Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Welcome back.

This week on the cover of the magazine, we take a look at the lorry-driver shortage, explaining where all the drivers have gone, what the consequences are, and what it means for your money.

And our main investment feature this week is on the power of the “grey pound” – how to invest as the world’s population ages. Matthew Partridge picks some of the best ways for you to profit. If you’re not already a subscriber, sign up now and get your first six issues free.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This week’s “Too Embarrassed To Ask” video explains what “stagflation” is (a nasty combination of economic stagnation and inflation which might be rapidly becoming more pertinent today). Watch the whole thing here (it only takes a couple of minutes).

And in this week’s podcast, Merryn’s joined by Anna Macdonald of Amati Global Investors. She has a particular passion for UK small-cap stocks, and explains to Merryn just how she goes about finding the companies that she hopes will be the blue-chip stocks of tomorrow. Listen to the episode here.

Here are the links for this week’s editions of Money Morning and other web articles you may have missed:

- Monday Money Morning: Should investors be worried about stagflation?

- Web article: State pensioners probably aren’t going to get an 8% pay rise next year

- Tuesday Money Morning: El Salvador could be the shape of things to come for bitcoin – and emerging nations

- Web article: Bitcoin is now legal tender in El Salvador. What does that mean for investors?

- Web article: What’s better than two types of income tax? Three types of income tax!

- Merryn’s blog: China may be cheap, but is it cheap enough to make investing there worth it?

- Wednesday Money Morning: Here’s a useful fund for investing in blockchain without buying bitcoin

- Web article: What is Solana and why has the cryptocurrency rocketed this year?

- Thursday Money Morning: Is China facing a Lehman Brothers moment?

- Web article: Why now is a great time to buy Japanese stocks

- Web article: EasyJet rejects takeover bid and announces £1.2bn rights issue

- Friday Money Morning: Uranium prices are spiking – and conditions look ripe for a longer-term bull market

- Cryptocurrency roundup: Bitcoin sells off even as it becomes legal tender

Now for the charts of the week.

The charts that matter

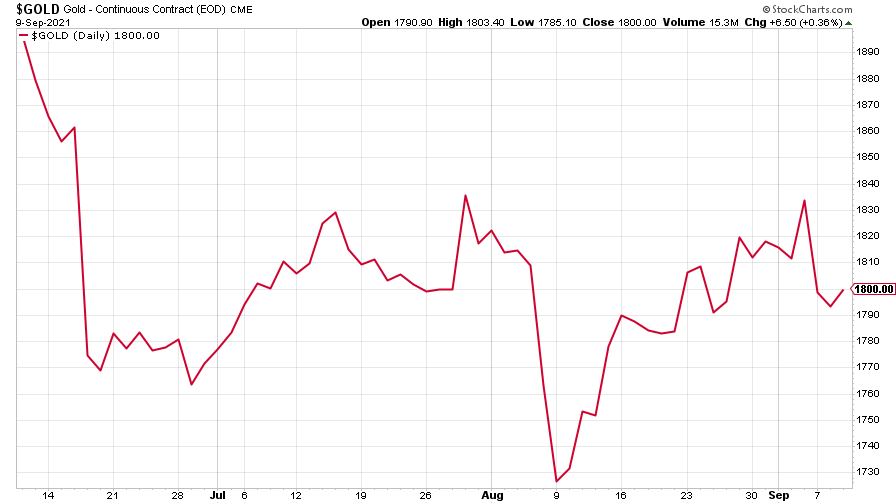

Gold sold off after a spike at the end of the previous week.

(Gold: three months)

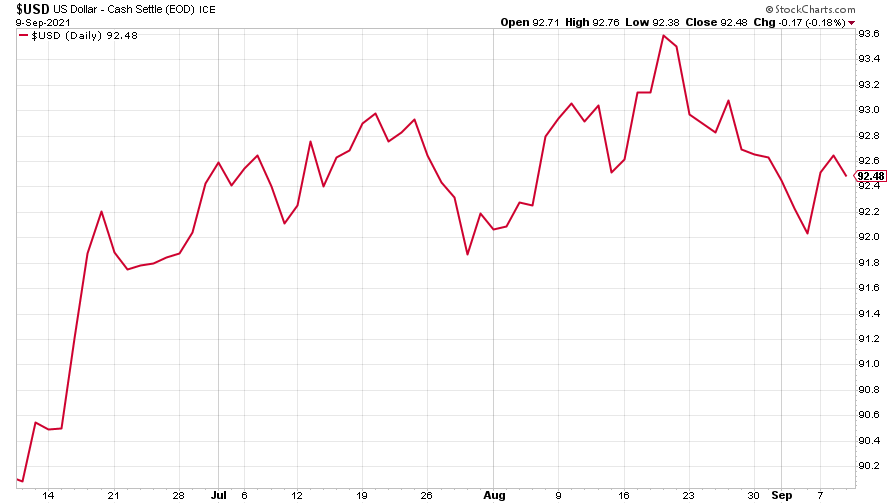

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) halted its decline.

(DXY: three months)

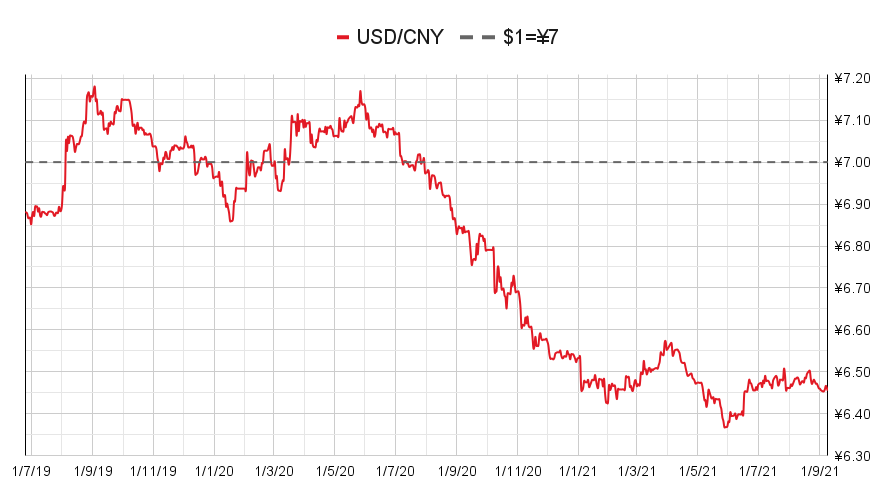

The Chinese yuan (or renminbi) again saw very little action (when the red line is rising, the dollar is strengthening while the yuan is weakening).

(Chinese yuan to the US dollar: since 25 Jun 2019)

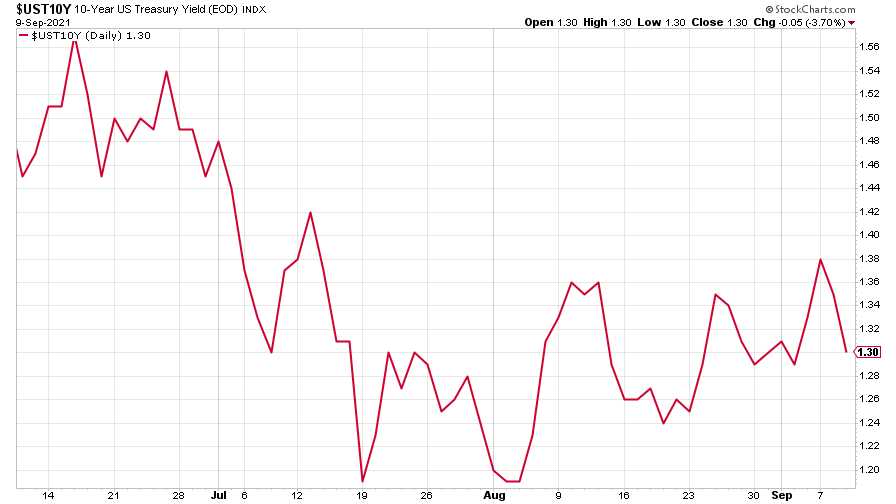

The yield on the ten-year US government bond ended the week more or less where it started, after an earlier sharp rise was reversed.

(Ten-year US Treasury yield: three months)

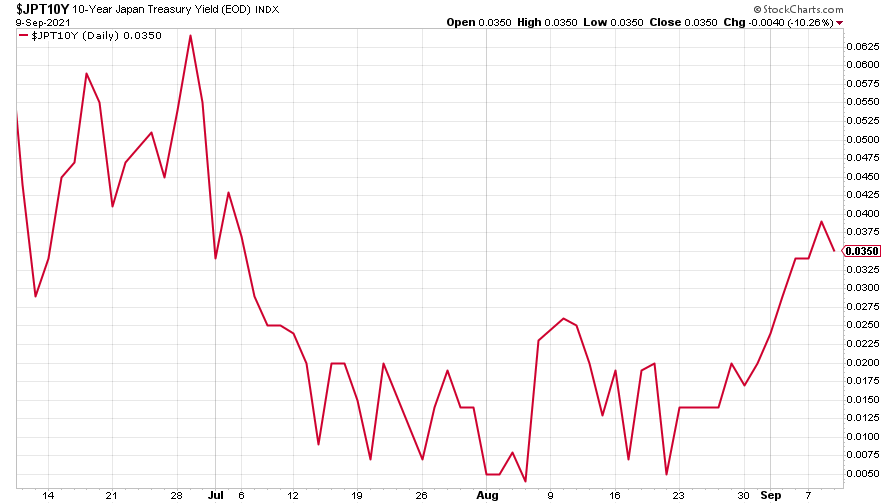

The yield on the Japanese ten-year bond climbed higher after news of the prime minister’s resignation.

