Rishi Sunak’s ‘£2,000 Labour tax policies’ claim 'misled voters', official stats body suggests

The Conservative Party leader has made the Labour tax claim several times on the general election campaign trail. Here's why the numbers don't add up - at least right now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

If you've been following the general election campaign trail, you will have heard Rishi Sunak make a stark claim about Labour tax rises.

The Prime Minister has repeatedly claimed that a Labour government would raise taxes by more than £2,000 for working households, if it wins the election. He first raised it during the ITV leaders debate on 4 June and also brought it up at the Conservative party manifesto launch on 11 June.

Labour says the figure is not true. The Tories have also come under fire for claiming the civil service came up with the costings - something the politically impartial body has denied.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It’s hardly the first controversial claim we’ve seen or heard being made on an election campaign trail. Vote Leave’s ‘£350m a week for the NHS’ Brexit referendum promise and Boris Johnson’s ‘40 new hospitals’ pledge are two recent examples of politicians using contested figures while out campaigning. But such claims - truthful or not - can form narratives that define elections.

Both major parties look set to keep the UK tax burden at a record level. Tax rises will be baked in by an income tax threshold freeze - brought in by then-Chancellor Rishi Sunak in 2021 - even if the Tories win and cut National Insurance again. The Lib Dem manifesto and the Green Party's document have also outlined tax hikes.

But, where did Rishi Sunak get the £2,000 figure from - and what’s been the reaction to it? We’ve rounded up what you need to know.

Where does Rishi Sunak’s £2,000 Labour tax figure come from?

During the ITV election debate between Rishi Sunak and Sir Keir Starmer, Sunak said Labour’s policies would lead to a £2,000 tax rise for families. He told the ITV audience: “Labour will raise your taxes. It’s in their DNA. Your work, your car, your pension – Labour will tax it.”

Starmer responded by saying that the Prime Minister had “put pretend Labour policies to the Treasury” to come up with that figure. His party looks set to keep income tax, National Insurance and VAT levels where they are if, as the polls suggest, it wins the 4 July vote.

But it wasn't the first time the controversial £2,000 figure had been used. It actually originated from before the election. On 17 May, just days before the poll was called, the Conservatives published a dossier called ‘Labour’s Tax Rises’.

In this document, it said Labour’s plans for tax and public spending came with a £38.5 billion budgetary black hole. The party’s “unfunded spending would be equivalent to £2,094 per working household over the next four years”, the document claimed. This would work out as a £500 tax hike every year.

The first reason why this statement is controversial is that it is based purely on assumptions about what Labour's plans could be. We don't know what policies Labour will bring in, whether it will pay for them by putting up working taxes, or how ambitious the party will be with its spending.

Labour hasn’t published its manifesto yet, which will set out the party’s full plans and costings for government. It will be this document that we can use to judge their fiscal aptitude by.

The second reason is that, in the report’s foreword by Chancellor Jeremy Hunt, he states that the figures are “based on formal costings by HMT” - the implication being that Treasury civil servants had drawn them up.

While the costings will have been created using data compiled by Treasury civil servants, the final figures and interpretation of them is entirely down to the Conservatives. In a letter sent to Darren Jones, the shadow Chief Secretary to the Treasury, James Bowler - the top civil servant in the department - said: “Civil servants were not involved in the production of presentation of the Conservative Party's document 'Labour's Tax Rises' or in the calculation of the total figure used.”

A third and final reason why the £2,000 figure cannot be trusted is that it has been calculated very crudely. The Tories have taken the difference between tax raising measures and public spending (£38.5bn), and divided it by the number of working households in the UK (18.4 million). Of course, the tax system in the UK is a lot more complicated, with some households paying more than others.

Jeremy Hunt presented the 'Labour's Tax Rises' dossier to the press on 17 May 2024 - days before Rishi Sunak called the 2024 general election (Photo by Leon Neal/Getty Images)

How has Sunak’s Labour tax policy claim been received?

Leading Conservatives, including Claire Coutinho and Laura Trott, have doubled down on the Labour tax claim, while the party's social media accounts have been pushing the line: "If you think Labour will win, start saving".

On Thursday (6 June), Jeremy Hunt went further, penning a piece for the Daily Telegraph that challenged Labour to match Conservative promises to not hike capital gains tax, stamp duty or council tax. Labour has so far not responded to the policy commitments.

