Hang onto your gold miners – this boom has further to go

The gold price is heading for new highs, and it’s taking gold mining stocks with it. Indeed, says Dominic Frisby, the boom is just getting started. Get in and sit tight.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Covid-19. The Great Accelerator, I call it. So many things that were going to happen anyway have happened quicker than they would otherwise. We have modernised many working practices, adopted new technologies and abandoned old habits. Businesses have died, yet new companies are being formed at an unprecedented rate.

Many relationships – whether working or amorous – have ended. Yet new ones have begun, perhaps more intensely than they would otherwise. And, to the delight of your author, for the first time in yonks, we have a bull market once again in junior mining stocks.

Who remembers the noughties gold mining boom?

Oh, my goodness, we have been waiting long enough. I remember the noughties. You used to buy a junior mining stock and it went up. What’s the problem?

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

2008 came along. They crashed. But then went back up again so quickly it was as though the GFC (Global Financial Crisis) never happened.

But by 2011 it reached the point where CEOs of exploration companies – whose main asset had as much chance of becoming a mine as I do of becoming a sky-diving champion – were jetting across Europe (first class) to raise money while taking up residence at the Savoy, the Shangri-La and the Dolder Grand.

There then – and, given the extremes reached, quite rightly – followed the most vicious, gruelling, relentless bear market ever known to man. There was six months of respite in early 2016, but then the bear got its grip back and junior mining went back into oblivion, sans teeth, sans eyes, sans taste, sans everything.

It didn’t matter that gold was steadily creeping up. The miners were not playing ball.

Then 2020 came along and the game has turned on a sixpence.

The sector is up about 150% since the March crash lows, individual stocks are doubling and tripling, speculation is rampant, investors are falling over themselves to get in on the game, and those lovely mining executives are happily trousering any money that’s offered while it’s on the table.

We know how it usually ends.

One company I have in my portfolio is Canasil Resources (it’s listed in Toronto). I’m not even entirely sure what it does. Silver exploration in Mexico or something. And probably, guessing by the “Can”, in Canada too.

I had heard it was going to be taken out a few years back, so I bought. It duly didn’t get taken out and it remained in my mining portfolio, overlooked and forgotten, not unlike my comedy career.

“What the hell is that thing?” I would ask myself when I occasionally surveyed my mining brokerage account. In April, it was trading at five cents. On Monday it hit $0.22.

Why has this stock quadrupled? Partly because it was overlooked, forgotten and then re-discovered. Partly because these microcaps are so small, a tiny bit of buying sends them rocketing. But the main reason, in this particular case, is that the company announced last week it was going to do some drilling.

It doubled! It didn’t say it had found anything. Just “we are going to do some drilling”. Which is what it is supposed to do anyway.

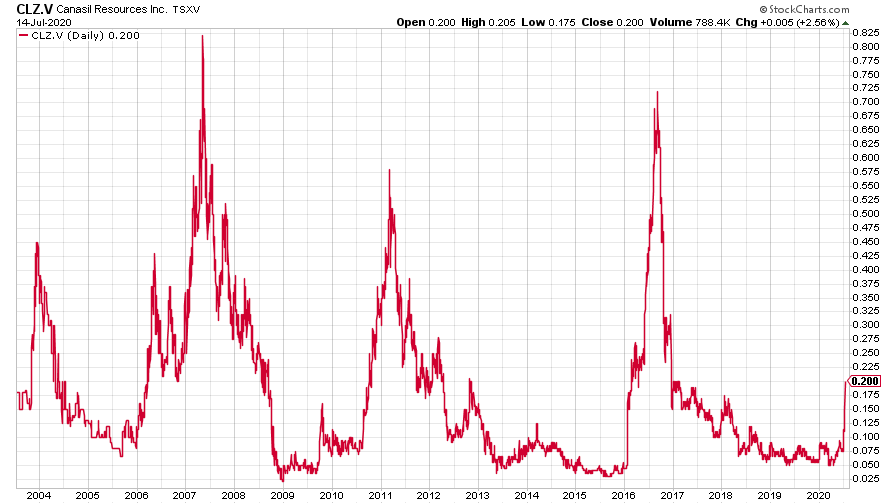

Take a look at this long-term chart of Canasil (which goes back to 2003). Was ever there a chart that symbolized the feast or famine of speculative mining tiny caps? Huge spikes up, followed by collapse, followed by years of nothing, followed by another speculative frenzy.

So it’s just gone from 5c to 20c. The disciplined investor should really take some money off the table, sell half or something. But I think this stock could have further to go – and this is not a recommendation! I stress: I have no idea what this company does, what its management is like – I don’t even know what they’re called.

But in the mini-boom of 2016 it went over 70c. In 2011 it went to 60c. In 2007 it went to 80c. Why not something similar this time?

The key to making money from a boom market is to get in and sit tight

It’s my view that this mining boom is just getting started. Gold is at $1,800 an ounce. It’s in a strong uptrend. To my mind it is (almost) inevitably going to go up another $100 to retest its old highs around $1,920. It’s already trading at all-time highs in most other currencies.

If/when it does go to $1,920, there is going to be a lot of hype. The FT might even mention it. So there’s all that upside still left in this run for the miners. But then what if gold breaks above its all-time highs? How much noise then?

And gold is very likely to break to new highs, I’d say. Inflation is coming, as we keep saying. Money is being printed like there’s no tomorrow. There’s social unrest. Negative real rates. A looming Cold War with China. Economic depression.

GDXJ – the bellwether exchange-traded fund for junior mining – is at $53 (I’m looking at the US listing, the London one is lower). It has broken above its 2016 highs. But it would have to almost triple to get back to where it was in 2011 ($140).

So for all the excess we are already seeing in mining speculation, I would say this run has further to go. It will end, and it will end badly. But this is not the end; I’m not even sure it’s the end of the beginning (that would be an initial failed re-test of the old highs of $1,920).

As the bitcoiners are so commonly heard saying – “HODL” (hold). Don’t be tempted to sell.

“Money is made by sitting, not trading,” as the great speculator Jesse Livermore once said. “It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight!

“It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I've known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine – that is, they made no real money out of it.

“Men who can both be right and sit tight are uncommon.”

Sit tight!

PS If you haven’t already registered to watch Merryn’s upcoming webinar with James Dow, co-manager of Baillie Gifford’s Scottish American Investment Company (Saints), all about where to find the most resilient dividend payers around the world right now, then make sure you do – sign up here (it’s free).

Daylight Robbery – How Tax Shaped The Past And Will Change The Future is available at Amazon and all good bookstores with the audiobook, read by Dominic, on Audible and elsewhere.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.