The charts that matter: gold closes in on an all-time high

John Stepek looks at the gold chart, which has risen higher on the back of eurozone relief and dollar weakness, along with all of the other charts that matter to investors.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

Podcast-wise, I had another enjoyable chat with The Week Unwrapped team this week. I talked about the Greek government’s plans to poach Europe’s rich pensioners (we’re all thoroughly in favour of that one). We also discussed whether pathological lying should be a clinical diagnosis, and had a look at the amazing calming powers of toast. Check it out here.

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

- Monday: How moving averages can reveal trades worth betting on – and ones to avoid

- Tuesday: Here’s the one simple reason the EU deal matters for investors

- Merryn’s blog: Prepare yourself for a rise in capital gains tax

- Wednesday: Silver’s had a cracking run – what happens now?

- Merryn’s blog: How to have a low-tax retirement in the sun

- Thursday: The market is starting to wake up to inflation risk – here’s why that matters

- Friday: Is it time to buy Europe and sell the US?

Don’t forget to sign up for our webinar, ready to view this coming Tuesday, 28 July. Merryn will be interviewing James Dow, co-manager of Baillie Gifford’s Scottish American Investment Company, about where to find sustainable dividend income in a post-coronavirus world. Register to watch here – it’s completely free.

And if you haven’t yet subscribed to MoneyWeek, now’s a good time to do so. I feel as though we’re getting close to real fireworks in markets (as if we haven’t already seen plenty this year).

Now for the charts of the week, which are really quite exciting this week...

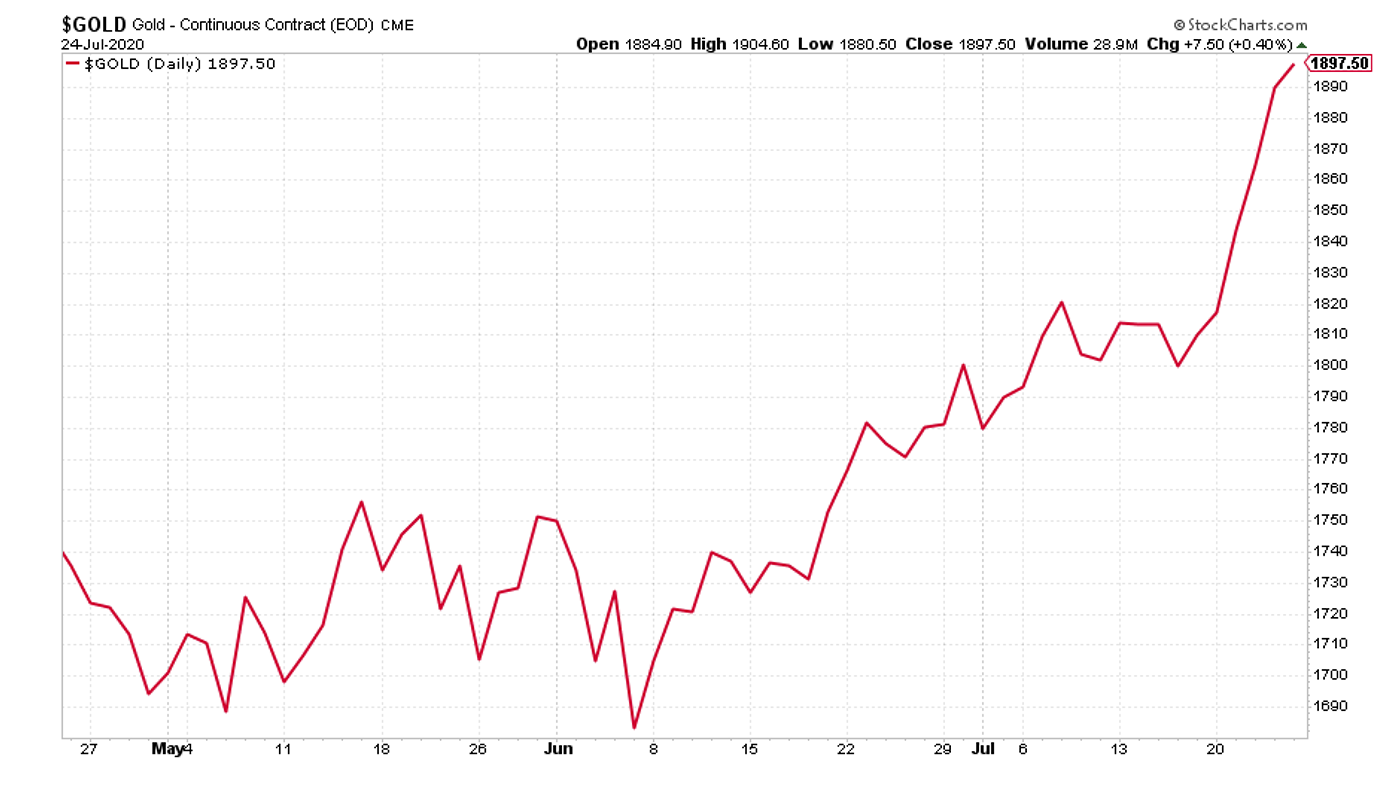

The charts that matter

Gold had an extraordinary week, surging higher (along with silver). That’s partly down to the US dollar slipping, which in turn is at least partly because the fact that Europe has agreed a joint coronavirus recovery package means that the tail risk of a massively deflationary eurozone breakup is off the cards (or at least for a significant period of time). In a world where inflation is being viewed as an increasing possibility, even as interest rates are likely to be kept down, gold is a natural asset to hold.

