How open banking became a great British success story

Over the past few years financial technology has stepped up a gear. The way we spend, save, borrow and invest is now changing rapidly

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Open banking is a great British success story. Launched in 2018, this initiative, backed by the government, regulators and industry, lets third-party providers access your financial information at the touch of a button, but only after you’ve given explicit consent (renewed every 90 days). The idea is to connect various service providers to your bank account and thus benefit from a wide range of products and services that are tailored to your needs because they are based on analysing your data.

Around 300 financial technology firms (“fintechs”) and innovative-finance providers have joined the open-banking network and more than 2.5 million British consumers and businesses now use open banking-enabled products to manage their finances, access credit and make payments. One practical measure of success is that so-called API call volume – which gauges how many times an app has accessed data – has increased from 66.8 million in 2018 to nearly six billion in 2020.

Track and cut your spending

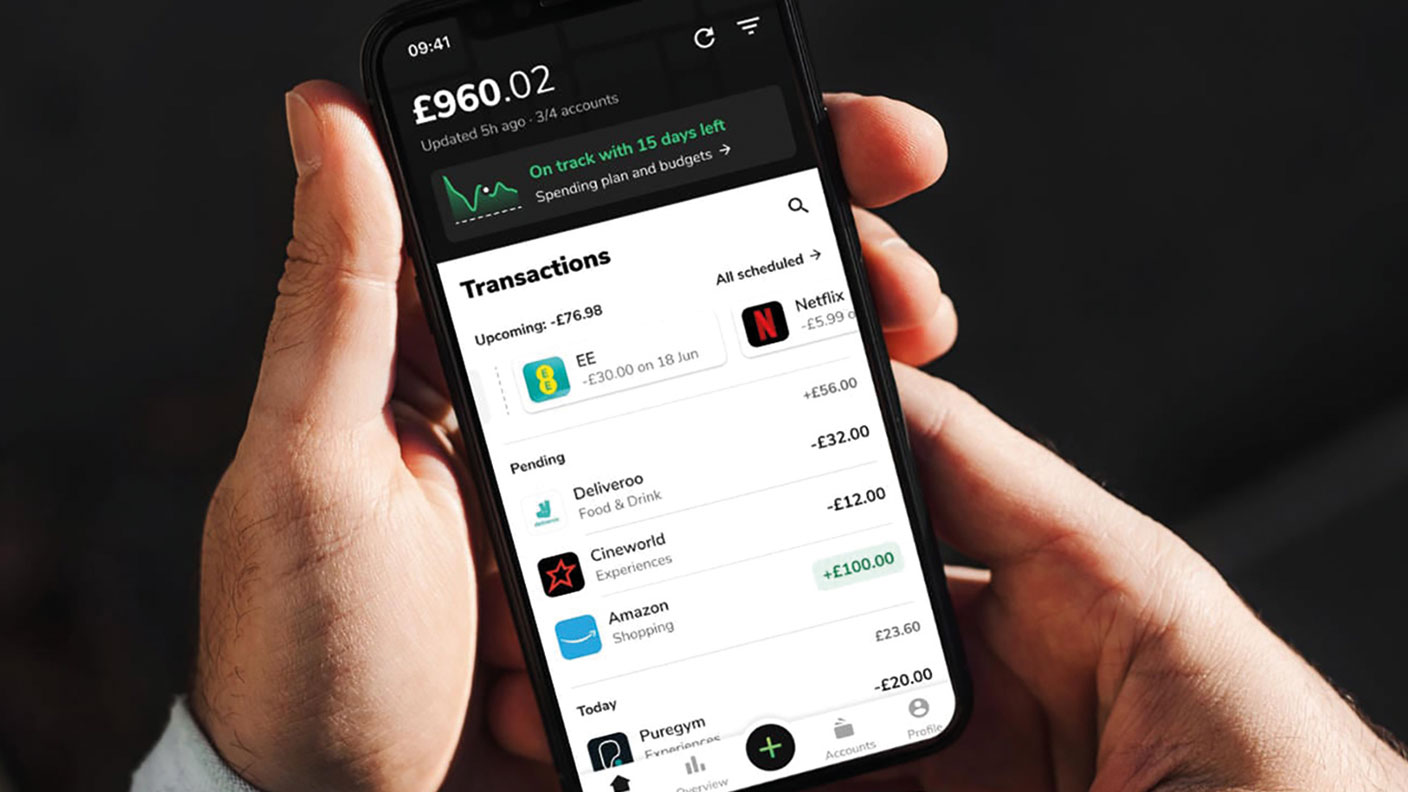

Those unfamiliar with open banking are almost certainly missing out on some great new ideas. Let’s start with account aggregation. Outfits such as Yolt, Money Dashboard and Snoop are blazing a trail in grouping together all your bank accounts into one page and then analysing how your money is spent – and, crucially, how you might spend less.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Snoop is arguably the most innovative of these firms. It feels like a cross between a data cruncher and a MoneySavingExpert advice and content site. It searches for new ideas to save money, ranging from insurance through to cash savings accounts or Amazon offers. Over time all these services begin to learn more about how you spend money.

As artificial intelligence (AI) improves, these services will analyse your spending in more and more detail and come up with ideas to help you keep a lid on it. One Nordic bank, for instance, is already trialling a service that lets consumers tag their spending using over 30 broad categories and over 250 specific labels. Another way that open banking can help is by giving access to more and better savings and investing products. As far as the latter are concerned, several providers are now allowing bank-account holders to shift money from their accounts into an online-investing platform that allocates spare cash to exchange-traded funds.

