The next phase of the AI boom

The technology is about to become far more widespread, says Dan McEvoy. Here’s how to profit

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

For a brief moment in January, it looked as though the era of US dominance in technology was over. DeepSeek, a Chinese generative artificial intelligence (AI) start-up, shot to the top of the US app-store install list. DeepSeek was not only popular, but could also perform on a par with competitors from OpenAI and Google. Its developers claimed it could do so for just $6 million in training costs and without relying on the cutting-edge Nvidia chips that have driven hundreds of billions of dollars in capital expenditure (capex) in the West.

That money suddenly looked very badly spent, and Nvidia – a priced-for-perfection market darling – suddenly seemed to have lost any justification for its $3 trillion-plus valuation. Nvidia’s market capitalisation fell $589 billion in a day, a record for the biggest valuation decline in stock market history. Within weeks, though, most of these losses had been recovered, and while Nvidia’s stock has fallen further since, that has far more to do with turbulent trade policy in the White House than with doubts over the future of AI.

The AI boom is not over. Although the light is dimming, Nvidia’s day in the sun is not yet done. “You have these secular themes that emerge every so often,” says Michael Seidenberg, lead portfolio manager of Allianz Technology Trust. Secular in this sense means the trend is durable, implying outsized expenditure over decades. “I don’t doubt that [AI] is a secular theme,” he says. DeepSeek has not ended this, but it has catalysed a shift from one phase of the AI cycle to another. In that light, it might be time to start looking at AI investing a little differently

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Is Nvidia still the leading chipmaker?

DeepSeek was undoubtedly highly innovative in improving the efficiency of inferencing, the process whereby a machine applies what it has learnt in order to analyse new data. But there is doubt over whether its lofty claims stack up. It insists it did not use the most advanced Nvidia GPUs (electronic circuits) available – but it has to say that, because officially Chinese firms aren’t allowed to access these chips. The US Department of Commerce is reportedly investigating whether or not restricted chips were used to develop the model.

From an investing standpoint, asking which chips DeepSeek did or didn’t use misses the point: falling production costs are good for AI companies – even chipmakers such as Nvidia. “There’s almost no drawbacks to a lower cost of AI,” says Nick Dumas-Williams, technology investment analyst at Polar Capital. Technology is inherently deflationary, and as the cost of production falls, adoption tends to balloon.

While semiconductor firms such as Nvidia or TSMC may lose some direct pricing power, increased volume should more than compensate for it. Cloud service revenue has exploded, while the cost of providing the service has fallen; there is no reason to think that AI will follow a different path. Moreover, Nvidia is still “leading the AI industry”, in the words of Wedbush Securities’ analyst Daniel Ives, and demand for its Blackwell chips outstrips supply. In February, Wedbush forecast that the Magnificent Seven’s capex will rise from $100 billion to $325 billion this year. Any forecasts made prior to the tariff disruption are now meaningless, but the fact remains that, as Dumas-Williams puts it, AI is “the highest return-on-investment project that they can spend on”.

The next generations of Nvidia chips (Rubin and Feynman) promise greater performance still. The mathematics of AI still works in Nvidia’s favour too. “The AI scaling laws remain intact,” says Dumas-Williams. “You can put more computing power behind AI and improve the performance.”

While that relationship holds, there is always an incentive for AI developers to spend more on GPUs. Meanwhile, Nvidia is looking at the next wave of democratisation. It’s no coincidence that CEO Jensen Huang has started to push Nvidia’s personal-computing (PC) products as enthusiastically as its data-centre hardware. There is likely to be a radical overhaul of PCs once the economics reach the right tipping point. More markets, more demand, more growth.

Are chip stocks still good investments?

On the other side of the ledger, however, is the fact that, having seen explosive growth over the last two years, Nvidia’s years of outsized share-price returns may well be behind us. Its annual growth is slowing, and will inevitably plateau eventually. That doesn’t make it a bad stock, and it doesn’t mean it’s not worth owning. But it probably won’t produce the same kind of growth over the next two years that it has over the past two. The explosive spending growth in the next phase of the cycle will be directed towards new corporate uses of AI.

AI, post-DeepSeek, is getting cheaper, and moving from what Seidenberg calls the “test-and-develop” phase through to “production”. Corporate uptake of AI is accelerating, and companies are starting to see benefits for their productivity and bottom lines. Take Klarna. It was able to cancel its Salesforce subscription in September, having built its own systems internally using AI that can replicate it. That saved Klarna a yearly $40 million once the 700 full-time contractors it also managed to replace were taken into account.

Then there is Shopify, which told managers that before they can make a new hire, they must show that AI can’t do the job. Moves like these will affect firms’ bottom lines in a big way, especially as agentic AI models – those taking decisions and executing relatively complex tasks, rather than just spinning up images or text – become more sophisticated.

DeepSeek was a big catalyst in this respect. It essentially pioneered a technique called “distillation”, whereby a large, powerful AI model – in its case, Meta’s Llama – is used to train a smaller, more specialised model, quickly and cheaply. Crucially, it relies on the “teacher” in order to work. That alone secures the future of computer demand for the big chipmakers.

