Summary

- Microsoft (NASDAQ:MSFT) and Meta’s (NASDAQ:META) shares both jumped after impressive earnings beats

- Meta's stock gained 12% overnight after announcing a 38% year-on-year earnings increase

- Microsoft shares surged almost 9% after announcing 24% year-on-year increase in earnings

- Those gains are enough to push Microsoft's stock to a $4 trillion+ valuation

- Wedbush Securities raised Meta share price target to $920 from $750

- Amazon (NASDAQ:AMZN) and Apple (NASDAQ:AAPL) both posted earnings beats

- Apple stock gained 2% overnight as China sales grew 4%

- Amazon's share price fell over 7% as AWS growth lags that of rivals GCP and Azure

| Microsoft and OpenAI | AI ETFs | Apple shares |

Microsoft and Meta kick off big week of results

Good afternoon, and thanks for joining our live coverage in the run-up to Microsoft and Meta’s results tomorrow evening, followed by Amazon and Apple’s on Thursday.

Microsoft’s share price movements are the subject of intense interest on Wall Street, as the company’s market capitalisation (market cap) nears the $4 trillion threshold Nvidia became the first company to break earlier this month.

A bumper earnings release on Wednesday could send Microsoft’s shares soaring. Will it be enough to join Nvidia?

Magnificent Seven earnings season is in full swing. Follow here for rolling previews, analysis, updates and reaction.

Microsoft and Meta shares gaining ground ahead of results

Markets have been open for around twenty minutes today, and as things stand Microsoft shares are up around 0.7%, while Meta’s stock has fallen 0.2%.

During yesterday’s session, Meta’s shares gained a boost from market optimism over a US-EU trade deal, gaining 0.69%. Microsoft’s stock was 0.25% up at one point, but closed the session down 0.24%.

When do Microsoft and Meta announce their results?

Both Microsoft and Meta will announce their results this Wednesday (30 July) after US markets close. That means after 9pm UK time.

Meta’s earnings call is scheduled to start at 2pm PT, which is 10pm in the UK. Microsoft’s is scheduled to start half an hour later, at 10.30pm in the UK.

What | When (BST) |

US market close, after-hours trading begins | 9.00pm, 30 July |

Meta’s earnings call starts | 10.00pm |

Microsoft’s earnings call starts | 10.30pm |

After-hours trading ends | 04.00am, 31 July |

Results will be released in between the close of markets and the start of the respective earnings calls – generally, soon after markets close.

Microsoft and Meta’s shares will continue to be traded during this period in what is known as after-hours trading.

What do analysts expect from Meta and Microsoft’s results?

Analysts polled by FactSet and LSEG have the following expectations for Meta and Microsoft’s results this week:

| Header Cell - Column 0 | Revenue (FactSet) | Earnings per share (FactSet) | Revenue (LSEG) | Earnings per share (LSEG) |

|---|---|---|---|---|

Meta | $44.8 billion | $5.88 | $44.8 billion | $5.92 |

Microsoft | $73.8 billion | $3.38 | $73.8 billion | $3.37 |

The FactSet estimates see Meta’s revenue increasing 14.7% and earnings rising by 14.0% year-on-year.

Microsoft, meanwhile, is expected to grow revenue by 14.0% and earnings by 14.6%.

Microsoft earnings preview

Besides the headline numbers, analysts and investors will be keeping a close eye on Microsoft’s cloud revenue platform, Azure.

Azure is one of the top three cloud service platforms, alongside Magnificent Seven rivals Amazon Web Services (AWS) and Google Cloud. Cloud services like these are getting a boost from the compute demands of artificial intelligence (AI) training.

“We strongly view this as Microsoft’s ‘shining moment’ with AI set to change the cloud growth trajectory,” says Dan Ives, global head of technology research at Wedbush Securities.

Analysts might look to ask Microsoft CEO Satya Nadella about Copilot’s profitability during Wednesday’s earnings call.

Like Google, Microsoft has its own AI model, Copilot. A theme for this week’s results could be analysts watching for signs of return on these AI investments.

“Adoption [of Copilot] has been picking up, and investors want to know whether it's boosting revenue in a meaningful way,” says Lale Akoner, global market analyst at eToro. “Microsoft is spending heavily to build more AI infrastructure, so profit margins will be closely watched.”

Meta earnings preview

Like Microsoft, investors will want to see evidence that Meta’s extensive investments into AI, especially its Llama model, are yielding results.

“So far, markets have rewarded the company’s massive capex pivot, driven by custom silicon, Llama models, and expanding infrastructure, but now it’s “show me the money” time, says Lale Akoner, global market analyst at eToro.

Can Meta CEO Mark Zuckerberg convince investors that AI spend is paying off?

“Reality Labs losses remain a sore spot, but are tolerable if core earnings impress,” adds Akoner. “User growth and ad pricing trends, especially outside the US, will be scrutinised closely given recent dollar strength and macro wobble in emerging markets.”

Thanks for following our reporting ahead of Microsoft and Meta's earnings. Join us again tomorrow for a full day of preview and analysis, followed by Amazon and Apple's on Thursday.

Meta stock falls and Microsoft trades flat ahead of earnings

Good morning, and welcome back to our live coverage ahead of Microsoft and Meta’s results.

Microsoft shares closed yesterday’s session just 0.01% above the previous session’s close.

Meta’s share price, meanwhile, fell 2.46% in regular trading, though some of these losses were recovered after hours.

Expect to see lots of movement in both Microsoft and Meta’s stock this evening as both companies announce their results for the most recent quarter.

When do Apple and Amazon announce their results?

Apple and Amazon will both announce their latest results tomorrow (31 July), after markets close in the US.

The results will land in between markets closing and the start of each company’s earnings call, both of which are scheduled for 2pm Pacific time (10pm BST).

What | When (BST) |

US market close, after-hours trading begins | 9.00pm, 31 July |

Apple’s earnings call starts | 10.00pm |

Amazon’s earnings call starts | 10.00pm |

After-hours trading ends | 04.00am, 1 August |

During after-hours trading, both Apple and Amazon’s stock is likely to be highly volatile. Share price movements will depend initially on the reaction to how the raw numbers compare to the expectations of analysts (we’ll bring you more on those later today), as well as how each company’s management discusses them during the earnings calls.

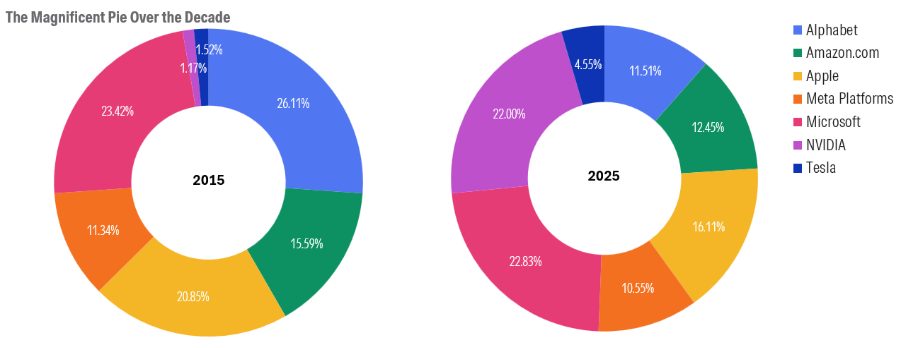

Why the Mag7 still matter

In case investors are wondering why changes in Microsoft or Meta’s share price should interest them, it is worth remembering that the Magnificent Seven group has been outperforming the broader market for over a decade.

“It really has been a case of investors needing to keep up exposure to these companies to enhance portfolio returns,” says Daniel Casali, chief investment strategist at Evelyn Partners.

The roots of this outperformance goes back to the rise of the internet during the 1990s, mobile data in the early 2000s, and the cloud computing revolution from 2006 onwards.

“In 2025 this is reflected in their earnings forecasts,” says Casali. “For the second quarter, they are expected to post an aggregate annual earnings increase of 14%.”

Data from FactSet suggests that the S&P 500 as a whole has, by contrast, posted average year-on-year earnings growth of under 6% so far this earnings season.

When it comes to the Magnificent Seven, “their financial leadership is not just a matter of trend: it’s a structural advantage,” says Casali.

Meta’s AI spend in focus

Meta’s share price has made solid gains this year as the company is, currently, viewed as one of the winners of the AI boom. It has been successful in incorporating AI into its ad business, for example, boosting targeting, engagement and efficiency.

However, the company is spending big on developing its own AI models, and that could lead to some investor pessimism if it isn’t able to demonstrate results.

“Meta’s had some disappointing progress on its open-source language models, and it’s opening the chequebook to put things right,” says Matt Britzman, senior equity analyst at Hargreaves Lansdown. “The creation of a new ‘superintelligence lab’ has caused quite the stir, with Meta rumoured to be dangling $100 million+ packages to poach AI talent.”

Last week, Alphabet shares fell immediately after it released its results despite strong headline numbers, with investors alarmed at its increased capital spend projections for this year.

Could we see a similar reaction in Meta’s share price this evening?

Microsoft shares are a favourite among fund managers

Microsoft’s stock has a dominant share of overall fund exposure compared to the rest of the Magnificent Seven, according to data from Morningstar, suggesting that it is a favourite of institutional investors.

Despite having been overtaken by Nvidia as the world’s most valuable company, it still edges the semiconductor giant out of top spot in terms of institutional fund holdings.

“Institutional confidence remains strong, driven by Azure’s 30% growth, deep enterprise ties, and its leading position in AI through OpenAI,” says Monika Calay, director of UK manager research at Morningstar.

Microsoft’s share of the top fund holdings has fallen by just 0.41% over the past ten years – and it has demonstrated greater consistency than any other Magnificent Seven stock during that time.

“Microsoft is the only member of the Magnificent 7 to consistently hold at least a 20% average weight in global equity portfolios every year for the past decade, a testament to its enduring institutional appeal,” Calay adds.

Apple and Amazon results: what the analysts expect

Analysts polled by FactSet and LSEG have the following expectations for Apple and Amazon’s results tomorrow:

| Header Cell - Column 0 | Revenue (FactSet) | Earnings per share (FactSet) | Revenue (LSEG) | Earnings per share (LSEG) |

|---|---|---|---|---|

Amazon | $162.1 billion | $1.32 | $162.1 billion | $1.33 |

Apple | $89.1 billion | $1.42 | $89.5 billion | $1.43 |

The FactSet forecasts, if accurate, envisage Amazon’s revenue increasing 9.5% and its earnings rising by 5.6% year-on-year. For Apple, they predict a 3.9% increase in revenue and a 1.4% rise in earnings.

Meta and Microsoft shares swing during final session before earnings

We’re about one hour into the final trading session before Meta and Microsoft announce their results.

Meta’s stock opened 1.1% higher today, but it has fluctuated through the first hour of trading, currently sitting around 0.5% above yesterday’s close.

Microsoft’s share price opened 0.6% higher than yesterday’s close, but has lost much of those gains in the meantime.

Recap: Microsoft and Meta results expectations

Analysts polled by FactSet and LSEG have the following expectations for Meta and Microsoft’s results tonight:

| Header Cell - Column 0 | Revenue (FactSet) | Earnings per share (FactSet) | Revenue (LSEG) | Earnings per share (LSEG) |

|---|---|---|---|---|

Meta | $44.8 billion | $5.88 | $44.8 billion | $5.92 |

Microsoft | $73.8 billion | $3.38 | $73.8 billion | $3.37 |

Meta and Microsoft shares will likely make their first moves based on their performance against these headline figures, as well as other relevant factors included in their earnings release, like capex expectations and forward guidance.

We’ve seen before, though, that management comments during the earnings calls can have a big impact on share price movements. The sentiment for both Microsoft and Meta’s stock will depend heavily on whether they can convince investors that they are winning the AI war.

Microsoft results: Azure growth in focus

Microsoft shares are still struggling to make gains during this session, up just 0.14% three hours into trading.

Could strong growth in Azure - Microsoft's cloud platform - give Microsoft stock a boost this evening?

"Cloud performance through Azure was stronger than expected last quarter, and there could be some upside to guidance of 34-35% growth," says Matt Britzman, senior equity analyst at Hargreaves Lansdown.

Could Microsoft's Azure send MSFT stock surging with an upside surprise?

Dan Ives, head of global technology research at Wedbush Securities, also believes that Azure's growth could take the market by surprise.

"We believe the stock still has yet to price in what we view as the next wave of cloud and AI growth," says Ives. "We view MSFT as the clear front-runner on the enterprise hyper scale AI front, despite increasing competition from Amazon's AWS and Google's GCP."

We're going to take a pause in reporting for now. Join us back here at 9pm for live coverage of Microsoft and Meta's earnings releases.

Breaking: Microsoft stock surges on earnings beat

Microsoft's share price has gained over 7% since close of trading.

Earnings per share increased 24% year-on-year to $3.65, and revenue increased 18% to $76.4 billion.

Azure revenue increased 34% year-on-year to $75 billion.

BREAKING: Meta stock up over 9% as earnings soar

Meta's stock, meanwhile, has surged 9.1% in after-hours trading on a bumper earnings beat.

Revenue increased 22% year-on-year to $47.5 billion and earnings per share rose 38% to $7.14 - smashing through the ~$5.90 that analysts had expected.

Concerns over Meta's profits following its AI investments seem misplaced now...

Microsoft's "slam-dunk quarter"

A few more highlights from this earnings beat that has seen Microsoft's stock surge over 7%:

- Intelligent Cloud revenue of $29.88 billion, ahead of an expected $28.92 billion.

- Gross margin of 68.6% beat an expected 68.0%; operating margin of 44.9% beat the expected 43.6%.

- Net income increased 24% year-on-year to $27.2 billion.

"This was a slam-dunk quarter for MSFT with cloud and AI driving significant business transformation," said Dan Ives, global head of technology research at Wedbush Securities. "We believe Microsoft is just hitting its next phase of monetisation on the AI front and more enterprises are accelerating their AI budgets," he added.

Meta's capex will keep growing next year

Meanwhile Meta's stock is still climbing, now up almost 9.5% since those results dropped.

"Meta has knocked it out of the park," says Matt Britzman, senior equity analyst at Hargreaves Lansdown. "AI is clearly delivering real-world benefits for advertisers, and they’re willing to pay more as a result. Average price per ad was up 9% over the quarter, a clear indication that Meta is delivering an improved product for both users and advertisers."

Capital spend is likely to increase $30 billion in the full year 2025, and CFO Susan Li signposted a similar rate of capex growth next year.

That may have taken analysts by surprise, but the market doesn't seem to mind. With the previous investments yielding such strong returns already, big spending seems to be going down well, and Meta shares are climbing.

We're going to end coverage here for this evening, but we'll be back tomorrow with more reaction and analysis for these eye-catching results, as well as a digest of what Meta and Microsoft's management says during their upcoming earnings calls.

Microsoft to enter $4 trillion club?

Good morning, and welcome back to our live coverage of tech earnings season. We’ll be digesting those huge earnings beats from Microsoft and Meta as today goes through.

Meta’s stock has gained 12% in out-of-hours trading since it reported a 22% revenue rise and a massive 38% increase in earnings.

Meanwhile, Microsoft looks set to join Nvidia in the $4 trillion market cap club when regular trading opens today. Microsoft stock has gained 8.7% overnight, following a 24% year-on-year increase in its earnings. Its market cap at close yesterday was $3.81 trillion – so closing today’s session with share price gains of anything over 5% from yesterday’s close will be more than enough to make Microsoft the world’s second $4 trillion company.

End of the AI profitability debate

There have been questions over the last two years as to whether or not the money that the Magnificent Seven hyperscalers are pouring into AI will deliver results.

That debate seems to be over.

"Meta and Microsoft turned over a new chapter in the AI story last night," says Matt Britzman, senior equity analyst at Hargreaves Lansdown. "Both companies crushed it, with debates around whether AI is delivering tangible returns starting to fade into history."

Meta’s stock surges on Superintelligence optimism

There was speculation ahead of Meta’s earnings release that investors would be put off by the big spending that the company is pouring into its Superintelligence Lab. But in the event, the vision of a superintelligent future painted during the earnings call saw Meta’s share price surge.

CEO Mark Zuckerberg led with optimism over the lab and its potential early in the investor call.

“Developing superintelligence, which we define as AI that surpasses human intelligence in every way, we think, is now in sight,” said Zuckerberg at the start of his prepared remarks.

“To build this future, we've established Meta Superintelligence Labs, which includes our foundations, product and FAIR teams as well as a new lab that is focused on developing the next generation of our models.”

Zuckerberg said that AI-infused smart glasses, such as those it has developed with Ray-Ban and a new range it is launching with Oakley, will be the main way that superintelligence is integrated into people’s daily lives.

Meta smart glasses, like these Ray-Bans, are Zuckerberg’s vision for AI superintelligence to be incorporated into daily human life.

