Cyber insurance is crucial to your business

The impact of a cyber attack can be devastating, so start researching now for cyber insurance

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Does your company need cyber insurance? While high-profile cyber attacks on firms such as Marks & Spencer generate most of the headlines, there is a much broader cyber crime epidemic going on. Around 42% of small and medium-sized enterprises (SMEs) in the UK have experienced a cyber attack or breach over the past 12 months. The impact can be devastating. Transport company KNP last month announced it was closing down after almost 160 years in business following a cyber attack that left it locked out of its own IT systems. The damage caused proved too much for the firm to recover from. Data from BT suggests the average cost of a serious breach to a small business is just short of £8,000, but in many cases, the bill will be substantially higher.

Moreover, while costs such as restoring systems and the interruption to business may be easy to quantify, additional expenses such as reputational damage can be large and unknowable. A data breach could also leave your firm vulnerable to sanctions from the Information Commissioner’s Office: it can fine businesses up to 4% of their global turnover for transgressions.

Consult a broker for cyber insurance

Cyber insurance offers valuable risk mitigation benefits.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Firstly, your insurer can offer practical advice and support that will enable your business to better protect itself from an attack through technology improvements and stronger security. If an attack does get through, your insurer will be able to help you manage the breach and get your SME back up and running more quickly. And it will also refund many of the costs you incur.

Still, cyber insurance is a fast-evolving market, and it’s important that SMEs understand what policies do and don’t cover before signing up. This is one area of the insurance industry where getting independent advice from a broker can be especially valuable. Most insurers will want to develop a detailed understanding of your SME before offering cover. They’ll work with you to conduct a risk assessment, aimed at identifying the type and potential cost of attacks you might face, as well as the quality of your existing defences. They will also want to know how well you’ve trained employees on cyber security.

This process can take some time, and the results of the assessment will have a direct impact on the cost of cover. But it can be a worthwhile exercise. Insurers will be able to suggest improvements you can make to your risk management processes; this will help you secure affordable cover but also enhance your firm’s cyber security. Make sure you understand exactly what insurance offers. For example, what support will your insurer provide immediately in the event of a cyber attack? What limits are there on payouts, both for the cost of the attack itself and associated losses such as business interruption? What threats are you covered for, and will this cover evolve as new threats emerge? Will you be covered for attacks that result from a mistake made by one of your employees?

Clearly, the price of insurance will be key too. It will depend on the nature of your business. Certain firms and industries handle more sensitive data and rely more heavily on technology systems, for example. However, one recent survey put the average cost of cyber insurance at between £500 and £3,500 a year for a small business with an annual turnover of less than £1 million. For businesses with revenues between £1 million and £10 million , that rose to £3,500 to £10,000 annually.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David Prosser is a regular MoneyWeek columnist, writing on small business and entrepreneurship, as well as pensions and other forms of tax-efficient savings and investments. David has been a financial journalist for almost 30 years, specialising initially in personal finance, and then in broader business coverage. He has worked for national newspaper groups including The Financial Times, The Guardian and Observer, Express Newspapers and, most recently, The Independent, where he served for more than three years as business editor.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Hiring new staff for your business? Help is available

Hiring new staff for your business? Help is availableHiring more employees is a costly business, but help is available from the government, says David Prosser

-

'Expect more policy U-turns from Keir Starmer'

'Expect more policy U-turns from Keir Starmer'Opinion Keir Starmer’s government quickly changes its mind as soon as it runs into any opposition. It isn't hard to work out where the next U-turns will come from

-

How pet insurance can help cut the costs of vet bills

How pet insurance can help cut the costs of vet billsYou can temper the expense of vet bills with pet insurance. There are four main types to consider

-

Rachel Reeves's punishing rise in business rates will crush the British economy

Rachel Reeves's punishing rise in business rates will crush the British economyOpinion By piling more and more stealth taxes onto businesses, the government is repeating exactly the same mistake of its first Budget, says Matthew Lynn

