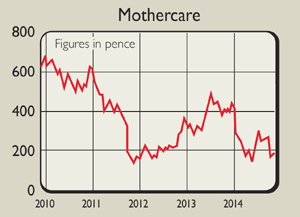

Company in the news: Mothercare

High-street retailer Mothercare has issued a £100m rights issue. Should you buy in? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Back in May, I tipped shares in troubled retailer Mothercare (LSE: MTC)at 139p. The shares are now 245p, having seen a 300p per share takeover approach from US company Destination Maternity rebuffed in July.

I argued, at the time, that Mothercare's international business was a hidden gem due to the company's loss-making UK stores. I also said that there was a risk that the company might have to ask its shareholders for more money to help it fix the problems in the UK.

This has come to pass with the announcement of a £100m rights issue, on Tuesday this week. This gives existing shareholders the right to buy nine new shares at 125p for every ten shares that they already own.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The money raised will be used to pay off all the company's debt. On top of that, up to 75 UK stores will be closed and a better internet business will be created.

I think this is good news and may attract another bid for the company. At a theoretical ex-rights issue price of 188p that's the expected price after the rights issue the company would have a debt-free market value of around £317m, which is arguably less than the international business is worth.

Verdict: buy and take up rights

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

UK unemployment hits highest level since 2021 – will interest rate cuts follow?

UK unemployment hits highest level since 2021 – will interest rate cuts follow?UK unemployment reached its highest rate in almost five years by the end of 2025. Is AI to blame and will the Bank of England step in with an interest rate cut in March?

-

Did UK inflation fall in January?

Did UK inflation fall in January?After rising in December, analysts expect the next round of UK inflation data to show that disinflation returned in January

-

Mothercare’s inevitable demise

Mothercare’s inevitable demiseFeatures Mothercare's UK arm has gone into administration, But that's hardly any surprise.

-

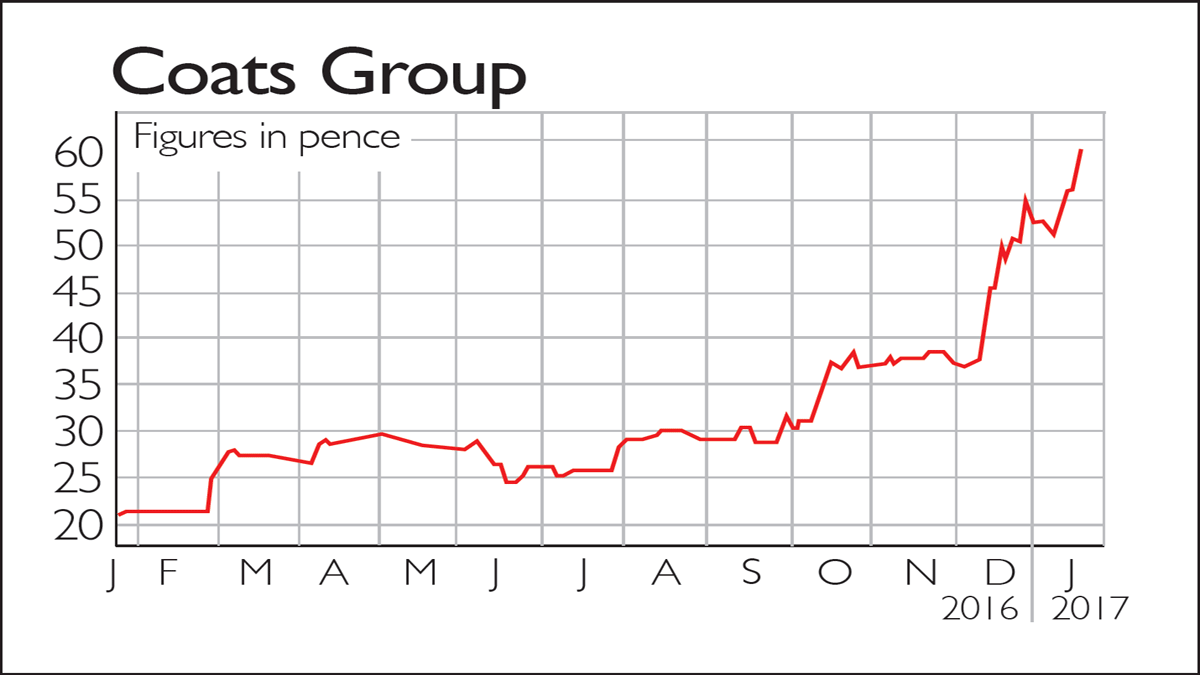

If you'd invested in: Coats Group and Mothercare

If you'd invested in: Coats Group and MothercareFeatures Venerable British thread-maker Coats is flying high, while Mothercare continues to struggle.

-

If you’d invested in: Flowgroup and Mothercare

If you’d invested in: Flowgroup and MothercareFeatures Gas boiler-maker Flowgroup relaunched its product in January following a few tweaks to its design. Since then, its shares have heated up.

-

Shares in focus: How our tips have fared this year

Features It's been a tough year for stocks. Phil Oakley looks back over the share tips he made in 2014 to see how they have fared, and what investors should do next.

-

Tips update: Mothercare

Tips update: MothercareFeatures Phil Oakley tipped children’s goods retailer Mothercare as a risky but potentially good value turnaround story back in May. But are the share still a buy?