(Ten-year Japanese government bond yield: three months)

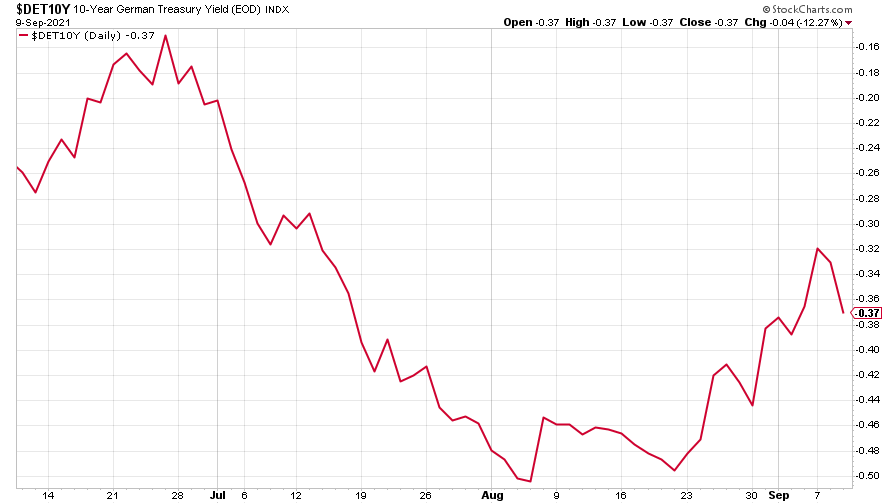

And the yield on the ten-year German Bund nudged slightly higher, perhaps spurred by talk of the ECB possibly cutting back on its stimulus measures.

(Ten-year Bund yield: three months)

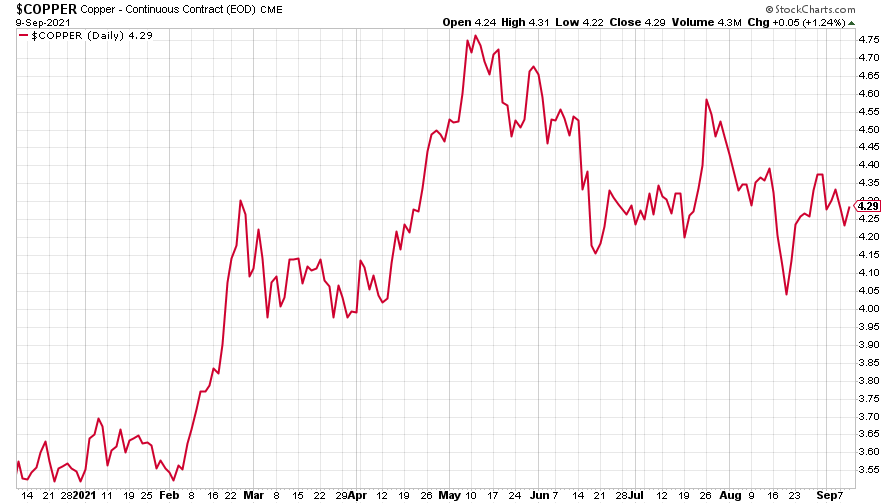

Copper drifted sideways.

(Copper: nine months)

