Santa rally helps FTSE pass 10,000

A festive boost for the UK’s flagship index sees it open 2026 at record highs

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The FTSE 100 gained 2.2% during December 2025, delivering on the seasonal promise of a Santa rally.

The gains helped the index break through a new milestone on the first trading day of 2026.

The Santa rally left the FTSE 100 at 9,982 at the end of 2025. It took just hours of trading for the index to pass the 10,000 mark on the morning of 2 January 2026 for the first time in its history.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Rebecca Maclean, investment director at Aberdeen Investments, hailed the milestone as a strong start to the year for the UK’s flagship index.

“It follows a strong 2025, when the UK market delivered a 22% gain, led by its largest companies. An impressive return for a region many investors continue to overlook,” Maclean added.

UK chancellor Rachel Reeves called the index’s new milestone “a vote of confidence in Britain’s economy and a strong start to 2026”.

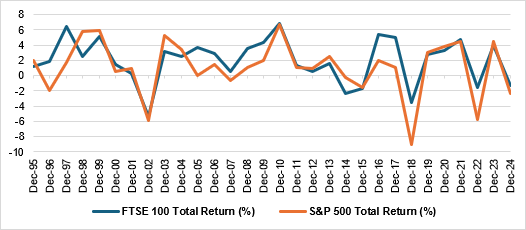

The S&P 500 didn’t participate in the Santa rally last year, closing December 2025 just 0.05% above where it ended November.

This echoes a year that saw diversification in the stock market, with the top stocks of the year reflecting a move away from US dominance.

“Last year saw global equity leadership broaden, with almost every major market outpacing the US, as investors diversified their exposure,” said Maclean.

What is the ‘Santa rally’?

The term ‘Santa rally’ refers to the tendency of stock markets to rise as the festive season kicks in and consumer spending rises. This also sees optimistic investors pile more into the top stocks and funds.

The FTSE 100 has returned 2.1% on average during December since 1984, making it the index’s best-performing month of the year. April and July are the only other months of the year with an average gain above 1% during that period.

“If you want to know why markets talk about the Santa Rally, that is why – because the numbers back it up,” said Russ Mould, investment director at AJ Bell.

How often do we see a Santa rally?

The data shows that stock markets do tend to rise during December. Analysis from Fidelity International shows that the FTSE 100 posted a positive return in December in 24 of the last 30 years, while the S&P 500 rose in 22 of the last 30 Decembers.

Why that happens is less clear. Jemma Slingo, pensions and investment specialist at Fidelity International, attributes the existence of Santa rallies to positive sentiment among investors at this time of year.

“Optimism tends to build as the year draws to a close and investors look ahead with a sense of renewal in the new year,” she said. “Festive optimism, Christmas bonuses and thinner trading volumes are often cited as contributing factors.”

Mould points out that in the past, investors looked forward to a ‘January effect’, wherein financial advisers would put their clients’ money to work in the new year and lift the stock market.

While this no longer happens, Mould thinks that the Santa rally effect may have originated with investors attempting to anticipate the January effect in advance.

While the Santa rally effect can make December a buoyant month for the stock market, Mould cautions that it often precedes a weaker year ahead.

“The FTSE 100 has served up 11 annual losses since 1984 and 10 of those came after a gain in the December of the previous year,” he said. “The only exception was 2015, whose 4.9% annual decline came after a 2.3% slide in December 2014.”

Some of the biggest historical Santa rallies have preceded sharp market downturns, such as the shock Federal Reserve rate hike in 1994 that followed a buoyant December 1993.

Last year (2024) was one of the rare cheerless Decembers for the FTSE 100, which fell 1.4% during the month. But the index’s gains this year underscores the point that a dismal Decembers doesn’t necessarily mean an unhappy new year.

In a separate article, we also take a look at where to invest for 2026.

Should you bank on a Santa rally?

Santa rallies are frequent occurrences, but like any seasonal investing trend, such as the ‘sell in May’ approach, they shouldn’t be relied upon too heavily.

“Seasonal patterns like the Santa rally are no substitute for a long-term investment plan, but they do offer an insight into how investor psychology can drive markets,” says Slingo. “Even in times of uncertainty – whether it’s financial crises, referendums or pandemics – December has often rewarded those who stayed invested rather than trying to time the market,” she added.

“History shows that investors who stay the course tend to be rewarded over time,” said Slingo. “The festive season can bring volatility and opportunity in equal measure, but discipline and perspective remain the best gifts investors can give themselves.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Dan is a financial journalist who, prior to joining MoneyWeek, spent five years writing for OPTO, an investment magazine focused on growth and technology stocks, ETFs and thematic investing.

Before becoming a writer, Dan spent six years working in talent acquisition in the tech sector, including for credit scoring start-up ClearScore where he first developed an interest in personal finance.

Dan studied Social Anthropology and Management at Sidney Sussex College and the Judge Business School, Cambridge University. Outside finance, he also enjoys travel writing, and has edited two published travel books.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge