Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only

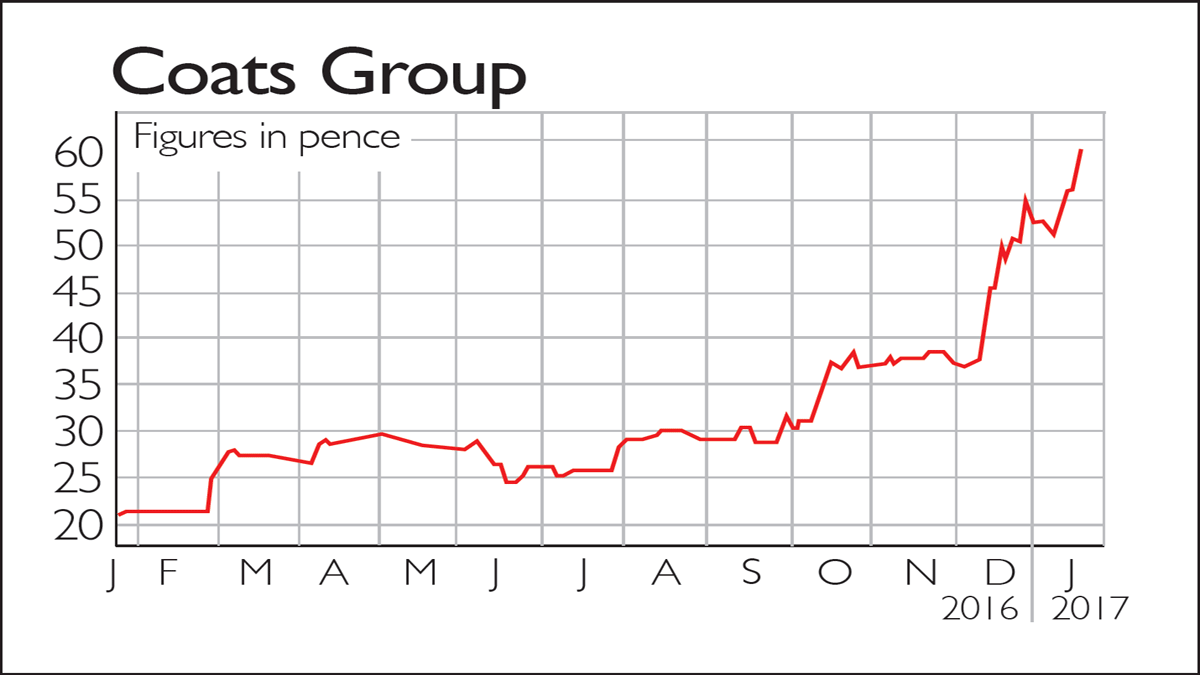

Coats Group (LSE: COA) is a venerable British maker of threads and textiles, with a history going back to the 1750s. It's not always been plain sailing. By the end of the last century it was facing oblivion, and in the early 2000s was bought up by investment firm Guinness Peat, who took the company private. It returned to the stockmarket in 2015, and now employs 19,000 people in 60 countries. After a deal to settle its pension deficit in December that enabled it to pay dividends, the share price took off. In the last year, the shares have risen by 180%.

Be glad you didn't

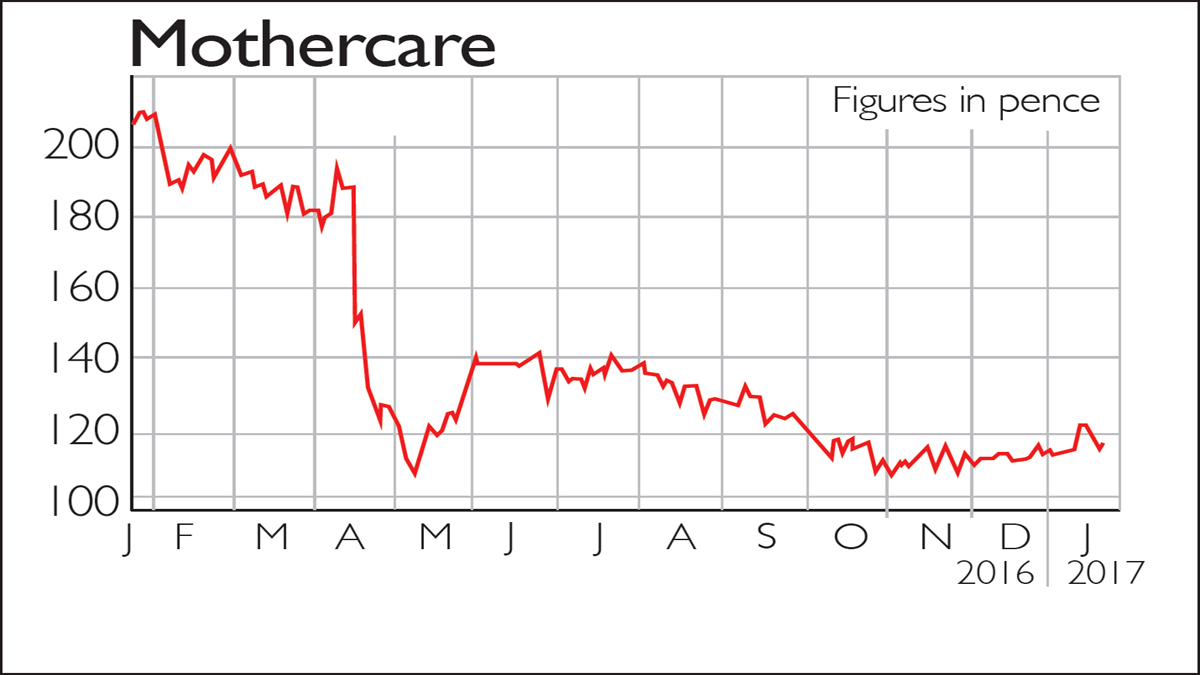

Mothercare (LSE: MTC) has been battling a decline in sales for a long time, stuck in an endless "turnaround" loop. Competition has been eroding margins and customers have been deserting the stores. In April 2016 a dramatic drop in international sales caused a big fall in the shares. Despite a rally after positive news a month later, the shares have fallen steadily since. The price has turned back up in the last few weeks, but remains more than 40% down in the last year.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Mothercare’s inevitable demise

Mothercare’s inevitable demiseFeatures Mothercare's UK arm has gone into administration, But that's hardly any surprise.

-

If you’d invested in: Flowgroup and Mothercare

If you’d invested in: Flowgroup and MothercareFeatures Gas boiler-maker Flowgroup relaunched its product in January following a few tweaks to its design. Since then, its shares have heated up.

-

Shares in focus: How our tips have fared this year

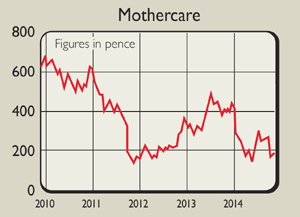

Features It's been a tough year for stocks. Phil Oakley looks back over the share tips he made in 2014 to see how they have fared, and what investors should do next.

-

Tips update: Mothercare

Tips update: MothercareFeatures Phil Oakley tipped children’s goods retailer Mothercare as a risky but potentially good value turnaround story back in May. But are the share still a buy?

-

Company in the news: Mothercare

Features High-street retailer Mothercare has issued a £100m rights issue. Should you buy in? Phil Oakley investigates.