Japan's stock market crashes – what it means for investors

Japan's stock market crash could ultimately mean “lower prices and better valuations” for investors

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

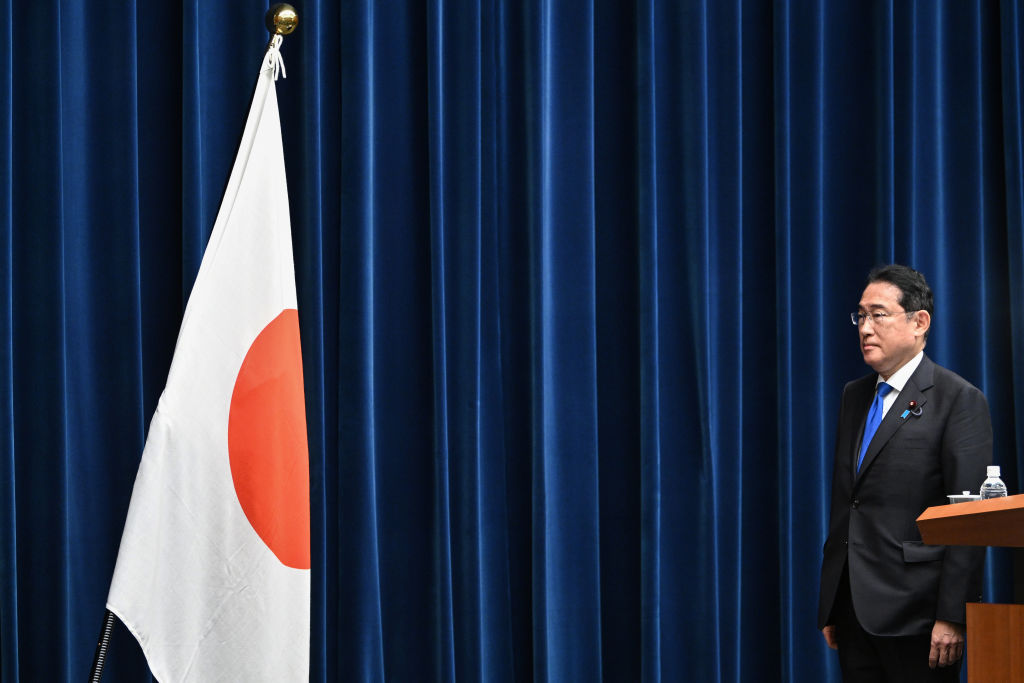

Japanese prime minister Fumio Kishida has given up. Beset by public anger about cost-of-living pressures and a party corruption scandal, Kishida has announced that he will not seek re-election as leader of the country’s governing party. He is expected to step down next month. Change at the top of Japanese politics comes as the local stock market recovers from a bruising sell-off, which saw the Nikkei fall 12.4%, its biggest one-day drop since 1987.

Japanese shares suffered their worst two-day drop since the 1950s, says River Akira Davis in The New York Times. The plunge could mark the end of one of the country’s “most enduring stock rallies” in decades. The benchmark Topix index has gained 36% since the start of last year amid excitement about corporate reform. Yet the speed of the drawdown – which came after the yen strengthened – has left many asking if Japan’s much-vaunted revival was just an illusion driven by currency weakness. The weak yen boosts the earnings of big listed multinationals, such as Toyota.

The Topix has rallied 15% from its nadir last week, although it is still down 11% since the mid-July peak. Such “absurd” daily swings make Japan resemble an emerging market, says Leo Lewis in the Financial Times. In just a week, the Topix “drunkenly” lurched from being “one of the best-performing major benchmarks of 2024 to one of the worst”. The “whole market is trading like a penny stock”, laments one fund manager. While there have been some “genuine bright spots”, sceptics say that the sell-off has “exposed the true face of an economy” that is still rife with “zombie” businesses, bad management and wasted capital. “Far too many companies” in Tokyo “should not be listed at all.”

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Should you buy Japanese equities?

A 20.3% stock plunge over three days marks Japan’s worst performance in data going back to 1973, says Jeff Weniger of WisdomTree. But the crash might spell opportunity. After previous big drops in Japan, the median subsequent 12-month return was 10.9% and the average was 14.6%. The $1.1 trillion drawdown in Tokyo has wiped “some of the froth” off a market that was becoming overheated, say Hideyuki Sano and Aya Wagatsuma on Bloomberg. Valuations look reasonable again, with the Topix on a forecast 13 times earnings, compared with 20 times for America’s S&P 500. The sell-off was triggered by a rate hike from Japan’s central bank, but the bankers – scared by the market’s fragility – now say that they won’t tighten too quickly, cutting the risk of a repeat performance.

The era of a weak yen propelling banks, insurers, carmakers and tech to the forefront of the Topix is drawing to a close, says James Salter of Zennor Japan Fund. These trades unwound quickly last week after becoming “overcrowded” with foreign cash. “It will take a little time for the market to adjust,” but a stronger yen doesn’t kill the case for Japanese equities. Instead, the baton will now pass to smaller, more domestically oriented stocks that are enjoying the fruits of a “corporate governance revolution”. For investors, the Tokyo crash could ultimately mean “lower prices and better valuations”.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems