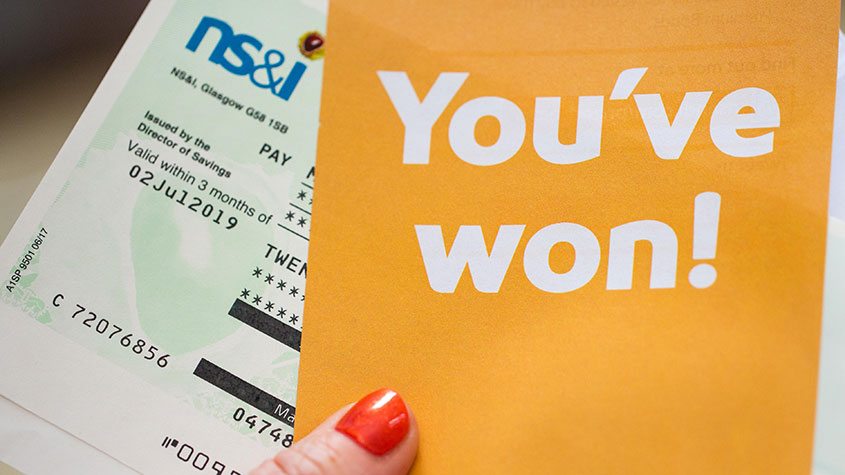

NS&I bumps up interest rate on Premium Bonds again

NS&I is increasing the Premium Bond prize rate for the second time this year, meaning there are hundreds of extra prizes in every draw. We look at how the changes will affect you.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

National Savings & Investments has bumped up the interest rate on Premium Bonds again at the same time when rate increases on some of its other products also kicked in. If you’re on the lookout for the best savings accounts for your cash, then could NS&I be worth another look?

The Premium Bonds prize fund rate will jump from 3% to 3.15% (effective from the February 2023 prize draw), representing another increase after the rate went up from 2.2% to 3% on 1 January 2023.

Other product rate increases include:

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

- Direct Saver - up 2.3% to 2.6%

- Income Bonds - up 2.3% to 2.6%

- Direct ISA - up from 1.75% tax-free to 2.15% tax-free

- Junior ISAs - up from 2.70% tax-free to 3.40% tax-free

More than 870,000 customers holding NS&I’s Direct Saver, Income Bonds and Direct ISA will benefit from the increased rates, plus 80,000 junior ISA account holders.

The new rate on income bonds at 2.6% is the highest NS&I is paying since 2008, and 2.15% on the direct ISA product is the highest seen in a decade. And the latest rate rise on the direct saver product at 2.6% is not the highest since it launched in March 2010.

Premium bonds rate rise - now at highest level in 14 years

The rate rise on premium bonds is the fourth increase NS&I has made in the last 12 months in a bid to lure savers into the government backed bank.

If you have premium bonds the rate actually means the number of prizes, worth between £50,000 and £100,000, will increase - so there’s a higher chance of you bagging a larger amount of prize money from February 2023.

NS&I chief executive, Ian Ackerley, said: “Today’s changes will provide a welcome boost for savers of all ages across the country, with more Premium Bonds prizes and some of the highest interest rates we’ve seen in over a decade.

“In a fast changing savings market, we’re committed to making sure our products remain competitive and our customers get a good return on their savings. Today’s changes ensure that we continue to balance the needs of savers, taxpayers and the broader financial services sector.”

However, despite the increases it is worth noting that the rates are not necessarily market leading and it will pay to shop around, as banks and building society rates on savings products have been creeping up in recent weeks; and with the Bank of England expected to increase interest rates again next month, better rates may well be on the horizon.

It's also worth noting that none of these rates are market-leading. For non-ISA savings you can make 2.9% elsewhere from the first £1, without any restrictions, and even for ISA savings you can make 2.75% on the same basis. And you could get 3.8% on cash junior ISAs from Coventry Building Society.

“This is effectively NS&I playing catch up after the easy access market has crept up with successive interest rate rises,” Sarah Coles, head of personal finance at Hargreaves Lansdown commented.