So while as far as investing in Nvidia is concerned, there’s no need to throw in the towel just yet, but we are on the verge of seeing a new set of winners from the AI boom. This is often expressed as a shift from one phase to another; the last phase saw the rise of the chipmakers, AI’s picks and shovels. Phase two will see increased focus on the software companies building the products businesses use to improve their performance, whether that be by cutting costs, increasing productivity, or both.

Anthony Ginsberg, CEO of GinsGlobal Index Funds, likens this to the rise of cloud computing. Cloud’s first winners were the firms that provided the infrastructure – Alphabet, Microsoft and, above all, Amazon. “But once the initial infrastructural plumbing is in place, it’s the software-as-a-service (SaaS) guys that are the bigger players,” he says. There is a cautionary tale here, though: it isn’t as straightforward as looking to SaaS companies with AI functionality for your winners. Like all revolutions, the AI boom may well eat some of its own along the way.

It has been more than ten years since Salesforce – perhaps the archetypal SaaS company – became “AI-first” at the behest of its CEO, Marc Benioff. Now, it risks finding itself out in the cold. What, then, makes a good second-wave AI play?

AI as a service: the boom's next big winners

AI is, deep down, a numbers game. Better training data means better AI. As such, Seidenberg advocates looking for businesses that have access to good data sets – often through judicious mergers and acquisitions. One that catches his attention is HubSpot, a maker of marketing, sales and customer-service software. Most of its 14 acquisitions have been “technology tuck-ins” such as Frame AI, a conversation intelligence platform, or Clearbit, a corporate data platform. Clearbit in particular gives a customer-relationship management platform such as HubSpot a rich pile of data to mine, learn and exploit. It could provide Hubspot with “a homogeneous data set that really speaks to the use of AI”, as Seidenberg puts it – in a stark contrast to some other companies “that bought ten or twenty different companies and never unified the data model”.

Another approach is to look for companies that can easily and effectively augment an existing product by building AI into it. Ginsberg offers up Ray-Ban, owned by EssilorLuxottica, and its partnership with Meta as an example: “if you’ve got a platform or an existing brand that you can leverage with AI… that, for me, is the software-as-a-service of AI”, he says.

At a broader level, it is industries that have the most data – and the biggest challenges turning it into a usable format – that AI can potentially affect the most. Medicine is one of these. Drug discovery in particular is “the great white hope” of AI, says Dumas-Williams. In isolated cases, AI is already having a huge impact.

DeepMind’s AlphaFold is mapping millions of protein structures and predicting how these might interact with one another. Scientists worldwide are using it to research treatments for malaria, Parkinson’s and osteoporosis. Scale, though, is the challenge. “Getting that deployed into [bio-research] workflows in a scaled manner, when a lot of research is done at an individual level... and takes so long to come through – I think we will only start recognising this in the coming years,” says Dumas-Williams.

How to invest in the next phase of the AI boom

During that time, other data-intensive industries are likely to take great leaps forward thanks to AI. Robotics, including autonomous vehicles, is foremost among them, as is the world of finance via tools such as robo-advisers. It’s impossible to say which companies are set to capture this value, so diversify your AI investments. AI should see huge uptake across most companies. It’s less certain that Nvidia will supply all the chips that underpin that uptake, or that any given developer will create the most transformative model.

We’ve also seen two stark tech sell-offs this year, highlighting the dangers of over-concentration. “The Magnificent Seven... have sucked up all the oxygen in the room,” says Ginsberg. Focusing on them – as market cap-weighted strategies and many active ones do – “gives tech investing a very narrow view”.

Ginsberg manages the HAN-GINS Tech Megatrend Equal Weight UCITS ETF (LSE: ITEK). The equal weighting is a key to the appeal of this exchange-traded fund; assets are split equally between its 120 holdings, and these represent a fairly even spread across ten sectors – including robotics and automation, future cars, cloud computing, and social media – mostly directly related to the AI theme. It also only has 60% of its weighting in the US, which is low for a tech strategy.

It rebalances semi-annually, so winners get little time to run, but crucially equal weighting means it cannot become over-concentrated in the tech megacaps. That makes it good for tech diversification without compounding any over-exposure to the biggest players. However, there is also a danger in over-diversification. There will be losers as well as winners, and with something this disruptive, losers could lose big.

Active strategies such as those behind the Polar Capital Technology Trust (LSE: PCT) or the Allianz Technology Trust (LSE: ATT) put the decision-making of which companies to allocate to into the hands of experienced managers. “You have to stay incredibly active, and frankly quite humble with your opinions,” says Dumas-Williams of the challenges in investing in the next AI phase. “You have to remain very alert to developments on the leading edge.”

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Dan is a financial journalist who, prior to joining MoneyWeek, spent five years writing for OPTO, an investment magazine focused on growth and technology stocks, ETFs and thematic investing.

Before becoming a writer, Dan spent six years working in talent acquisition in the tech sector, including for credit scoring start-up ClearScore where he first developed an interest in personal finance.

