Is now a good time to invest in Europe?

European stocks are undervalued, but experts believe that defence and infrastructure spending could see renewed growth

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Europe’s stock market has been in the doldrums for years. The EU has struggled against low growth and persistent inflation.

Meanwhile, the top stocks among investors have had a distinctly American flavour. The Magnificent Seven big tech stocks, especially Nvidia, have provided much of the impetus for global equities growth over recent years.

But the events of 2025 to date have prompted investors to consider selling US assets as the concept of American exceptionalism weakens.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Meanwhile, Europe could be on the up. Driven primarily by a drive to increase defence spend, a number of stimulus proposals have been approved, including the European Council passing a proposal to exempt defence spending from the EU’s fiscal rules and to establish a €150 billion EU loan facility to fund military spending.

Individual countries have also boosted their spending power, in particular Germany, Europe’s largest economy.

“Germany’s new parliament has approved plans to reform the country’s constitutional debt brake, thus removing constraints on defence spending,” says Marcel Stötzel, co-portfolio manager of Fidelity European Trust PLC and Fidelity European Fund.

“This stimulation of the European economy has been very positively received, particularly as US tariff uncertainty threatens to impact the region’s exports of goods,” adds Stötzel.

Are European stocks undervalued?

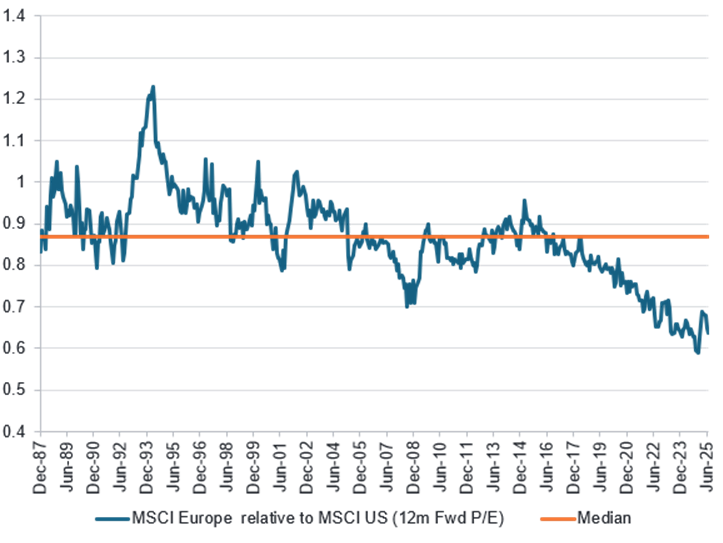

Despite the rotation away from US stocks this year, European stocks are enduring their lowest valuations compared to their US counterparts for decades, creating attractive entry points for value-focused investors.

“Even after the recent rally, European markets continue to trade at significant discount to US counterparts,” says Stötzel, adding that “the combination of attractive valuations and improving fundamentals creates favourable risk-adjusted return potential for quality-focused investors".

Europe vs US average valuation premium

And Hywel Franklin, head of European equities at Mirabaud Asset Management, believes that European small caps are especially undervalued at present.

“You’ve got low valuations, and the ability for some of these companies to start to surprise investors to the upside,” he says.

Technology is a particularly intriguing part of the equation for Franklin.

“The perception in the market is that artificial intelligence (AI) is a big cap story, and it’s a US story,” he says. “I think one of the surprises going forward may be that people forgot it’s some of the smaller companies who will be able to deploy AI quickly and to benefit downstream.”

Defence and infrastructure spend set to rise

European defence stocks have benefitted greatly this year from increased spending commitments in the wake of Trump’s tepid stance towards the NATO alliance during his second term in the White House.

“If they don’t pay, I’m not going to defend them,” he said in March of the other members of the alliance.

While Trump has since adopted a slightly more pro-Ukrainian stance in his approach to the country’s conflict with Russia – he said, on 11 August, that he will aim to reclaim some of the country’s lost territory during a peace summit with Putin this week – it has awoken Europe to the knowledge that it can no longer rely on the US to guarantee its safety.

European defence firms have been profited. Shares in Rheinmetall (DE:RHM) have almost tripled over the 12 months to 13 August, while Leonardo’s (MI:LDO) stock has gained 115% over the same period.

Read more about how to access the European defence opportunity in MoneyWeek’s explainer: the top funds and investment trusts for European defence spending.

But while Europe scrambles to unlock more funding for its military, stimulus packages haven’t just impacted defence stocks.

As well as boosting military spending, Germany’s debt brake reform paved the way for a €500 billion infrastructure investment fund, and other countries are already reaping the benefits of similar investments made in the past.

During the entirety of 2024, Spain’s economy grew at 3.2%, making it the fourth-fastest growing economy in the Eurozone.

“Spain is growing quite quickly,” says Franklin. “It’s actually showing the way forward, because it’s spent quite a lot on its energy infrastructure and its broadband infrastructure.”

Capturing the infrastructure spending trend is Mirabaud’s Discovery Europe Ex-UK fund’s top holding (as of 30 June), Norma Group, a German company that manufactures machine joining components used in the water piping and emission outputs as well as the aviation and automotive sectors.

How to invest in European stocks

Stötzel recommends a focus on quality companies if picking individual European stocks.

“Identifying the most compelling opportunities in this environment requires focusing on companies with specific quality characteristics,” he says. He defines quality businesses as those with stable or growing end markets with a degree of insulation to macro changes, as well as clear business models, strong competitive positions and conservative levels of debt on their balance sheet.

He also looks for businesses that consistently grow their dividends.

Investors that want to diversify their European exposure could select a fund or investment trust to invest with. Fidelity European (LON:FEV), the largest UK-listed investment trust to target European stocks, has signed a proposal to merge with Henderson European Trust (LON:HET), the second largest, subject to shareholder approval.

For a small cap focus, one option is Mirabaud Discovery Europe Ex-UK, which takes a bottom-up approach to investing in high-conviction small caps across Europe, with a focus on identifying undervalued gems.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Dan is a financial journalist who, prior to joining MoneyWeek, spent five years writing for OPTO, an investment magazine focused on growth and technology stocks, ETFs and thematic investing.

Before becoming a writer, Dan spent six years working in talent acquisition in the tech sector, including for credit scoring start-up ClearScore where he first developed an interest in personal finance.

Dan studied Social Anthropology and Management at Sidney Sussex College and the Judge Business School, Cambridge University. Outside finance, he also enjoys travel writing, and has edited two published travel books.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how