What are the chances of winning per bond?

According to NS&I, this is the estimated number of prizes we can expect to see next month.

Number and value of Premium Bonds prizes

| Value of prizes in January 2023 | Number of prizes in January 2023 | Value of prizes in February 2023 (estimated) | Number of prizes in February 2023 (estimated) |

| £1,000,000 | 2 | £1,000,000 | 2 |

| £100,000 | 56 | £100,000 | 59 |

| £50,000 | 111 | £50,000 | 117 |

| £25,000 | 224 | £25,000 | 236 |

| £10,000 | 559 | £10,000 | 590 |

| £5,000 | 1,116 | £5,000 | 1,177 |

| £1,000 | 11,968 | £1,000 | 12,573 |

| £500 | 35,904 | £500 | 37,719 |

| £100 | 1,159,432 | £100 | 1,280,509 |

| £50 | 1,159,432 | £50 | 1,280,509 |

| £25 | 2,617,902 | £25 | 2,376,161 |

| Total: £299,202,350 | Total: £4,986,706 | Total: £314,347,875 | Total: £4,989,652 |

Source: NS&I

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Kalpana is an award-winning journalist with extensive experience in financial journalism. She is also the author of Invest Now: The Simple Guide to Boosting Your Finances (Heligo) and children's money book Get to Know Money (DK Books).

Her work includes writing for a number of media outlets, from national papers, magazines to books.

She has written for national papers and well-known women’s lifestyle and luxury titles. She was finance editor for Cosmopolitan, Good Housekeeping, Red and Prima.

She started her career at the Financial Times group, covering pensions and investments.

As a money expert, Kalpana is a regular guest on TV and radio – appearances include BBC One’s Morning Live, ITV’s Eat Well, Save Well, Sky News and more. She was also the resident money expert for the BBC Money 101 podcast .

Kalpana writes a monthly money column for Ideal Home and a weekly one for Woman magazine, alongside a monthly 'Ask Kalpana' column for Woman magazine.

Kalpana also often speaks at events. She is passionate about helping people be better with their money; her particular passion is to educate more people about getting started with investing the right way and promoting financial education.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

NS&I February Premium Bonds winners revealed – did you win £1 million?

NS&I February Premium Bonds winners revealed – did you win £1 million?More than 2.7 million historic Premium Bonds prizes are still waiting to be claimed, NS&I says

-

NS&I cuts interest rates on 8 savings accounts – are they still worth it?

NS&I cuts interest rates on 8 savings accounts – are they still worth it?NS&I will now offer less attractive interest rates for customers wishing to lock their savings away to grow for one, two, three or five years.

-

Premium Bonds winners announced – did you scoop the September jackpot?

Premium Bonds winners announced – did you scoop the September jackpot?NS&I has announced the winners for September’s Premium Bonds prize draw, with two lucky savers becoming overnight millionaires. Did you win this month?

-

NS&I announces August 2025 Premium Bonds winners – did you win £1 million jackpot?

NS&I announces August 2025 Premium Bonds winners – did you win £1 million jackpot?NS&I has released details about August 2025’s Premium Bonds jackpot winners. We look at who won a big prize this month

-

How long does it take to win a Premium Bonds prize?

How long does it take to win a Premium Bonds prize?It could take much longer than you think to win something in the Premium Bonds prize draw

-

Premium Bond winners – who won the December £1 million jackpot?

Premium Bond winners – who won the December £1 million jackpot?NS&I has unveiled December’s Premium Bond winners. Who bagged the jackpot and what other prizes are on offer?

-

NS&I cuts Premium Bond prize fund rate to 4%

NS&I cuts Premium Bond prize fund rate to 4%NS&I will reduce the Premium Bond rate from 4.15% to 4% in January, while also cutting the rates on other savings accounts. Are Premium Bonds still worth it?

-

NS&I to cut Premium Bond prize rate to 4.15%

NS&I to cut Premium Bond prize rate to 4.15%The odds of winning a prize will fall to 22,000 to 1 for the December draw, while NS&I is also slashing the rates on other savings products. We have all the details