China may be cheap, but is it cheap enough to make investing there worth it?

China’s crackdown on its markets has spread beyond Big Tech to all sectors of the economy. Investors in China must now ask themselves: is it worth it?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

BlackRock, the world’s biggest asset manager, announced in May that it was very keen on China, which, it told us, had “emerged from the pandemic with renewed confidence”. Its economy and market had both nicely outperformed during the crisis, something that “deepened” BlackRock’s view that it could expect “relatively better returns for Chinese assets over peers”.

It is early days of course. We must never judge an investment call on three months’ performance, but so far this is not going well. Not at all. When I run my eye down a list of my investments, the one that stands out from a long list of pleasant positive numbers is the Fidelity China Special Situations investment trust. It is down 15% in the past three months.

It is not alone in its misery; look at the worst-performing funds and trusts in the UK and you will find most are China-focused. The clue to what has gone wrong here is embedded in the BlackRock gush: “a stable economic background has made authorities more comfortable emphasising structural reforms over short-term growth targets”. That’s true; it has. It’s just that it turns out that the market is not comfortable with quite the same things as China’s leaders.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

There were hints that there might be a problem brewing last year with the halting of Ant Group’s IPO and ban on ride-hailing firm Didi Global registering new users a mere two days after its US IPO. At $4.4bn, the valuation was naturally based on it registering new users.

China’s crackdown spreads beyond Big Tech

But we are now well beyond the hinting stage. In late July the once highly profitable tutoring companies in China were told they are no longer allowed to make profits. The market cap of the sector was about $100bn at the start of the year. It’s now more like $10bn. Why it now has any value at all is something of a mystery given that the value of a share is based on the expectation of the distribution of profits, and here we have companies banned from making profits.

These specific examples now look to be the tip of a looming iceberg. This week we’ve seen announcements of new rules about how Chinese kids, companies and celebrities should behave.

Tech companies that can influence public opinion have been told to register their algorithms with the government: they must work to “spread positive energy”. Delivery companies have been hit by demands that all workers must get the local minimum wage. Parents are to lose more of what little agency they still have over their children, with the state mandating a limit of three hours a week using the “electronic drugs” that are video games, enforced by facial recognition technology. And “irrational fan culture”, as officials put it, is no longer to be allowed: popularity charts for the biggest Chinese celebrities have been removed from microblogging site Weibo, for example.

This is all in the name of what Beijing calls “safeguarding the internet’s political security and ideological security” as well as providing a “safe spiritual home” for the general population. As opposed to a safe home for tech stock profits...

