Conservative manifesto 2024: what money policies are in it?

National Insurance will be cut again if Rishi Sunak's Conservative Party wins the general election. We look at what else is in their 2024 manifesto.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Rishi Sunak has launched the Conservative Party's general election 2024 manifesto.

The document contains plans to cut national insurance again during the next Parliament, after two separate 2p cuts so far this year. There are also plans to introduce a state pension triple lock plus and reform child benefit, if the Tories are re-elected at the national poll on 4 July.

Alongside the giveaways, there are some harder pills for prospective voters to swallow. Jeremy Hunt has confirmed income tax thresholds will remain static under another - an effective tax hike. This contrasts with the promises set out by Reform UK and the Lib Dems.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The Conservatives face a major challenge to overhaul Labour in the polls. They have routinely come in around 20 points below Sir Keir Starmer's party - a gap that could see the current opposition party win a landslide.

So, here is what the Conservative manifesto could mean for your money, if the party defies current expectations and holds on to power. We have published a separate piece on what a potential Labour government could mean for your money.

General election: what is in the Conservative Party manifesto?

Tax

The Conservative manifesto contains tax cuts that would amount to more than £17bn by the 2029/30 financial year. During Sunak's speech, he once again used the contentious £2,000 Labour tax claim.

The document recommits to the Tories’ “long-term ambition” to scrap National Insurance to move away from the “unfair” practice of taxing people twice on their income - although it doesn’t commit to doing so in the next Parliament.

In the meantime, the party says there will be another 2p cut to the levy by April 2027, which will drop its rate to 6% - a 6p cut in every £1 compared to where the levy was at the start of 2024. The party claims this cut, when combined with the previous two, would amount to £1,350 for a worker on the average UK salary of £35,000. But workers on lower salaries would see a smaller tax cut.

The main rate of Class 4 self-employed National Insurance will also be abolished by the end of the Parliament. It comes after Class 2 NICs were abolished in the Spring Budget. Despite the scrapping of these rates, the four million self-employed workers the pledge affects will keep their entitlement to the state pension.

However, these policies are the only ‘rabbits out of the hat’ when it comes to the Conservatives’ tax plans. Other commitments already announced on the campaign trail by Sunak include: a pledge to not raise income tax or VAT rates, changes to child benefit for high earners, the triple lock plus - and maintaining the existing triple lock, as well as an aim to raise £6bn by 2029/30 via a crackdown on tax avoidance and evasion. Surprisingly, there is no commitment to abolish inheritance tax - a move that had been expected in some quarters.

The manifesto also includes the ‘family home tax guarantee’ Jeremy Hunt set out earlier in June. This would be a pledge to not increase the number of council tax bands, undertake revaluations for council tax or remove council tax discounts.

Public finances

Rishi Sunak’s manifesto claims that the Conservative Party has “repaired” the UK’s public finances during its 14 years in office. While suggesting Covid is to blame for knocking borrowing and national debt off course (there is no mention of Liz Truss), the document says the Conservatives’ tight fiscal rules would continue if it gets re-elected.

It says it wants to get public sector net debt down and to reduce borrowing to below 3% of GDP by the end of the decade. To get there, the party would bring in welfare cuts equivalent to £12bn a year by the end of the decade, and almost £6bn in government efficiency savings.

Welfare changes under a Conservative government would include plans to clamp down on the sick note process, restrict who can be assessed as being unfit for work, and give the Department for Work and Pensions “powers similar to that of HMRC” to tackle benefit fraud. Meanwhile, government efficiency reforms would include reducing the civil service’s headcount and bringing public body spending “under control”.

Pensions and savings

Beyond the commitment to maintaining the triple lock, the Conservatives say they will not introduce any new taxes on pensions through the “Pensions Tax Guarantee”. The party says it will keep the 25% tax free lump sum and “maintain tax relief on pension contributions at their marginal rate”.

For Waspi women, the Tories say they are “carefully considering” the recommendations made in the Parliamentary and Health Service Ombudsman (PHSO) report. The PHSO suggested affected women should receive £10.5bn in compensation. The Conservatives promise to provide an “appropriate and swift response” to the report, which was published in March.

