The charts that matter: gold finally sets a new record high

As gold surges past its previous high, John Stepek looks at how it's affected the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

Exciting new feature to point out to you – we are now doing weekly videos, explaining financial topics in plain English. Our first “Too Embarrassed To Ask” video covers “tax wrappers” in an effort to demonstrate, once and for all, that the question “property or pension?” is a daft one. Watch it here and let me know what you think, at editor@moneyweek.com.

There’s a new podcast from Merryn and me this week too – unsurprisingly our main topic is the new record high for gold. How much further could it go? Where are we in terms of sentiment? And how have the gold miners done so far this year? We also talk V-shaped recoveries and the run on paddleboards. Have a listen here.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And of course, in this week’s issue of MoneyWeek, we also wrote about gold. (And silver). if you haven’t yet subscribed, I’d suggest getting in now before the rush.

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday: What would the greatest mathematician of the Middle Ages say about gold today?

- Record highs for gold: Gold could set new records, even from here – here’s how to invest

- Tuesday: What will the US central bank do next?

- Merryn’s blog: Income investors: here’s what to do as dividends shrink

- Wednesday: How much further will gold go? $2,250, $2,460 – or beyond?

- Thursday: Don't fight the Fed – at least, not yet

- Friday: UK banks have had a shocking week – so it’s probably a good time to buy

If you missed our webinar earlier in the week, don’t worry – you can sign up to watch it here for free. Merryn interviewing James Dow, co-manager of Baillie Gifford’s Scottish American Investment Company, all about where to find sustainable dividend income in a post-coronavirus world.

Now for the charts of the week.

The charts that matter

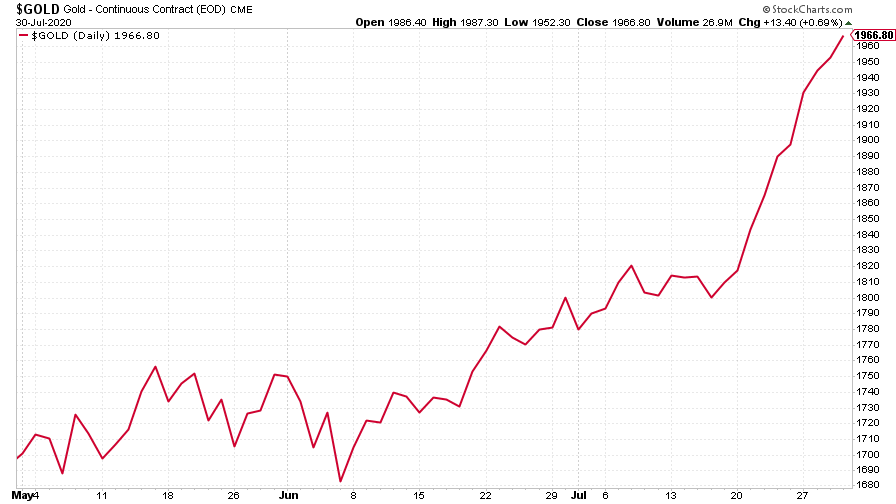

Gold had another great week, finally bursting through its previous record high, without really stopping for breath. We’ve looked at the reasons behind the gold surge before, but fundamentally it’s about falling “real” interest rates. How much further could gold go? Dominic took a look earlier in the week – but suffice to say, there’s the potential to go a lot higher.

(Gold: three months)

Another factor behind the gold surge is that the US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) continued to tumble this week. Again, Dominic covered the state of the US currency in his most recent Money Morning.

(DXY: three months)

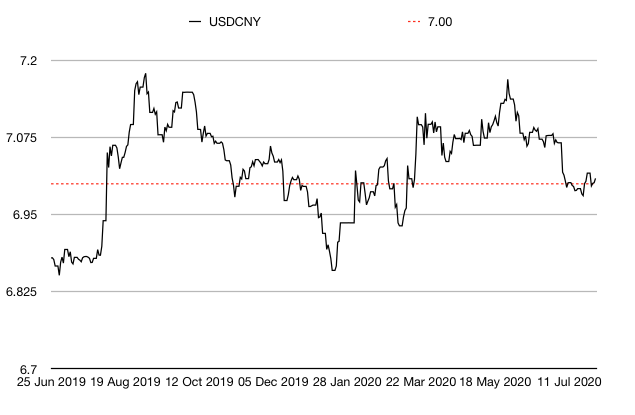

The Chinese yuan (or renminbi) was little changed this week, meandering around the €1/¥7 mark.

