Microsoft’s partnership with OpenAI is on the rocks

Microsoft’s joint venture with OpenAI, the developer of ChatGPT, appears to be in trouble. What now for the two groups?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

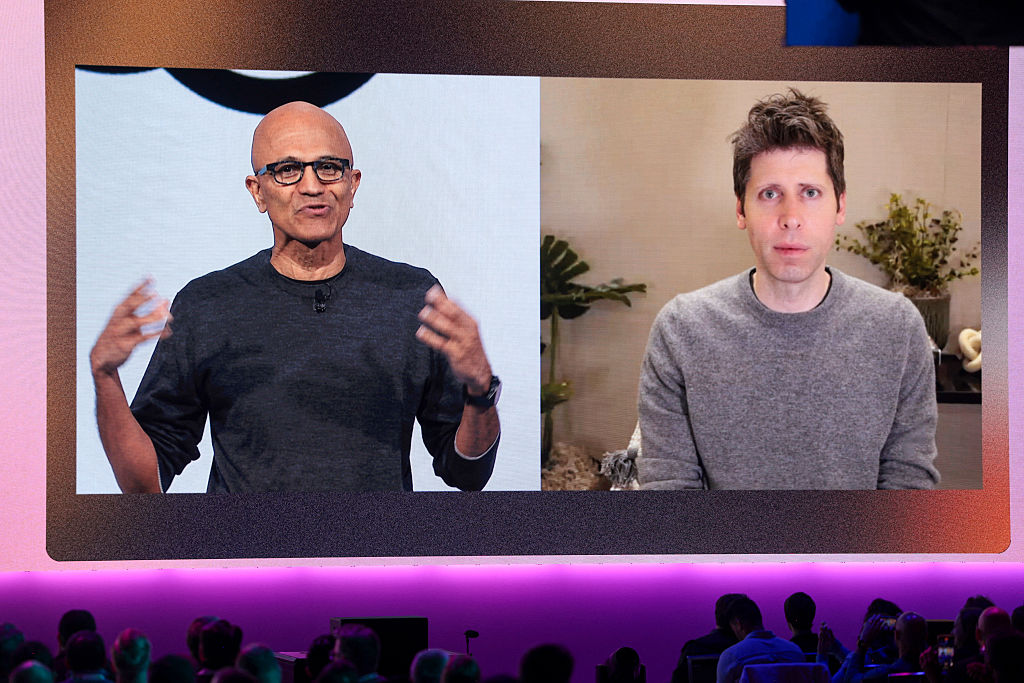

For six years, the alliance between Microsoft and OpenAI, developer of ChatGPT, has been “one of the most successful partnerships in tech history”, says Berber Jin in The Wall Street Journal. Microsoft’s investment provided funding that fuelled OpenAI’s ascendancy in exchange for early access to OpenAI’s technology and nearly half of any profits. But now the relationship may be on the rocks. The two firms are at loggerheads over OpenAI’s $3 billion acquisition of the coding start-up Windsurf, which competes directly with Microsoft. And negotiations over OpenAI’s conversion into a for-profit company have stalled.

Even before this “behind-the-scenes dogfight”, the relationship between Microsoft and OpenAI was “already fraught”, say Bloomberg’s Brody Ford and Shirin Ghaffary. While it has put $14 billion into OpenAI, Microsoft has also backed rival AI start-ups and begun to construct its own AI models. OpenAI, meanwhile, has signed deals with “rival cloud-computing partners and spent much of the past two years building out a suite of paid subscription products for businesses, schools and individuals”.

Who has the advantage: Microsoft or OpenAI?

Experts believe that Microsoft has the upper hand, given how “crucial” converting to a for-profit entity is for the future of OpenAI, says the Financial Times. This is because most of the other investors who have put money into Sam Altman’s company only did so on the condition that they would be able to convert their equity investment into debt, or even ask for it back, if OpenAI failed to change its status. There are rumours that SoftBank, for instance, could cut its $30 billion investment by $10 billion if the conversion is not completed by the end of the year.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Still, OpenAI may have a few tricks of its own if Microsoft refuses its offer of a 33% stake in a restructured unit in exchange for foregoing rights to future profits, says Benj Edwads in Ars Technica. One of these is the “nuclear option” of seeking a federal regulatory review of the terms of its contract with Microsoft for potential antitrust law violations. In that case, OpenAI is likely to argue that “Microsoft is using its dominant position in cloud services and contractual leverage to suppress competition”.

OpenAI has several potential “sweeteners”, such as extending Microsoft’s exclusivity to OpenAI’s technology, or discounting access to new models, says Karen Kwok for Breakingviews. It could also give Microsoft a new class of shares that would give it outsized control, although this might be unpopular with other investors.

But if nothing else works, then OpenAI might be forced to scale back plans for developing new products, as it is currently “incinerating cash”. This would in turn “send ripples through the wider market, where investors have rushed into over $120 billion of generative AI start-up fundraising since 2023”. While this might not matter if AI becomes commoditised anyway, it would at least calm AI “mania”.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

What is physical AI, and how can you invest in it?

What is physical AI, and how can you invest in it?Artificial intelligence is increasingly taking physical form and could completely transform how we live. How can investors gain exposure?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Three companies with deep economic moats to buy now

Three companies with deep economic moats to buy nowOpinion An economic moat can underpin a company's future returns. Here, Imran Sattar, portfolio manager at Edinburgh Investment Trust, selects three stocks to buy now

-

Should you sell your Affirm stock?

Should you sell your Affirm stock?Affirm, a buy-now-pay-later lender, is vulnerable to a downturn. Investors are losing their enthusiasm, says Matthew Partridge