Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

This week, we take a look at the opportunities for investors in Asia’s best stockmarkets. Chinese stocks may be out of favour at the moment – indeed JPMorgan classified the country’s whole internet sector as “uninvestable” since the government clamped down – but there is still value to be found elsewhere, says Rupert Foster. Specifically in India, Indonesia and our favourite Asian market, Vietnam.

Elsewhere, David Stevenson picks a new fund to profit from pampered pets. And in personal finance, Ruth Jackson Kirby asks if you should bother with highly expensive pet insurance or opt for the “self insurance” road.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Find out all the details in this week’s magazine. If you’re not already a subscriber, sign up here and get your first six issues free.

We’ve got a bumper podcast for you this week with a guest many of you will be keen to hear from – James Anderson, the outgoing manager of the Scottish Mortgage investment trust. He tells us about his career, and gives his views on the state of the fund management industry in general, and picks one stock to buy and hold for the next 20 years. Listen to the podcast here.

Here are the links for this week’s editions of Money Morning and other web articles you may have missed:

- The bond bubble has burst – what comes next?

- Should you buy BP shares? The oil giant looks cheap, but approach with caution

- UK house prices will fall – but not for a few years

- Will house prices crash in 2026? This surprisingly reliable cycle theory suggests so

- Scottish Mortgage Investment Trust update: discount to net asset value narrows

- “Show me the money!” – what the collapse in Netflix’s share price says about markets today

- Can Naked Wines prove there’s life beyond the pandemic for its business?

- Will house prices crash in 2026? This surprisingly reliable cycle theory suggests so

- Netflix’s share price has fallen by two thirds from its peak – is it time to buy?

- If you’re going to buy FANG stocks today, these are the three to focus on

- Is this the end of the road for Russian gold miner Petropavlovsk?

- Three things you should learn from Bill Ackman's brilliant Netflix trade

- Britain’s ten-most hated shares

- GlaxoSmithKline is set to cut its dividend – should you sell your shares?

- Cybersecurity firm Darktrace is enjoying rapid growth, but the competition could prove too much

- Elon Musk is still trying to buy Twitter – will he succeed and should you care?

- Don’t write off Ukrainian iron ore miner Ferrexpo just yet

- Cryptocurrency roundup: IMF’s warning for emerging markets

Now for the charts of the week.

The charts that matter

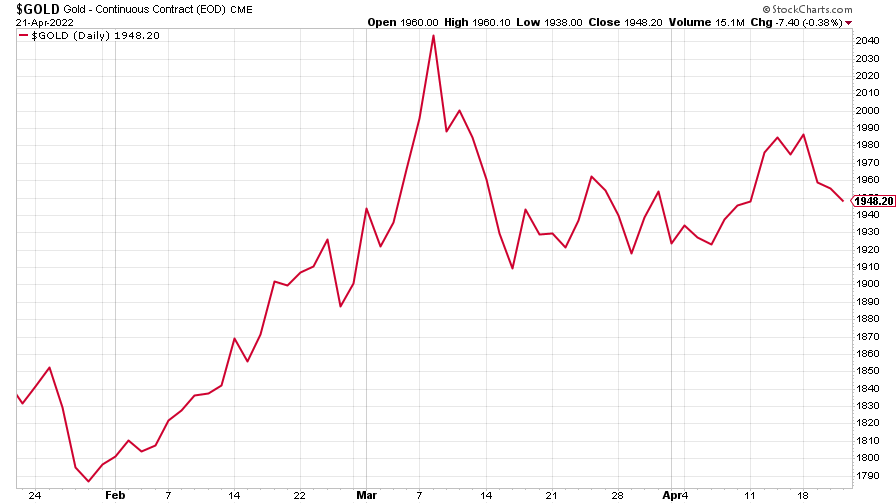

Gold fell back as the US dollar climbed – the price of gold tends to slip as the dollar strengthens.

