Mothercare’s inevitable demise

Mothercare's UK arm has gone into administration, But that's hardly any surprise.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

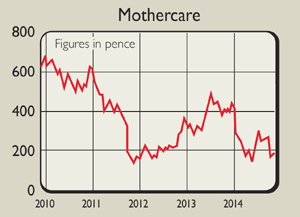

In "one of the most highly anticipated collapses on the high street", baby-paraphernalia retailer Mothercare is to appoint administrators to its British business, reports Jonathan Eley in the Financial Times. While the listed company will continue to operate, thanks to its profitable international division, its shares still fell by nearly a quarter once the news was announced. While Mothercare still has a high market share in certain areas, supermarkets and online retailers have undercut its prices.

It's easy to blame a combination of "challenging market conditions', competition from Amazon and the like", says Sarah Vine in the Daily Mail. However, the truth is that "Mothercare was struggling long before any of these things were a real problem". It always seems to have been badly managed. As early as 2003 there were reports that "money at Mothercare was so tight bosses had to borrow cash from the tills to pay the wage bill". While the chain would experience a "brief resurgence" over the next few years, its fate was sealed by the decision to "wildly" expand overseas while closing down city centre stores in favour of "large, faceless out-of-town centres".

Mothercare's demise is a case study in how rarely company voluntary arrangements (CVAs), whereby troubled retailers persuade landlords to temporarily accept lower rents, as it recently did, actually work, says Jim Armitage in the Evening Standard. Only 12% of companies involved survive. They "represent the triumph of bosses' optimism over reality".

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Do you face ‘double whammy’ inheritance tax blow? How to lessen the impact

Do you face ‘double whammy’ inheritance tax blow? How to lessen the impactFrozen tax thresholds and pensions falling within the scope of inheritance tax will drag thousands more estates into losing their residence nil-rate band, analysis suggests

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

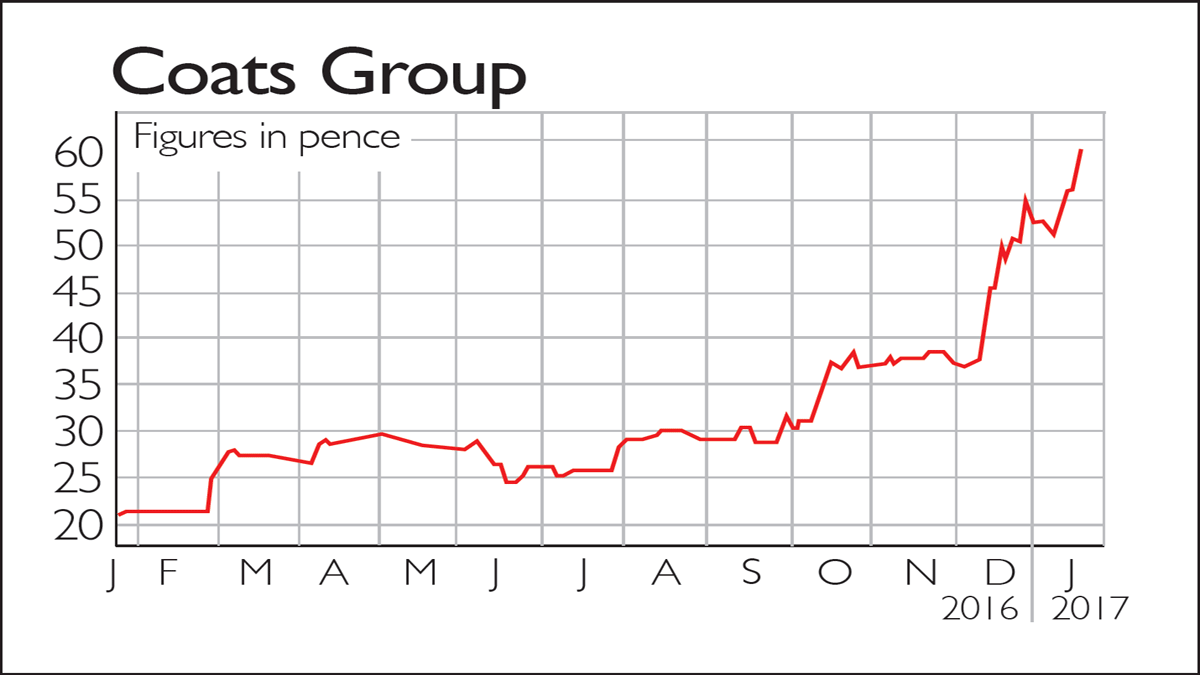

If you'd invested in: Coats Group and Mothercare

If you'd invested in: Coats Group and MothercareFeatures Venerable British thread-maker Coats is flying high, while Mothercare continues to struggle.

-

If you’d invested in: Flowgroup and Mothercare

If you’d invested in: Flowgroup and MothercareFeatures Gas boiler-maker Flowgroup relaunched its product in January following a few tweaks to its design. Since then, its shares have heated up.

-

Shares in focus: How our tips have fared this year

Features It's been a tough year for stocks. Phil Oakley looks back over the share tips he made in 2014 to see how they have fared, and what investors should do next.

-

Tips update: Mothercare

Tips update: MothercareFeatures Phil Oakley tipped children’s goods retailer Mothercare as a risky but potentially good value turnaround story back in May. But are the share still a buy?

-

Company in the news: Mothercare

Features High-street retailer Mothercare has issued a £100m rights issue. Should you buy in? Phil Oakley investigates.