Gamble of the week: Can this retailer return to profit?

If this high-street retailer can rein in its losses, the shares could soar, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

This high-street retailer is in a mess. Like many others, in recent years it has had to battle against the big changes in people's shopping habits.

Going up against the supermarkets and internet retailers is no easy task when you rent hundreds of expensive high street stores that are difficult to close. It's virtually impossible to match their prices and hang on to your profits.

Its UK stores are losing money £22m last year which makes it ha7rd to pay the rent and interest bills. To make things worse, the company's chief executive walked out a few months ago.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

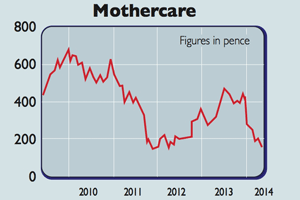

Rumours of it asking suppliers for bigger discounts and its banks to cut it more slack have seen investors sell lots of shares. In July last year, its shares were changing hands for nearly 500p. They are now less than 140p with the whole business having a stock market value of just £123m.

It doesn't seem that anyone is expecting Mothercare (LSE: MTC)to go bust in the near future. More worrying is that it might have to ask shareholders for more money. That said, it looks as if Mothercare's very successful overseas business is being ignored by investors for now and could be a source of hidden value.

Unlike its UK operations, Mothercare's overseas business is based on franchises. The burden of paying rent on stores and staff wages rests with the franchisee, with Mothercare being paid a royalty. This makes for a less risky and arguably more valuable business for Mothercare.

The strength of the pound has beenholding this business back recently butthere's no doubt that it has a lot of value.Based on a multiple of trading profits ofbetween eight to ten times, it could be worthbetween £300m-£400m dwarfing thecurrent market valuation.

So, the key question is how long willit take to get the UK business back toprofit if this actually happens at all?It will take a lot of hard work to makethat happen, but with stores beingclosed and more stuff being sold online,things are definitely moving in the rightdirection.

If Mothercare can eventuallyget back to profit, then the shares couldsoar from their current depressed level.This is the gamble you are taking if youbuy Mothercare shares; but if you areprepared to wait, it might be one thatpays off in the end.

Verdict: speculative buy

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how