General election 2024: what do banks want to see the next government do?

UK Finance, which represents the UK banking sector, has published its general election wish list. It includes ideas for how to improve personal finance and crack down on fraud.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Banking trade body UK Finance has announced the key pledges it wants to see included in general election manifestos.

Arguing that the sector is a “global success story”, its chief executive David Postings said the organisation’s main asks would “help build a better society for all” after the election. It represents the views of 300 firms, including high street banks and financial services providers.

It comes as the major parties have started to draw their key battle lines ahead of the 4 July national poll. The Labour Party has been attempting to build support among the business community, while the Conservative Party has been attempting to win over older voters with its triple lock plus pledge and plans to reintroduce national service.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So, what do the banks want from the 2024 general election? We’ve rounded up their manifesto wish list.

General election winner should improve financial education, banks say

Among its main asks of the next government, UK Finance has outlined the policies it believes are needed to help support people and businesses. It says pledges that will help people manage and grow their money, get onto the housing ladder and get out of financial difficulty are needed.

The trade body said financial education should be a big priority for whoever occupies 10 Downing Street from 5 July. It added that such a move would improve household financial resilience, by giving people the “basic tools and knowledge” to “effectively” manage their money. It follows a report by the Education Select Committee which called for improvements to be made in the provision of financial education in schools.

UK Finance also said it wants to see measures that would boost the returns its members’ customers can gain. It has called for personal savings allowances to be reviewed so that savers can “build up a cushion” against any future cost of living crises. Of course, any growth in deposits would also benefit bank balance sheets.

Other ideas on its wish list include greater encouragement for people to become investors. The trade body wants to see UK households catch up on countries, like the USA and France, when it comes to the proportion of their financial assets that are tied up in equity. It said improvements to the tax regime would help in this regard, whilst also helping to grow the economy.

UK Finance: ‘urgent planning reform needed after the election’

In terms of the measures UK Finance thinks could boost the property market, it said the next government should announce a package of measures “early in the next Parliament” to expand housing supply. Chief among them would be reforms to the planning system, which would “unlock more housebuilding”, it said. The construction of new homes plummeted at the end of 2023, recent figures have shown.

Stamp duty reform is also a priority, the trade body said. It said lowering upfront buying costs would incentivise housing market activity and would free up buyers to improve the energy performance of their home - something it said could also be incentivised by growing homeowner access to financing. The organisation also urged a future government to allow buy-to-let lenders to access the Private Rented Sector Database, which contains information on landlords. Doing so would help to “raise standards” in the lettings sector.

Meanwhile, in terms of helping people to manage financial difficulty, UK Finance said its members should not be the only ones footing the bill for free debt management advice. It wants to see energy and utility companies forced to contribute so that the existing provision can be expanded. The trade body also said it wants greater regulation of the personal debt advice market - an area that’s not currently under the Financial Conduct Authority’s (FCA’s) remit.

Banks call for scam crackdown

Alongside its calls for more support for individuals, UK Finance also urged the next government to bring in tougher action on fraud. In its annual scams report, which was published on 22 May, it found fraudsters stole £2.3m a day from British consumers in 2023.

To stop the yearly £1bn flow of ill-gotten gains, the trade body said online platforms, internet service providers and telecoms firms should be compelled by a new Fraud and Scams Bill to work harder to stop fraud “at source”. These firms should also have to contribute to the cost of fraud reimbursement, and should be brought under the scope of the Economic Crime Levy, which helps to fund anti-fraud schemes. Banks currently foot the bill if their customers fall victim to scams.

UK Finance also said it wants to see Companies House reformed so that the UK is better protected from economic crime. It also wants to see tax incentives to help businesses invest in bolstering their defences against cyber attacks.

In terms of its broader aims for the victor of the next general election, the trade body wants to see Jeremy Hunt’s Edinburgh Reforms expanded through the appointment of a government competitiveness champion. These reforms unwound some of the regulations that were introduced in the wake of the 2008 Financial Crisis.

The champion would review and tackle the “burden” of regulations which “inhibit growth”. Doing so would allow the UK banking sector to compete internationally, and attract more banks to the UK, the trade body claimed.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

General election 2024: who’s in the Labour cabinet?

General election 2024: who’s in the Labour cabinet?A new Labour cabinet has been appointed by Keir Starmer after his party won the general election. Here’s the latest on who’s in it

-

What does the Labour election win mean for your money? Key manifesto points after landslide

What does the Labour election win mean for your money? Key manifesto points after landslideNews The Labour election win was not as large as some polls had predicted. But the new government’s majority will mean it can enact significant changes.

-

What would a Labour supermajority mean for capital markets?

What would a Labour supermajority mean for capital markets?The Conservative Party has warned that a Labour supermajority would be bad for democracy. But what impact could a big win for Keir Starmer have on the markets?

