Summary

- Inflation rose to 3.8% in July, up from 3.6% in June, according to figures published by the Office for National Statistics (ONS) this morning. It means inflation is at its highest level since January 2024.

- The largest upward contribution to the inflation jump came from the transport division, particularly airfares.

- Longer term, Bank of England forecasts suggest inflation will peak at 4% in September before gradually falling back towards the 2% target by 2027.

- The Bank of England’s governor Andrew Bailey recently told the BBC that although the path for interest rates is still downwards, the course is now “a bit more uncertain” given ongoing inflationary pressures.

- The Bank cut interest rates to 4% on 7 August in a knife-edge decision that required two votes before reaching a 5-4 verdict. The close split has caused investors and economists to adjust their interest rate expectations going forward.

- Most experts now expect a maximum of one more interest rate cut before the end of the year.

| What is inflation? | CPI versus RPI inflation | When will interest rates fall further? | CPI inflation release dates | Bank of England meeting dates |

What to expect from tomorrow’s inflation report

Good afternoon and welcome to our inflation live coverage.

Households should brace themselves for another jump when July’s inflation report is published at 7.00am tomorrow. The Bank of England expects the headline inflation figure to jump to 3.8%, up from 3.6% in June.

Economists at Deutsche Bank are also expecting a 0.2 percentage-point jump compared to last month’s reading. Meanwhile, research firm Pantheon Macroeconomics is expecting a slightly smaller increase, bringing inflation to 3.7%.

Stick with us as we bring you the latest news and analysis, both in the lead-up and aftermath.

After briefly returning to the Bank of England's 2% target last year, inflation has been rising in recent months.

What’s driving price increases?

Summer spending could be partly responsible, if inflation jumps to 3.8% as expected tomorrow.

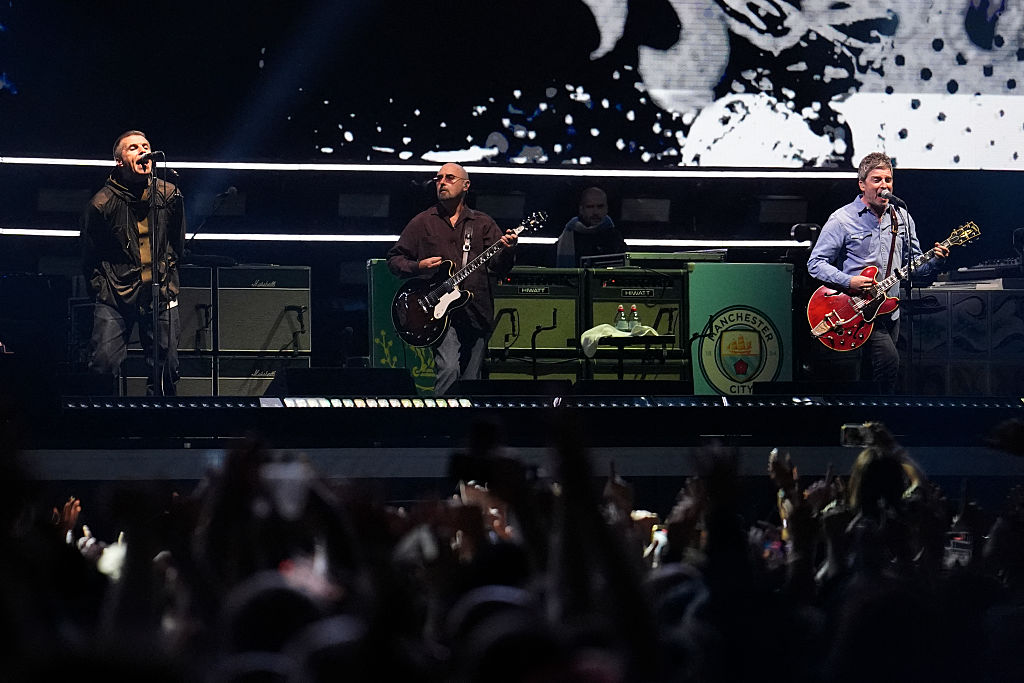

“There’s likely to be more upside in services momentum, particularly around airfares and accommodation prices, with the former supported by the timing of school holidays and the latter potentially flattered by an Oasis-related bump higher,” said Sanjay Raja, chief UK economist at Deutsche Bank.

Food inflation has also been adding pressure in recent months. Extreme weather has impacted harvests and higher employment costs are also pushing prices up.

“We expect food inflation to continue its ascent – but we do think we may be nearing the peak,” Raja said.

