Where investors can find value now

Active fund managers and blue chips on both sides of the Atlantic look appealing, says ByteTree’s Charlie Morris

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Investors in 2025 are either anxious or happy. The anxious believe investing is all about costs. Buy some cheap trackers, and in the long run, you’ll do fine with minimal effort. The happy are active investors who have avoided the largest stocks. It is an anomaly for the largest stocks to lead the market (1929, 1972, 1999 excepted), and following the crowd into richly valued areas doesn’t end well.

As an active manager, I have found 2025 rewarding mainly because my portfolios pursued value outside the US. A weak dollar has meant US equities have lagged the world. US equities have delivered zero returns in sterling this year, and the MSCI World index, with 70.3% exposure to the US, is up just 2.4% including dividends. Contrast that with the FTSE 100, up 12%, or the pan-European EuroSTOXX, up 20% this year. US exceptionalism has once again been exaggerated.

Passive investing makes sense for people who do not want to take an interest in their finances, which presumably counts out MoneyWeek readers. It delivers a market return, before fees, and prevents a worse outcome from incompetent active managers or bad actors. Being cheap and simple, it deserves to be the default option for the majority, and rightly so. After all, beating the markets is a minority sport.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Therein lies the opportunity. Passive management is now so vast that, according to US investment platform Market Structure Edge, trading in index products accounts for 56% of market volume; in 1995, it was in its infancy. If passive management today is so vast, it means active management should provide fertile grounds for rich pickings.

This is reaffirmed by a recent market trend that shows active fund-management companies on the up this year, while the passive managers are waning. For example, shares in institutional active manager Schroders are up 25%, while BlackRock, owner of iShares, is down for the year. Is this a one-off? I don’t think so, because the valuation gap is enormous. Schroders trades on twice sales, with a free cash-flow yield of 16%. Contrast that with BlackRock on a hefty eight times sales with a free cash-flow yield below 3%.

Youthful investors forget, or have never witnessed, that active managers were among the most highly rated stocks in the 1990s. Today, they are dirt cheap. My recent picks include Man Group, Jupiter, and the Dutch company Allfunds, which provides trading infrastructure for the funds sector.