Elsewhere, the manifesto makes no fresh commitments to savers or investors. The British ISA, which was only announced in the Spring Budget, is not mentioned at all, suggesting it could be dead in the water. There will, however, be a renewed crackdown on fraudsters who attempt to scam people into making fake investments.

The Conservative manifesto was launched at Silverstone on 11 June

Property

One of the Tories’ key property market commitments is their pledge to make the current first-time buyer (FTB) stamp duty thresholds permanent. It means first-timers will be exempt from paying the property tax on homes costing up to £425,000.

An eye-catching surprise policy is a plan to introduce a temporary capital gains tax relief for landlords who sell to their existing tenants. The party also wants to revamp Help to Buy, which would give FTBs an initially interest-free equity loan of up to 20% towards the cost of a new build, and only require them to provide a 5% deposit. The mortgage guarantee scheme, which Labour says it will expand through its Freedom to Buy plan, will remain in place.

The two key housing bills that were lost or watered down in the wake of the election announcement will also be resurrected. The Renters Reform Bill, which didn’t make it through Parliament before it was dissolved on 30 May, and the Leasehold Reform Bill, which did pass - but only with limited changes - will return under a Conservative government, the party has promised.

The Conservatives plan to build 1.6 million homes in England over the next Parliamentary session, if they get re-elected. This is 100,000 more than Labour has pledged to build. The party also wants to abolish ‘nutrient neutrality’ rules that it claims are blocking the building of 100,000 homes, and give brownfield sites a “fast-track” route through the planning system.

Energy

One of the most significant energy promises included in the Conservative manifesto is a plan to build new gas power stations - a move which would appear to push the UK back in its pursuit of net-zero. A re-elected Tory government would also approve two fleets of small modular nuclear reactors within 100 days.

In terms of immediate measures to cut domestic energy bills, the manifesto says Rishi Sunak’s party is committed to reducing green levies so that they come in below 2023 levels over each of the next five years. Other bill reduction ideas include pledges to: introduce local markets for energy (this could knock £20 to £45 a year off bills, the party says), making smart energy tariffs more common (savings of £900 a year are possible, it claims), and incentivising English homes to become more energy efficient through a voucher scheme.

Also included in the manifesto is a pledge to continue the windfall tax on oil and gas company profits until the 2028/29 tax year. However, this policy could be wound down before then if “prices fall back to normal sooner”. No detail has been provided on the definition of ‘normal’ in this instance.

What’s been the reaction to the Conservative manifesto?

The general reaction to the manifesto has been that it lacks fireworks, and may not be attractive enough to voters to overhaul Labour's significant advantage in the polls. There are also question marks hanging over its costings.

Reacting to the manifesto announcement, Paul Johnson - director of non-partisan think tank the Institute for Fiscal Studies (IFS) - warned they may not be watertight enough to cover the “definite giveaways” the Conservatives have announced.

He said: “The trouble is the [welfare] policies that have been spelt out are not up to the challenge of saving £12 billion a year. Some have already been announced and included in the official fiscal forecasts; others are unlikely to deliver sizeable savings on the timescale that the Conservatives claim.”

Johnson added that despite the National Insurance cut nominally putting £450 back into workers’ pockets “they would also lose £150 from continued freezes to income tax and NICs thresholds”. His think tank also pointed out that the tax burden would remain near a record high as a share of national income if the Conservatives implement their manifesto - despite the document claiming that the party would be reducing it.

Another issue pointed out by the IFS chief was that there was no indication about where public services could be cut. Johnson said: “What the manifesto did not tell us was where the £10 to £20 billion of cuts to spending on unprotected public services, as implied by the March Budget, might come from,” he said. “Indeed, the billions of savings from cutting civil service numbers and the rest noted in the manifesto have been earmarked to fund the additional defence spending, and would come on top of those cuts.”

In terms of specific policies, experts focused closely on what the Conservatives announced with regard to property. Tim Bannister, Rightmove's property expert, said the Conservative proposals were “a start” when it came to helping first-time buyers - but could go further.