(Chinese yuan to the US dollar: since 25 Jun 2019)

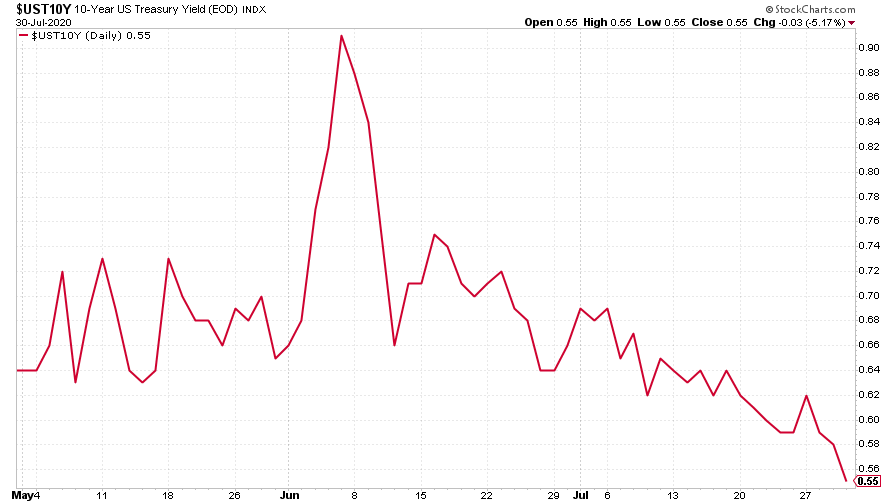

The yield on the ten-year US government bond continued to fall too, which helped push the US dollar lower (the lower the interest rate gap between the US and other countries, the less tempting it is to move money there). It also drove the aforementioned “real” yields lower, which in turn is a boost for gold.

(Ten-year US Treasury bond yield: three months)

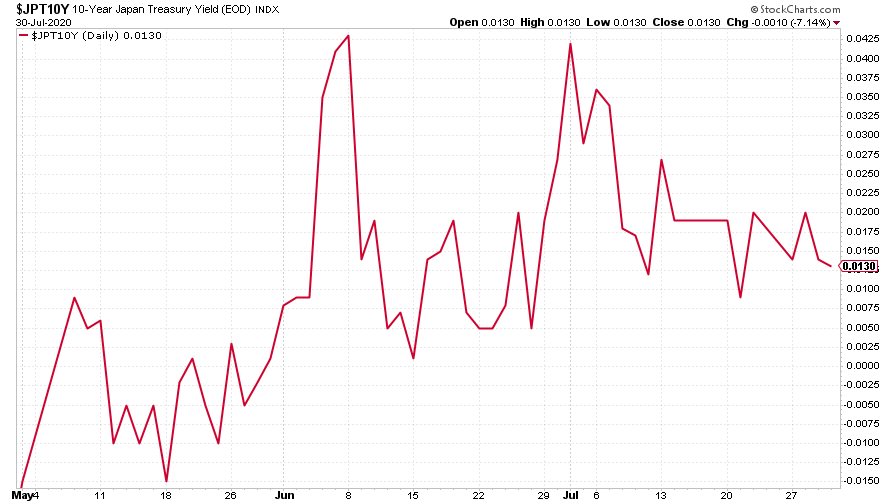

The yield on the Japanese ten-year slipped a little too, but is still basically static due to central bank yield curve control.

(Ten-year Japanese government bond yield: three months)

