Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I wish I had bought

Eco-boilers:

Flowgroup PLC (LSE: FLOW)

But after some redesigns the product relaunched in January this year. If bought along with Flow's domestic energy tariff, consumers effectively get a boiler for free, with Flow recouping the costs over five years from the electricity generated via feed-in tariffs. The share price is up 45% this year.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

I wish I had sold

Baby clothes:

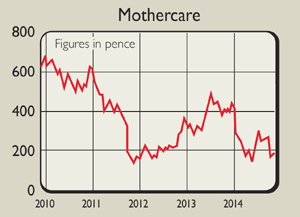

Mothercare (LSE: MTC)

The UK operation halved its losses last year, and the international stores provided £21m of profits. But in the first quarter of this year, sales fell in Europe, the Middle East, China and Latin America. While full-year profits are still set to meet expectations, "international markets are likely to remain challenging", as the firm puts it. The shares have taken a battering down by more than 40% this year.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Mothercare’s inevitable demise

Mothercare’s inevitable demiseFeatures Mothercare's UK arm has gone into administration, But that's hardly any surprise.

-

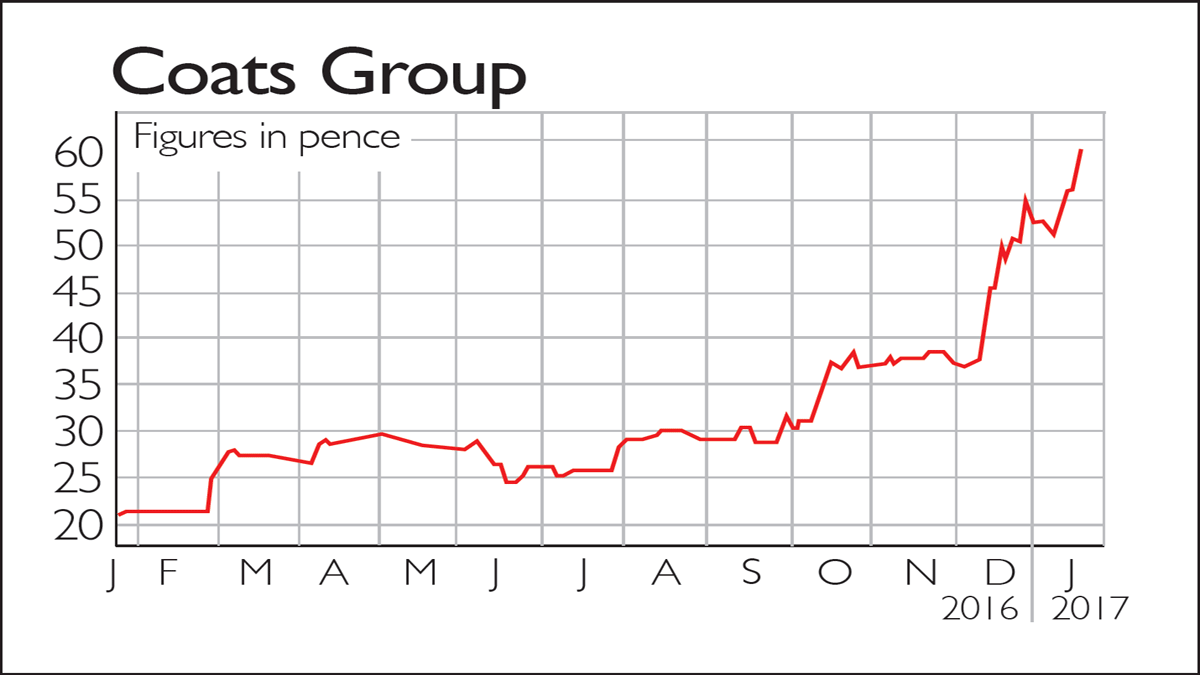

If you'd invested in: Coats Group and Mothercare

If you'd invested in: Coats Group and MothercareFeatures Venerable British thread-maker Coats is flying high, while Mothercare continues to struggle.

-

Shares in focus: How our tips have fared this year

Features It's been a tough year for stocks. Phil Oakley looks back over the share tips he made in 2014 to see how they have fared, and what investors should do next.

-

Tips update: Mothercare

Tips update: MothercareFeatures Phil Oakley tipped children’s goods retailer Mothercare as a risky but potentially good value turnaround story back in May. But are the share still a buy?

-

Company in the news: Mothercare

Features High-street retailer Mothercare has issued a £100m rights issue. Should you buy in? Phil Oakley investigates.