ONS: UK economy grew by ‘lacklustre’ 0.1% in final quarter of 2025

The construction sector performed its worst in more than four years in the final quarter of 2025, the latest Office for National Statistics (ONS) GDP figures show

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The UK economy grew by just 0.1% in the final three months of 2025 as the year ended on a sluggish note.

The slight rise in Gross Domestic Product (GDP) between October and December followed a 0.1% increase in Q3, according to the Office for National Statistics (ONS).

GDP also rose by 0.1% in the month to December, down from growth of 0.2% in November. November’s figure was revised down from a previous estimate of 0.3%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The ONS said GDP increased by 1.3% across 2025, following a weaker 1.1% in 2024.

But growth almost ground to a halt after a positive start to 2025, with GDP in the first and second quarters of the year increasing by 0.8% and 0.2%, respectively.

Adam Hoyes, senior asset allocation analyst at wealth management firm Rathbones, said: “Today’s preliminary GDP data show the UK economy wrapping up 2025 on a lacklustre note, which will be a disappointment to a prime minister and chancellor relying on a growing economy to help both turn around their political fortunes and set the public finances on a more sustainable footing.

“The meagre increase reemphasises the need for the government to prioritise growth and investment after the missed opportunity of the Autumn Budget.”

Why did the economy struggle in Q4 2025?

The services sector, which accounts for a significant portion of the UK economy, flatlined (0%) in the last three months of 2025, following a 0.2% uptick between July and September. (Q3).

Eight of the 14 services subsectors showed growth in the final quarter, offset by falls in the other four subsectors. Education and the financial and insurance industries were among the subsectors which saw growth.

The construction sector registered its worst growth in more than four years, shrinking by 2.1%.

These falls were offset by positive growth in production in the last three months of the year, which grew by 1.2% after a fall of 0.7% the previous quarter, in part due to a major cyber attack at Jaguar Land Rover in August.

The growth in the production sector in the last quarter of 2025 was mainly driven by a rise of 0.9% in manufacturing while mining and quarrying was up by 1.4%.

Scott Gardner, investment strategist at J.P. Morgan Personal Investing, said consumer spending also showed “promising signs” but many would be hoping the slow pace of growth improves in 2026.

Could an interest rate cut be on the cards?

The Bank of England’s Monetary Policy Committee (MPC) held interest rates at 3.75% in a narrow 5-4 vote this month.

It is predicting inflation to slow to around 2%, its target, by April, acknowledging that “risk from greater inflation persistence has continued to become less pronounced”.

With that in mind, and today’s latest GDP figures showing a stagnating economy, could it make a rate cut at MPC’s next meeting on 19 March more likely?

Not according to Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales (ICAEW).

Thiru said: “The UK economy should see slightly stronger growth in this current quarter with reduced uncertainty now the Budget is in the rear-view mirror, and lower inflation likely to boost consumer spending and business activity, despite higher unemployment.

“These figures mean that a March interest rate cut remains doubtful by giving those policymakers wanting more evidence that inflation is slowing comfort over economic conditions to delay reducing rates, particularly given the elevated political uncertainty.”

What does rising GDP mean for you?

GDP is the total value of all the goods and services produced in a country over a set period of time. Rising GDP shows an economy is healthy.

People living in a country with high GDP are likely to have higher incomes and therefore better standards of living.

If these people spend their incomes inside the country, that also boosts takings for businesses who in turn are likely to hire more staff and invest more, creating a snowball effect.

However, GDP rising too fast can cause inflation to surge. This makes interest rate rises by the Bank of England more likely, leading to higher borrowing and mortgage costs.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Sam has a background in personal finance writing, having spent more than three years working on the money desk at The Sun.

He has a particular interest and experience covering the housing market, savings and policy.

Sam believes in making personal finance subjects accessible to all, so people can make better decisions with their money.

He studied Hispanic Studies at the University of Nottingham, graduating in 2015.

Outside of work, Sam enjoys reading, cooking, travelling and taking part in the occasional park run!

