How much further will gold go? $2,250, $2,460 – or beyond?

The gold bull market has really taken off – and it's only just begun. Dominic Frisby explains what's behind its big rise, and asks how much further it has to go.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In today’s Money Morning we consider the bull market in gold – we are at all-time highs and it feels great.

As I write, we sit at $1,960 an ounce. Yesterday, we touched $1,981.

It feels frothy. Are we in final blow-off mode, or simply climbing the proverbial bull market wall of worry?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The US dollar has been a big factor in the gold rally

A large part (but not all) of the answer to that question – at least in the short term – lies in the other side of the trade, the US dollar. It has been sinking like a coin (1 oz pure gold) in the ocean since it peaked during the coronavirus panic in mid-March. A weak dollar is Christmas for gold bugs.

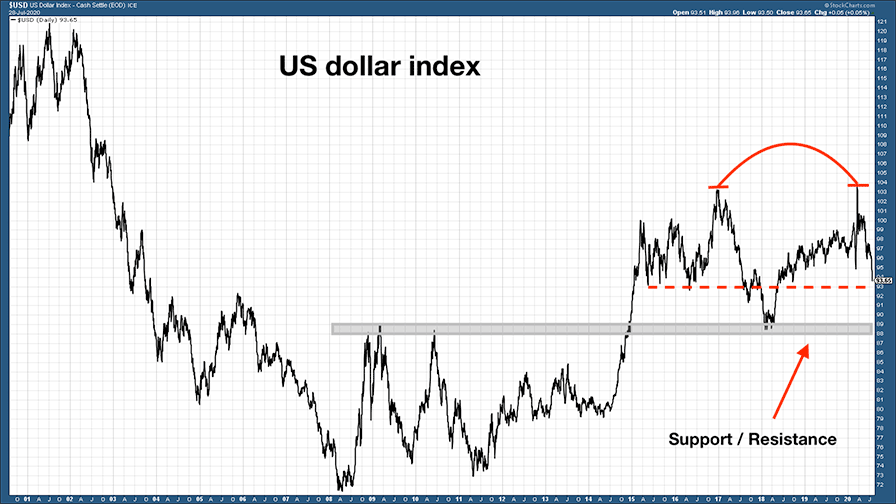

Downward momentum is strong – in March, the US dollar index was at 103; now it’s at 93. Below we have a 20-year chart of the US dollar index – the US dollar vs a basket of major currencies. As the world’s reserve currency, in many ways the US dollar index is the most important price in the world. You can see that it has put in as textbook a “double top” as you will ever see (marked in red) at 103 – in late 2016, and in March. There is some support in the 92/93 area (dashed red line), and much longer-term support in the grey zone at around 88.

Donald Trump wants a weaker dollar. He has said so many times, and in an election year it’s even more important to him. When the dollar is weak, assets tend to rise and so people feel richer, even if they are not. He wants people feeling rich, so they will be more likely to vote for him. In fact, you can take a chart of the S&P 500, overlay a chart of Trump’s popularity polling, and the two almost exactly track each other.

If the dollar goes to 88 (and in the context of the last ten years, that really isn’t that low a price – it spent the entire period from 2006 to 2014 below 88) then gold will be a good two or three hundred dollars above where it is now.

Downward momentum is so furious at the moment that, I have to say, I will almost be more surprised if we don’t hit 88 this year than if we do. The euro in particular looks like it’s begun a new bull market against the dollar.

Gold is frothy, but it still has a lot further to run

But gold’s strength is not just a weak US dollar story – it is a weak fiat currency story and a global money-printing bonanza story. Take sterling: in the first half of 2019, gold was trading below £1,000/oz. It began 2020 at £1,150/oz; now it’s over £1,500/oz.

The story has changed since 2011, which was the last time gold was up here in the $1,900 zone. In 2011, the concept of negative interest-rate policies barely existed. The US national debt was almost half what it is now.

The Federal Reserve’s balance sheet was sub-$3trn, compared to $7trn today. The European Central Bank’s balance sheet has tripled since 2011. The Bank of England’s balance sheet has – well, I can’t say on these pages, as swearing is not allowed.

And the US dollar index was at 73 – a full 20 points lower. In fact, it was, as much as anything, the dollar turning up that did for gold and, especially, gold miners.

Another difference between then and now is that now there is perhaps a third of a generation of investors and speculators who haven’t heard all the pro-gold narratives – fiat money collapse, inflation, Austrian economics and so on – and had them confirmed by a rising gold price.

This bull market is not mature – it is, what, three four years old? When did it start? December 2015 at $1,050? August 2018 at $1,170? If you say the latter, then we are not even two years in. The bull market of the noughties went on for ten years. It all points to much higher prices down the road.