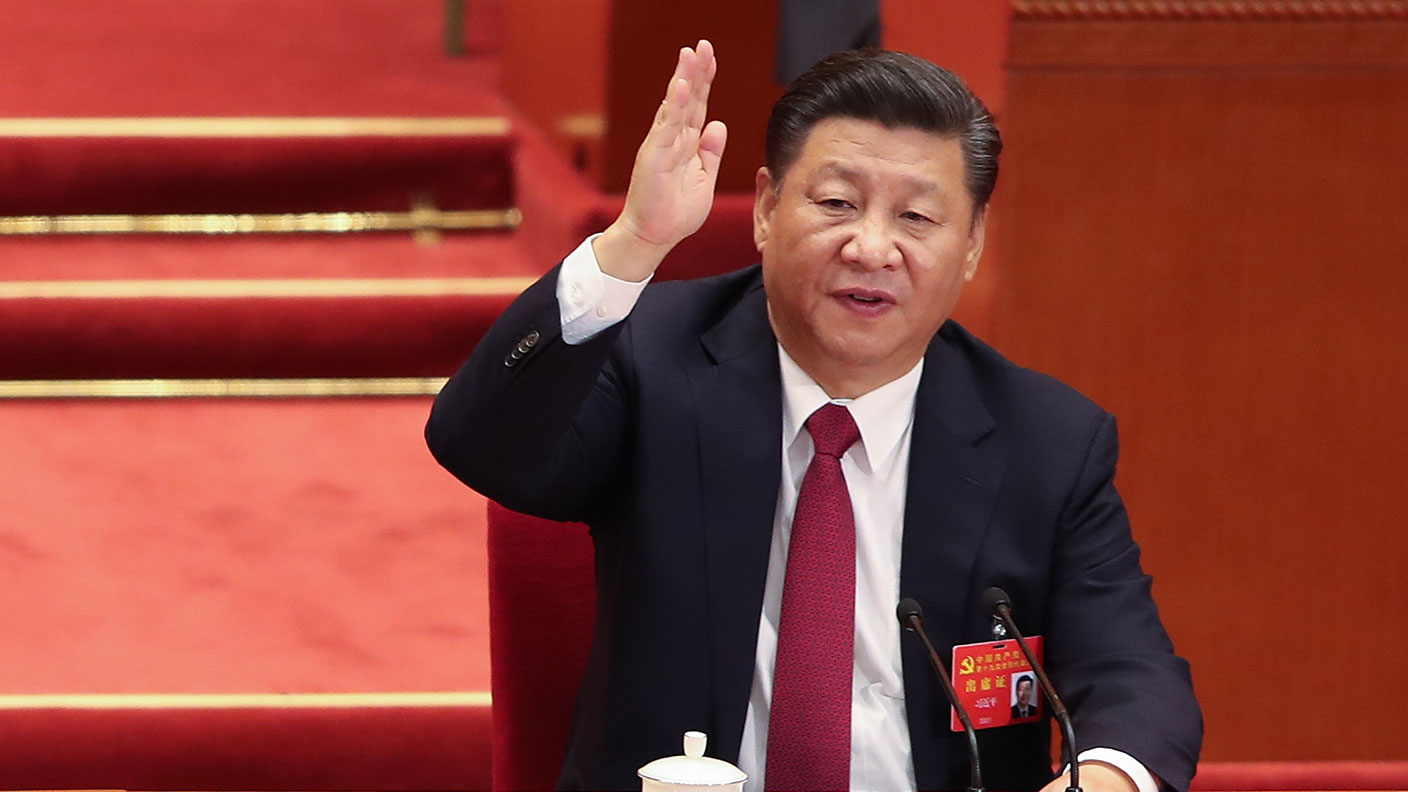

There’s more. President Xi Jinping isn’t just after safe spiritual homes for Chinese people, he’s after providing more equal homes. Enter the announcement that he intends to “regulate excessively high incomes”. That’s been a shock to the share prices of the world’s luxury goods companies: Chinese consumers buy a good 40% of their products and, as anyone who has ever browsed the products of LVMH will know, you need an excessively high income to even drag up the courage to enter the store.

“Experts” say it’s fine – but it’s really not

Maybe this is all OK. JPMorgan reckons you can still “navigate” the Chinese market on the basis that there have been “clear domestic motivations” for each destabilising action. The move against Ant was to rein in shadow banking; that against Didi was to protect data (data protection in China has been weak); and that against the for-profit education sector to “ease the financial burden on households to incentivise higher birth rates”.

Most other analysts appear to think the same: the worst is over and China will now move into a “compliance phase”; companies will adapt, and that will be that. This is possible, but even if the policies have a clear agenda behind them, that doesn’t bring the profits back – and given what we know about how government intervention tends to destroy innovation, it seems unlikely to foster new ones either.

It’s also fair to say that analysts predicting there will not be another round of new regulation did not help their case by failing to predict the first one. After all, if tutoring companies can be told that it is their job to make life cheaper for families, why not tell housing and healthcare companies the same – note that only a few days ago the government moved to cap rises in rents. “Renewed confidence” sounds good, but I’m not sure that this tsunami of totalitarian speak and OTT legislation represents the kind of state confidence that works for stockmarkets.

You’re probably already exposed enough to Chinese stockmarkets

Still, there is no such thing as an uninvestable market, only a market that isn’t priced to reflect its risks. You could argue that many Chinese equities are now cheap enough that the risk really is in the price. Tencent and Alibaba, for example, now trade at major discounts to US tech groups, which aren’t exactly 100% free of state interference either.

Compare the two and you might be a big buyer. However, before you fall for that bit of relativity consider another bit. I’ve mentioned the Russian market in the past. When it was on a price/earnings ratio of about five to six times, I noted that it was not just priced as an emerging market but pretty much discounting a return to communism, something that was unlikely. I bought some shares.

China may be jammed full of potentially high-growth companies, but it still isn’t priced to reflect the unpredictability of a government that can already be as communist as it likes. With that in mind note that the cyclically-adjusted price/earnings ratio for Russia is about ten times.

It’s 17 times in China, about the same as in the UK, where I would argue political risk is rather less of a problem. We all probably have Chinese exposure via our pensions and any global growth funds (Alibaba, Tencent and Meituan alone make up 12% of Scottish Mortgage Investment Trust’s portfolio – which I also own – for example). That’s probably enough.

Like most people, I am not certain of much about China, but one thing I know is this: when its government refers to “prosperity for all”, the definition of “all” does not include me – or you.

• This article was first published in the Financial Times

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.