(Gold: three months)

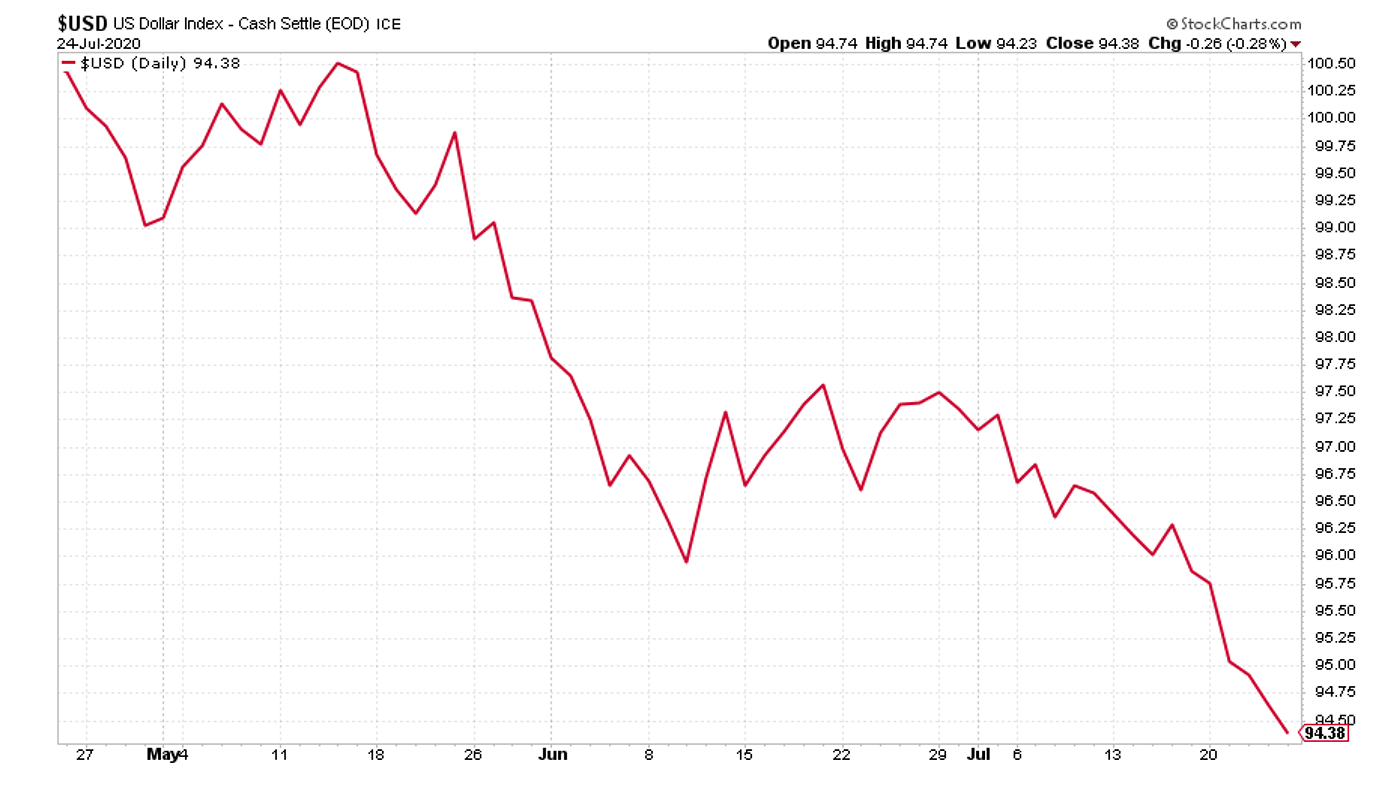

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) – took a sharper turn lower this week. That’s good news for risk assets (everyone needs dollars so a cheaper dollar effectively means cheaper money across the world). It helps that the euro is the biggest chunk of the dollar index, and it’s been strengthening following the coronavirus budget deal.

Is this the start of a weaker dollar trend? It could well be. That may pose its own problems in the long run but for now, markets certainly won’t object to it.

(DXY: three months)

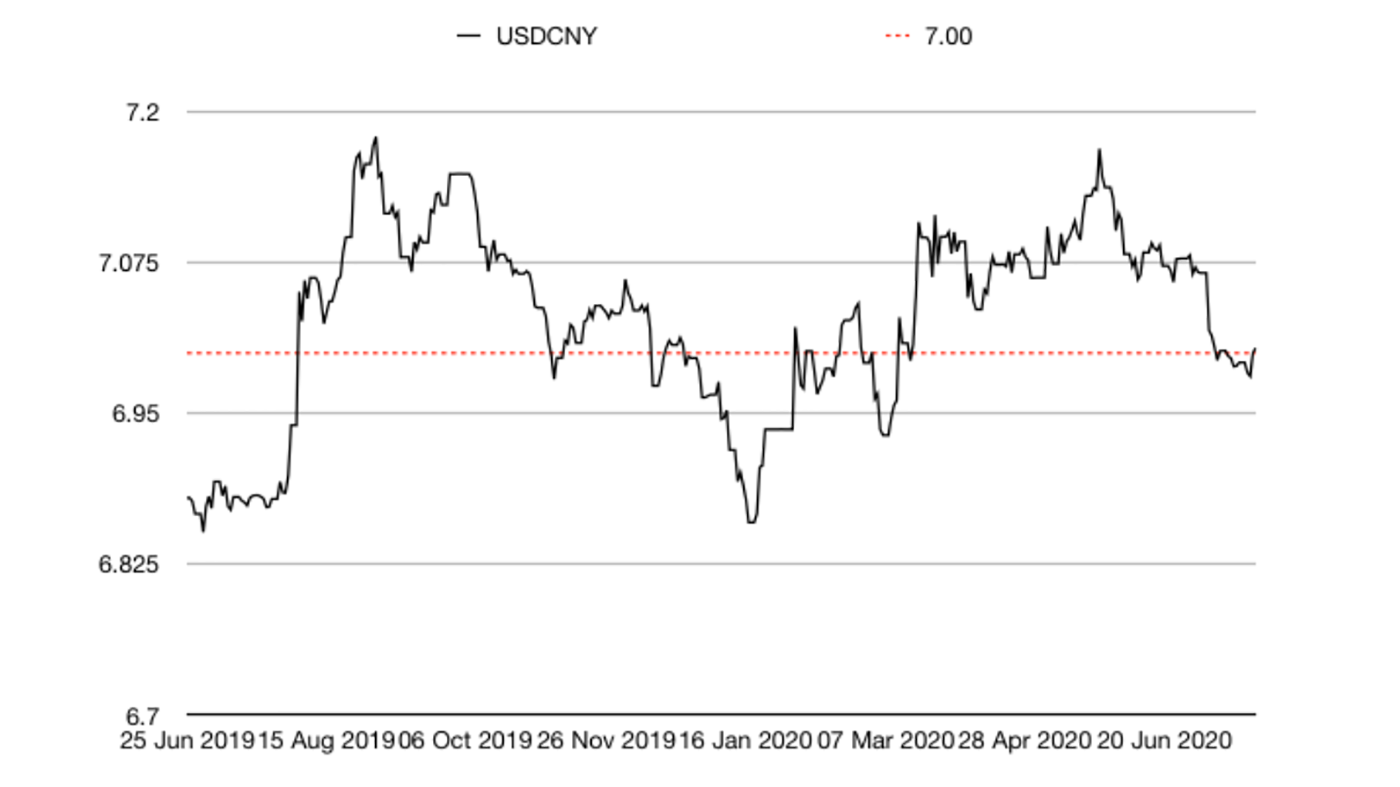

The Chinese yuan (or renminbi) strengthened against the dollar (when the black line on the chart below falls, the yuan is getting stronger) until the end of the week, when a spat between the US and China broke out over embassies. The number of yuan to the dollar dropped below the seven mark pretty rapidly, which can be viewed as a warning sign – it’s suggestive of trade tensions building up again.

(Chinese yuan to the US dollar: since 25 June 2019)

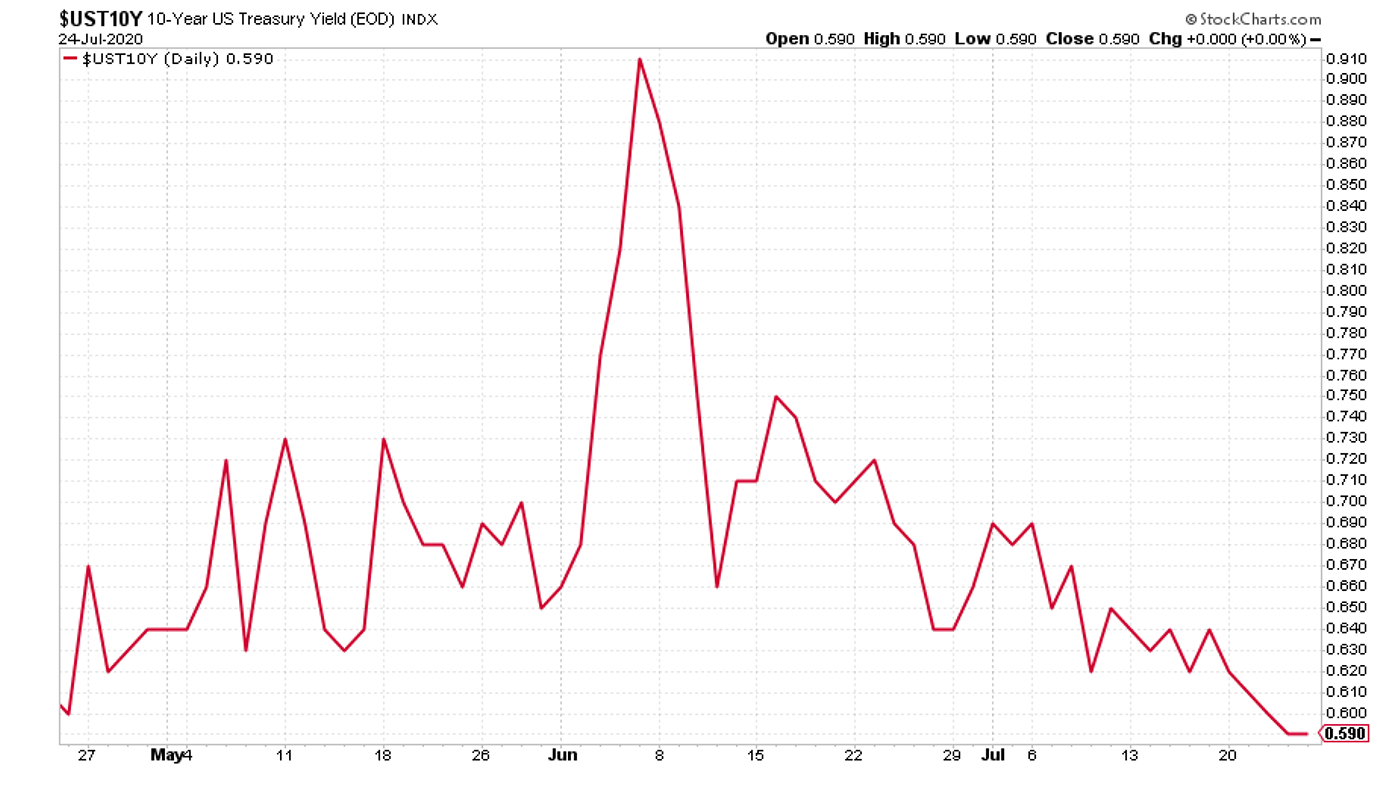

The yield on the ten-year US government bond fell to below 0.6%. That’s its lowest level in three months. With interest rates this low, it’s little wonder the US dollar was down and gold was up.

(Ten-year US Treasury yield: three months)

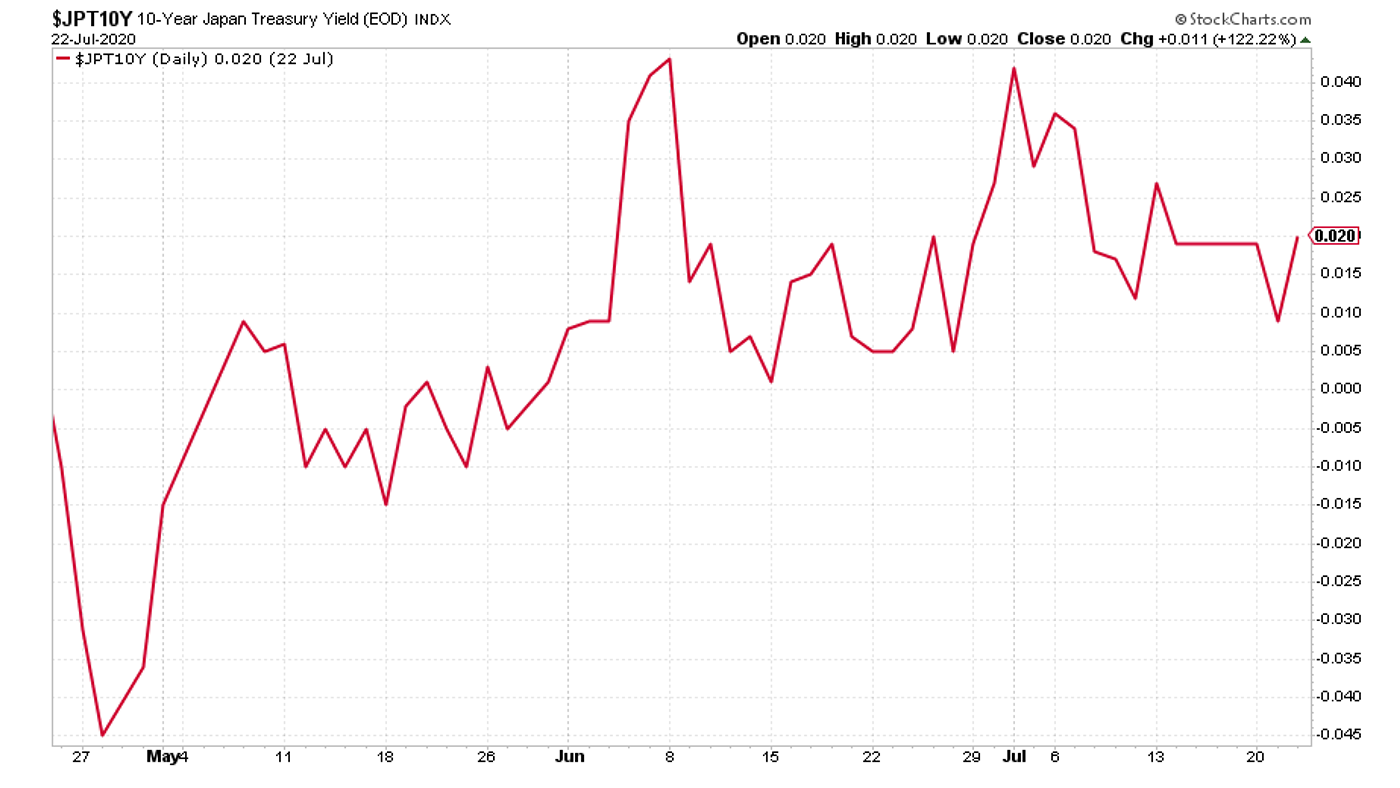

The yield on the Japanese ten-year by contrast, was a tiny bit higher, but nothing to write home about.

(Ten-year Japanese government bond yield: three months)