Instead, Labour has described the £2,000 claim and Hunt's challenge as "desperate". Labour leader Sir Keir Starmer also accused Rishi Sunak of “lying” on Wednesday (5 June) - a rare accusation in politics. He added: “What you saw is the prime minister with his back against the wall desperately lashing out and resorting to lies.”

In the run up to the TV debate, the Office for Statistics Regulation (OSR) sent a letter to all the major parties. Its chair, Sir Robert Chote, wrote: “We believe official statistics should serve the public good. This means that when statistics and quantitative claims are used in public debate, they should enhance understanding of the topics being debated and not be used in a way that has the potential to mislead.”

After Sunak made the £2,000 claim, the OSR opened an investigation into it. In its conclusion, published on Thursday (6 June), the independent public body criticised the way the claim was presented to the public, suggesting it misled voters.

Its report said: "Without reading the full Conservative Party costing document, someone hearing the claim would have no way of knowing that this is an estimate summed together over four years." Independent fact-checking charity Full Fact described the £2,000 figure as "unreliable".

The Institute for Government (IfG) think tank is also unhappy with the Conservatives for not using its figures as they were intended. Part of its dossier claims that 'insourcing' - i.e. the act of taking services back under public control - would cost almost £6.5bn over four years. This is based on the assumption that “services are 7.5% less efficient if they are insourced” - the 7.5% figure coming from a 2019 IfG report.

However, the think tank's report was specifically about cleaning contracts. Its deputy director, Emma Norris, said on X/Twitter: “Our work does not support Sunak’s £2k tax rise claim. We said *in some cases* cost savings could be associated with outsourcing. But the evidence is limited and cannot be applied to all services. We make this clear in our work, but the Conservative claims last night ignored this."

What has Labour said about Conservative tax policy?

The Conservatives have not been the only ones making suspect claims about their main rivals’ tax and spending plans. Labour has had a go as well.

On 25 May, just days after the election was called, it published a document called “Conservatives’ Interest Rate Rise”. In it, the party claimed Jeremy Hunt “committed” to scrapping National Insurance Contributions in his Spring Budget speech. It said this would amount to a £46bn a year commitment that hasn’t been costed. What Hunt actually said in his Budget speech was that it was his party’s “long-term ambition” to scrap it, and later admitted that it would not happen until after 2030 at the earliest.

Labour’s document also listed other policies it said it expects to see in the Conservative manifesto, such as the abolition of inheritance tax. As with the Conservative attack on Labour’s tax plans, this is almost entirely based on assumptions of what will be in the Tory manifesto rather than anything concrete.

So, when Labour claims that the Conservatives have an annual £71 billion funding gap that would lead to a hike in interest rates, we have to take it with a pinch of salt. Until we have both parties' manifestos in front of us, we cannot draw any conclusions about costings.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Three Indian stocks poised to profit

Three Indian stocks poised to profitIndian stocks are making waves. Here, professional investor Gaurav Narain of the India Capital Growth Fund highlights three of his favourites

-

UK small-cap stocks ‘are ready to run’

UK small-cap stocks ‘are ready to run’Opinion UK small-cap stocks could be set for a multi-year bull market, with recent strong performance outstripping the large-cap indices

-

General election 2024: who’s in the Labour cabinet?

General election 2024: who’s in the Labour cabinet?A new Labour cabinet has been appointed by Keir Starmer after his party won the general election. Here’s the latest on who’s in it

-

What does the Labour election win mean for your money? Key manifesto points after landslide

What does the Labour election win mean for your money? Key manifesto points after landslideNews The Labour election win was not as large as some polls had predicted. But the new government’s majority will mean it can enact significant changes.

-

What would a Labour supermajority mean for capital markets?

What would a Labour supermajority mean for capital markets?The Conservative Party has warned that a Labour supermajority would be bad for democracy. But what impact could a big win for Keir Starmer have on the markets?

