Where to invest in 2026

2025 provided plenty of twists and turns. What do experts think are the best investments in the year ahead? Here’s where to invest in 2026.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

If you’re looking to review your portfolio following a bumpy year in the markets, then you may be wondering what the experts think will be the best investments in 2026 and where the key opportunities for growth are.

The top stocks and funds for DIY investors throughout 2025 reflected a turbulent year. We saw Donald Trump’s tariffs threaten to upend global trade, DeepSeek disrupt the artificial intelligence (AI) narrative and, more recently, concern that the AI bubble may be about to burst.

Nvidia became the world’s first ever $4 trillion company, before crossing the $5 trillion threshold just months later. But Nvidia’s latest earnings release – despite trouncing expectations once again – only fuelled the AI bubble fears further.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Gold also continued its bull run through the first half of 2025. Despite a pullback in the autumn, the gold price finished the year strong, posting a new all-time high on 22 December.

So what is on the horizon for markets as we begin the new year?

“The environment heading into 2026 is constructive for risk assets,” said Salman Ahmed, global head of macro and strategic asset allocation at Fidelity International. “But there are structural shifts to watch: AI-led capex trends, global fragmentation, Federal Reserve independence, equity market concentration, and a depreciating dollar.”

Where do investment professionals see the greatest gains next year, and what does it mean for your portfolio?

What does world politics mean for 2026 investments?

Geopolitical uncertainty ramped up early on in 2026 with the US intervention in Venezuela that saw its president Nicolás Maduro removed from the country by US special services.

Despite being a major event in global politics, the intervention has so far had a limited impact on the markets though.

“The US’s actions are expected to have a far greater impact on the geopolitical front, continuing the trend of unconventional and disruptive behaviour that has characterised the second Trump presidency,” said John Wyn-Evans, head of market analysis at Rathbones.

That unpredictability coincides with a rise in populist policymaking worldwide, of which Johanna Kyrklund, group chief investment officer at Schroders, believes Trump is “more symptom than cause”.

Kyrklund said that this populism is manifesting in “a shift in the political consensus from an environment of globalisation, very tight fiscal policy, and therefore low rates [towards] a policy environment characterised by a backlash against globalisation, anti-immigration, and much looser fiscal policy”.