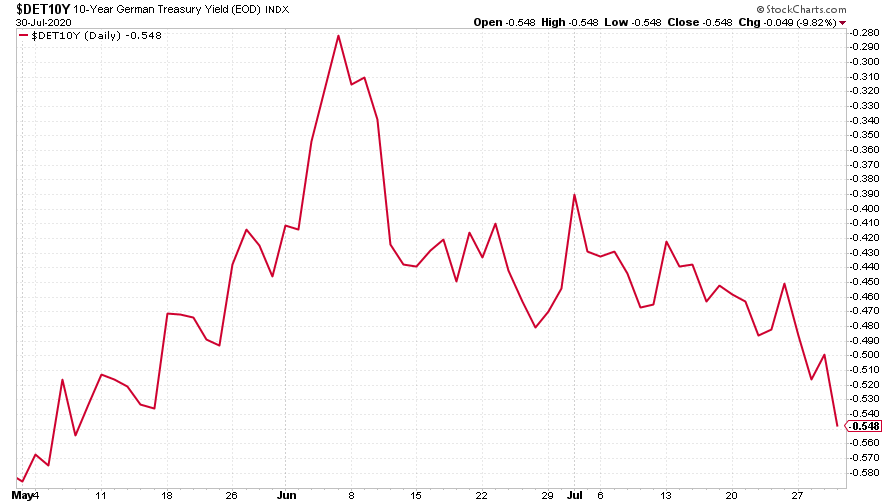

The yield on the ten-year German Bund slid deeper into negative territory. It’s edging closer to a three-month low, although still well above the lows set in March.

(Ten-year Bund yield: three months)

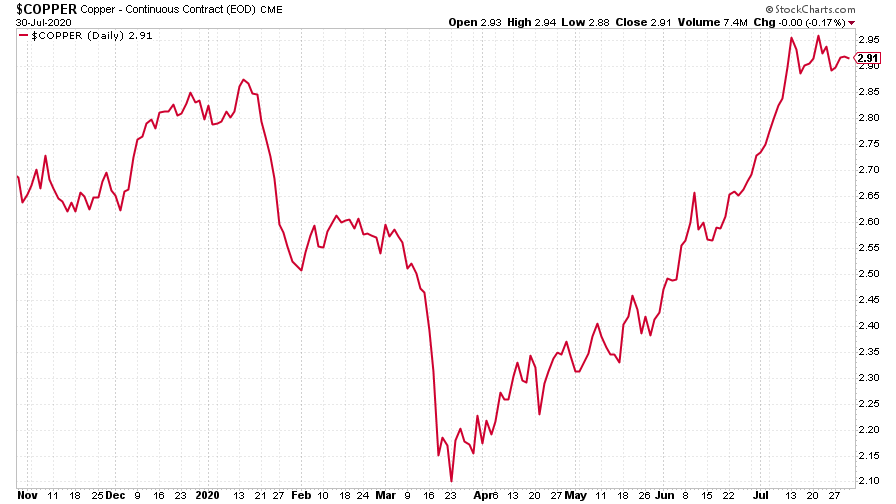

Copper took a bit of a breather this week after its strong run but it still managed to end the week a little higher.

(Copper: nine months)

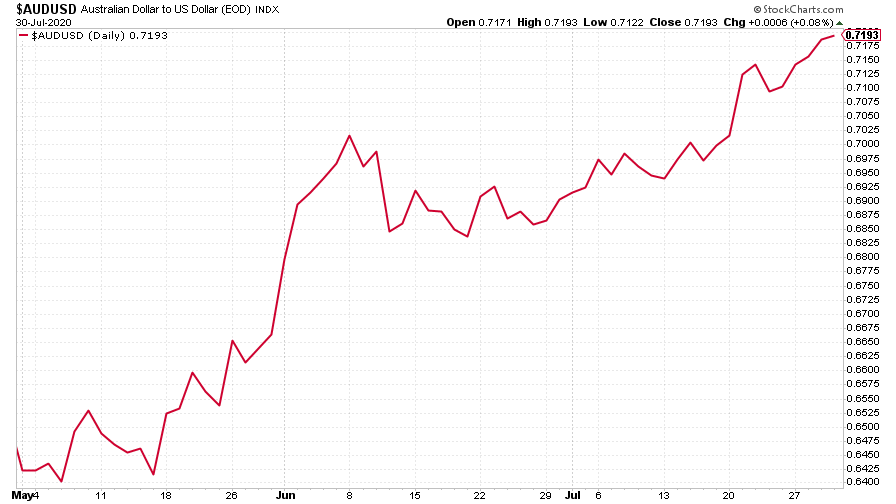

The Aussie dollar continued to climb, which is mostly driven by the weak US dollar.