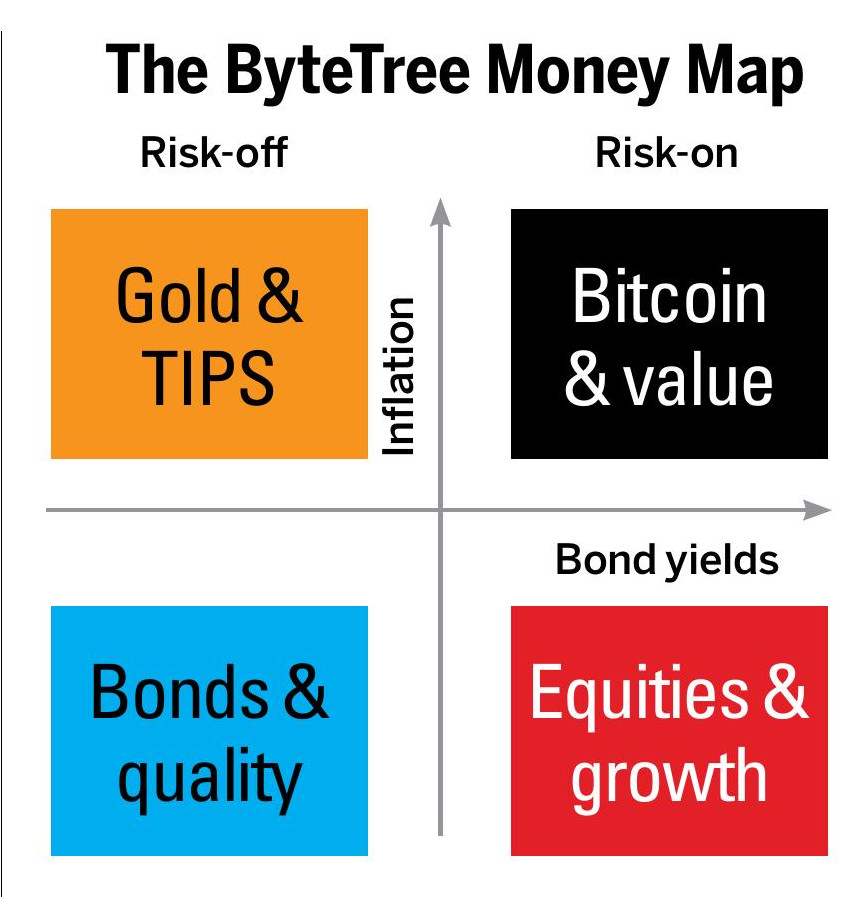

The investors' Money Map

Other investment themes that stand out include gold, precious metals and copper – all beneficiaries of a weak dollar, money printing, and burgeoning deficits. There’s bitcoin and crypto, which are increasingly looking like core allocations. There are also the banks, which benefit from high interest rates, and China, which has impressive technology companies trading on attractive valuations.

On the other hand, 2025 has been another year to avoid gilts. The long bond yield has settled at 5.5%, a level not seen since 1998. It is supposed to mimic annual nominal GDP growth, which comprises economic growth (1.3%) and inflation (4.4%), so the yield is about right. For it to come down, we would need to see a recession to break inflation, tough love in dealing with the budget deficit, or “growth” policies that don’t involve raising taxes. A recession will come about sooner or later, as they always do, but a balanced budget? Unlikely.

The economy may be in better or worse shape next year, but does it matter? In 30 years since I took an interest in financial markets, I am certain that value is more important than the economy. Therein lies the importance of my Money Map (pictured), which I last wrote about for MoneyWeek in 2017: What to take with you in the investment jungle. It outlines the investment strategy most suited to different macroeconomic environments. When times are good, stay on the right, and when bad, stay on the left. When inflation rises, stay high, when it is low and stable, duck.

I have long built portfolios around this idea, filled with undervalued stocks, bonds, commodities, or funds. The Money Map helps to identify the key areas on which to focus, and more importantly, the areas to avoid. Above all, this is how to diversify a portfolio: by having exposure to each quadrant, whatever the weather, because macroeconomic environments can change quickly.

That said, I have more exposure to the favoured quadrant, and to the adjacent quadrants, with less in the least-favoured one. In recent times, this has meant having more value, and less quality and bonds in the portfolios, while staying broadly neutral in growth and gold. At some stage, this will change, probably when there are clear signs that inflation is under control and interest rates fall.

I am looking forward to that because you will have noticed that quality stocks such as Unilever, Diageo, and Reckitt Benckiser have struggled in recent years and now offer good value. In the US, quality stocks such as Nike, Procter & Gamble, McDonald’s and PepsiCo are also waning, and maybe they’ll be cheap by 2026, or 2027. In any event, the world’s best companies have had their bubble pricked and are headed lower, which is something to look forward to.

Charlie Morris is the CEO and founder of ByteTree. It offers investment research for private clients through the Multi-Asset Investor, in addition to other research services. ByteTree also has a Bitcoin and Gold ETF (BOLD) managed by 21Shares in Zurich.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Inheritance fights are up 80% – here’s why and what to do if it happens to you

Inheritance fights are up 80% – here’s why and what to do if it happens to youFamilies are increasingly disputing inheritances, as age-related and economic factors force a tussle over the last will and testament of loved ones. What should you do if you find yourself in the middle of a fight over money?

-

The northern powerhouse city where first-time buyers are snapping up properties

The northern powerhouse city where first-time buyers are snapping up propertiesFirst-time buyers are “casting their nets” wider to find properties that match their budgets and lifestyles. We look at the top areas for first-time buyers.

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Three companies with deep economic moats to buy now

Three companies with deep economic moats to buy nowOpinion An economic moat can underpin a company's future returns. Here, Imran Sattar, portfolio manager at Edinburgh Investment Trust, selects three stocks to buy now

-

Should you sell your Affirm stock?

Should you sell your Affirm stock?Affirm, a buy-now-pay-later lender, is vulnerable to a downturn. Investors are losing their enthusiasm, says Matthew Partridge

-

Beeks – building the infrastructure behind global markets

Beeks – building the infrastructure behind global marketsBeeks Financial Cloud has carved out a lucrative global niche in financial plumbing with smart strategies, says Jamie Ward