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Rachel Reeves is rediscovering the Laffer curve

Rachel Reeves is rediscovering the Laffer curveOpinion If you keep raising taxes, at some point, you start to bring in less revenue. Rachel Reeves has shown the way, says Matthew Lynn

-

'Expect more policy U-turns from Keir Starmer'

'Expect more policy U-turns from Keir Starmer'Opinion Keir Starmer’s government quickly changes its mind as soon as it runs into any opposition. It isn't hard to work out where the next U-turns will come from

-

UK interest rates latest: December 2025

UK interest rates latest: December 2025Live Report The Bank of England’s Monetary Policy Committee (MPC) has cut interest rates from 4% to 3.75%

-

Rachel Reeves's punishing rise in business rates will crush the British economy

Rachel Reeves's punishing rise in business rates will crush the British economyOpinion By piling more and more stealth taxes onto businesses, the government is repeating exactly the same mistake of its first Budget, says Matthew Lynn

-

The consequences of the Autumn Budget – and what it means for the UK economy

The consequences of the Autumn Budget – and what it means for the UK economyOpinion A directionless and floundering government has ducked the hard choices at the Autumn Budget, says Simon Wilson

-

Why UK stocks are set to boom

Why UK stocks are set to boomOpinion Despite Labour, there is scope for UK stocks to make more gains in the years ahead, says Max King

-

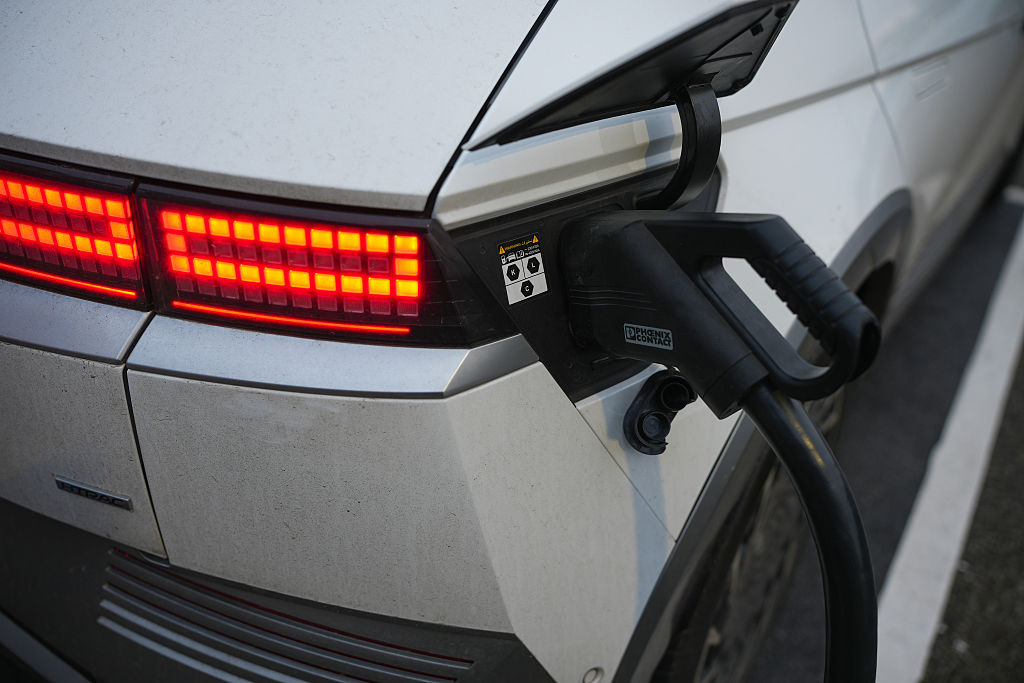

Electric vehicle drivers to be charged new per mile tax from 2028

Electric vehicle drivers to be charged new per mile tax from 2028Electric vehicle drivers will be forced to pay a 3p per mile tax, as taxation will be brought closer in line with petrol and diesel cars

-

Autumn Budget winners and losers

Autumn Budget winners and losers"Someone has to suck up the costs - those who can pay will pay,” says Kalpana Fitzpatrick