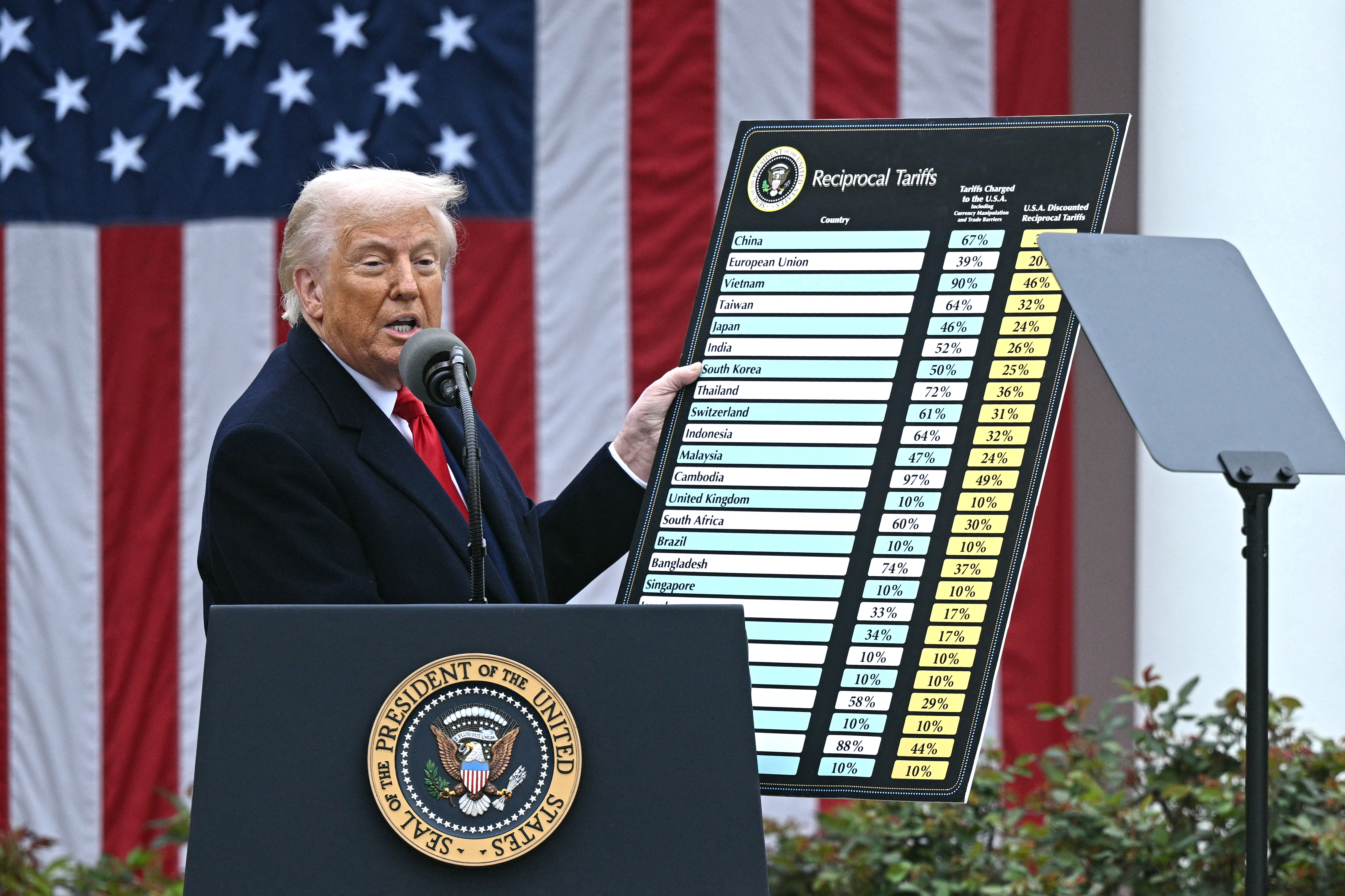

There is also Trump’s tariff regime.

This caused significant disruption in April, but the market has since calmed as the picture has become clearer – though there may be further turbulence on the horizon.

For the moment, the picture is relatively stable as long as the bond markets stay calm.

“The ultimate constraint on populist policy from a market perspective is the extent to which the bond market can take it,” said Kyrklund.

Trump's 'Liberation Day' tariffs were one of the defining features of 2026.

The outlook for equity investments in 2026

Developed markets: will the US continue to dominate?

The populist macro environment that Kyrklund describes is implicitly beneficial for corporate profits, given that it acts to boost nominal growth – so it is a supportive environment for equity investors.

Some experts feel there are further gains to be had in the US market, though Coop observes that valuations in the market have become stretched.

“What is interesting is that despite stronger economic growth in the US, the US market trailed and didn’t outperform,” he said. “The fact that even the UK, with no AI at all, did better, tells you something about how elevated [US] share prices have become.”

Most agree that there are other sources of opportunity besides the US.

“Europe looks relatively attractive, more than it has in a long time,” says Siddharth Shah, global equities product director at Invesco.

Among Europe’s most attractive sectors are aerospace and defence stocks, which are benefitting from the European re-armament trade and increased fiscal spending, particularly in Germany.

“Crucially, there are other sectors where you can find amazing businesses that are growing, providing a dividend yield, and trading at pretty attractive valuations,” said Shah.

Now is also a promising time to invest in Japan. Japanese stocks are benefitting from the country’s shift away from long-term deflation, and reforms to corporate governance. This is leading to increased levels of stock buybacks this year.

“Japan is one that investors should focus on,” says Niamh Brodie-Machura, chief investment officer, equities at Fidelity International. “I think it’s the tortoise to America’s hare.”

More defensive-minded investors could take a contrarian take towards the equities market.

“As nations refocus on energy, security, and industrial strength, the companies serving these essential needs are emerging as some of the most undervalued and enduring opportunities in global markets,” says Alec Cutler, head of global multi-asset at Orbis.

For more growth-oriented companies, Cutler is particularly interested in biotech stocks.

“We’re finding amazing names that were down 60-90% from when they were incredibly popular and held by all the growth funds,” he says.

Could emerging markets be worth investing in 2026?

The setup is increasingly positive for emerging markets (EMs) especially given the context of a weakening dollar. Until this, a strengthening dollar had been a headwind for EM investors, but that has reversed especially since the tariff disruption. Emerging markets also currently exhibit lower levels of government debt as a percentage of GDP compared to developed markets.

Brodie-Machura also highlights that an improving economic backdrop in China is improving the broad EM picture, while in EMs ex-China, increasing domestic investment is setting the stage for valuations – which remain cheap – to rise.