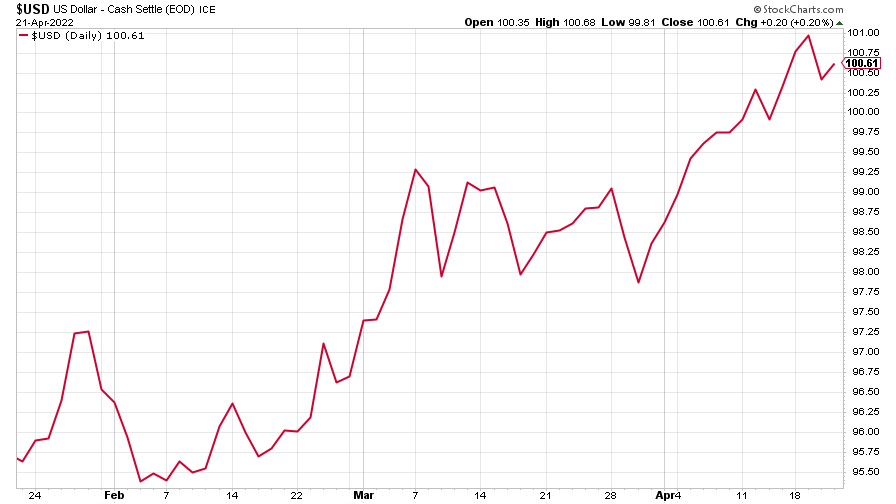

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) continued its rise.

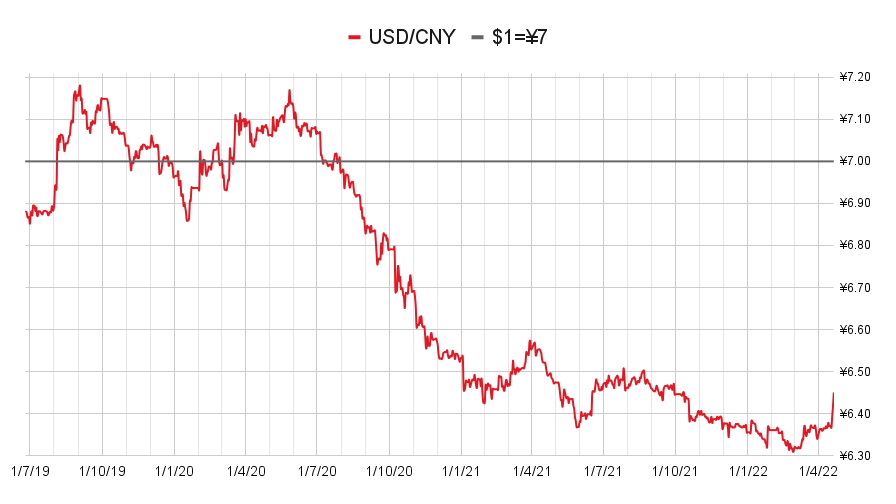

The Chinese yuan (or renminbi) fell against the dollar (when the red line is rising, the dollar is strengthening while the yuan is weakening).

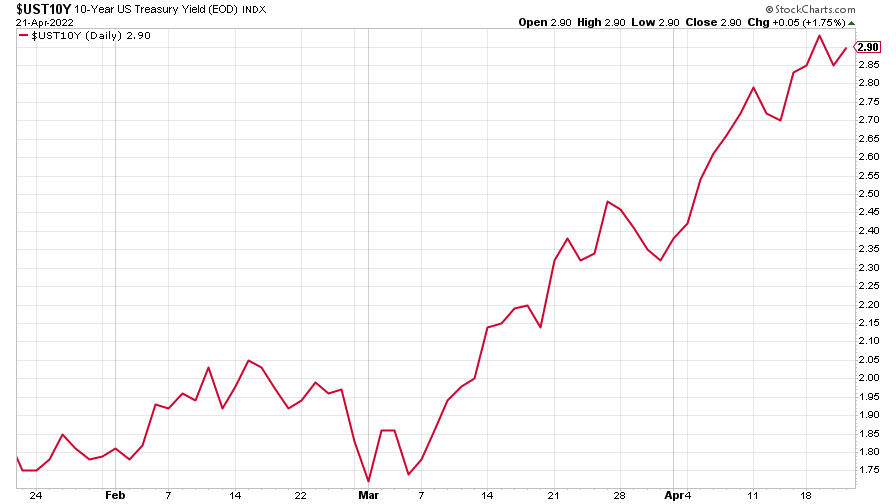

The yield on the ten-year US government bond continued to rise.

