Ignore the doomsayers - things are looking bright for the bulls

Everywhere you look there seems to be bad news, but if past trends are anything to go by, 2023 could be a bumper year for equity returns says Dominic Frisby

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

“As January goes, so goes the rest of the year,” is the wisdom, and January is going rather well. So far. Here in Britain the FTSE 100 has broken out to all-time highs. In the States, the S&P 500 is up 5% for the month.

With all this in mind, here is a cool stat I wanted to share with you - one I just learnt from JC Parets over at All Star Charts.

If you get, first, a Santa Claus rally - that would be a rally in the S&P 500 over the week between 23rd December 23 and 4th of January - then a positive first five days of the year, and then a positive January, you have what Parets calls “the Trifecta.”

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

(Note by the way there was no Santas Claus rally in the years going into the big crashes of 2000 and 2008).

It’s only January 26. There is another week to go. But barring a major turndown over the next few days, it looks like we have Parets’ “Trifecta”.

We got a 0.8% Santa Claus rally - doesn’t sound like much, but Parets argues it is “more than three times the historical returns for all the other seven-day periods throughout the year.”

US stocks rallied another 1.4% in the first five days of 2023. And things, as we have already noted, are looking good for a strong January overall.

So here’s the stat that will get bulls salivating.

“Since 1950, whenever the S&P 500 has completed the Trifecta coming off a down year, the stock market has never been down. And it's up almost 27% on average, more than three times the average annual rate of return for the S&P500.”

27%? I’ll take that!

You don’t get these trifectas very often, by the way.

The US Presidential Cycle could be good news for markets

Here’s some more bull food.

We are coming into the third year of the four-year US Presidential Cycle - the year when the powers that be try to get everything looking hunky dory in time for the next election. They are normally very good years for stocks.

Don’t believe me? Charles Schwab researcher Lee Bohl has analysed market data since 1933 to find that the strongest market gains came, in general, with the third year of the presidency. Here are the average returns in each year of the presidential cycle between 1933 and 2015:

- Year after the election: +6.7%

- Second-year: +5.8%

- Third-year: +16.3%

- Fourth-year: +6.7%

Note that 2019, President Donald Trump’s third year, saw a 27% rally, which would carry the above averages even higher.

Between 1933 and 2022, the stock market saw gains in roughly 70% of calendar years, says macrotrends.net. But in year three of the presidential election cycle, that rises well over 80% of the time. We like 80% probability rates.

The portents then are very good.

But, but, but … the economy, the war in Ukraine, China, inflation, Russia, political uncertainty, political division, social unrest, the bear market blah blah.

Markets don’t care about that stuff - except when they do. They are tired narratives, anyway, and they are all “priced in”.

For now, the easiest direction of travel is up.

The trend is your friend

Here’s one final bit of bull food.

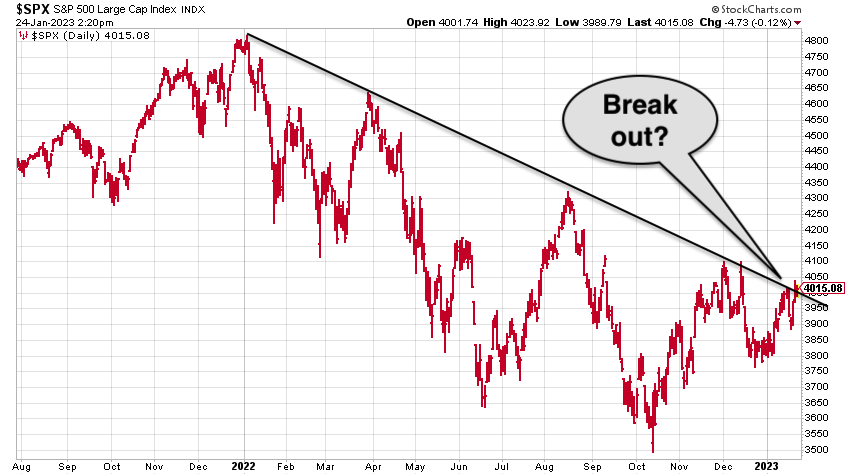

The S&P 500 peaked in early 2022 and trended lower for the year - with occasional rallies.

But it seems to be just breaking above its falling trend line, as the chart below isolates.

This kind of signal might not mean much in isolation, but coupled with everything else, you’ve got to say things are looking up.

Trend-followers will also have observed that all the short- and intermediate-term moving averages - over say seven days, 21 days, 55 days, even 144 days - are now sloping up. The S&P 500 has broken above its 200-day moving average. It won’t be long before that turns up too.

In other words, we have a new uptrend in place. Trends are powerful things. You might have heard me mention that once or twice.

So whether it’s the technicals, the cycles, or the historical patterns, there are lots of reasons to be bullish for the year ahead. After the year we have just had it’s hard to feel that way - it’s far easier to be stuck in a negative mindset, just as perhaps we were too slow to get into a negative mindset at the onset of the bear. But your author reports nevertheless on what he sees.

On the other hand, it might, for example, be worth pointing out that we are still below where we were in early December.

And that, as always, there is a lot that can go wrong in the world.

But, for now, it’s a Wednesday morning and I’m feeling bullish.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Fund inflows hit a six-month high in November – where are investors putting their money?

Fund inflows hit a six-month high in November – where are investors putting their money?Investors returned to the financial markets amid the Autumn Budget in November 2025 but caution remains.

-

The top stocks of 2025 - did you pick a winner?

The top stocks of 2025 - did you pick a winner?Last year was a chaotic one for the stock market, but which stocks did investors buy the most of?

-

Canada will be a winner in this new era of deglobalisation and populism

Canada will be a winner in this new era of deglobalisation and populismGreg Eckel, portfolio manager at Canadian General Investments, selects three Canadian stocks

-

Best-performing stocks in the S&P 500

Best-performing stocks in the S&P 500We take a look at the best-performing stocks in the US equity market. Are there opportunities outside of Big Tech?

-

What is Vix – the fear index?

What is Vix – the fear index?What is Vix? We explain how the fear index could guide your investment decisions.

-

The case for dividend growth stocks

The case for dividend growth stocksMany investors focus on yield alone when looking for income, that’s a mistake says Rupert Hargreaves. It’s the potential for dividend growth that really matters.

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?