He explained that one of the biggest technological hurdles that needs to be overcome in building AI that is more intelligent than humans is to build software that can train itself.

“We’ve begun to see glimpses of our AI systems improving themselves,” he said, adding that the progress was “slow for now”.

BREAKING: Wedbush raises Meta share price target

Influential investment bank Wedbush Securities has raised its 12-month price target for Meta from $750 to $920.

Based on where Meta's stock closed regular trading yesterday, that implies 32.3% in share price gains over the next year.

"We believe the recent level of investment is justified, and the infusion of AI capabilities across the company's ad stack and content recommendation engines are driving tangible results for Meta's Family of Apps and Reality Labs," said Scott Devitt, managing director, Equity Research at Wedbush Securities.

Recap: when do Amazon and Apple announce results?

With Microsoft and Meta's stock surging after their earnings beats is easy to forget we've got two more Magnificent Seven companies announcing results tonight.

Here's a recap of those timings:

What | When (BST) |

|---|---|

US market close, after-hours trading begins | 9.00pm, 31 July |

Apple’s earnings call starts | 10.00pm |

Amazon’s earnings call starts | 10.00pm |

After-hours trading ends | 04.00am, 1 August |

eToro: Microsoft stock offers "perfect mix" to investors

It’s quite hard to overstate how impressive the double beat from Microsoft and Meta was last night.

Microsoft in particular hit all the right notes for a stock that looks set to break $4 trillion in market cap.

“Microsoft is investing heavily to build AI infrastructure, though it seems to be working,” says Lale Akoner, global market analyst at eToro. “Margins are holding up, and the business is seeing real demand, not just hype.”

Akoner believes that investing in Microsoft is one of the best ways to ride the AI wave long term.

“For retail investors, this is a perfect mix of a tech giant growing fast, spending smart and actually delivering on their AI promise,” she says.

Amazon stock on a high heading into earnings

Amazon’s share price looks set to catch some of the positive fallout from Microsoft’s big earnings beat yesterday. Amazon stock is up 2.6% in pre-market trading five minutes before US markets open.

With Azure revenue growing 39%, investors seem to be positioning themselves for the possibility of AWS following suit.

Scott Devitt, managing director, Equity Research at Wedbush Securities, expects AWS revenue to increase by 16% year-on-year in these results. That figure would put AWS revenue on approximately the $30.5 billion mark.

“AWS commentary was encouraging last quarter, highlighting the strength of AI demand,” Devitt said in a research note. He also highlighted that AWS management had said that AWS growth would have been higher in Q1 were it not for near-term capacity constraints.

BREAKING: Microsoft stock opens session at $4 trillion+ market cap

US markets have opened and Microsoft's share price has opened 8.2% above yesterday's close, more than enough to tip its market cap above $4 trillion during regular trading for the first time in its history.

Can Meta stock stay higher for longer?

Meta’s share price has also sustained its overnight gains, opening today’s session up 11.6% following its stellar results last night.

“Meta reported a blow-out quarter, meaningfully eclipsing both Street and Buyside estimates for 2Q revenue and the 3Q guide,” said Benjamin Black, co-head of Internet Equity Research at Deutsche Bank in a research note.

Black drew attention to Meta alleviating fears that its capex might be getting out of control.

“Perhaps just as importantly, the high ends of both FY25 operating expenses and capex guidance were maintained, while the lower ends were both modestly increased, which is meaningfully better than feared,” he said.

Big spending is perhaps the only cause for concern with Meta’s stock at present.

“Meta is planning to spend a lot more, possibly over $100 billion next year on AI and infrastructure. That’s a huge bet and while it could pay off long term, it adds real risk in our opinion,” says Lale Akoner, global market analyst at eToro.

“Meta stock jumped after earnings, but it’s had sharp ups and downs lately. Investors are still trying to figure out if all this spending will drive future profits, or just higher costs,” she added.

Apple’s share price has fallen 16.5% in the year to date. Apple used to be the world’s most valuable company, but at the moment it is languishing.

Macro conditions haven’t helped. Trump’s tariffs pose a particular threat to the company given how reliant its supply chain is on components manufactured overseas – particularly in China. Apple’s management has already flagged a $900 million hit to its profits as a result of tariffs.

But this is compounded by mounting disappointment on its progress in AI, which has “fallen well short of what investors and consumers have come to expect from one of the world's leading brands”, says Matt Britzman, senior equity analyst at Hargreaves Lansdown.