He said: “Stamp duty reform is the number one change that home-owners and estate agents would like the next government to introduce, so it’s good that it’s being addressed. However, keeping the existing thresholds for first-time buyers is the minimum we would hope for, and an election would seem an ideal opportunity for greater change. The headline proposals don’t appear to support people looking to downsize, or address the significant regional differences in property prices, and therefore stamp duty.”

Bannister added that the landlord capital gains tax relief plan was “interesting”. But he warned that a stumbling block for the policy is that “many renters live in properties that they would be unable to afford to purchase”.

Alice Haine, personal finance analyst at Bestinvest, said the stamp duty exemption “may encourage” more first-time buyers to get on the housing ladder given the stamp duty cap is similar to that of the £450,000 Lifetime Individual Savings Account (LISA) ceiling. But she added that property was an area that has “damaged the Tories politically” among younger voters, and said that she felt the reforms “will likely be considered as too little too late”.

There was also surprise at what was missing from the Conservative manifesto, such as the British ISA. Tom Selby, director of public policy at AJ Bell, said: “The fact the British ISA doesn’t even get a passing mention hopefully means Rishi Sunak’s party have recognised the fundamental flaws in the proposals and are quietly dropping the plans.

“The idea consulted on would have created a new, additional £5,000 ISA allowance, restricted to as-yet-undefined UK companies and potentially UK-focused investment vehicles. As AJ Bell has argued from the start, this ill-thought-through plan would have been ineffective and add unwelcome complexity to ISAs in the bargain. Over the long term, this complexity would risk deterring people using ISAs to invest for the long term.

“The new government needs to take a sensible, saver-focused approach to ISA reform, starting with ISA simplification. No policymaker starting from scratch would advocate for six different types of ISA, which our research shows often leaves potential investors overwhelmed.”

But Selby welcomed the pension tax guarantee: “Pensions have suffered from near-constant tinkering over the last 14 years, an approach which has layered on complexity and created huge uncertainty for long-term savers.

“However, it is important to take this pledge with a pinch of salt. The 25% tax-free lump sum is now capped at £268,275, and failing to increase this amount will effectively mean tax-free cash is steadily eroded by inflation. What’s more, the Conservatives haven’t ruled out making tweaks to the existing allowances.

“That said, this commitment is a step in the right direction and would at least give savers some confidence that the rules will not constantly be changed. Having shown pragmatism by dropping plans to reintroduce the lifetime allowance, it would be a huge positive if Labour also committed to delivering stability and predictability in the pension tax system.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

General election 2024: who’s in the Labour cabinet?

General election 2024: who’s in the Labour cabinet?A new Labour cabinet has been appointed by Keir Starmer after his party won the general election. Here’s the latest on who’s in it

-

What does the Labour election win mean for your money? Key manifesto points after landslide

What does the Labour election win mean for your money? Key manifesto points after landslideNews The Labour election win was not as large as some polls had predicted. But the new government’s majority will mean it can enact significant changes.

-

What would a Labour supermajority mean for capital markets?

What would a Labour supermajority mean for capital markets?The Conservative Party has warned that a Labour supermajority would be bad for democracy. But what impact could a big win for Keir Starmer have on the markets?