-

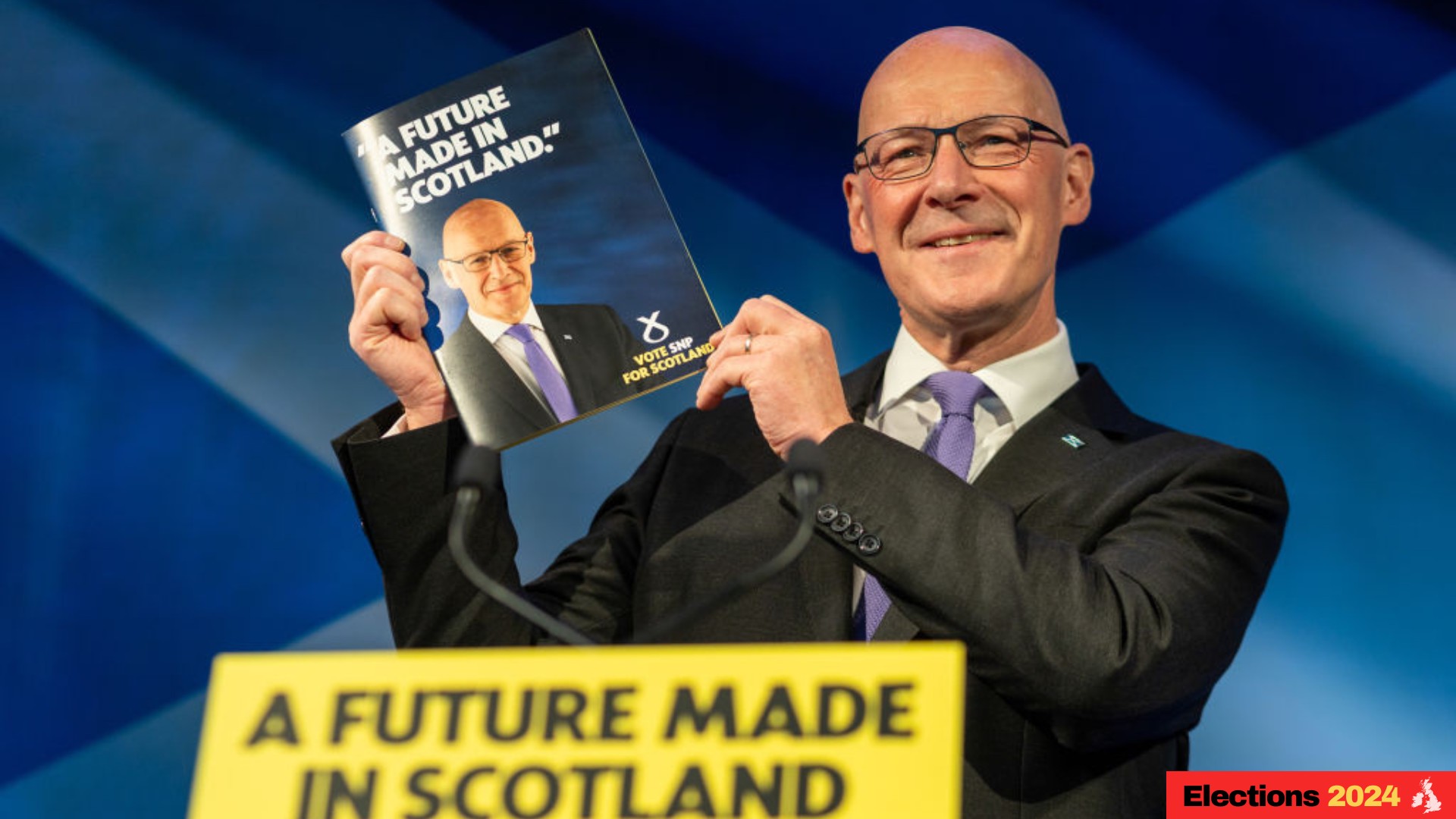

SNP manifesto 2024: what money policies did John Swinney announce?

SNP manifesto 2024: what money policies did John Swinney announce?The SNP manifesto has been launched in Scotland, and makes several key commitments, including a pledge to end austerity and a commitment to rejoin the EU.

-

Labour pledges to open 'at least' 350 banking hubs over next Parliament

Labour pledges to open 'at least' 350 banking hubs over next ParliamentNews The Labour Party claims it will ‘bring banking back to the high street’ if it forms the next government after the 2024 general election.

-

What does the Labour manifesto say about property? Key 2024 general election pledges

What does the Labour manifesto say about property? Key 2024 general election pledgesNews The Labour manifesto has made several promises around rental reforms, the leasehold system and housing market support. Here’s what a Keir Starmer government means for property.

-

Green Party manifesto 2024: key personal finance general election policies

Green Party manifesto 2024: key personal finance general election policiesA Green Party government would introduce a wealth tax, increase National Insurance Contributions for high earners, and move towards a universal basic income.

-

Conservatives pledge to raise high income child benefit threshold – how much could you save?

Conservatives pledge to raise high income child benefit threshold – how much could you save?News The high income child benefit charge threshold could be doubled to £120,000 if the Conservative Party wins the general election, Chancellor Jeremy Hunt has pledged.