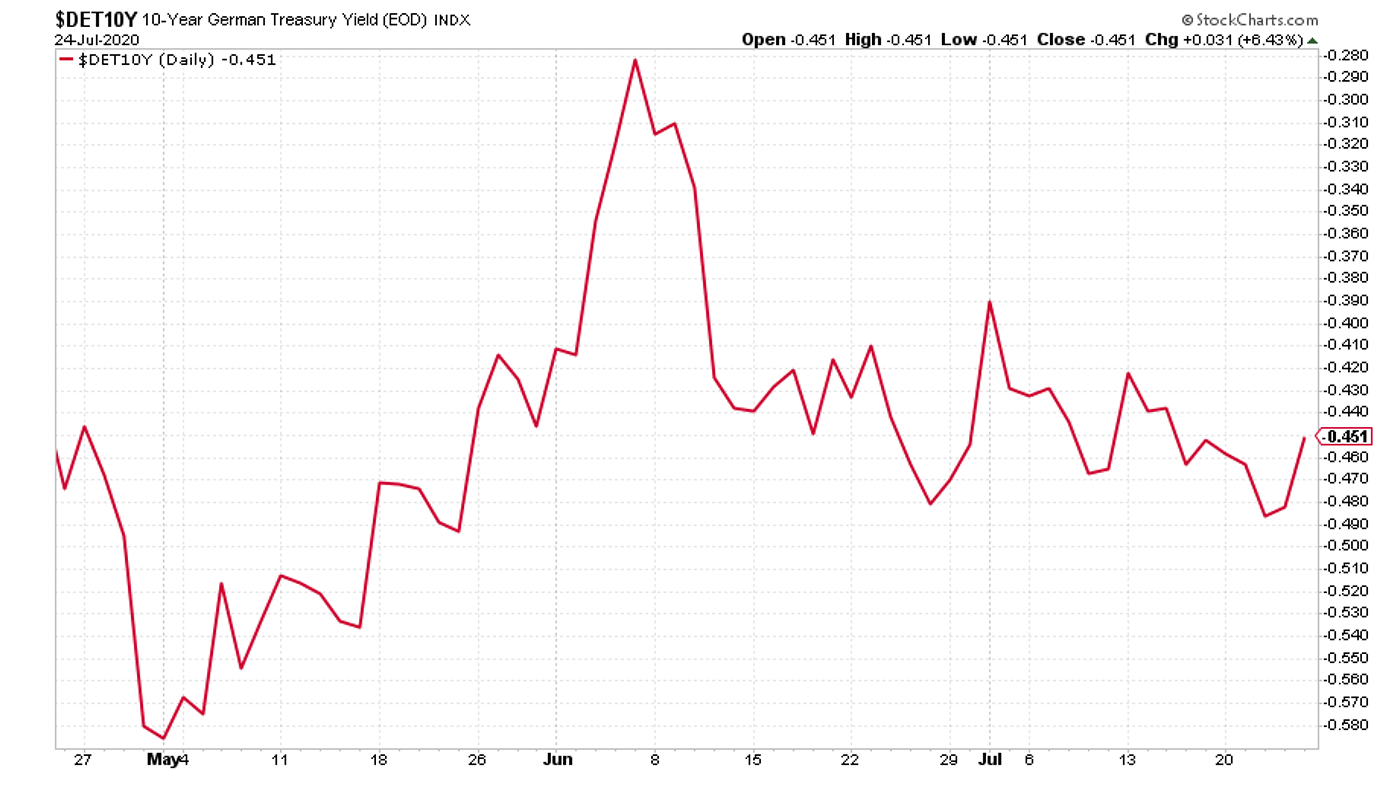

The yield on the ten-year German bund dipped further into negative territory.

(Ten-year Bund yield: three months)

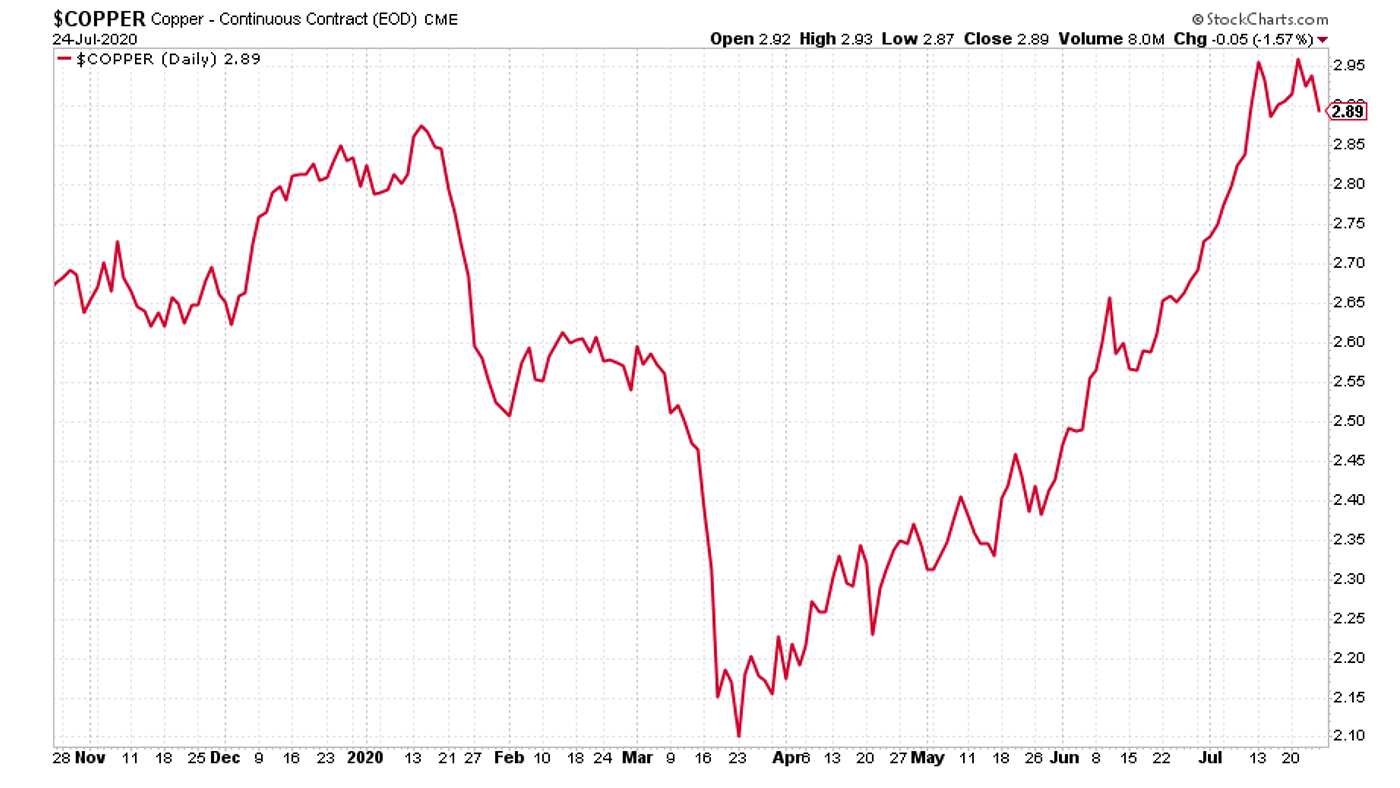

Copper managed to claw its way higher yet again – the weakness in the dollar is helping alongside an apparent recovery in Chinese activity, and as the nine-month chart below shows, copper is now back above its pre-Covid levels, which is quite a striking indicator.