“There are really interesting, strong corporates in many of these countries that are now starting to get attention again,” said Brodie-Machura, “so we think it’s a really good setup going into 2026.”

Mark Dunley-Owen, portfolio manager at Orbis investments, said that emerging markets “at a very high level look cheap”. He cites China and Brazil, in particular, as potential sources of value.

“Brazil has so much going for it,” says Dunley-Owen. It has a large, young population, abundant natural resources, and an entrepreneurial culture, but the challenges it is facing at present provide an opportunity for value investors.

Is AI still going to be the biggest investment opportunity in 2026?

The big question on everyone’s mind when it comes to equities is whether the current AI-driven bull market is sustainable, or if we’re looking at a bubble.

Through 2025, says Brodie-Machura, AI usage, use cases, and demand have all increased.

“For 2026, our team is focused on the shift from more foundational AI towards agentic AI,” she says.

Corporates are trialling agentic AI for uses such as energy efficiency, fraud detection and process automation, and Brodie-Machura believes these could drive further infrastructure spend if successful.

However, she cautioned that there is as yet no concrete proof of sustainable return on these investments. “That’s a really critical point that will determine how this develops through 2026,” she said.

Alongside these questions over long-term profitability is the way in which AI is financed.

“We are monitoring closely the increasing use of debt and circular financing to fund AI-related investment, as these trends could create longer-term structural vulnerabilities,” says Patrick Brenner, chief multi-asset investment officer at Schroders. “Although risks are present, particularly around the possibility of an “AI bust” scenario, we believe it is too early to take a defensive stance.”

Kyrklund advocates a stock-by-stock approach to investing in AI companies.

“I wouldn’t advocate passive exposure to this space at this point in time,” she says, but she feels that for the key players, current levels of capital expenditure feel sustainable.

In terms of what to look for in an AI stock, Shah says that the important question is the return on investment they are likely to achieve from present capex levels, as well as having multiple strings to their bow.

“Crucially, we're looking for businesses within the AI space that have some diversification,” said Shah.

Daniel Casali, chief investment strategist at wealth manager Evelyn Partners, thinks that companies successfully harnessing AI will be among 2026’s winners.

“The real story with AI is not just about visible stock market returns, but it is about using unseen data effectively to drive company profitability,” he said. “Since ChatGPT’s launch in late 2022, companies in the information technology, communication services, and financials (including banks) sectors have led margin gains.”

Is 2026 a good year to invest in bonds?

Analysts at Aegon Asset Management expect short-dated government bond yields to be held down by declining interest rates, but that longer-dated government bond yields could be pushed upwards thanks to inflation and deficit concerns.

“Investors should favour short-duration exposure in both government and corporate bonds,” said Colin Dryburgh, investment manager at Aegon Asset Management.

“Bonds don’t offer the same diversification benefits they did over the last decade,” says Kyrklund.

Bonds and equities were negatively correlated between 2000-2022, but this is something of an anomaly when viewed historically and is symptomatic of the deflationary macro backdrop during this period.

“In the last couple of years, we’ve seen a return to a more normal, positive correlation between bonds and equities,” says Kyrklund.

Kyrklund still believes that bonds have a role to play in portfolios, but “it’s for the old-fashioned reason of generating yield, rather than as a source of diversification”.

Commodities: a golden investment for 2026?

Because bonds and equities are becoming more correlated, commodities are taking on greater importance as a source of diversification. Gold is the standout commodity on this front, having gained 62% in the first 11 months of 2025, continuing its positive form from 2024.

Deutsche Bank analysts are now forecasting that the price of gold could approach $5,000 during 2026.

“There will undoubtedly be more geopolitical volatility in 2026; gold should provide some protection in this environment,” says Ahmed.

Dunley-Owen calls gold “doomsday security: something that does well when the world falls apart.”

For more inspiration for your 2026 portfolio, see our article on four stocks for 2026.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Dan is a financial journalist who, prior to joining MoneyWeek, spent five years writing for OPTO, an investment magazine focused on growth and technology stocks, ETFs and thematic investing.

Before becoming a writer, Dan spent six years working in talent acquisition in the tech sector, including for credit scoring start-up ClearScore where he first developed an interest in personal finance.

Dan studied Social Anthropology and Management at Sidney Sussex College and the Judge Business School, Cambridge University. Outside finance, he also enjoys travel writing, and has edited two published travel books.