax bands.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Income tax thresholds are set to remain frozen until 2028 if the Conservatives return to power after the general election, Chancellor Jeremy Hunt has confirmed.

Speaking to the Today programme on BBC Radio 4 on Thursday (30 May), Huntsaid “a future Conservative government will not increase income [tax] rates and VAT”. But, when pushed about tax thresholds, he confirmed the current freeze would remain in place. The BBC has reported that Labour will also maintain the existing thresholds.

Should the stealth tax remain in place beyond the 4 July election, it would mean millions of workers could fall into higher tax bands over the coming years due to wage growth - something which is known as fiscal drag. It means high earners may be paying an extra £4,000 a year to HMRC by 2027, with one in five earners dragged into the higher band over this timeframe.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The Personal Savings Allowance (PSA) also remains frozen, although it’s unclear whether it’s also included in the major political parties’ threshold freeze. Banking trade body UK Finance has called for the PSA to be expanded for savers. Tax-free thresholds for capital gains tax and the dividend allowance have already been cut, and are unlikely to change. At the same time, there has been a 4p cut to National Insurance since January.

Both the Conservatives and Labour have said they will not raise headline tax rates if they are elected. Other Tory policies include the triple lock plus and a commitment to bring back national service. Meanwhile, Labour has pledged to keep the triple lock in its current form and bring in a state-owned energy company.

Income tax thresholds freeze means millions will pay ‘substantially more’

Personal tax thresholds have been frozen since March 2021. The policy, which was brought in while Rishi Sunak was Chancellor, was introduced in a bid to help the government make up for the vast amounts of public spending it made during the Covid pandemic.

The Conservative government had already planned to keep it in place as a result of the impact of record inflation on public spending and the hangover from Liz Truss’s stint in 10 Downing Street, which has affected how much the government can borrow.

An assessment of the freeze by the Office for Budget Responsibility (OBR), which was released with the Spring Budget in March, found it would move an extra 3.3 million taxpayers into the higher and additional rate income tax bands by the 2027/28 financial year. There would also be 3.8 million more taxpayers overall.

If the Conservatives are re-elected, the OBR’s overall number could be lowered as a result of the triple lock plus policy. The party’s pledge would decouple pensioners’ tax-free income tax allowance from the £12,570 most workers are entitled to. There are expectations the full amount of the new state pension will exceed the allowance before the end of the decade.

AJ Bell analysis of current inflation figures and OBR forecasts has found that a person with a salary of £15,000 a year in 2021 will have had to have paid an extra £2,816 in income tax by 2027/28 than if the tax-free allowance had risen with inflation, assuming their salary rose in line with the rate of price rises over the period.

It also found that by the 2028 horizon, the personal allowance could be almost £3,500 below where it would have been were it indexed, while the higher rate threshold would be more than £13,500 above the current £50,270 limit.

Director of public policy at AJ Bell, Tom Selby, said: “Working families might understandably feel more than a little aggrieved that, having committed to ending the personal allowance freeze for pensioners, Rishi Sunak and Jeremy Hunt are not making a similar pledge for younger people.

“This works in exactly the opposite direction to the National Insurance reductions announced by the government, not to mention the hints at further National Insurance (NI) cuts to come. The Conservatives are effectively giving with one hand, by lowering NI, and taking away with the other through the stealth tax of frozen thresholds. Creating a different personal allowance for pensioners will also complicate the tax system and add unfairness between generations.

“This all adds up to a pretty incoherent approach to income tax and National Insurance policy which seems to be driven entirely by a desire to win over older voters ahead of the general election.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?

-

General election 2024: who’s in the Labour cabinet?

General election 2024: who’s in the Labour cabinet?A new Labour cabinet has been appointed by Keir Starmer after his party won the general election. Here’s the latest on who’s in it

-

What does the Labour election win mean for your money? Key manifesto points after landslide

What does the Labour election win mean for your money? Key manifesto points after landslideNews The Labour election win was not as large as some polls had predicted. But the new government’s majority will mean it can enact significant changes.

-

What would a Labour supermajority mean for capital markets?

What would a Labour supermajority mean for capital markets?The Conservative Party has warned that a Labour supermajority would be bad for democracy. But what impact could a big win for Keir Starmer have on the markets?