(Copper: nine months)

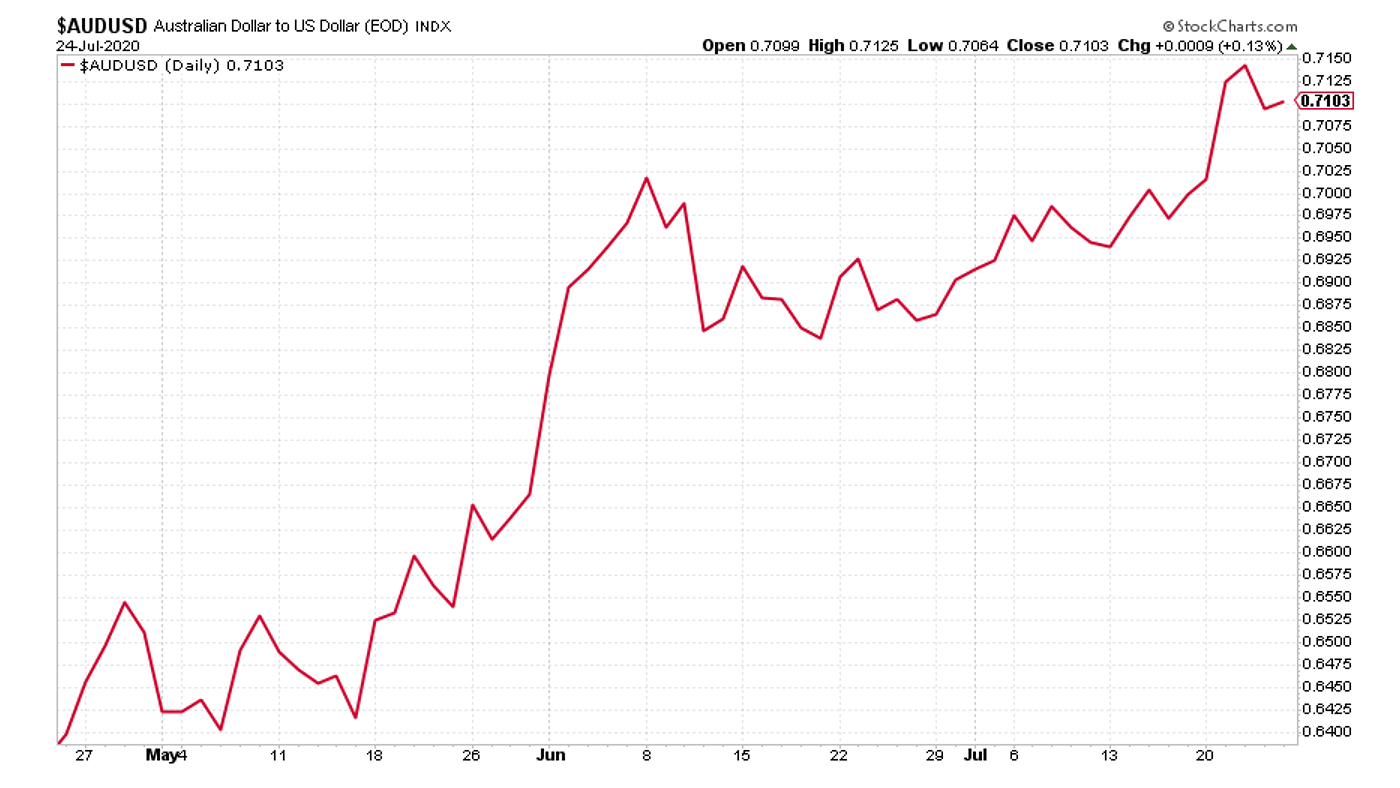

The Aussie dollar moved significantly higher, helped by the weak US dollar.

(Aussie dollar vs US dollar exchange rate: three months)

Towards the end of the week, cryptocurrency bitcoin started to edge higher and it looked as though it might just be coming out of the stasis it’s been in for the last few weeks. Let’s see what happens.

(Bitcoin: three months)

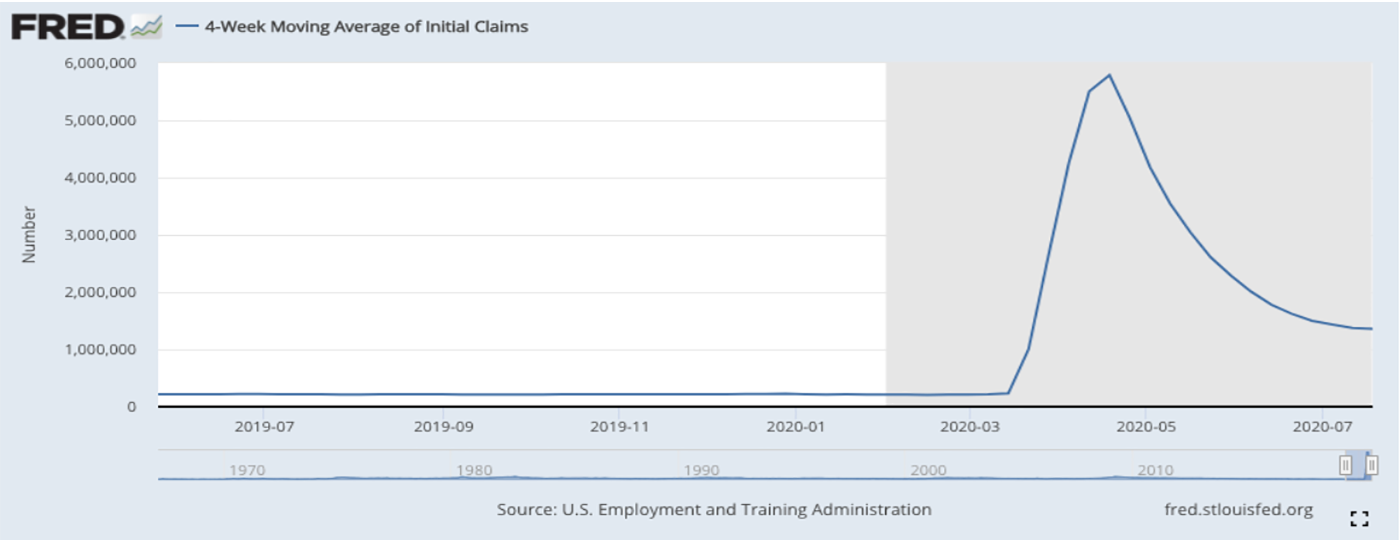

This week’s US weekly jobless claims figure actually rose this week. The number of new claims came in at 1.42 million (from 1.3 million last time). The four-week moving average was barely moved, sitting at 1.36 million, compared to last week’s 1.37 million. Given that support measures for the unemployed are close to expiring, the rise in claims is not encouraging.

