Investors flock to NS&I savings after SVB scare - should you follow this trend?

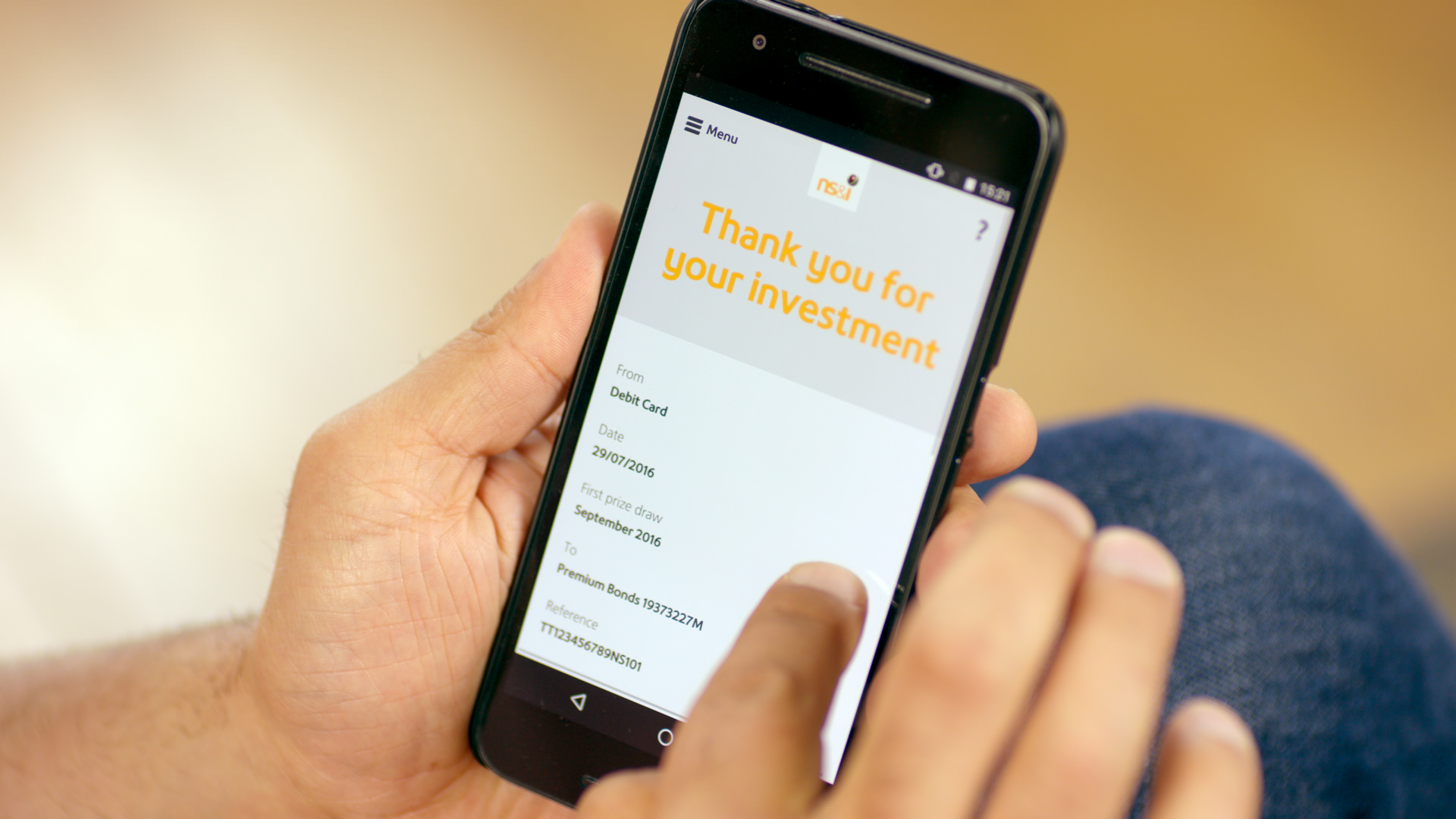

Investors are increasingly pumping their cash into the safety-net of NS&I - lured by increased rates and the security of a government-backed savings account. Should you move your savings to NS&I?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The collapse of Silicon Valley Bank and Credit Suisse in the US has undoubtedly sent shockwaves across the globe, but for both savers and investors, it has left many nerves rattling, with questions being asked over whether money is safe with a bank. With more savers switching to the safety of NS&I, we look at whether now is a good time to switch to government-backed National Savings & Investments (NS&I).

NS&I has attracted £2bn in February alone, according to Bank of England data.

In December 2022, £700m was deposited, while a month prior, £300m was withdrawn from accounts.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

While UK savers and investors benefit from a layer of protection from the Financial Services Compensation Scheme (FSCS) - which covers you for up to £85,000 should a bank or building society go bust - with NS&I, your cash is guaranteed by the Treasury to be safe no matter how much you hold.

And with an increase in interest rates across NS&I savings accounts, savers are increasingly looking to stash their cash there for higher returns and added security.

It is highly expected that NS&I may increase rates further to help boost funding - this is looking more likely as the Bank of England put up its Base rate this month to 4.25%.

