Four money apps to help your cut your spending

These four money apps will help you cut your bills, cancel unwanted subscriptions, grow your savings, and even file your tax return.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

A growing number of money apps are popping up to help users manage their finances, save them cash and build their financial resilience. If you have a smartphone you probably already have a few banking apps to check your current account or credit card balance, and maybe one to keep an eye on your investments. But there’s also a range of budgeting and money-saving apps that can help you manage your finances better and even cut your household bills – something we’re all looking to fo during the cost of living crisis.

Money apps can save you time and money, with some switching your household bills to a cheaper competitor, cancelling unwanted direct debits for you, helping to file a tax return, or automatically squirrelling away some of your earnings to invest or save. We round up four of our favourite money management apps.

1. Snoop: reduce your bills

If you want personalised help cutting your bills, consider Snoop. The free money management and budgeting app can help you track your spending and lower your household bills.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

By using Open Banking you can connect your bank accounts and credit cards to the app and see them all in one place. This allows the app to “snoop” through your finances and look at where you already spend your money. Snoop lets you know if there are voucher codes available for when you buy something from one of your favourite stores, or cheaper competitors for you to switch your bills to, such as broadband or car insurance.

Snoop is registered and authorised by the Financial Conduct Authority (FCA), the City regulator.

2. Emma: help with direct debits

The average adult spends £39 a month on unused direct debits, standing orders and recurring card payments, according to NatWest - that’s £468 a year. The Emma app can help cut back on these money leaks. The most common unused subscription is a gym membership. But many of us are also paying for video-streaming services we don’t watch.

Get help sorting through your wasteful subscriptions with Emma. This free app is described as “your financial super app”, designed to help you avoid overdrafts, cancel wasteful subscriptions, track debt and save money. It also offers commission-free stock trading.

Using Open Banking you can connect your accounts, including investments, to the app and view them in one place. The app can find and cancel any subscriptions you may have signed up to but forgotten about, offers cashback at more than 500 retailers, and helps you save for different goals by creating “Emma pots”. There are also three paid-for versions of the app that offer extra features, ranging from £4.99 to £14.99 a month in price, though you can do a 7-day trial for free.

The Emma app is authorised and regulated by the FCA.

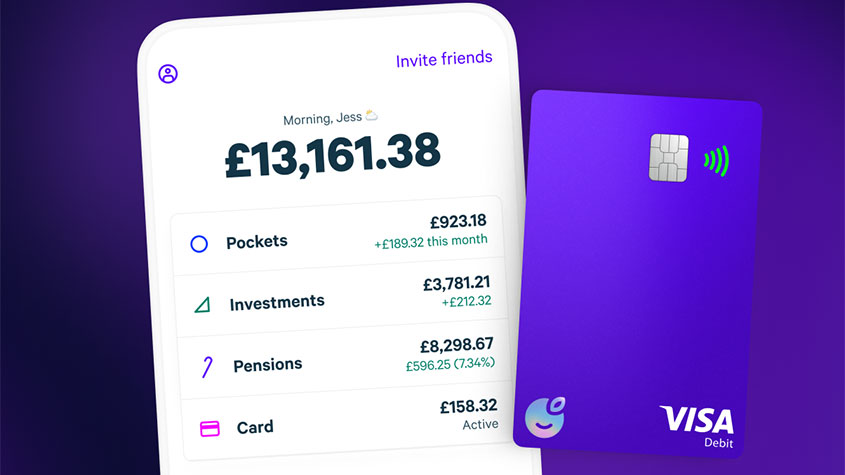

3. Plum: Help with saving and investing

Plum says it helps more than one million people invest, save and manage their spending. The app tracks your spending habits and gauges how much you can afford to save, then puts some money aside for you every few days. This auto-save feature also gives the option to round up your purchases to the nearest pound and save the difference (for example if you spent £2.60 on a coffee, it would save 40p).

The basic version app is free, but you can also upgrade for £1 a month, which means your savings will automatically be invested into shares and bonds via a Plum Isa (additional investment fees will apply). There are alternative plans ranging from £2.99 to £9.99 a month (note: you can do a 30-day trial for free) , offering extra features such as cashback of up to 11% when shopping with certain retailers, a Plum card and additional stocks to invest in.

Plum is registered and authorised by the FCA – although some of its products are not covered by the Financial Services Compensation Scheme (FSCS).

4. Untied: Help filing your tax return

Get help filing your tax return with Untied. It allows users to link the app to bank accounts, credit cards and tax accounts, upload or add data manually, and then it gives an estimate of what your tax bill is likely to be.

Untied’s “lite” version costs £24.99 a year, while the “pro” version is priced at £49.99 a year, which gives you access to the app (the lite version works only on a desktop or mobile browser), plus you can link an unlimited number of bank accounts. The pro version also includes support for capital gains and property income.

The average accountant charges £150 to £250 to file your tax return. So if you’re comfortable using an app, this could save you a decent chunk of cash. Untied is regulated by the FCA and supervised by the Chartered Institute of Taxation.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ruth is an award-winning financial journalist with more than 15 years' experience of working on national newspapers, websites and specialist magazines.

She is passionate about helping people feel more confident about their finances. She was previously editor of Times Money Mentor, and prior to that was deputy Money editor at The Sunday Times.

A multi-award winning journalist, Ruth started her career on a pensions magazine at the FT Group, and has also worked at Money Observer and Money Advice Service.

Outside of work, she is a mum to two young children, while also serving as a magistrate and an NHS volunteer.

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Why pension transfers are so tricky

Why pension transfers are so trickyInvestors could lose out when they do a pension transfer, as the process is fraught with risk and requires advice, says David Prosser

-

Nationwide promises to protect all its branches from closures until at least 2030

Nationwide promises to protect all its branches from closures until at least 2030The building society has extended its pledge to keep all high street Nationwide and Virgin Money branches open, now until at least 2030.

-

Thousands of Brits switch to Nationwide, Monzo and NatWest – which banks are least popular?

Thousands of Brits switch to Nationwide, Monzo and NatWest – which banks are least popular?We look at the most and least popular banks and building societies as current account bank switches reach a record high. Is it worth moving your money?

-

NatWest sell-off moves closer as the government offloads more shares

NatWest sell-off moves closer as the government offloads more sharesThe UK Treasury's stake in NatWest has fallen to below 11% - here is what it means for the share price

-

NatWest online banking and mobile app 'running again' after outage

NatWest online banking and mobile app 'running again' after outageBreaking NatWest's online banking and mobile app went down this morning, affecting as many as 10 million users.

-

Best and worst UK banks revealed

Best and worst UK banks revealedWe reveal the best UK banks – and the worst – when it comes to managing your money and good customer service. How does your provider compare?

-

iPhone users can now check bank balance from Apple Wallet

iPhone users can now check bank balance from Apple WalletNew tool aims to make it easier for smartphone users to track bank balance and spending

-

Barclays launches £175 switching deal - plus earn 5.12% interest on cash

Barclays launches £175 switching deal - plus earn 5.12% interest on cashBarclays launches £175 switch bonus, which also gives you access to 5.12% easy access savings. We have all the details