(US jobless claims, four-week moving average: since June 2019)

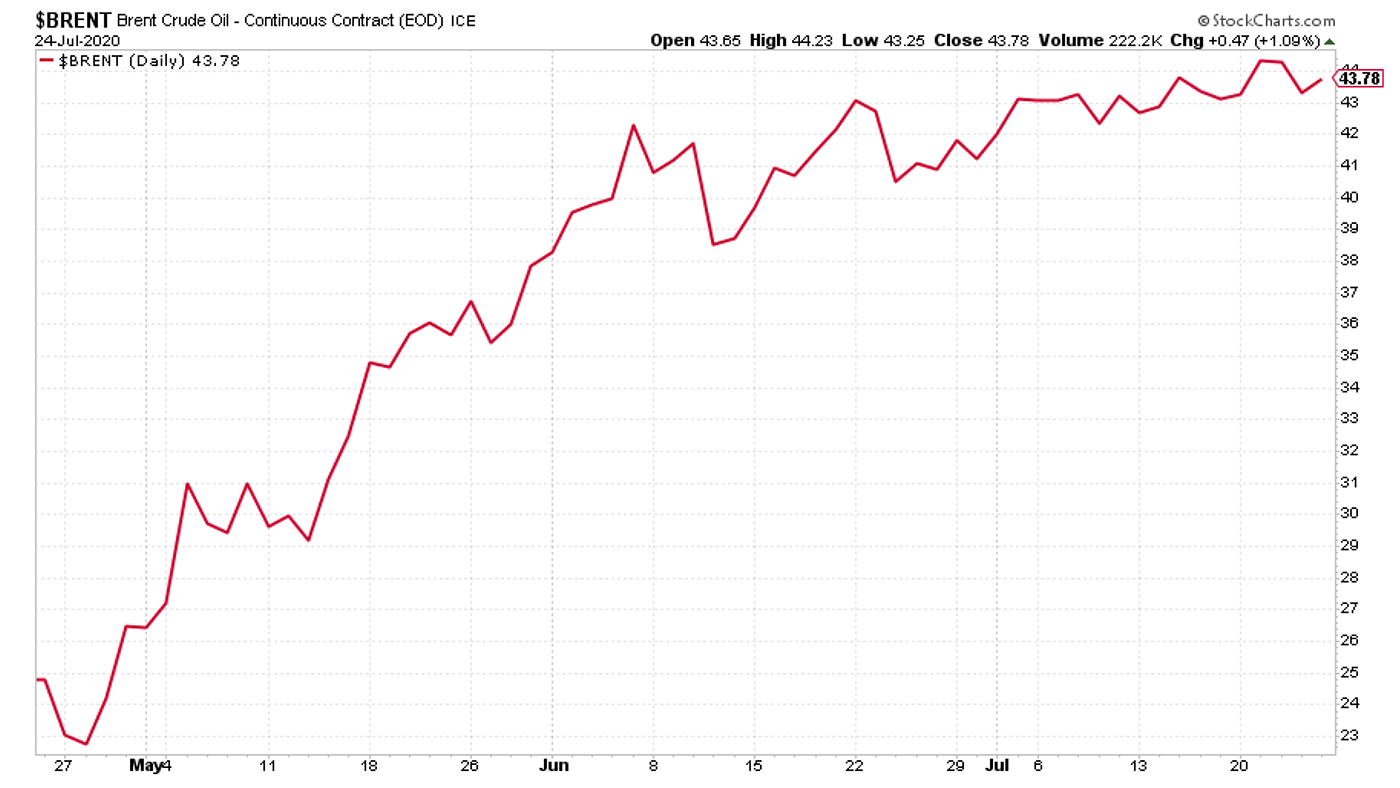

The oil price (as measured by Brent crude) was once again little changed on the week.

(Brent crude oil: three months)

