Shares in focus: How our tips have fared this year

It's been a tough year for stocks. Phil Oakley looks back over the share tips he made in 2014 to see how they have fared, and what investors should do next.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

A disappointing 2014 for UK stocks has meant few big winners, says Phil Oakley.

After two years of gains, 2014 has not been a stellar year for the UK stockmarket. Between 1 January and 19 December, the broad market represented by the FTSE All Share Index fell by 2.3%.

Once again, the FTSE 250 index of medium-sized companies has done better than the FTSE 100, but it still ended up in the red. The mid-cap index lost 0.3%, compared to a loss of 3% for the index of the biggest companies.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This may be because investors are starting to shift their focus. For the last few years, stocks have been mostly driven by speculation over the direction of interest rates. The prospect of continued low rates of interest on savings accounts and bonds has kept the stockmarket going up.

However, in recent weeks people have instead started to worry about the outlook for company profits. A falling oil price has spooked investors that the global economy might be about to hit the rocks. If profits start falling, low interest rates are unlikely to support stock valuations that are far from cheap.

In fact, one likely reason why UK stocks have struggled to make much headway in 2014 is that professional analysts have been too optimistic. Share prices are very much driven by what investors expect company profits to be.

And according to a recent article in the Financial Times, accountants Ernst & Young have found that 2014 was the worst year for profit warnings since 2008. Nearly a quarter of the constituents of the FTSE 350 index has warned on profits in 2014.

In contrast, the better economic performance of the US has ensured that American investors have had a much better time of things. The S&P 500 is up 12% in US dollar terms, after gaining nearly 30% in 2013. Since the dark days at the end of 2008, American shares have gone up by 129% compared to a 59% gain for the FTSE All Share.

Hopefully 2015 will bring better returns. But with the year drawing to the close, it's time to face up to how the stock tips made on these pages have fared. The short answer is not too well.

I've taken the view that most MoneyWeek readers are looking for places to invest their money. This means that I've been looking for shares to buy, rather than simply warning you what to avoid. That has not been easy in a market where bargains are scarce.

With hindsight the more cautious stance I've adopted in the last few weeks probably should have been applied throughout the year.

How our tips have fared

Booker (LSE: BOK)

returns on capital employed (ROCE)

It is also exposed to growing parts of the UK grocery market such as convenience stores, which should see profits continue to rise over the next few years. The shares were already richly valued back in September but now trade on a forward price/earnings (p/e) multiple of over 25. That looks a little too rich to me, despite how good a business Booker is. Take profits.

British American Tobacco (LSE: BATS) has continued to be a reliable performer. Despite the problems of black-market cigarettes, tougher government regulations and the strength of the pound for most of the year, BAT remains one of the most profitable large companies on the stockmarket.

Dividends look like they can keep on increasing for a while yet. If 2015 does turn out to be a rocky year for shares, then this one with a yield of 4.4% should be worth hanging on to. Hold.

Supermarket chain Morrisons (LSE: MRW) has had a terrible year. It has been struggling to tell customers what it stands for, and seems trapped in no-man's-land between the cheap discount stores of Aldi and Lidl and more upmarket chains such as Waitrose.

I tipped Morrisons as a property play. My thinking was that rivals might want to exploit its weaknesses, break the company up and share its stores between them. This has not happened yet and Morrison's profits have continued to fall sharply.

Based on profits alone, I think the shares have little support at the current share price. The dividend looks unsustainable too and is thinly covered by profits. It is being paid with the cash from selling some stores and warehouses. Once these sales end, a big dividend cut looks to be on the cards if profits haven't recovered. Avoid.

Rolls-Royce (LSE: RR) looks more interesting. The shares did not look cheap when I tipped them back in January. With hindsight they were clearly too expensive and they have since fallen sharply on the back of a series of profit warnings. But I think there is more scope to profit from the share price now.

Rolls-Royce's strength is its civil aerospace business. Air travel across the world is expected to keep growing, which means that aircraft makers such as Boeing and Airbus should keep buying Rolls-Royce engines in the years ahead.

This means that the installed base of engines should keep on growing, which in turn means more maintenance work and spare parts sales for Rolls-Royce. This should lead to a big increase in the amount of free cash flow Rolls-Royce can produce.

The trouble is that the company looks like it is trying to do too much elsewhere, which is hurting the value of its shares. But investor pressure to sell the less significant parts of the business could increase in 2015, and that would be good news for the share price. Buy.

The gamble that paid off

I look for companies that may have fallen on hard times that could recover, momentum plays where profits can keep on pushing the share price higher, possible takeover candidates or just shares that look very cheap. In 2013, investing in these kinds of shares paid off. But 2014 hasn't been as kind as it became increasingly difficult to find opportunities.