-

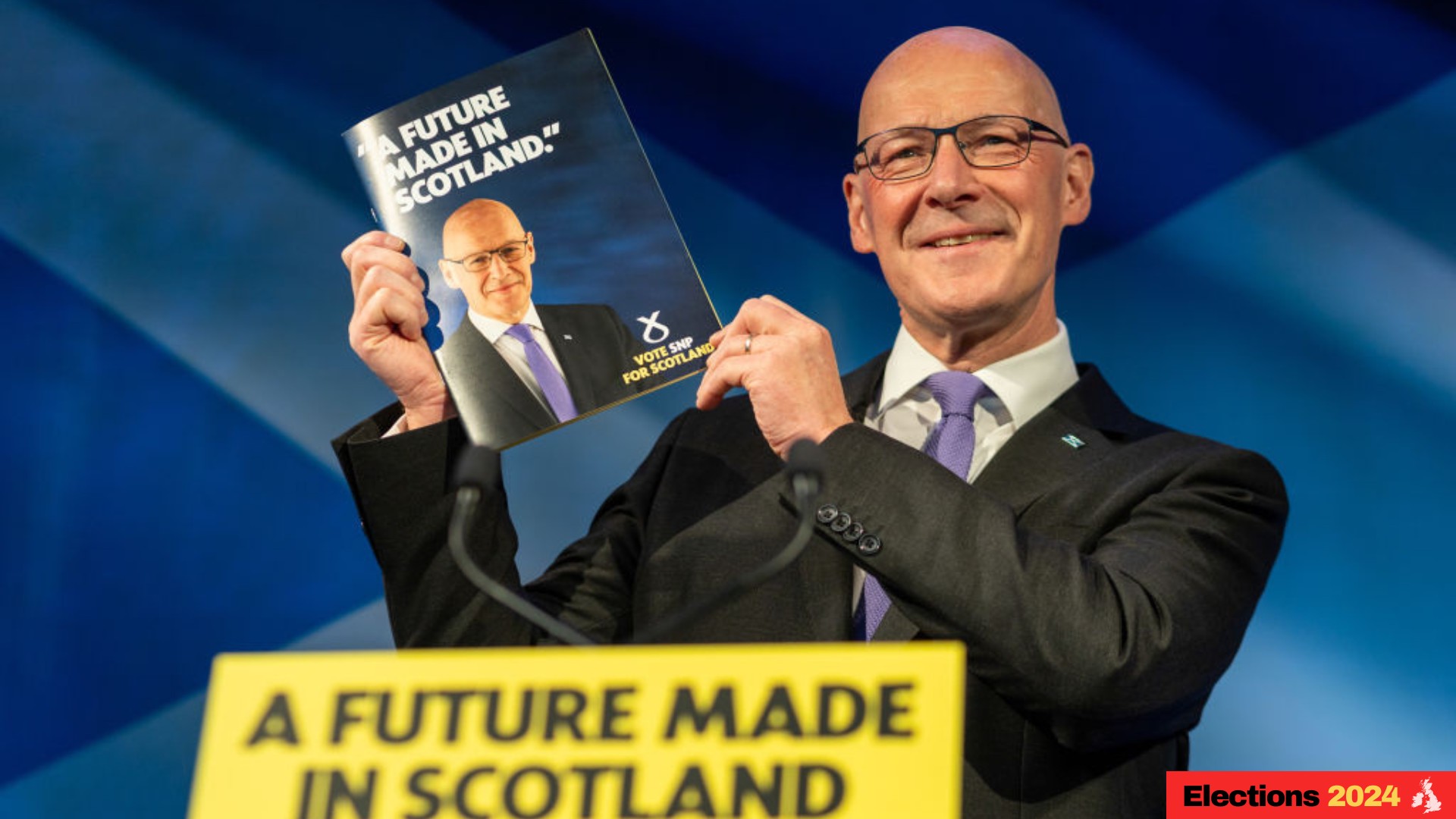

SNP manifesto 2024: what money policies did John Swinney announce?

SNP manifesto 2024: what money policies did John Swinney announce?The SNP manifesto has been launched in Scotland, and makes several key commitments, including a pledge to end austerity and a commitment to rejoin the EU.

-

Labour pledges to open 'at least' 350 banking hubs over next Parliament

Labour pledges to open 'at least' 350 banking hubs over next ParliamentNews The Labour Party claims it will ‘bring banking back to the high street’ if it forms the next government after the 2024 general election.

-

What does the Labour manifesto say about property? Key 2024 general election pledges

What does the Labour manifesto say about property? Key 2024 general election pledgesNews The Labour manifesto has made several promises around rental reforms, the leasehold system and housing market support. Here’s what a Keir Starmer government means for property.

-

Green Party manifesto 2024: key personal finance general election policies

Green Party manifesto 2024: key personal finance general election policiesA Green Party government would introduce a wealth tax, increase National Insurance Contributions for high earners, and move towards a universal basic income.

-

Conservatives pledge to raise high income child benefit threshold – how much could you save?

Conservatives pledge to raise high income child benefit threshold – how much could you save?News The high income child benefit charge threshold could be doubled to £120,000 if the Conservative Party wins the general election, Chancellor Jeremy Hunt has pledged.