Deutsche Bank thinks the Oasis reunion tour may have contributed to higher accommodation prices in July.

Inflation “much hotter than government and Bank of England would like”

Although inflation has slowed considerably from its peak of 11.1% in October 2022, it remains elevated. Victoria Scholar, head of investment at the platform Interactive Investor, points out that it is “much hotter” than both chancellor Rachel Reeves and the Bank of England would like.

This was reflected at the Bank’s latest rate-setting meeting, when policymakers voted to cut rates by a narrow 5-4 majority. Two votes were required before that verdict was reached. Commentators had been expecting a more decisive vote and, as a result, some have dialled down the tone of their forecasts going forward.

“Although we still expect another 25 basis-point cut in November, our call is made with much less confidence,” said Andrew Goodwin, chief UK economist at Oxford Economics.

“We think it wouldn't take much to convince the committee to pause for longer before cutting again. If inflation continues to surprise to the upside, this could tip the balance towards no change, particularly if market pricing moves against a rate cut.”

Governor of the Bank of England, Andrew Bailey

What does rising inflation mean for your money?

At the basic level, rising prices means the cost of everyday goods and services is going up, stretching household budgets. This could prove challenging if your income isn’t rising at the same pace.

Although annual wage growth remains high, coming in at 5% in the latest labour market report, it is starting to slow as the jobs market cools. Survey data from the Office for National Statistics suggests businesses have been pausing hiring decisions, with some opting not to recruit new workers or replace those who have left.

“While workers may take comfort in the fact that pre-tax incomes are still growing faster than inflation for now… this is offset by a heavier tax burden and the risk that wage growth could slow further from here,” said Alice Haine, personal finance analyst at investment platform Bestinvest.

“With uncertainty around the timing of future rate cuts and businesses adopting more cautious hiring strategies – or turning to AI to plug skills gaps – consumers would be wise to adopt a prudent approach to expenditure,” she added.

Of course, it is not just household budgets that inflation impacts, but other areas of your finances like savings and investments too. More on that in our next post.

What would another inflation jump mean for savers?

Rising inflation is bad news for those with cash savings, particularly when coupled with interest rate cuts. Inflation erodes the real value of cash, as the pound in your pocket doesn’t go so far when the cost of goods and services goes up.

To protect your savings against inflation, make sure the interest rate on your savings account keeps pace with inflation, at the very least. Ideally, you should look to beat it. The top easy-access savings accounts are currently offering rates of up to 5%. Even if inflation jumps to 3.8% tomorrow, that means you can still earn a real return of 1.2%.

If you are happy to lock up your cash for a year or so, it could make sense to fix your savings to lock in higher rates for longer. Easy-access accounts tend to have variable rates that can drop with little or no notice, while fixed-rate accounts offer more certainty. The top one-year fixed-rate account with no minimum deposit requirement currently pays 4.25%, according to comparison site Moneyfacts.

Can investing help you beat inflation?

If you are looking to beat inflation over the long term, you might want to consider investing a portion of your savings in a diversified portfolio of stocks, bonds and other assets.

There are some caveats – for example, you should be willing to keep the money invested for a minimum of five years to ride out short-term volatility. Before investing, you should also make sure you have paid off any high-interest debts and put aside enough cash to cover emergencies and any short-term savings goals.

While investing exposes you to market risk, stocks typically outperform cash over the long run and have a better track record when it comes to beating inflation.

Data from Barclays looking back over the past 120 years or so shows that equities have outperformed cash 70% of the time, based on a two-year holding period. If you extend the holding period to 10 years, it rises to 91% of the time.

It is important to invest sensibly across a diversified range of opportunities rather than putting all of your eggs in one basket. If you don’t feel confident picking your own investments, a ready-made fund could be a good option.

Our beginner’s guide shares some useful tips for those who are thinking about investing for the first time.

Rising inflation worsens the impact of fiscal drag

Rising inflation is bad news when it comes to taxes. Personal tax thresholds have been frozen since 2021, meaning more taxpayers are finding themselves in a higher tax bracket as inflation-related wage increases push them over the line.

Inflation also erodes the value of the tax-free personal allowance – the amount of income you do not need to pay tax on. This has been frozen at £12,570 since 2021.

This effect is known as fiscal drag. Critics often call it a stealth tax, as it causes income tax bills to go up, even when rates are left unchanged.

“Frozen tax thresholds affect everyone. With the personal allowance and higher-rate threshold frozen until 2028, this means that even lower earners will gradually pay tax on more of their income,” said Craig Rickman, personal finance expert at Interactive Investor.