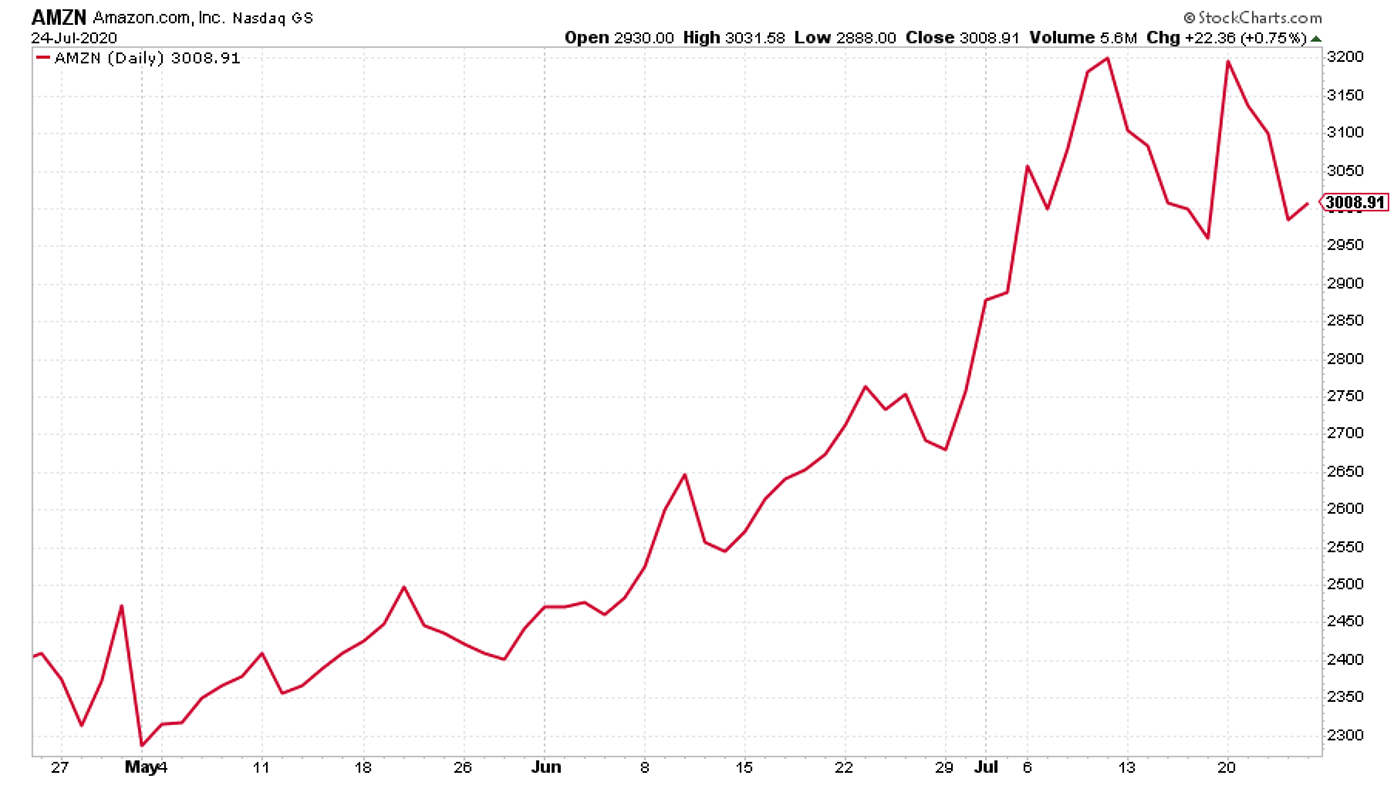

Amazon headed back above the $3,000 mark, before the Nasdaq took a bit of a tumble on Thursday, denting the advances made by tech stocks.

(Amazon: three months)

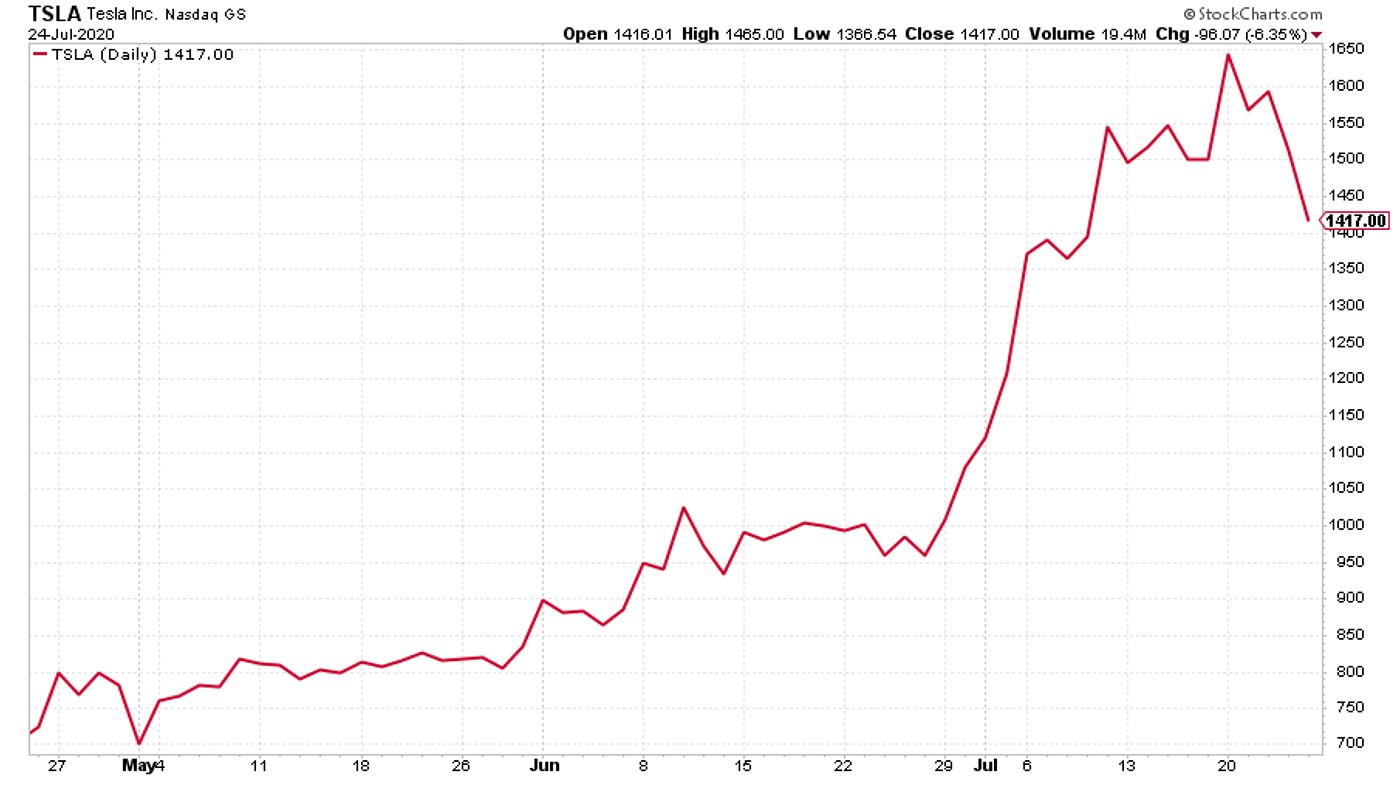

The same thing happened to electric car group Tesla, even although its fourth-quarter results actually beat expectations.

(Tesla: three months)

Have a good weekend. If you fancy some reading material for the summer (or the winter), pick up my book, The Sceptical Investor, on digital or print or audio here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?