-

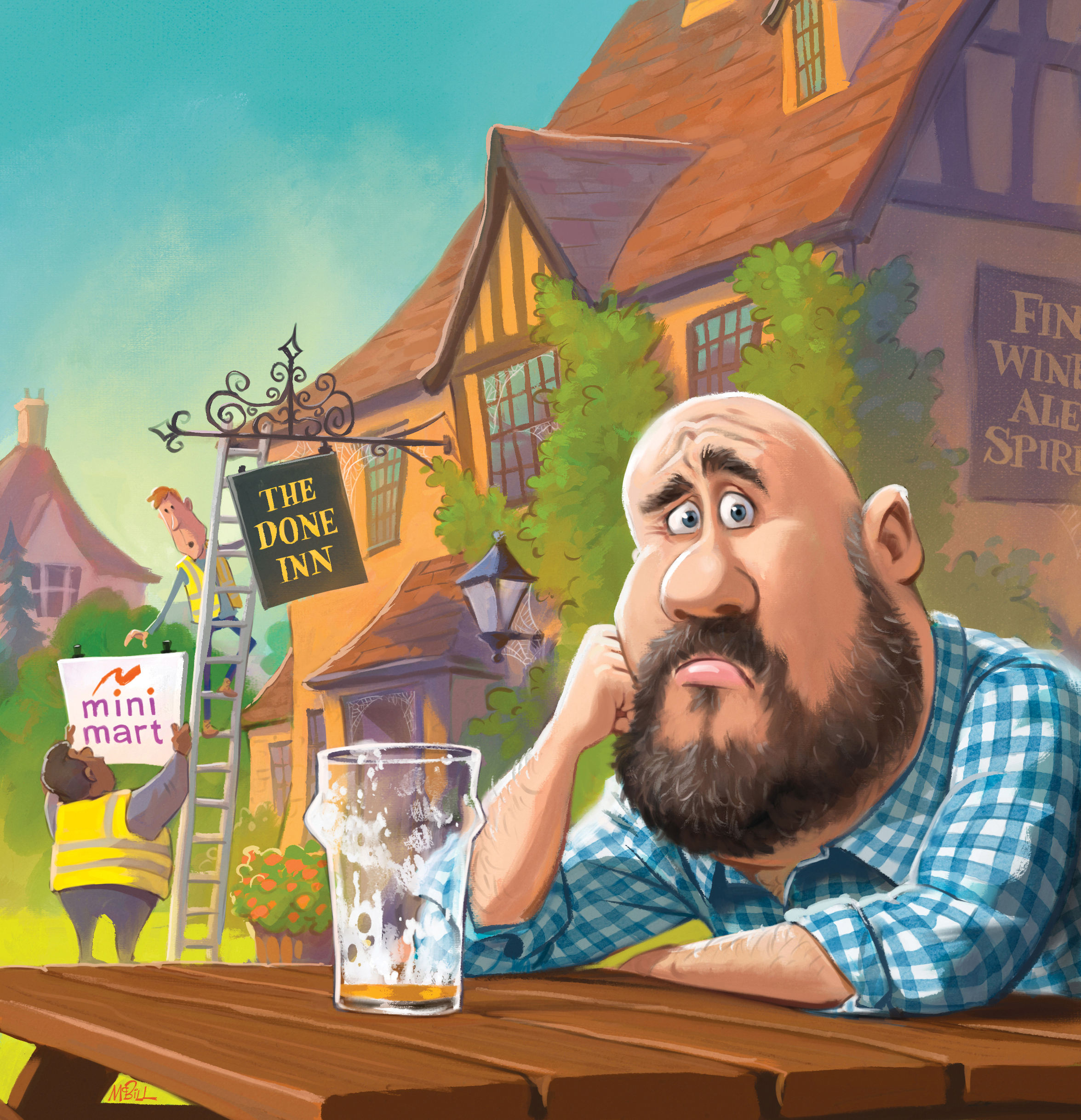

Last orders: can UK pubs be saved?

Last orders: can UK pubs be saved?Pubs in Britain are closing at the rate of one a day, continuing and accelerating a long-term downward trend. Why? And can anything be done to save them?

-

Beazley: a compelling specialist insurer

Beazley: a compelling specialist insurerThe insurer Beazley is unusually profitable at present, and that looks set to continue. The stock is also a valuable portfolio diversifier, says Jamie Ward

-

How to invest in the booming insurance market

How to invest in the booming insurance marketThe insurance sector is experiencing rapid growth after years of stagnation. Smart investors should buy in now, says Rupert Hargreaves

-

How British businesses can tackle Trump's tariffs

How British businesses can tackle Trump's tariffsThe majority of British businesses are likely to take a hit from the chaos caused by Trump’s tariffs to reorder global trade. Companies in the firing line face some difficult decisions, says David Prosser