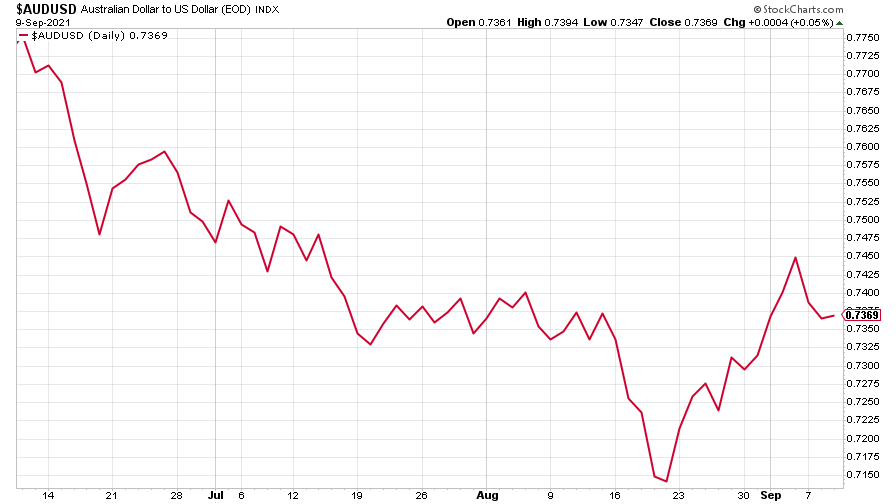

The closely-related Aussie dollar pared back its recent gains.

(Aussie dollar vs US dollar exchange rate: three months)

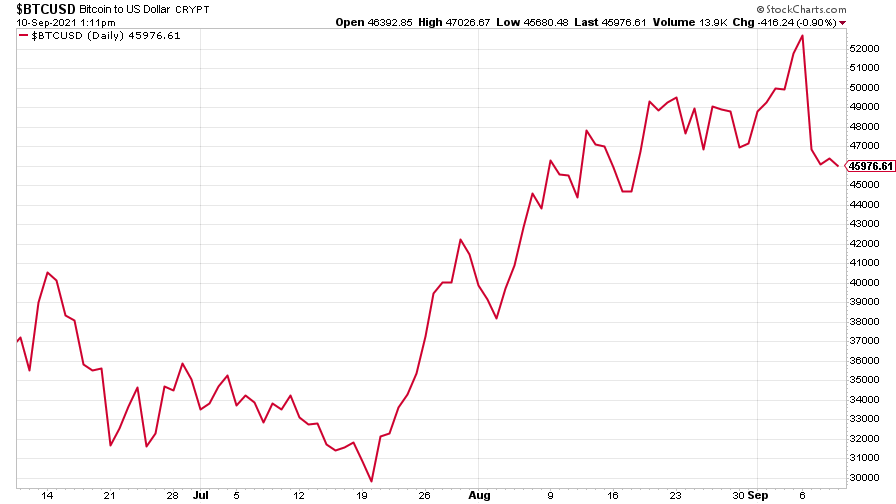

Bitcoin took a mighty tumble, along with most other cryptocurrencies (bar one), even as it became legal tender in El Salvador. However, in the longer term, Dominic thinks it is an “extraordinarily bullish move” for both crypto and country.

(Bitcoin: three months)

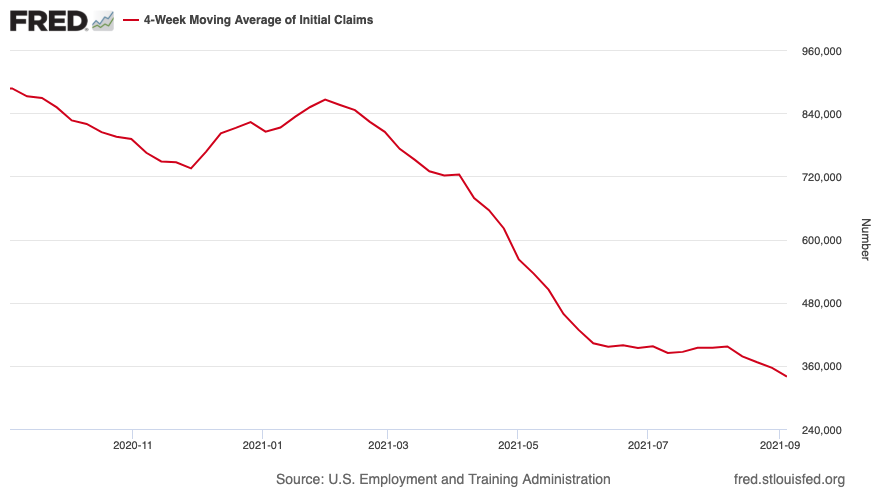

US weekly initial jobless claims fell by 35,000 to 310,000. The four-week moving average fell by 16,750 to 339,500. Meanwhile, the nonfarm payrolls figure for August, released last Friday afternoon, was far weaker than expected.