My best suggestion was a small US company looking to build water pipelines in California called Cadiz Inc (Nasdaq: CDZI). I was intrigued by UK hedge fund manager Crispin Odey buying a big chunk of its shares and decided they were worth a punt.

So far this gamble has paid off. Cadiz shares could still go up a long way if its plans come to fruition, but as I said back in June there is a big risk of dilution from issues of new shares in the future. Take profits.

However, Mothercare (LSE: MTC) shares still look interesting after a fundraising of its own. The company has rebuffed a takeover approach this year and has a decent strategy for getting its troubled UK business back into the black.

It has tapped shareholders for fresh capital and this should ensure that it's debt free, which lowers the risks of the business going forward.

The overseas business is very valuable and this is probably not reflected in the current share price. If the UK business can get back on an even keel then I think Mothercare shares are comfortably worth over 200p. Buy.

A bad year for oil stocks

However, if these types of company can avoid going bust then they could be a good albeit a risky punt on a rebounding oil price. Afren (LSE: AFR) has received a takeover approach whilst Tullow Oil (LSE: TLW) shares could also bounce. Both remain a risky buy.

The most disastrous pick of 2014 was IGas (LSE: IGAS), which aims to produce onshore gas in the UK through hydraulic fracturing (fracking). Fracking remains controversial and largely unproven in Britain, and this makes the shares very risky.

Matters have not been helped by a complicated transaction by the company's chief executive, which made it look as if he was selling shares by the back door.

That said, IGas remains profitable as it continues to produce oil and gas from its existing fields. Around half its production is hedged until September 2015 at a price of $87 per barrel.

Recent drilling has gone well with 1,400 feet of shale gas found at Ellesmere Port. The coming year could bring better fortunes. Still a risky buy.

| Pepsico | 28/02/2014 | $78.22 | $95.44 | 22.0% | Hold |

| Friends Life | 04/04/2014 | 300p | 372.5p | 24.2% | Hold |

| Booker | 12/09/2014 | 119.75p | 157.25p | 31.4% | Take profits |

| BATS | 17/01/2014 | 3,066p | 3,500p | 14.2% | Hold |

| Home Retail | 08/08/2014 | 166p | 191.75p | 15.5% | Hold |

| Morrisons | 10/01/2014 | 263p | 176.25p | -33.0% | Avoid |

| Rolls-Royce | 24/01/2014 | 1,246p | 864p | -30.7% | Buy |

| BHP Billiton | 07/02/2014 | 1,768p | 1,348p | -23.8% | Avoid |

| N.Brown | 09/05/2014 | 460p | 349.75p | -24.0% | Avoid |

| Standard Chartered | 28/03/2014 | 1,206p | 927p | -23.1% | Avoid |

| Mothercare | 23/5/2014 | 139p | 172p | 23.7% | Buy |

| Cadiz | 20/06/2014 | $8.28 | $11.49 | 38.8% | Take profits |

| Dart Group | 25/07/2014 | 208p | 285p | 36.9% | Take profits |

| Ted Baker | 01/08/2014 | 1,708p | 2,220p | 30.0% | Take profits |

| Moneysupermarket | 13/06/2014 | 180p | 216.6p | 20.3% | Take profits |

| IGas | 31/01/2014 | 134p | 37.5p | -72.0% | Risky buy |

| Tullow Oil | 07/02/2014 | 795p | 424.25p | -46.6% | Risky buy |

| Netplay TV | 08/08/2014 | 12.25p | 7p | -42.6% | Risky buy |

| Afren | 15/08/2014 | 96.25p | 47.5p | -50.6% | Risky buy |

| De La Rue | 04/04/2014 | 814p | 518p | -36.4% | Avoid |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Morrisons takeover bid: supermarket is an attractive target for private-equity buyers

Morrisons takeover bid: supermarket is an attractive target for private-equity buyersNews A private-equity group has made an offer for Morrisons, Britain’s fourth-largest supermarket. Other bids are likely to emerge. Matthew Partridge reports.

-

Morrisons is just the start – get ready for a private equity feeding frenzy

Morrisons is just the start – get ready for a private equity feeding frenzyAnalysis The bid to buy the Morrisons supermarket chain is the latest example of UK listed companies being snapped up by private equity groups. It won’t be the last, says John Stepek – we could well see a feeding frenzy before this is all over.

-

Yet more trouble at Tullow Oil

Yet more trouble at Tullow OilFeatures Tullow Oil shares have plunged to a 16-year low after the company slashed its annual production forecast.