“The noise around fiscal drag is likely to crank up over the coming months as the Autumn Budget heaves into sight. With the government at risk of missing its narrow, iron-clad fiscal rules, tax hikes could be in the offing.”

Rickman added that extending the freeze on tax thresholds beyond 2028 is “a way for the government to raise billions of pounds without technically breaking its manifesto promise not to raise taxes on working people”.

How are investors responding to rising inflation?

Although inflation is expected to hit 4% later this year in September, interest rates have been coming down. A falling interest rate environment can encourage savers to invest their money, as cash returns start to look less attractive when savings rates drop.

Despite this, the investment environment remains complex, according to Charlie Ambler, co-chief investment officer at wealth management firm Saltus.

“While rate cuts should disincentivise saving, rising inflation and the prospect of further tax rises in the autumn are forcing investors to exercise a degree of caution. With economic growth slowing to 0.3% between April and June, policymakers must reassure investors and boost confidence in the economy in order to unlock growth,” he said.

“There are undoubtedly opportunities in interest rate sensitive sectors and UK equities, but we are seeing investors adopt a patient, disciplined approach with a focus on long-term returns.”

Join us tomorrow morning

Thank you for following our preview analysis this afternoon. We will be back tomorrow morning, just before July's inflation report is published at 7.00am. To recap, here is what is expected:

- The rate of inflation is expected to jump again tomorrow, potentially hitting 3.8%.

- This would mark a 0.2 percentage-point increase compared to June’s reading of 3.6%.

- Summer spending could be partly responsible for the rise, including higher airfares and accommodation prices. Food prices have also been adding pressure in recent months, and this trend could continue in tomorrow’s report.

The Bank of England will also be keeping a close eye on core and services inflation to get a sense of how embedded inflationary pressures are in the economy:

- Core inflation strips out categories that tend to see short, sharp fluctuations in prices, like food and energy.

- Services inflation covers things like hotel stays, airfares, educational costs and more. Services make up around 80% of the UK economy, so this is an important measure.

- Core inflation is expected to hold steady at around 3.7% tomorrow, according to Deutsche Bank, while services inflation could creep up to 4.9% (compared to 4.7% in June).

All of this has important implications for household budgets and the Bank of England’s interest rate decisions – which in turn impact things like savings rates and mortgage rates. Join us tomorrow as we share the latest news and analysis.

Welcome back – 15 minutes to go

Good morning and welcome back to our live report. In 15 minutes, the Office for National Statistics (ONS) will publish July’s inflation figure. It is expected to show another jump to 3.8%, which would be the highest reading since January 2024.

Stick with us for the latest news, plus what it means for your finances.

Patience could be required from investors when it comes to inflation

Although investors won’t be delighted if inflation jumps again this morning, patience could be required, according to Michael Field, chief equity strategist at investment firm Morningstar.

“Economists have previously warned that we could be dealing with elevated levels of inflation for a transitory period,” he said.

“We believe this is how the Bank of England will view the situation when making upcoming decisions on interest rate levels. Interest rates in the UK are the highest in the western world, so the bank has plenty of room for manoeuvre, even with elevated inflation in the short term.”

Field points out that UK equity markets are trading at all time-highs. “While inflation remains somewhat concerning, the effect of lower interest rates feeding through the economy should only add weight to investor confidence.”

BREAKING: Inflation jumps to highest in 18 months

UK inflation hit 3.8% in July, up from 3.6% in June, in line with analysts' expectations.

What drove the inflation jump?

The largest upward contribution to the jump in inflation came from the transport sector, particularly airfares. Economists had foreseen this heading into today's report.

Commenting earlier this week, Sanjay Raja, Deutsche Bank's chief UK economist, said: “There’s likely to be more upside in services momentum, particularly around airfares and accommodation prices, with the former supported by the timing of school holidays and the latter potentially flattered by an Oasis-related bump higher.”

Transport costs up 3.2% as airfares took off

Transport costs rose by 3.2% on an annual basis in July, up from 1.7% in the previous report. As introduced previously, airfares were largely responsible as prices soared in the busy summer period.

Airfares jumped by 30.2% on a monthly basis – the largest July increase since records began in 2001.

Petrol prices also pushed inflation higher

Motor fuels also added pressure to inflation in the latest report, with the average price of petrol rising by 2 pence per litre between June and July 2025. This compares to a drop of 1.4 pence per litre between June and July 2024.

Diesel prices were up 2.9 pence per litre over the same period, versus 1.1 pence per litre a year ago.

