Retreat from risk: buy stocks with moats

A moat represents a castle’s first line of defence against intruders. An ‘economic moat’ does the same thing for a company – and it’s a critical feature to look for before you invest in any stock, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

A moat represents a castle's first line of defence against intruders. The bigger and deeper it is, the better. An economic moat' does the same thing for a company and it's an absolutely critical feature to look out for before you invest in any stock. An economic moat gives companies staying power. As we'll discuss in a moment, the moat can come in a wide range of guises from a brand, to a patent, to regulatory constraints but in essence, it's any aspect of the business that allows it to keep making money, and stops other firms from stealing its customers.

Companies with economic moats are highly sought after. They are central to the success of US investor Warren Buffett, for example. According to Buffett, buying companies with moats is a great way to reduce your risk as an investor. That's because if a company's advantages have allowed it to make good money in the past, it will probably have a decent chance of continuing to do so in the future.

By buying these businesses at the right time, and then holding on for a long period of time, the investor can compound the high returns the company makes, and potentially become very rich. That's why Buffett invested lots of money in big companies such as drinks giant Coca-Cola, consumer goods group Gillette and credit-card firm American Express.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

How to find a company with a moat

return on capital employed (ROCE)

All else being equal, that will erode returns over time. So if a company has maintained a high ROCE for a long while say ten years or more that suggests it could have a moat that offers a strong defence against rivals.

But it's not just about the numbers you also need to understand what lies behind them. Why does the moat exist? And can you continue to rely on it? One common form of moat is that the company sells branded products. Brands are a symbol of quality that customers identify with. They will often stay loyal to a brand and pay a premium for it because they trust it. Brands can take years to build up and can be defended with large advertising budgets that a prospective rival may struggle to match.

Related to brands are products that are habit-forming, such as tobacco or alcoholic drinks products that consumers feel compelled to buy.

Another example is products that are deeply entrenched within a business, such as Microsoft Office software. Here, users are loath to change their habits because of the cost and hassle of doing so, which means a lot of repeat business for sellers.

Patents are another example of a solid economic moat. These protect products such as prescription drugs or technologies from competition, which is why pharmaceutical companies have hadvery high returns in the past. Just bear in mind that patents do not last forever.And they are not much use if a better product comes along.

You should also look for companies that have cost advantages. The sheer size of a company can give rise to what is known as economies of scale'. This means they can spread the cost of making something over lots of units, which means they can make things more cheaply than smaller competitors. They may also be able to buy goods and services cheaper as their size allows them to obtain bigger discounts.

One thing that shouldn't be seen as a moat is company management a moat usually comes from a company's assets and products. Good management matters, there's no denying it. But US investor Peter Lynch offered some good advice when he said: "invest in a business that any idiot could run because some day one will".

When to buy moat companies

So you have to be patient. Build a watch listand only buy these companies after theyhave suffered a temporary setback, or when the overall stockmarket is crashing. I've listedthe details of four promising companies with excellent, durable moats below.

Four companies with deep moats

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Reckitt shares are undervalued

Reckitt shares are undervaluedTips Reckitt shares have struggled in recent years, but the consumer-goods giant is now getting its act together.

-

Investors should take a closer look at Reckitt as an inflation hedge

Investors should take a closer look at Reckitt as an inflation hedgeAnalysis Consumers are sticking with Reckitt Benckiser despite it passing on higher costs, and the company is expecting further growth. Rupert Hargreaves looks at the latest figures.

-

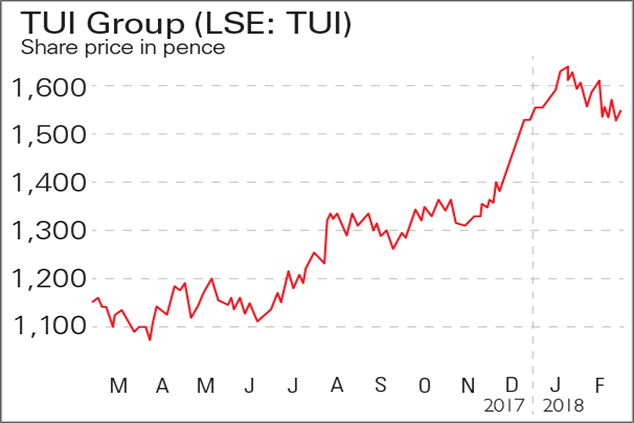

If you’d invested in: TUI Group and BAT

If you’d invested in: TUI Group and BATFeatures Tui revealed an 11.7% rise in annual turnover to €18.5bn, as well as 12% growth in underlying earnings to €1.1bn.

-

Reckitt Benckiser’s clean-up

Reckitt Benckiser’s clean-upFeatures The consumer-goods sector is no longer the cash cow it once was. Reckitt’s revamp will help it buy some growth. Alice Gråhns reports.

-

A new growth formula for Reckitt Benckiser

Features Reckitt Benckiser is bidding for baby milk giant Mead Johnson. Will it pay too high a price? Ben Judge reports.

-

Holding tobacco stocks for income? Neil Woodford is too – but maybe you should both sell

Holding tobacco stocks for income? Neil Woodford is too – but maybe you should both sellMerryn's Blog Tobacco stocks have long provided some of the best and most regular dividend payments around. But, says Merryn Somerset Webb, that may not last much longer.

-

Shares in focus: How our tips have fared this year

Features It's been a tough year for stocks. Phil Oakley looks back over the share tips he made in 2014 to see how they have fared, and what investors should do next.

-

Neil Woodford may be a star fund manager – but he’s wrong about tobacco stocks

Neil Woodford may be a star fund manager – but he’s wrong about tobacco stocksFeatures Star fund manager Neil Woodford recently revealed that of his top ten holdings, three are tobacco stocks. But that doesn't mean you should follow his lead. Ed Bowsher explains why.