(Aussie dollar vs US dollar exchange rate: three months)

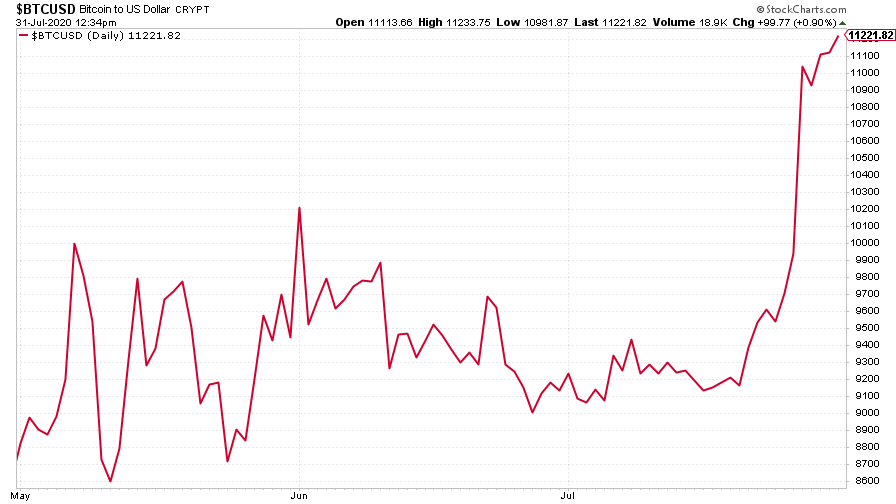

Cryptocurrency bitcoin finally broke out of the tight range it’s been wobbling around in for the past three months or so. While I don’t claim to understand what drives bitcoin, I feel fairly confident that the current surge is mostly about it being seen as a “catch-up” trade for gold, alongside silver. It’s an asset I’m essentially agnostic on but I’m certainly not against owning a little bit, just in case it decides to go on another of its wild runs.

(Bitcoin: three months)

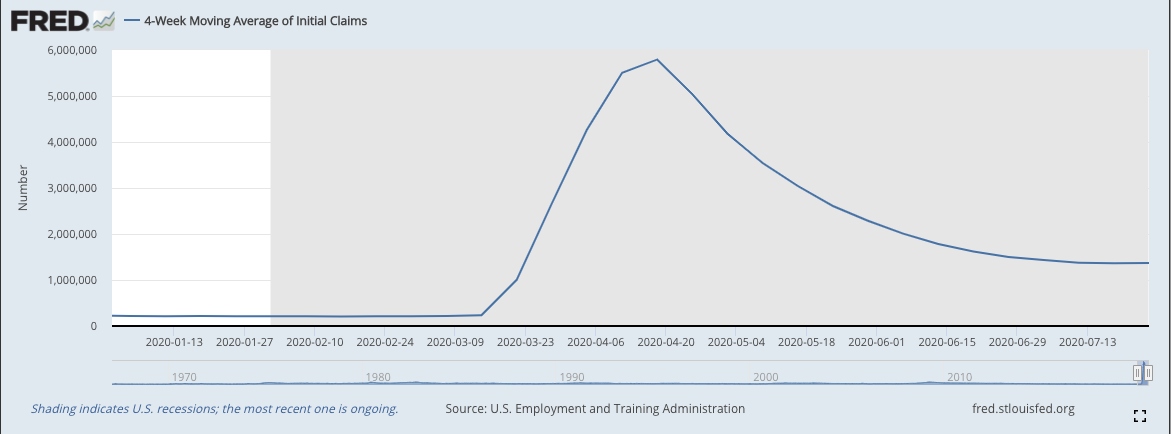

This week’s US weekly jobless claims figure rose again this week. The number of new claims came in at 1.43 million (from 1.42 million last time). The four-week moving average edged higher to 1.37 million from last week’s 1.36 million. US politicians are still trying to agree a deal to extend unemployment benefits.

(US jobless claims, four-week moving average: since Jan 2020)