Apple Intelligence has so far failed to capture investors’ imagination, compounding Apple’s share price woes.

“Apple Intelligence has so far failed to deliver the game changing experience that was promised, so investors should watch out for any updates on new AI features,” Britzman adds. He also believes that tariff impacts are likely to come under scrutiny during this evening’s earnings call.

Apple and Amazon shares steady heading into results

Apple shares are trading flat today, while Amazon stock is up 1.7%, in their final trading session ahead of results.

On paper, analysts polled by FactSet expect the following figures from each company:

Stock | EPS | Sales |

|---|---|---|

AAPL | $1.43 | $89.2 billion |

AMZN | $1.33 | $162.2 billion |

While these numbers could impact Amazon and Apple’s share price moves in after-hours trading, there is also likely to be a strong focus on deeper metrics.

In Amazon’s case, that will be growth of its cloud division, AWS. Microsoft set the bar high on that front last night, with its Azure division posting 39% revenue growth.

Apple, meanwhile, will need to demonstrate to the market that it is not being left behind in the AI race. Again – both Meta and Microsoft have demonstrated that spending big on AI is already delivering profits. Apple will need to convince the market that it is prepared to be bold in this race.

Our coverage is going to pause here for now, but we will be back after these results have been posted to bring you the headlines and all the reaction.

Apple shares rise after encouraging results

Good morning, and welcome back to our live coverage of big tech earnings season.

Apple shares have gained 2% overnight, following the company’s latest earnings release which revealed a return to positive growth territory in China, a key market for Apple.

Revenue of $94.0 billion represented 10% year-on-year growth and a record for Apple’s June quarter. Diluted earnings per share (EPS) were up 12% on last year to $1.57. Analysts had forecast revenue of $89.2 billion and EPS of $1.43.

“This was a major step in the right direction for [Apple CEO Tim] Cook and Cupertino with China the star of the show,” said Dan Ives, global head of technology research at Wedbush Securities.

“Now it's time to address the elephant in the room: the AI strategy which remains absent while the rest of the tech world is laser focused on the AI Revolution,” he added.

Amazon stock falls despite earnings beat

Amazon delivered an earnings beat – $1.68 compared to $1.33 expected – but its share price has fallen by more than 7% since the close of trading yesterday.

Revenue increased by 13% year-on-year to $167.7 billion, well ahead of the $162.2 billion that analysts had forecast.

AWS revenue rose 17.5% to $30.9 billion. In isolation, that’s not a terrible result – but compared to the momentum that Google’s GCP and, in particular, Microsoft’s Azure have demonstrated, investors are clearly concerned that AWS is being caught by its rivals.

“The spotlight was firmly on AWS, and it didn’t quite shine as brightly as expected,” said Matt Britzman, senior equity analyst at Hargreaves Lansdown.

“While Microsoft and Alphabet have already shown strong momentum in cloud growth, AWS wasn’t the knockout many wanted to see, highlighting just how tightly investor sentiment is tied to the AI narrative right now.”

AI pessimism dampens reaction to Apple’s results

The 2% overnight gain for Apple’s shares is a fairly modest response to what is on paper one of the strongest sets of results in recent years.

iPhone sales grew 13% year-on-year, as did Apple’s Services division.

Investors, though, are clearly still underwhelmed by Apple’s progress on AI.

“We believe our platforms offer the best way for users to experience the full potential of generative AI,” said CEO Tim Cook during the earnings call that followed Apple’s results.

But the market isn’t convinced.

“Apple should be a leading name in AI hardware, but that’s simply not the case,” said Matt Britzman, senior equity analyst at Hargreaves Lansdown. “Apple Intelligence was a flop, so a lot of hope now lies in an AI-powered Siri – but that might not come until next year.

“Brand loyalty gives Apple time to get the AI transition right, but it needs to start delivering,” adds Britzman.

Thank you for following

Thanks for following our coverage of Meta, Microsoft, Amazon and Apple's results.

We're going to wrap up our live reporting here. But we will keep breaking down the latest round of results and their implications for the market over the coming days, so keep checking MoneyWeek for the latest news on tech stocks.

We'll also bring you live coverage of Nvidia's results at the end of August. With cloud revenue booming and AI capex booming in Magnificent Seven results season so far, will it be another bumper set of results for the semiconductor giant?