Dan studied Social Anthropology and Management at Sidney Sussex College and the Judge Business School, Cambridge University. Outside finance, he also enjoys travel writing, and has edited two published travel books.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Investing in space – finding profits at the final frontier

Investing in space – finding profits at the final frontierGetting into space has never been cheaper thanks to private firms and reusable technology. That has sparked something of a gold rush in related industries, says Matthew Partridge

-

Three promising emerging-market stocks to diversify your portfolio

Three promising emerging-market stocks to diversify your portfolioOpinion Omar Negyal, portfolio manager, JPMorgan Global Emerging Markets Income Trust, highlights three emerging-market stocks where he’d put his money

-

Polar Capital: a cheap, leveraged play on technology

Polar Capital: a cheap, leveraged play on technologyPolar Capital has carved out a niche in fund management and is reaping the benefits

-

SRT Marine Systems: A leader in marine technology

SRT Marine Systems: A leader in marine technologySRT Marine Systems is thriving and has a bulging order book, says Dr Michael Tubbs

-

Coreweave is on borrowed time

Coreweave is on borrowed timeAI infrastructure firm Coreweave is heading for trouble and is absurdly pricey, says Matthew Partridge

-

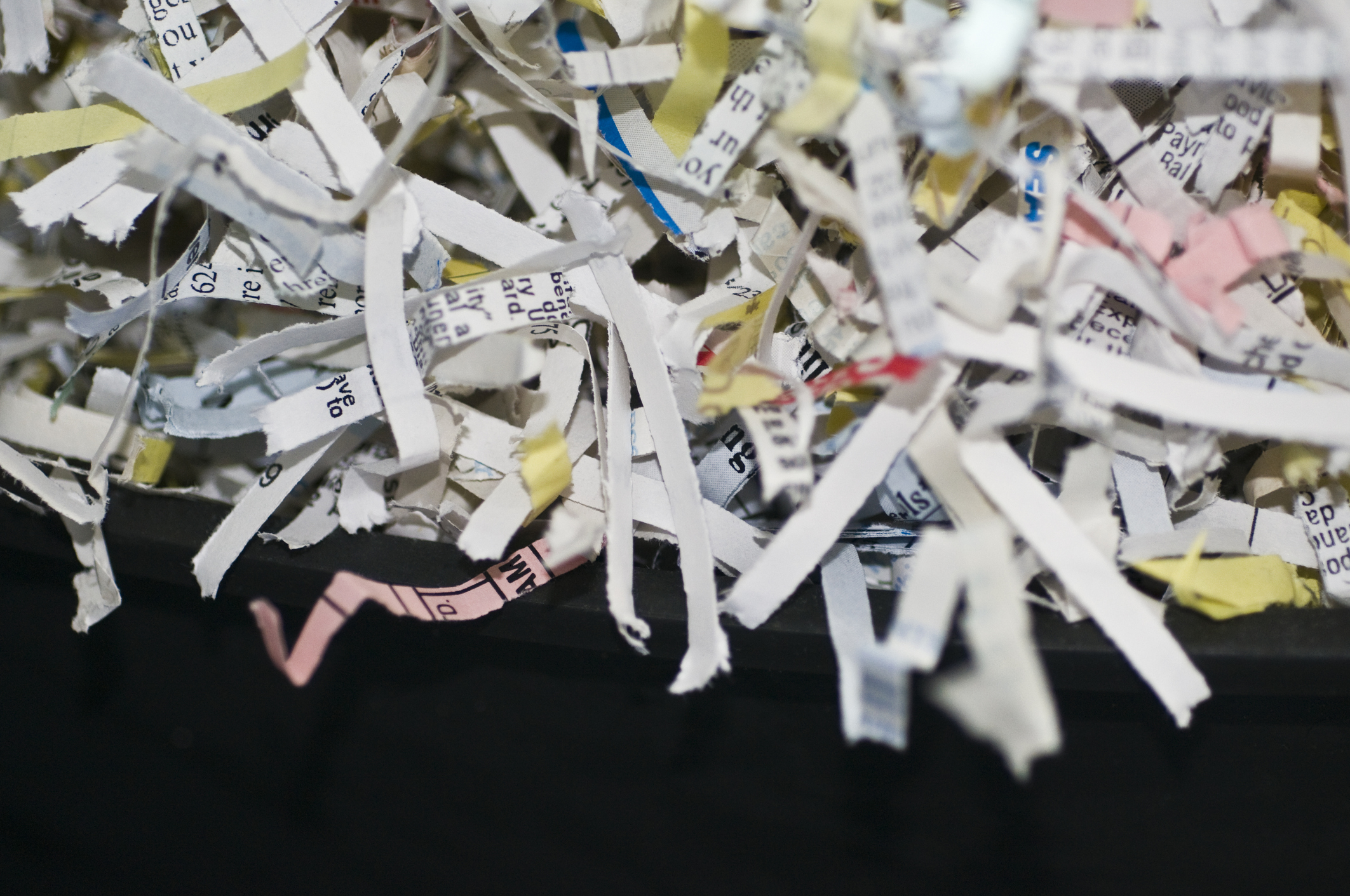

Profit from document shredding with Restore

Profit from document shredding with RestoreRestore operates in a niche, but essential market. The business has exciting potential over the coming years, says Rupert Hargreaves