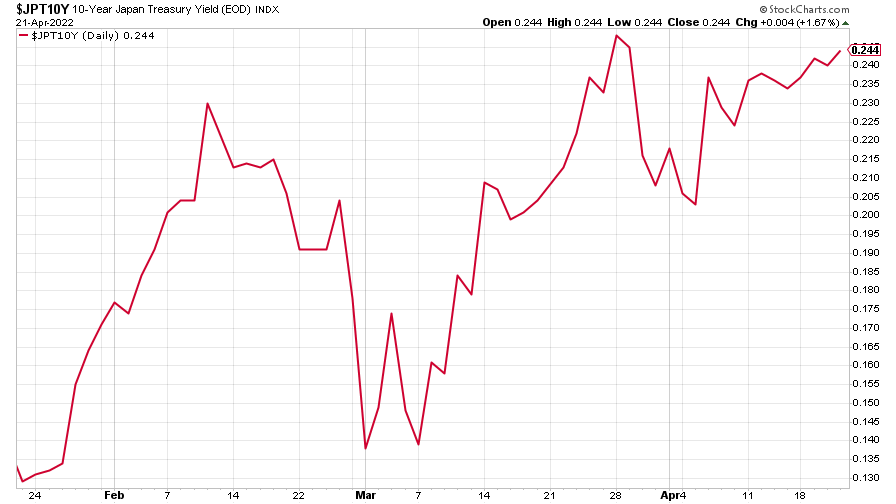

The yield on the Japanese ten-year bond climbed higher, too.

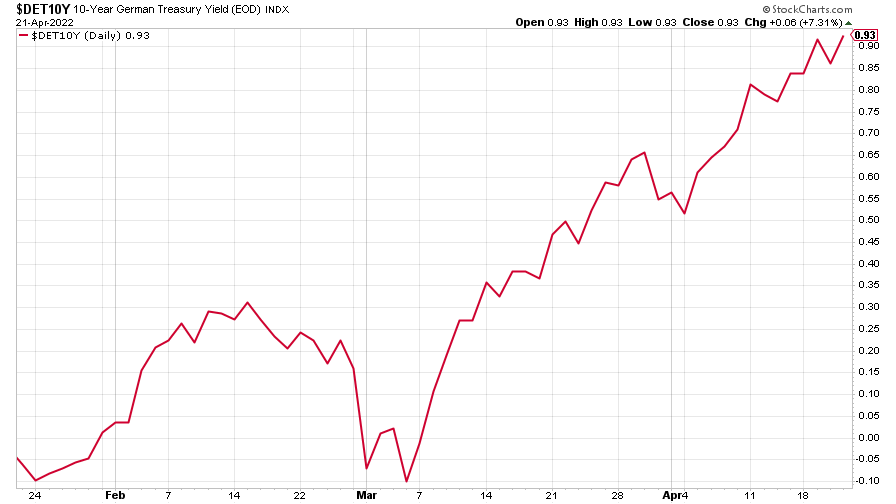

The yield on the ten-year German Bund continued its drive higher.

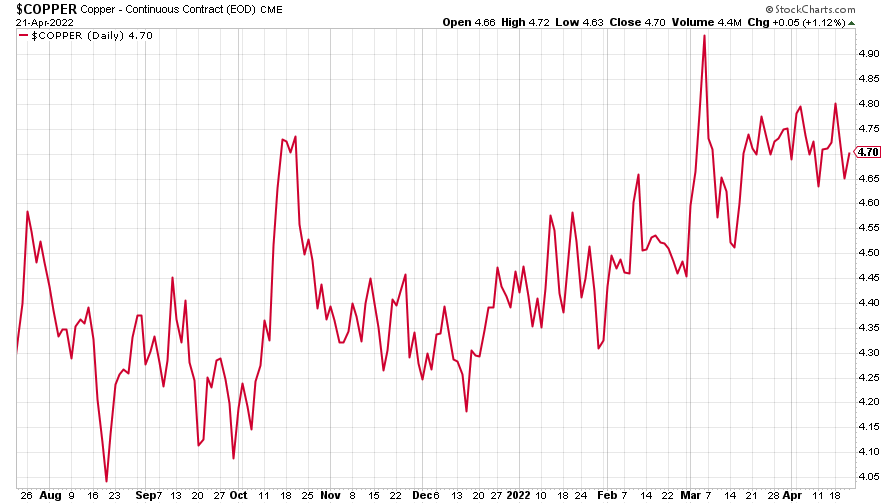

Copper slipped, but maintained its erratic rise.