As I said in Monday’s missive, I have targets at the $2,250, $2,460 and $2,800 areas. They are quite reachable given the extraordinary situation we are in. Gold is overbought, frothy, bubbly – all those things. But all those things are features of a bull market. Heck, the BBC hasn’t asked me on yet to talk about gold. When they do, that’s when we will know.

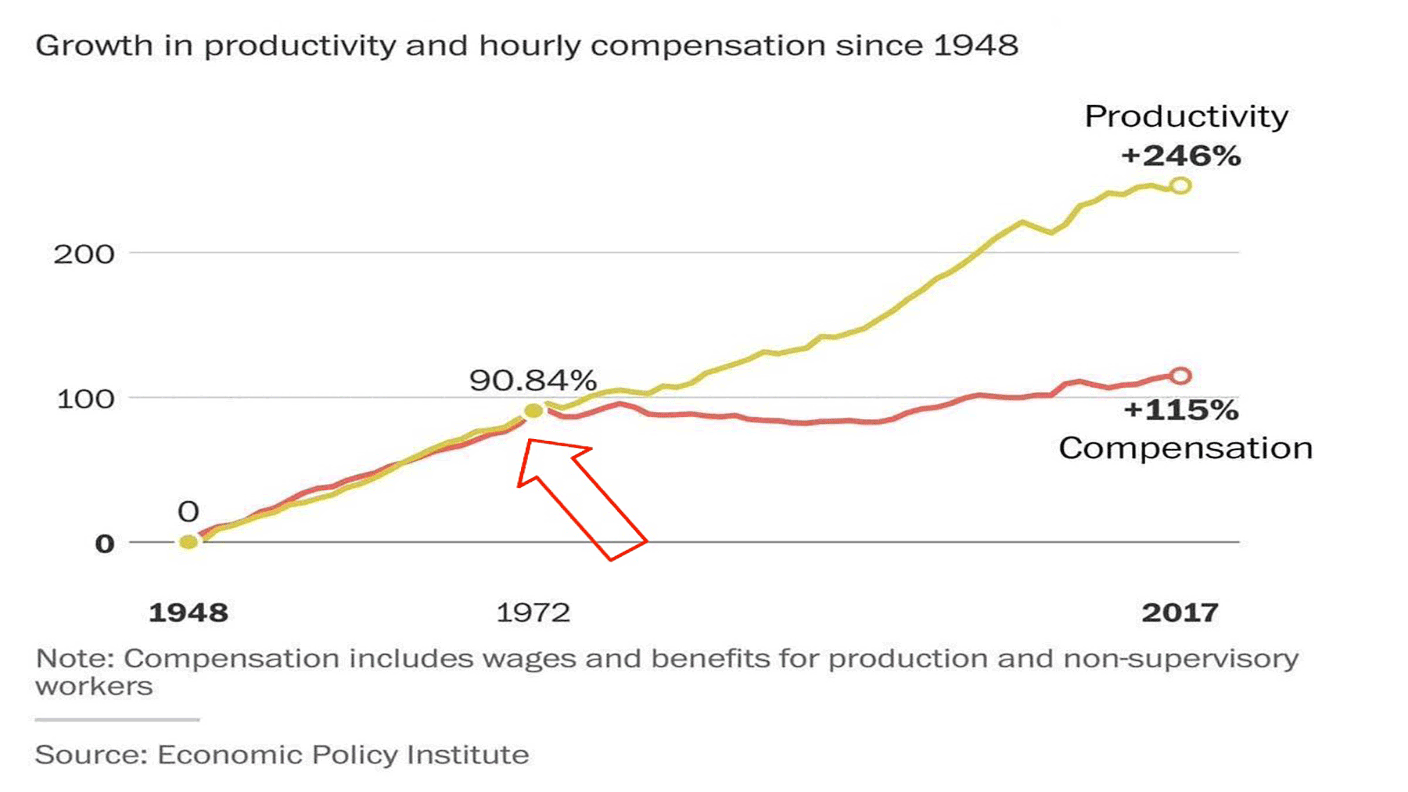

In other – but related news – I think I should record for posterity that, for the first time in its history, gold passed $1,971/oz yesterday. 1971 was of course the year that Nixon took the US off the gold standard – and currency, Swiss franc aside, finally lost its ties to gold. It was a huge turning point in history. Many would argue that it was the point at which things began to go to pot.

It was certainly the point of no return as far the wealth gap in the West was concerned. Here is just one example: we see how wages have stagnated, while productivity has increased. Thus does the worker get left behind.

You can see more of these charts over at https://wtfhappenedin1971.com/

In the meantime, enjoy the bull market. It won’t last forever. They never do – so don’t get too religious about it or you’ll end up losing money. A bit of religion is good – you need belief in the underlying asset.

But there will come a point at which you need some healthy cynicism too.

Daylight Robbery – How Tax Shaped The Past And Will Change The Future is available at Amazon and all good bookstores with the audiobook, read by Dominic, on Audible and elsewhere.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.