Probably the best-known service is called Moneybox but it has several rivals. One recent deal, for instance, features a service called Bud, which has signed an agreement with banking challenger Dozens to encourage customers to save and invest more effectively.

A boost for small businesses

Owners of small and medium-sized enterprises (SMEs) are also benefiting from these developments. Digital bank Starling, for example, has enabled owners of SMEs to access everything from VAT and accounting software to legal documentation providers on its platform. Open banking should also help small business owners get quicker access to credit.

Atom Bank, another digital bank, is launching an open banking service that will enable “near real-time” lending decisions via an open-banking specialist called Plaid. Through access to SMEs’ transaction data, Atom can verify incomes, assess affordability, and identify and mitigate risks associated with outdated information.

Arguably though the biggest changes are emerging behind the scenes. If you want to make an online payment or top up, the typical options involve direct debits or a debit-card payment. The first works fine for very regular payments, while the latter is actually fairly expensive as the main providers, Visa and Mastercard, levy substantial interchange fees.

Open banking, by contrast, has allowed new players such as TrueLayer to offer cheaper, simpler ways of sending money. Users of Freetrade’s new Sipp trading plan can make use of a one-click service that cuts out debit cards or bank transfers so that they can get money into their account. This saves the provider’s interchange fees, giving scope for offering customers incentives to use these open-banking payment alternatives. Another open-banking application is credit ratings. Admiral Financial Services, part of the Admiral Group, for instance, has recently signed up a credit-referencing and open-banking fintech called Credit Kudos to improve its credit-assessment process.

When a customer applies for a loan from Admiral they will now be presented with the option of sharing their financial data securely as part of the application. Credit Kudos will aggregate and analyse this data in order to provide Admiral with insights about the person, including income verification. Open banking should also lead to better and quicker access to mortgage products.

What about “open finance”?

I suspect, however, that the holy grail for most MoneyWeek readers is something known as “open finance”. If investment platforms shared data, you would be able to see all your share dealing and fund accounts in one place – and maybe even use clever data tools to make a better analysis of how well your investments are performing.

If this idea sounds familiar, it is. You may remember the pensions dashboard, which has been promising to offer these insights and integration between different third-party providers for many years now. Don’t hold your breath.

Oliver Smith, who writes for the fintech publication AltFi, notes that “open finance and the pensions dashboard both suffer from the same ever-increasing complexity around the data sets they’re trying to unlock. Pensions data, for instance, [ranges] from multinational providers running on cloud infrastructure... to legacy or boutique pensions providers who still rely on analogue paper databases. Coming up with an industry-level solution to unlock that data is part of the reason the pensions dashboard has dragged on since 2016 with little progress to date”. If Smith is right, investors might have to wait a bit longer to understand their investment and pension products better.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David Stevenson has been writing the Financial Times Adventurous Investor column for nearly 15 years and is also a regular columnist for Citywire.

He writes his own widely read Adventurous Investor SubStack newsletter at davidstevenson.substack.com

David has also had a successful career as a media entrepreneur setting up the big European fintech news and event outfit www.altfi.com as well as www.etfstream.com in the asset management space.

Before that, he was a founding partner in the Rocket Science Group, a successful corporate comms business.

David has also written a number of books on investing, funds, ETFs, and stock picking and is currently a non-executive director on a number of stockmarket-listed funds including Gresham House Energy Storage and the Aurora Investment Trust.

In what remains of his spare time he is a presiding justice on the Southampton magistrates bench.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Why it might be time to switch your pension strategy

Why it might be time to switch your pension strategyYour pension strategy may need tweaking – with many pension experts now arguing that 75 should be the pivotal age in your retirement planning.

-

Rachel Reeves is rediscovering the Laffer curve

Rachel Reeves is rediscovering the Laffer curveOpinion If you keep raising taxes, at some point, you start to bring in less revenue. Rachel Reeves has shown the way, says Matthew Lynn

-

ISA reforms will destroy the last relic of the Thatcher era

ISA reforms will destroy the last relic of the Thatcher eraOpinion With the ISA under attack, the Labour government has now started to destroy the last relic of the Thatcher era, returning the economy to the dysfunctional 1970s

-

Investing in forestry: a tax-efficient way to grow your wealth

Investing in forestry: a tax-efficient way to grow your wealthRecord sums are pouring into forestry funds. It makes sense to join the rush, says David Prosser

-

'Expect more policy U-turns from Keir Starmer'

'Expect more policy U-turns from Keir Starmer'Opinion Keir Starmer’s government quickly changes its mind as soon as it runs into any opposition. It isn't hard to work out where the next U-turns will come from

-

Why pension transfers are so tricky

Why pension transfers are so trickyInvestors could lose out when they do a pension transfer, as the process is fraught with risk and requires advice, says David Prosser

-

Modern Monetary Theory and the return of magical thinking

Modern Monetary Theory and the return of magical thinkingThe Modern Monetary Theory is back in fashion again. How worried should we be?

-

The coming collapse in the jobs market

The coming collapse in the jobs marketOpinion Once the Employment Bill becomes law, expect a full-scale collapse in hiring, says Matthew Lynn