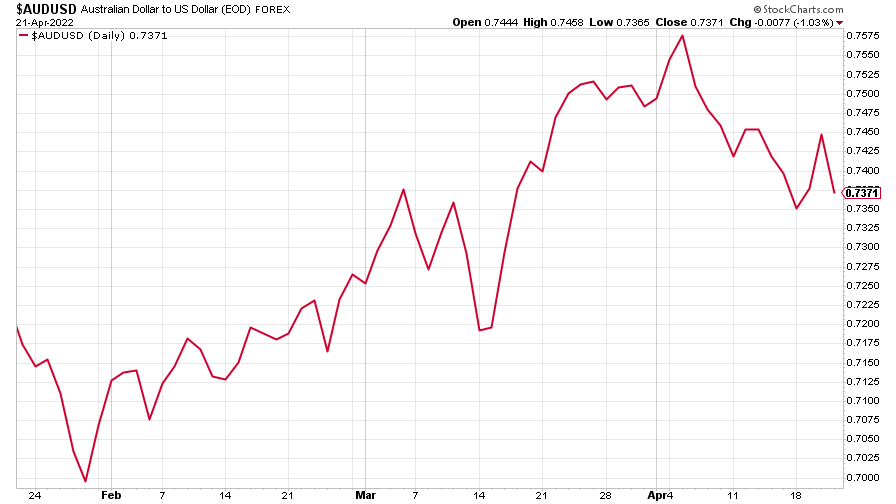

The closely-related Aussie dollar fell.

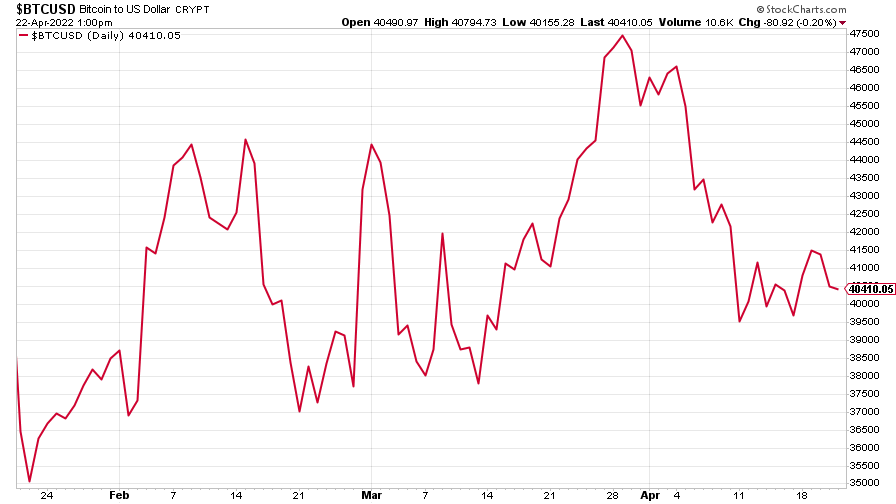

Bitcoin had a quiet week.

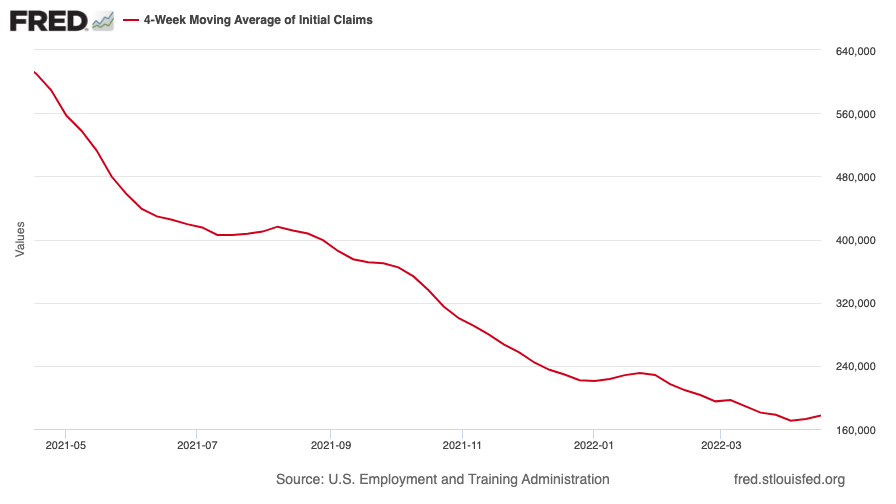

US weekly initial jobless claims fell by 2,000 to 184,000. The four-week moving average rose by 4,500 to 177,250.

