Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

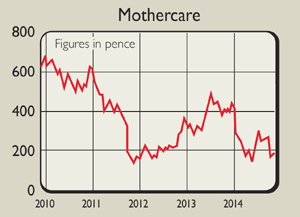

I tipped children's goods retailer Mothercare(LSE:MTC) as a risky but potentially good value turnaround story back in May. So far the company looks as though it is making good progress at getting its house in order. It has raised just under £100m from its shareholders in a recent rights issue and it looks as though it has a sensible plan to get its troublesome UK business turned around from making losses and back into profit.The good news is that last week's half-year results gave some further grounds for cautious optimism.

Same-store sales (which exclude new store openings to make a meaningful year-on-year comparison of sales growth) in the UK have started to grow again. Admittedly the business has been up against soft comparisons from the year before, but getting sales to grow again, even from a relatively low base, is a creditable result.

The company has also taken the bold decision to stop discounting its products. This has led to very volatile sales from week to week, but holding firm and selling more goods at their full price has stabilised profit margins after five years in decline, and reduced the trading loss compared with last year. Of course, avoiding promotional sales only works if the product quality is high. It seems that Mothercare is making some progress on this front, but it's too early to tell if this strategy will ultimately succeed.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The bulk of the value in Mothercare, however, rests with its overseas business. This continues to do well, with same-store sales up by 4.9%. The strength of the pound meant that trading profits were unchanged year on year, but there is still lots of scope for growth in this business, while the fact that the pound has grown weaker in recent weeks should help profits to keep rising in the years ahead.

Should you buy the shares?

The investment case for Mothercare remains unchanged. If the UK business can get back to break-even or even make a small profit while the international business keeps growing, then the shares are still worth backing. Current multiples of earnings are not really meaningful. On its own the international business could be worth £500m on a good day. If so, then a debt-free Mothercare without the UK losses is comfortably worth more than 200p per share.

Verdict: still a buy

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Mothercare’s inevitable demise

Mothercare’s inevitable demiseFeatures Mothercare's UK arm has gone into administration, But that's hardly any surprise.

-

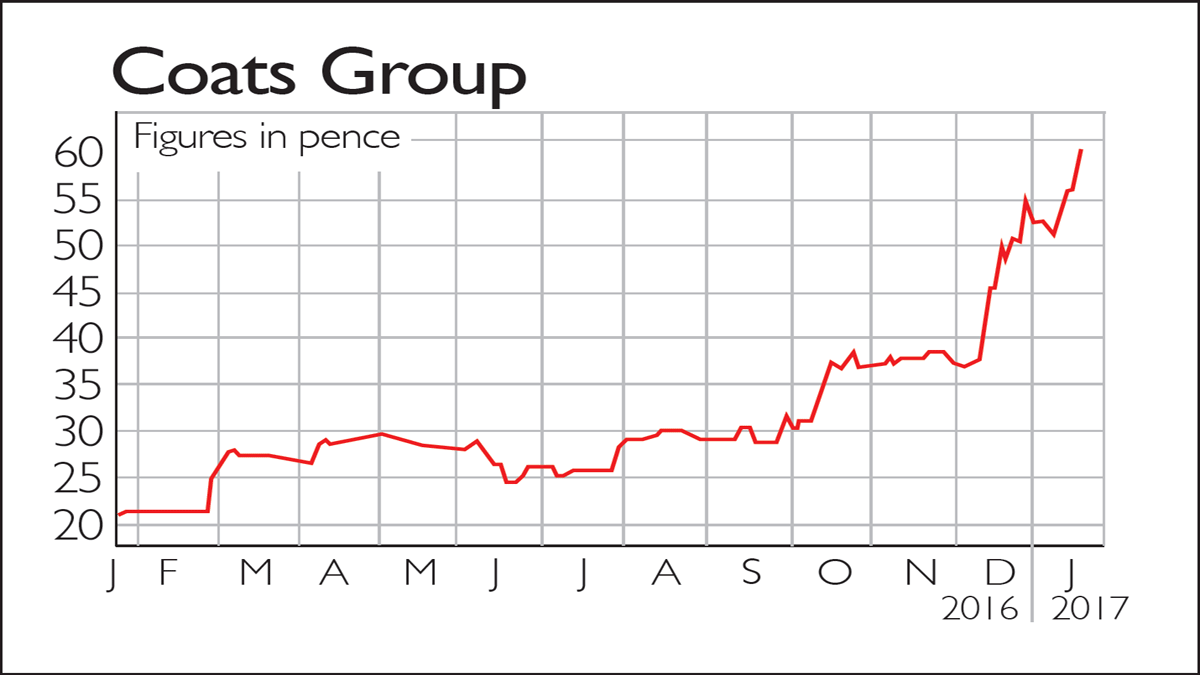

If you'd invested in: Coats Group and Mothercare

If you'd invested in: Coats Group and MothercareFeatures Venerable British thread-maker Coats is flying high, while Mothercare continues to struggle.

-

If you’d invested in: Flowgroup and Mothercare

If you’d invested in: Flowgroup and MothercareFeatures Gas boiler-maker Flowgroup relaunched its product in January following a few tweaks to its design. Since then, its shares have heated up.

-

Shares in focus: How our tips have fared this year

Features It's been a tough year for stocks. Phil Oakley looks back over the share tips he made in 2014 to see how they have fared, and what investors should do next.

-

Company in the news: Mothercare

Features High-street retailer Mothercare has issued a £100m rights issue. Should you buy in? Phil Oakley investigates.