-

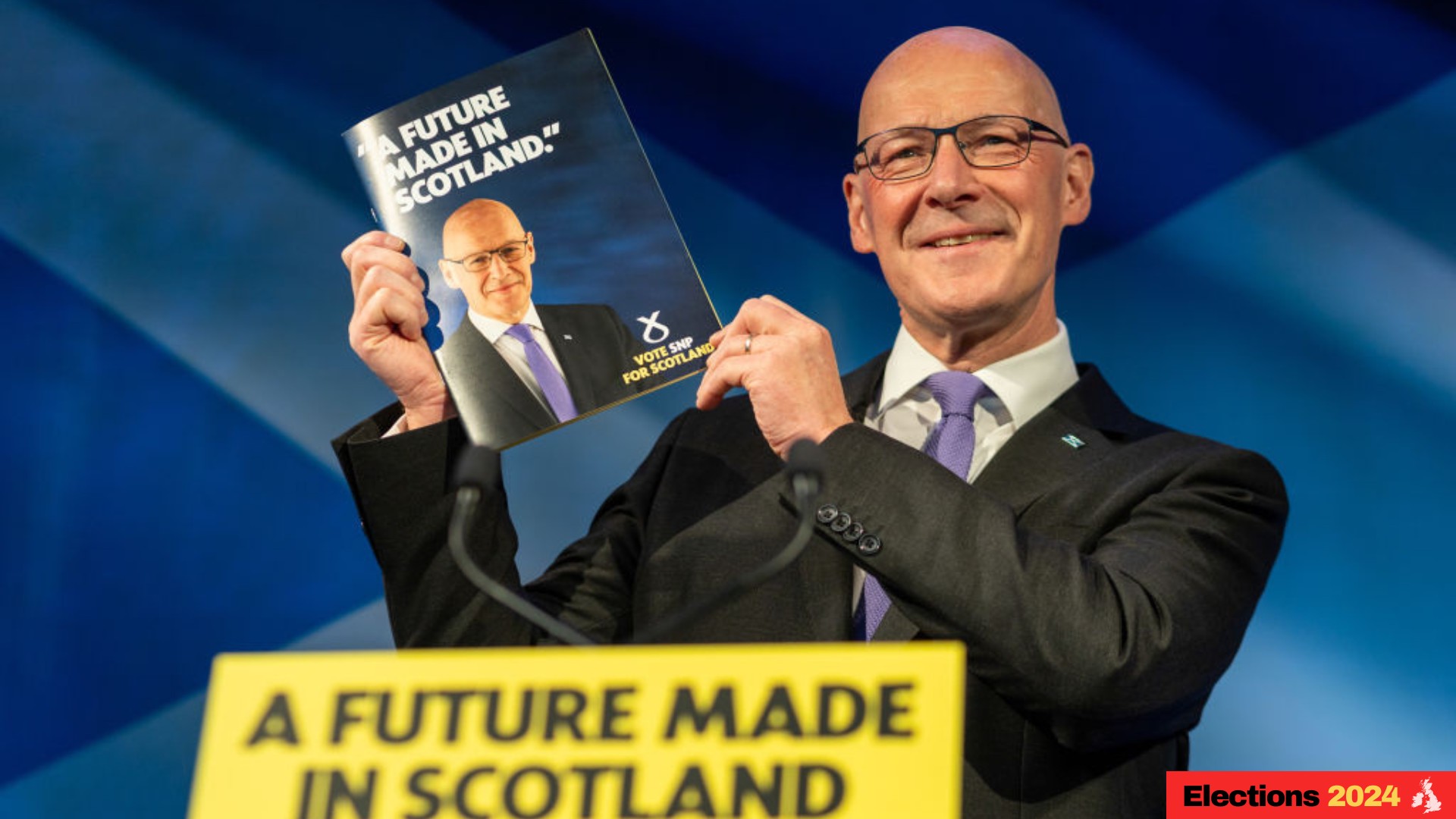

SNP manifesto 2024: what money policies did John Swinney announce?

SNP manifesto 2024: what money policies did John Swinney announce?The SNP manifesto has been launched in Scotland, and makes several key commitments, including a pledge to end austerity and a commitment to rejoin the EU.

-

Labour pledges to open 'at least' 350 banking hubs over next Parliament

Labour pledges to open 'at least' 350 banking hubs over next ParliamentNews The Labour Party claims it will ‘bring banking back to the high street’ if it forms the next government after the 2024 general election.

-

What does the Labour manifesto say about property? Key 2024 general election pledges

What does the Labour manifesto say about property? Key 2024 general election pledgesNews The Labour manifesto has made several promises around rental reforms, the leasehold system and housing market support. Here’s what a Keir Starmer government means for property.

-

Green Party manifesto 2024: key personal finance general election policies

Green Party manifesto 2024: key personal finance general election policiesA Green Party government would introduce a wealth tax, increase National Insurance Contributions for high earners, and move towards a universal basic income.

-

Conservatives pledge to raise high income child benefit threshold – how much could you save?

Conservatives pledge to raise high income child benefit threshold – how much could you save?News The high income child benefit charge threshold could be doubled to £120,000 if the Conservative Party wins the general election, Chancellor Jeremy Hunt has pledged.