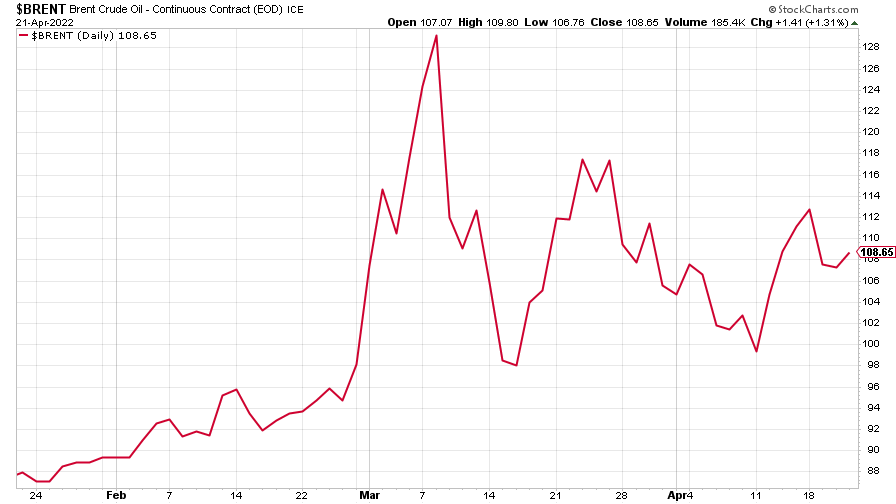

The oil price slipped, than regained some ground.

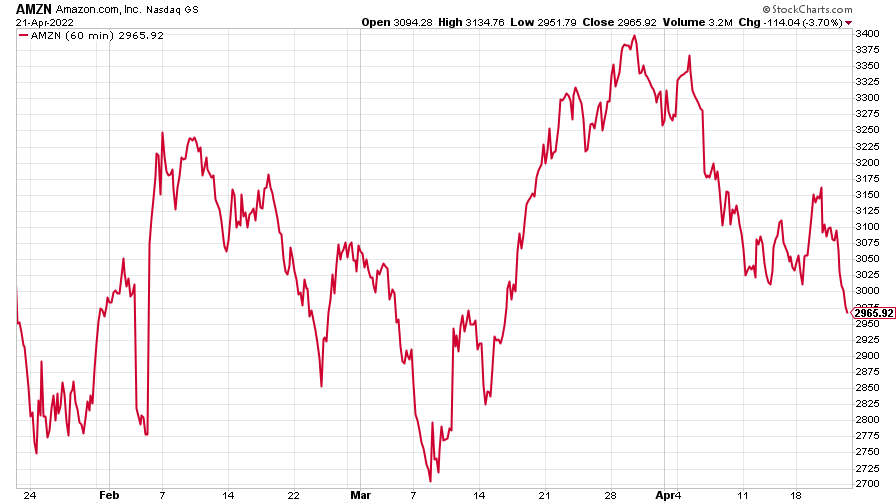

Amazon fell hard.

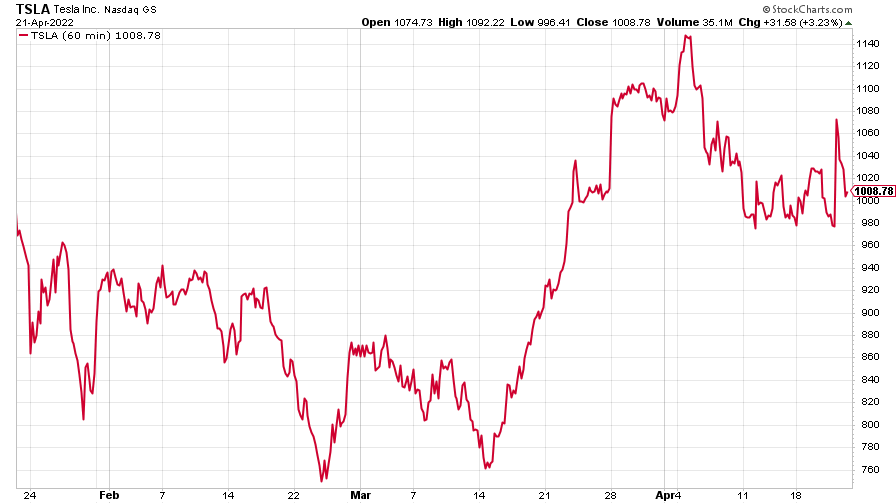

And Tesla had a volatile week.

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.