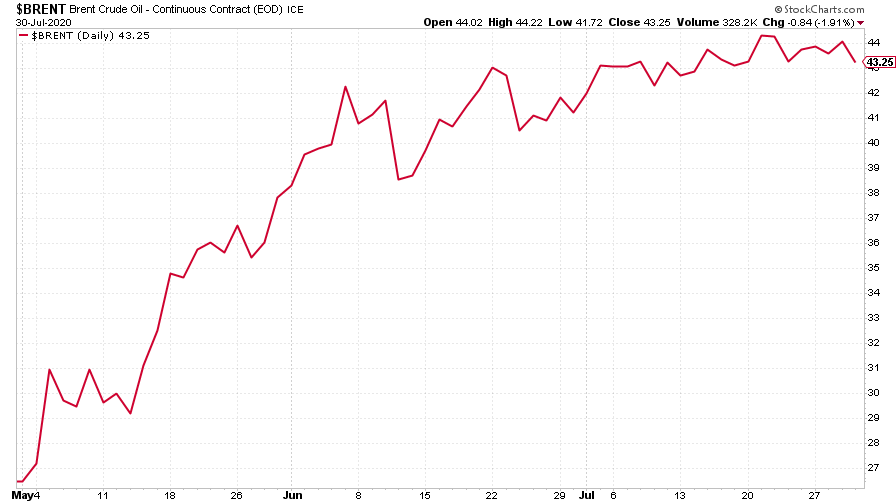

The oil price (as measured by Brent crude) didn’t change much this week. It looks to me as though the mood music around oil cartel Opec is getting a bit fractured, while there’s more and more clear distress in the fracking sector. I suspect that this adds up to the risk of more supply hitting the market in the shorter run, but in the longer run, a surprise shortage. We’ll see what happens.

(Brent crude oil: three months)

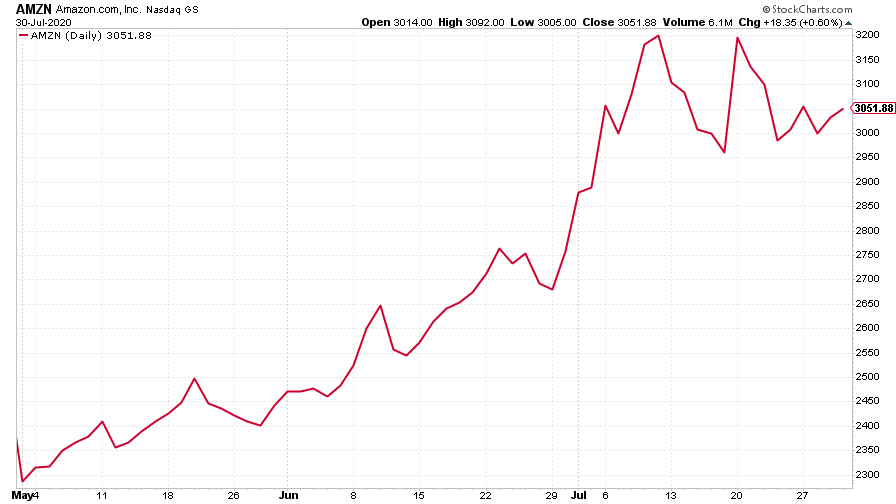

Amazon soared at the end of the week as it turned out that the lockdown – surprise, surprise – really has been very good for a company that dominates internet retail. In the same week, CEO and founder Jeff Bezos appeared in front of US politicians alongside his fellow technology company Masters of the Universe, to try to present the argument that they’re not monopolies or near-monopolies. From that point of view, having an extraordinarily profitable quarter probably doesn’t help things, but shareholders aren’t complaining right now.

(Amazon: three months)

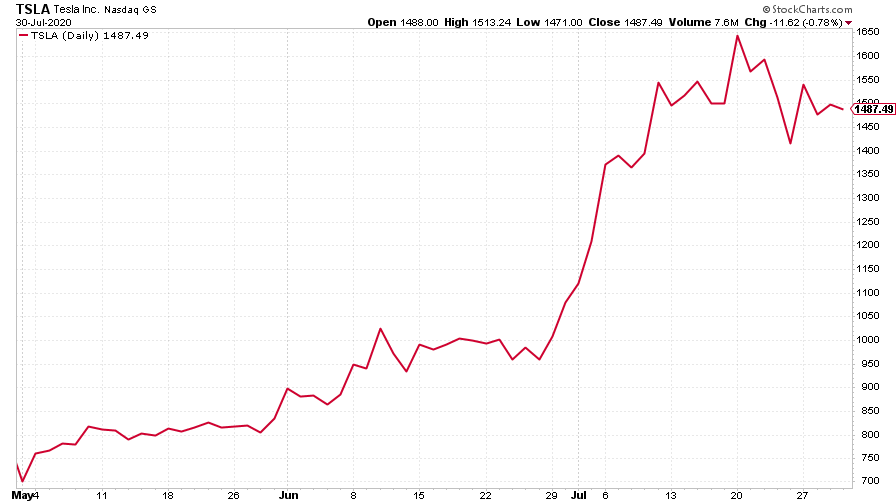

Electric car group Tesla had a relatively tame week by its volatile standards, ending up a little higher.

(Tesla: three months)

Have a good weekend – hopefully we’ll get to enjoy some sunshine.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?