Despite experiencing a bigger monthly jump this July than last, fuel is still cheaper than it was a year ago. A litre of petrol now costs 133.9 pence on average, versus 144.4 pence a year ago. Diesel costs 141.4 pence, down from 150.4 pence a year ago.

Although fuel prices are volatile, the overall trend has been a downward one after prices peaked in late 2022 during the energy crisis.

Rachel Reeves: "More to do to ease the cost of living"

Today's inflation jump was not unexpected, but it will still come as bad news to chancellor Rachel Reeves. It creates an even more challenging backdrop in the lead-up to her Autumn Budget, where tax hikes are widely expected.

Responding to this morning's report, Reeves said: “We have taken the decisions needed to stabilise the public finances, and we’re a long way from the double-digit inflation we saw under the previous government, but there’s more to do to ease the cost of living.

“That’s why we’ve raised the minimum wage, extended the £3 bus fare cap, expanded free school meals to over half a million more children, and are rolling out free breakfast clubs for every child in the country. Through our Plan for Change we’re going further and faster to put more money in people's pockets.”

Larger-than-expected jumps in core and services inflation could create concern

Core and services inflation both jumped in July – and by more than some economists were expecting.

Core inflation strips out categories that tend to see short, sharp fluctuations in prices, like food and energy. Meanwhile, services inflation covers things like hotel stays, airfares, educational costs and more. Services make up around 80% of the UK economy, so this is an important measure.

Core inflation rose from 3.7% to 3.8% on an annual basis in July, while services inflation rose from 4.7% to 5%. For comparison, economists at Deutsche Bank had been forecasting readings of 3.7% and 4.9% respectively, meaning both figures came in slightly higher than they were expecting.

Some will be wondering whether the recent increase in employment costs is having an impact on services inflation. Businesses warned this could happen after a higher minimum wage and higher payroll taxes kicked in from April this year. Many said they would look to offset some of these costs by increasing their prices.

"Increasing services inflation suggests that rising National Insurance and National Living Wage costs are exacerbating underlying price pressures by more than offsetting the current downward squeeze from looser labour market conditions," said Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales.

Food prices accelerate again

Higher food prices have been adding pressure to inflation in recent months, and prices accelerated again in July.

The cost of food and non-alcoholic beverages rose by 4.9% on an annual basis, up from 4.5% in the previous report.

The Office for National Statistics points out that this is the fourth consecutive increase and the highest rate recorded since February 2024. Despite this, the rate of food inflation remains below the peak seen in early 2023.

On a monthly basis, the cost of food and non-alcoholic beverages rose by 0.4%.

Some of the items contributing to higher food inflation in July were meat (mainly beef), sugar, jam, honey, syrups, chocolate and confectionary, coffee, tea, cocoa, mineral waters, soft drinks and juices (mainly fresh orange juice).

The ONS said orange juice was one of the items pushing food and drinks prices up in July

Higher inflation could be bad news for mortgage rates

Those who are looking to take out a mortgage (or refinance after the end of a fixed-rate period) will be disappointed by today's inflation jump. With inflation high and rising, the Bank of England could be more cautious when it comes to future interest rate cuts. That certainly seemed to be the tone of its last meeting on 7 August, when a rate cut was only narrowly voted through by a 5-4 majority.

David Hollingworth, associate director at broker L&C Mortgages, says that mortgage borrowers have recently been enjoying a market where rates have been dropping, but these reductions "have tended to come in small increments".

"We could see that slow further or even reverse in some cases if the market reacts badly to the threat of higher inflation than was previously expected," he explains.

"Borrowers holding out for more cuts may want to keep close tabs on mortgage rates. It’s far from doom and gloom but securing a rate now will protect against any turnaround while still allowing for a review before completion, if there are further improvements."

Upcoming reports will be important for pensioners, with implications for triple lock

Every inflation report feels significant at the moment given recent economic volatility, but the next few months could be particularly important if you are a pensioner.

September's inflation report (published in October) and next month's wage growth report (covering May-July) will be used when calculating how much state pension you receive.

Each year, state pension payments are increased in line with the triple lock rules. This means pensioners see this portion of their income rise in line with inflation, wage growth, or by 2.5% – whichever is highest.

The Bank of England currently expects inflation to hit 4% in September, the all-important month for pensioners. Wage growth is currently slightly higher than this at 4.6% (including bonuses), although it could shift slightly in next month's report.

"Wage growth has been drifting down, but it seems likely we will see a state pension increase somewhere in the 4-4.5% ballpark for next year. This would give someone on a new state pension an uplift somewhere around £479-538 per year. Someone on a full basic state pension would see that portion of their income rise by between £367-£413," said Helen Morrissey, head of retirement analysis at Hargreaves Lansdown.

