Profit from other investors’ trades with CME Group

CME Group is one of the world’s largest exchanges, which gives it a significant competitive advantage

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

At the heart of the global financial markets are the exchanges, such as the London Stock Exchange, the New York Stock Exchange, and the Nasdaq. The function they fulfil in the market is straightforward, yet vital. Exchanges match buyers and sellers and publish the data on the trades. They’re also responsible for bringing assets to market, which can range from shares in public companies to contracts on commodities and interest rates. Most exchanges don’t own the companies that are listed – they only facilitate buying and selling by market participants and take a cut for the privilege.

The CME Group (Nasdaq: CME) is a little different. It is the largest futures and options exchange in the world and, unlike other exchanges, it owns the futures contracts traded on its platforms. These range from the E-Mini S&P 500 contract to interest-rate futures, crude oil, cattle and even bitcoin. For example, more than one million contracts of WTI oil futures and options trade daily, with approximately four million contracts of open interest on the exchange. In this case, one contract is equivalent to 1,000 barrels of oil. The most liquid contract on the exchange, and indeed in the world, is the Three-Month SOFR Futures contract, used for hedging interest-rate exposure.

CME Group has long-term potential

The CME Group’s edge lies in its market position. Liquidity begets liquidity – the more traders there are in the market, the easier and cheaper it is to buy and sell. Along with the advantage of scale, the CME Group’s position in the market for debt futures means it’s well-positioned to capitalise on ballooning government deficits around the world.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Where the company lacks exposure, however, is in the equity futures market. Of all the major exchanges, it has one of the lowest levels of exposure to equity markets. Overall, 18% of revenue in 2024 came from equity contracts, compared with 27% for interest rates, 13% for energy and 10% for agricultural commodities.

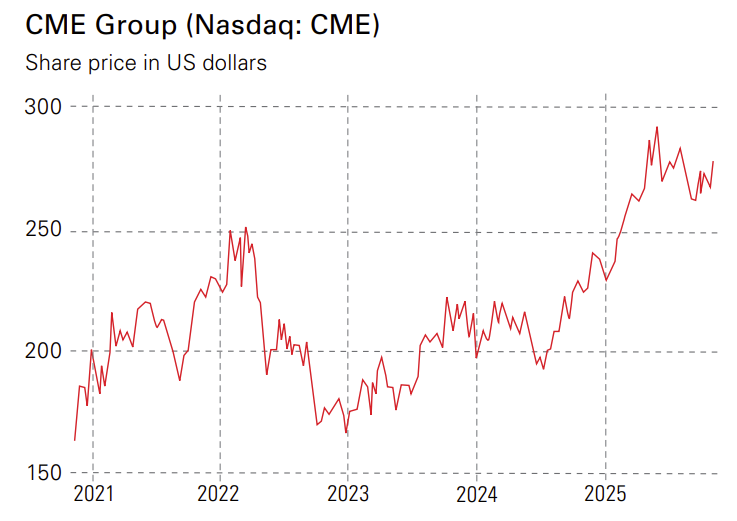

The company’s growth over the past five years provides a good indication of its long-term potential. The number of contracts traded across its platforms has jumped from around 18 million a day on average in the first quarter of 2019 to around 30 million. Meanwhile, the revenue per contract has steadily increased. In equities, revenue per contract is expected to rise from $0.529 in 2022 to $0.635 in 2026, according to UBS’s estimates. The overall group average revenue per contract is expected to have risen from $0.643 to $0.689 by 2026.

That might not seem like much on a contract-by-contract basis, but when CME facilitates the trade of 30 million contracts a day, revenue of $0.689 per deal adds up. The group’s Ebitda margin has risen from 67.4% to 70.3% since 2022.

Trading is just part of its offering. CME Group also sells market data. This is becoming an increasingly important part of all global exchanges. LSEG, which owns the London Stock Exchange, generates only 3% of its revenue from trading. A total of 12% of the CME Group’s revenue comes from the sale of data, which is generally far more profitable than trading activity. In the third quarter, CME’s revenue from market data reached a record high, up 14% due to expanding demand, particularly in the Asia-Pacific and Europe, the Middle East, and Africa regions.

CME Group expansion

Steady, but profitable growth has been the name of the game for CME. However, it’s now capitalising on two trends to accelerate expansion. The first is crypto. The group has launched a range of crypto contracts and in the third quarter it facilitated the trading of 340,000 contracts per day, up by more than 225% year-on-year. The group plans to accelerate this growth with the introduction of 24-hour trading.

The second is increased trading in the retail sector. Retail investors have surged into the US futures and options markets since the pandemic, aided by trading apps and easy leverage. Management is leaning into this expanding market. It recently signed an agreement with sports-betting platform FanDuel, which will provide access to approximately 13 million potential new retail accounts.

The exchange has also launched products to facilitate trading in smaller volumes, such as one-ounce gold futures as well as more flexible products, such as weekly agricultural options. As well as these levers, the group is also a leader in AI and machine learning. It’s been using AI to launch new products and reduce settlement and trading times, as well as administration.

CME Group's income kicker

With multiple routes to growth over the coming years, CME Group has all the hallmarks of a growth play. But unusually for US growth stocks, it also has an income kicker. The group pays a regular dividend, supplemented by special dividends. Last year, it paid out $10.80 per share and this year it’s paid out four regular quarterly dividends totalling $5 per share, with the final special dividend yet to be announced (last year, the final payout was $5.80). It’s not inconceivable that the total dividend in 2025 could exceed $11 per share, a yield of 4%. With net cash on the balance sheet (net of regulatory assets) and an Ebitda ratio in the 70s, CME has the capacity to maintain this payout.

Based on the current growth trajectory, analysts at UBS have the stock trading at about 19 times 2029 earnings. That’s not demanding at all for a business that’s consistently registered steady, high-margin growth and has a record of returning cash to investors. CME appears to be an attractive hedge against market volatility and uncertainty with an added growth bonus in the form of its exposure to crypto contracts.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is the former deputy digital editor of MoneyWeek. He's an active investor and has always been fascinated by the world of business and investing. His style has been heavily influenced by US investors Warren Buffett and Philip Carret. He is always looking for high-quality growth opportunities trading at a reasonable price, preferring cash generative businesses with strong balance sheets over blue-sky growth stocks.

Rupert has written for many UK and international publications including the Motley Fool, Gurufocus and ValueWalk, aimed at a range of readers; from the first timers to experienced high-net-worth individuals. Rupert has also founded and managed several businesses, including the New York-based hedge fund newsletter, Hidden Value Stocks. He has written over 20 ebooks and appeared as an expert commentator on the BBC World Service.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?