-

Mothercare’s inevitable demise

Mothercare’s inevitable demiseFeatures Mothercare's UK arm has gone into administration, But that's hardly any surprise.

-

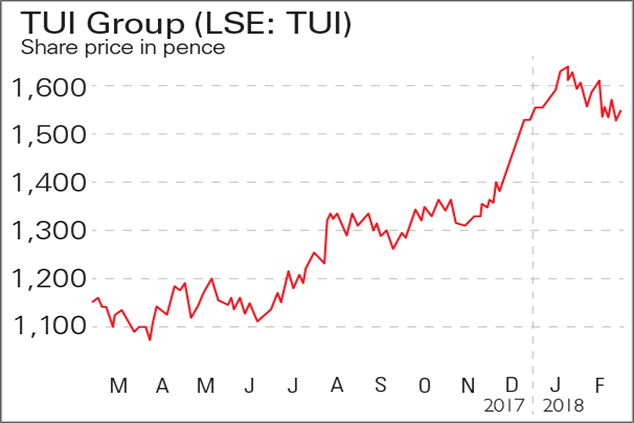

If you’d invested in: TUI Group and BAT

If you’d invested in: TUI Group and BATFeatures Tui revealed an 11.7% rise in annual turnover to €18.5bn, as well as 12% growth in underlying earnings to €1.1bn.

-

Morrisons back from the brink

Morrisons back from the brinkFeatures The supermarket chain has made a strong recovery from a near-death experience. How did CEO David Potts do it? Alice Gråhns reports.

-

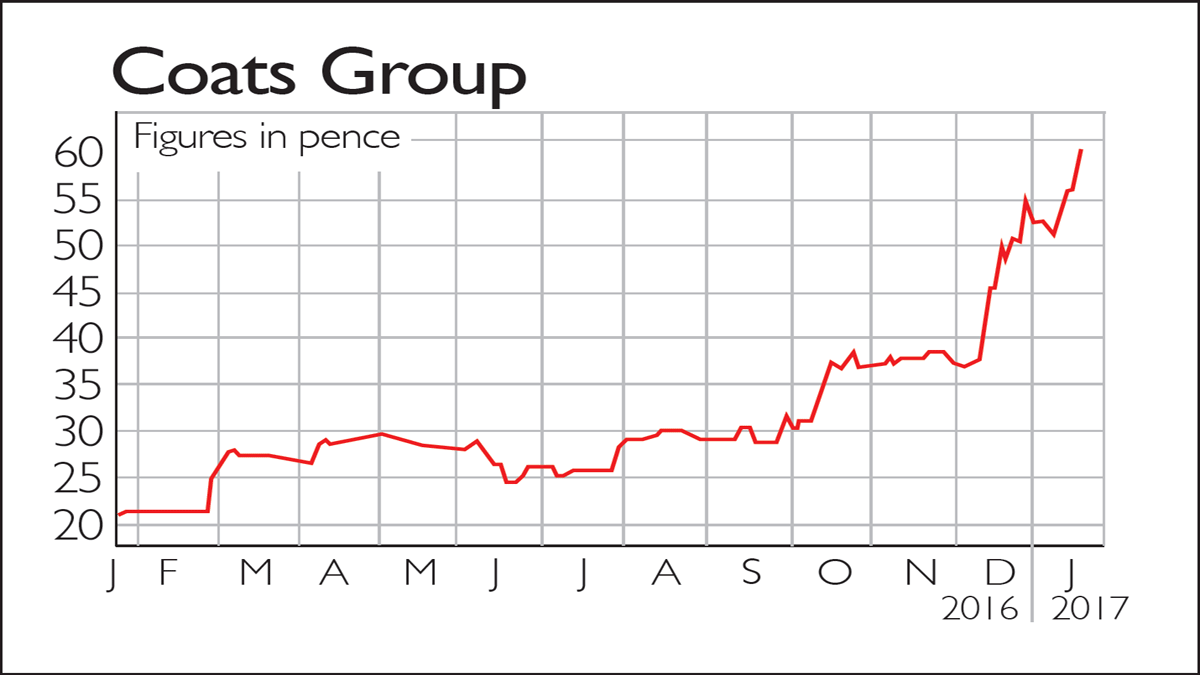

If you'd invested in: Coats Group and Mothercare

If you'd invested in: Coats Group and MothercareFeatures Venerable British thread-maker Coats is flying high, while Mothercare continues to struggle.

-

If you’d invested in: Flowgroup and Mothercare

If you’d invested in: Flowgroup and MothercareFeatures Gas boiler-maker Flowgroup relaunched its product in January following a few tweaks to its design. Since then, its shares have heated up.