Gamble of the week: A punt on Californian water

This US-listed small-cap stock owns plenty of California farmland, says Phil Oakley. But it's what lies underneath that makes this share a punt.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The smaller end of the stock market is stuffed with companies that make no money today, but have the potential to make lots of it at some time in the future if something good happens. Quite often, though, the profits never arrive and investors lose all their money.

These types of companies and their shares are very high risk. Normally, I wouldn't go near them, but as long as you are not investing your life savings, they can be a lot of fun.

However, shares in Nasdaq-listed stock have piqued my interest due to the fact that successful London-based hedge-fund manager Crispin Odey has just revealed that he owns 10.7% of the company. So what does he see in the stock?

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

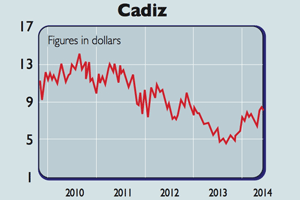

Cadiz (Nasdaq: CDZI)owns 45,000 acres of land in San Bernardino county in California. About 10,000 acres is allocated to farming, where it grows crops such as lemons, grapes and seasonal vegetables.

But it's the other 35,000 acres wherethe potential for Cadiz shares lies.California is short of water and prices have been rising strongly. Underneath Cadiz's land are billions of gallons of water from aquifers that are topped up every year with rain and melting snow.

In order to exploit these, it plans to build a 43-mile pipeline and use an old 96-mile gas pipeline to connect its supplies to the Californian water grid.

If it gets planning permission to do this which will hopefully be settled in the next year then Cadiz could be awarded a 50-year contract to supply water into California with annual price increases of 5%.

That is higher than Cadiz's current stock exchangevalue at $8.28 per share of$233m ($133m market value, plus $100mof debt). And there could be extra valueto come on top of the potential supplycontract, from storing water and fromsurplus land and properties.

But the fact that the project has not beengiven the go-ahead yet makes Cadizshares risky. What's more, if approvalis granted, the firm might need to raisemore cash to build it, potentially dilutingexisting shareholders.

Cadiz also has $100m of debt, of which$54m can be converted into sharesat a price of just over $8. This has thepotential to increase the shares in issueby nearly 60%. That said, even allowingfor all these extra shares, it looks like theshare price could double from here if theproject comes off.

Verdict: a speculative punt

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?