"These increases would be much smaller than the huge boosts we’ve seen in recent years, but they will be welcome nonetheless. The increase won’t be implemented until April 2026 and it’s to be hoped that inflation will have dipped significantly by that point, so it should give a bit more breathing space to pensioner budgets that have been sorely stretched."

Does today’s inflation print look worse than it is?

Although today’s jump takes inflation to its highest level in 18 months, several experts point out that some of the drivers are short term in nature.

“Services inflation rose slightly but the root cause was holiday expenditure: airline prices jumping as school holidays started, and hotels and restaurants no doubt reflecting the same,” said Michael Browne, investment strategist at Franklin Templeton, the asset management firm, “The comment in the MPC report that even the Hawks think this is short term, has not received enough scrutiny.”

Others point out that the Oasis reunion tour may have contributed to higher hotel and restaurant costs too, with prices in this category rising by 3.4% on an annual basis in July, up from 2.6% the month before.

Annual house price inflation is 3.7%

Each month on inflation day, HM Land Registry also publishes a report on how much house prices have gone up or down over the past year. Official house price data is published with a six-week time lag, meaning today's report covers the year to June (rather than July, which is the month covered in the latest CPI report).

UK house prices rose by 3.7% over this time period, bringing the average property to £269,000 – around £9,000 higher than a year ago. On a monthly basis, prices rose by 1.4%.

Remortgaging this year? Here’s what today’s economic environment means for you

For the reasons explored in a previous post, today’s inflation jump may come as bad news for those shopping around for a new mortgage deal. Given inflation is high and rising, many expect the Bank of England to slow down the pace of rate cuts – which could mean mortgage rates stall.

That said, there is some good news for those who are looking to refinance over the coming months as they come to the end of a two-year fix.

The average two-year fixed rate is currently 4.98%, according to comparison site Moneyfacts. This is considerably cheaper than this time two years ago. At its peak in August 2023, the average two-year rate was 6.85%.

For someone borrowing £400,000 over a 25-year mortgage term, this drop in rates equates to a £455 drop in monthly repayments.

Things don’t look quite so good for those coming to the end of a relatively cheap five-year deal agreed before rates started rising in 2021. Their monthly repayments are likely to jump when they refinance.

Moneyfacts: Fewer than half of savings accounts beat inflation

Data from comparison site Moneyfacts shows that fewer than half of available savings accounts now beat inflation. Savers have been hit by a double whammy of rising inflation and falling interest rates in recent months.

Of the 2,004 savings accounts currently available on the market, just 956 beat inflation. This has fallen from 1,558 inflation-beating deals a year ago (August 2024).

"After almost a year and a half of savings growth, many savers are slipping back into earning negative real returns as inflation figures jump again," said Caitlyn Eastell, a Moneyfacts spokesperson.

"With inflation running higher than the interest savings earn, money left languishing in a low-interest account is losing its spending power – making it tougher to achieve a sense of financial resilience or save towards goals."

This highlights the importance of shopping around for the best deal. Some of the top accounts are still paying around 5%, but savers should act sooner rather than later to boost their chances of earning a real return.

See our round-up of the best easy-access rates, one-year savings accounts, regular saver accounts and cash ISAs for the latest deals on cash savings.

Where is inflation heading next?

Inflation is expected to pick up over the next couple of months, peaking at 4% in September, according to the Bank of England. Recent increases have been driven by higher food prices, energy prices and increases in some regulated prices like water bills earlier this year.

There has also been some uncertainty arising from global developments, including changes in trade policy led by US president Donald Trump. “While recent trade agreements mean there is less uncertainty than earlier in the year, we continue to watch closely what this could mean for UK inflation,” the Bank of England said.

Some commentators think higher UK employment costs may also have added pressure in recent months, after the minimum wage and payroll taxes went up in April. Businesses previously warned they might look to raise prices to offset the cost. Economists will be keeping a close eye on how this develops over the coming months.

While inflation has been rising so far this year, the Bank of England still thinks the underlying disinflationary trend is intact. After peaking in September, the Bank expects inflation to gradually fall back towards the 2% target, finally reaching it in the second quarter of 2027.

That concludes our inflation live coverage for this month. Thank you for joining us. Here is a list of upcoming CPI dates, covering the remainder of 2025:

- 17 September (covering August)

- 22 October (covering September)

- 19 November (covering October)

- 17 December (covering November)

- 21 January 2026 (covering December)

We will be back with further analysis then.