(US initial jobless claims, four-week moving average: since Jan 2020)

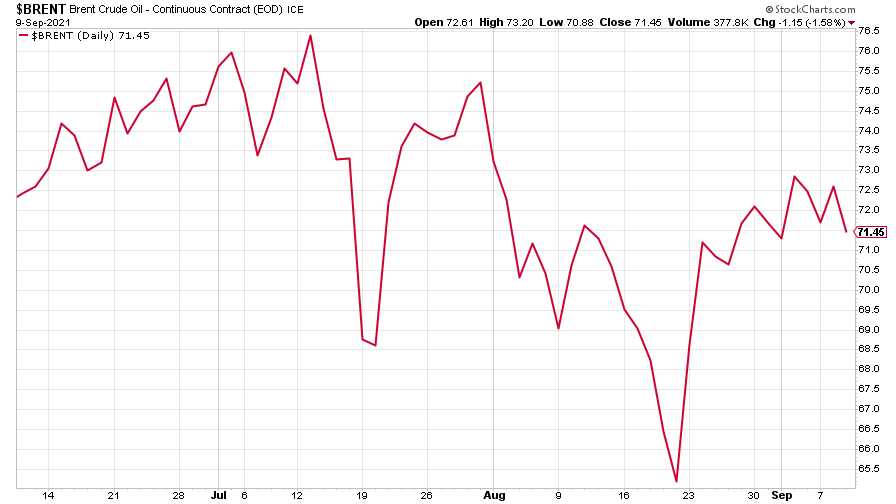

The oil price meandered around $71-$72 a barrel.

(Brent crude oil: three months)

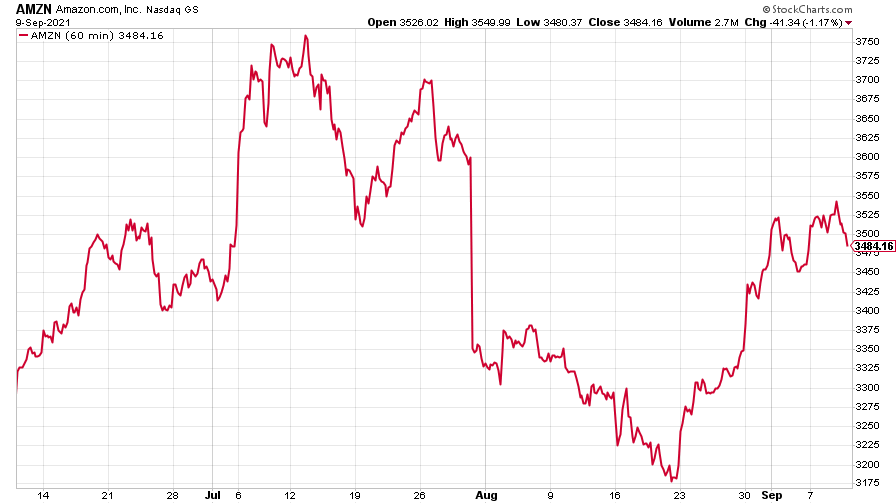

Amazon slipped a little.

(Amazon: three months)

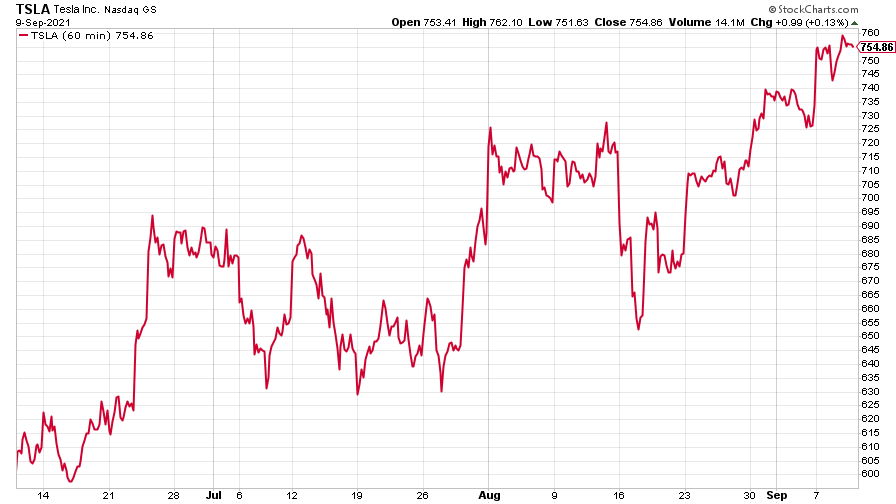

But Tesla just keeps on climbing.

(Tesla: three months)

Have a great weekend.

Ben

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change looms

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change loomsChanges to inheritance tax (IHT) rules for unused pension pots from April 2027 could trigger an ‘exodus of large defined contribution pension pots’, as retirees spend their savings rather than leave their loved ones with an IHT bill.

-

Why do experts think emerging markets will outperform?

Why do experts think emerging markets will outperform?Emerging markets were one of the top-performing themes of 2025, but they could have further to run as global investors diversify

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.