-

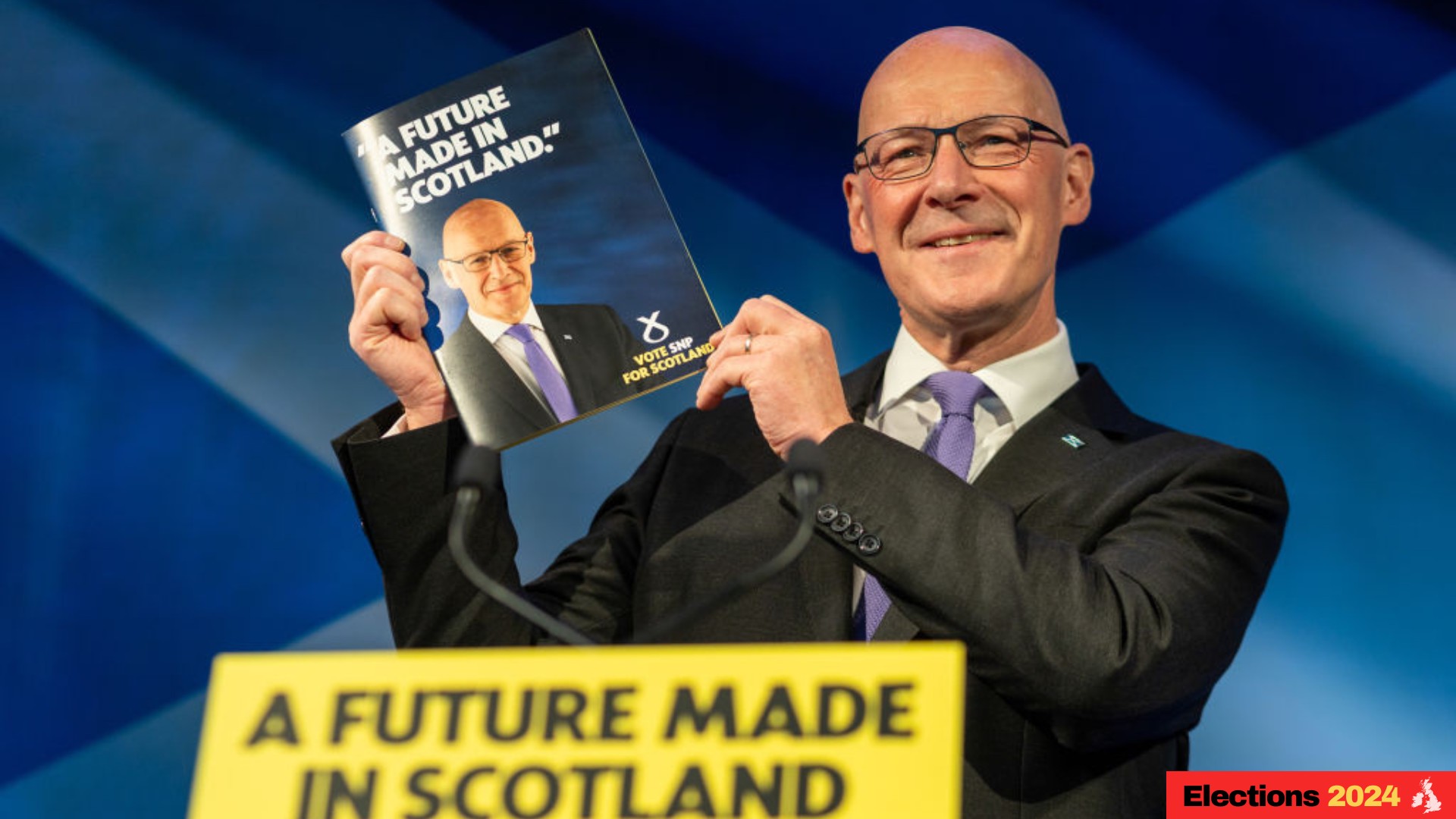

SNP manifesto 2024: what money policies did John Swinney announce?

SNP manifesto 2024: what money policies did John Swinney announce?The SNP manifesto has been launched in Scotland, and makes several key commitments, including a pledge to end austerity and a commitment to rejoin the EU.

-

Labour pledges to open 'at least' 350 banking hubs over next Parliament

Labour pledges to open 'at least' 350 banking hubs over next ParliamentNews The Labour Party claims it will ‘bring banking back to the high street’ if it forms the next government after the 2024 general election.

-

What does the Labour manifesto say about property? Key 2024 general election pledges

What does the Labour manifesto say about property? Key 2024 general election pledgesNews The Labour manifesto has made several promises around rental reforms, the leasehold system and housing market support. Here’s what a Keir Starmer government means for property.

-

Green Party manifesto 2024: key personal finance general election policies

Green Party manifesto 2024: key personal finance general election policiesA Green Party government would introduce a wealth tax, increase National Insurance Contributions for high earners, and move towards a universal basic income.

-

Conservatives pledge to raise high income child benefit threshold – how much could you save?

Conservatives pledge to raise high income child benefit threshold – how much could you save?News The high income child benefit charge threshold could be doubled to £120,000 if the Conservative Party wins the general election, Chancellor Jeremy Hunt has pledged.