If NS&I rates do go up, it is likely that more will turn to it as market volatility in the banking continues, which has already seen some investors readjust their portfolios according to investment platform Interactive investor.

Should you save with NS&I?

If you have more than £85,000 saved in cash, which you may have if you are saving for a house deposit maybe, then it makes good sense to put it into a NS&I account as you get a higher level of protection.

If you are worried about your bank not being safe, then it is worth noting that banks are covered for up to £85,000 of your cash via the FSCS. You can see if your bank is covered at FSCS.

What rates does NS&I offer?

NS&I has been upping rates for its products, including the premium bond prize fund rate from 3.15% to 3.3%, meaning there will be an extra £15m in prizes up for grabs each month.

We have the details of the March premium bond winners in our article - March premium bond winners revealed.

It marks the fifth rate increase for premium bonds in the last year alone.

In February, NS&I bumped up the interest rate on its green savings bond - up from 3% to 4.2%. It is available on a three-year fixed term.

This year also saw the relaunch of NS&I’s one-year fixed bonds, offering rates up to 4%, pitching the bonds as a competitor to some of the best one-year fixed savings accounts.

Meanwhile, its direct saver account offers a 2.85% variable rate, while its direct Isa offers 2.15%.

The junior Isa currently offers 3.4%.

Bank, building society or NS&I?

It’s not only NS&I that’s been attracting positive inflows. Banks, building societies and NS&I reported a combined net flow of £3.6bn into customer accounts – £300m more than in January.

And while NS&I may look look attractive, you may find better interest rates elsewhere - conventional banks may be incentivised to continue putting up rates to persuade savers to keep their cash in place.

Samuel Tombs, Pantheon Macroeconomics chief UK economist, said: “Households will be further disincentivised from spending their savings if, as we expect, banks raise deposit rates in order to ensure that depositors who have funds over the £85,000 guaranteed by the Financial Services Compensation Scheme do not withdraw their money.”

But savers are “continuing to vote with their feet” and shift their money to better-paying accounts, says Laura Suter, head of personal finance at AJ Bell.

“Fixed-rate accounts continued to be popular, as people lock in higher rates, with £6.8bn of money deposited in these accounts. February was the fifth consecutive month where people moved their money out of easy-access accounts and into fixed-rate ones.

“As many signal that we’re nearing peak interest rates it’s a good time for savers to snap up higher rates now, before the market plateaus when the Bank of England ends its rate-hiking cycle,” she said.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Tom is a journalist and writer with an interest in sustainability, economic policy and pensions, looking into how personal finances can be used to make a positive impact.

He graduated from Goldsmiths, University of London, with a BA in journalism before moving to a financial content agency.

His work has appeared in titles Investment Week and Money Marketing, as well as social media copy for Reuters and Bloomberg in addition to corporate content for financial giants including Mercer, State Street Global Advisors and the PLSA. He has also written for the Financial Times Group.

When not working out of the Future’s Cardiff office, Tom can be found exploring the hills and coasts of South Wales but is sometimes east of the border supporting Bristol Rovers.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

NS&I February Premium Bonds winners revealed – did you win £1 million?

NS&I February Premium Bonds winners revealed – did you win £1 million?More than 2.7 million historic Premium Bonds prizes are still waiting to be claimed, NS&I says

-

NS&I cuts interest rates on 8 savings accounts – are they still worth it?

NS&I cuts interest rates on 8 savings accounts – are they still worth it?NS&I will now offer less attractive interest rates for customers wishing to lock their savings away to grow for one, two, three or five years.

-

The best cash ISAs – February 2026

The best cash ISAs – February 2026Savings The best cash ISAs can help you make the most of your tax-free savings. But you may want to take advantage of top rates before they disappear

-

One-year fixed savings drop below 6% - have they reached their peak?

One-year fixed savings drop below 6% - have they reached their peak?The best one-year fixed-rate savings deals have fallen below the 6% mark. Find out if saving rates have reached their peak and the current top rates on the market.

-

NS&I cuts interest rate on Green Savings Bonds - where can you get a better deal?

NS&I cuts interest rate on Green Savings Bonds - where can you get a better deal?News The state-backed bank has slashed the interest rate on its Green Savings Bonds from 5.7% to 3.95%

-

Metro Bank boosts top easy access and one year fixed savings to hit best buy tables

Metro Bank boosts top easy access and one year fixed savings to hit best buy tablesMetro Bank has jumped into best buy tables offering a market-leading rate on both easy access and one year fixed savings accounts.

-

Charles Stanley Direct launches cash savings - is it any good?

Charles Stanley Direct launches cash savings - is it any good?Charles Stanley Direct has launched a savings platform to give savers access to the best deals on the market. We look at how it compares to other services.

-

Paragon launches best buy 5.25% easy access account

Paragon launches best buy 5.25% easy access accountAs the savings market heats up, rates on easy access accounts continue to rise with Paragon Bank now offering the table topping rate for easy access paying 5.25%. But there are some restrictions and you’ll need to be quick to get it.