Neil Woodford may be a star fund manager – but he’s wrong about tobacco stocks

Star fund manager Neil Woodford recently revealed that of his top ten holdings, three are tobacco stocks. But that doesn't mean you should follow his lead. Ed Bowsher explains why.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Tobacco giant Imperial Tobacco (LSE: IMT) is set to break America.

Currently it has a tiny 3% market share in the US. But following two major deals, that figure could rise to 11%.

Shares in Imperial soared to a record high on Friday as a result.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

However, I'm not tempted to buy Imperial or any other tobacco share.Yes, they've done very well over the last 15 years. But I don't see that performance being repeated in the future. Here's why.

A massive US tobacco deal provides a huge opportunity for Imperial Tobacco

Reynolds American

Lorillard

(NYSE: LO)

So to keep the competition regulators happy, some cigarette brands will probably be sold to Imperial. That will make Imperial a serious player in North America for the first time.

Long-term shareholders will be pleased by the news. Since January 2000, they've seen the company's share price rise by 500%. And once you add in dividends, they've enjoyed a total return of more than 700%. Other tobacco shares have delivered similarly strong performances.

(By the way, calculating those figures was no fun for me. Back in 2000, I was one of the idiots who was still buying tech stocks. I would have done far better with tobacco.)

Tobacco's gains might surprise you. After all, hasn't the cigarette market been in decline since the 1970s? Why have tobacco shareholders done so well?

There are two reasons. Firstly, while tobacco is in decline in the developed world, there has been some growth in emerging markets.

But more importantly, markets were too down' on tobacco in 2000. In hindsight, tobacco was a classic example of a market overshooting' or in this case, undershooting.' Just as markets often rise too high when times are good, so tobacco shares fell too low in the late 1990s. The sad truth is that investors often move in packs, and once a clear trend starts, many investors can't resist following.

Investors were probably right to think that prospects for tobacco in the very long term weren't great. But by 2000, the market was pricing in a much gloomier scenario. Many investors seemed to have forgotten that tobacco is an addictive product an addictive product that would carry on selling for many years to come.

What's more, because share prices had fallen so low, most tobacco shares in the late 1990s and early 2000s were offering sizeable dividend yields, which led to great returns for anyone who bought and held from that point.

The best known tobacco bull of the last 20 years is probably Neil Woodford, the star fund manager who recently launched his own investment business. His long-term record is very good, and much of his success is due to his tobacco investments.

And he hasn't changed his stance. Last week he revealed the ten largest holdings in his new High Income fund. Sure enough, there are three tobacco stocks on the list. British American Tobacco (LSE: BATS) comprises 6.2% of the new fund, Imperial 5.31%, and Reynolds American 3.55%.

Tobacco stocks aren't the bargains they once were

You see, tobacco is no longer an unfashionable sector, and that means that valuations are no longer cheap. Imperial is trading on a historic price/earnings ratio (p/e)of 16, and the dividend yieldis 4%. That doesn't look too bad at first glance, but remember that tobacco is a declining industry. Philip Morris (NYSE: PM), which sells tobacco around the world, reported a 4.4% year-on-year fall in cigarette shipments in the first quarter of this year.

What's more, Imperial Tobacco is carrying quite a lot of debt. Its net gearingis 236%. Granted, Imperial has fairly predictable cashflows, so it can cope with that level of debt, but it doesn't help the valuation case.

It's a similar story with British American Tobacco. It's on a p/e of 17, and its dividend yield is 4%. Not horrendous, but not great for a declining industry. And don't be under any illusions this most definitely is an industry in decline.

The health message will inevitably sink in, even in emerging markets soon. And don't place too much faith in e-cigarettes either. Sure, electronic cigarettes will become more popular. But they're only going to appeal to existing smokers who are trying to wean themselves off tobacco. E-cigarettes may slow the decline of the big tobacco companies, but that's all they can do. They're not a brand new growth market.

Of course, I could be wrong on this. And if you'd prefer to follow Woodford's strategy rather than mine, I'd understand. But I really don't see a compelling buy case here.

That said, where I do agree with Woodford is pharmaceuticals. Woodford has three drugs companies in his new fund's top ten, and that seems like a smart move. The difference between tobacco and pharmaceuticals is that the pharma sector has real growth potential. That's why I'm happy to hold shares in GlaxoSmithKline (LSE: GSK), and I may well buy more pharma shares in future.

Our recommended articles for today

For big income, look off the beaten track

Has the bell rung on the Dow Jones index?

On this day in history

14 July 1791: the Priestley riots' sweep Britain

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ed has been a private investor since the mid-90s and has worked as a financial journalist since 2000. He's been employed by several investment websites including Citywire, breakingviews and The Motley Fool, where he was UK editor.

Ed mainly invests in technology shares, pharmaceuticals and smaller companies. He's also a big fan of investment trusts.

Away from work, Ed is a keen theatre goer and loves all things Canadian.

Follow Ed on Twitter

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Imperial Brands has an 8.3% dividend yield – but what’s the catch?

Imperial Brands has an 8.3% dividend yield – but what’s the catch?Tips With an impressive dividend yield of 8.3%, Imperial Brands looks to be one of the most attractive income stocks in the FTSE 100 . But investors should beware, says Rupert Hargreaves. Imperial’s stock looks cheap – but there are good reasons for that.

-

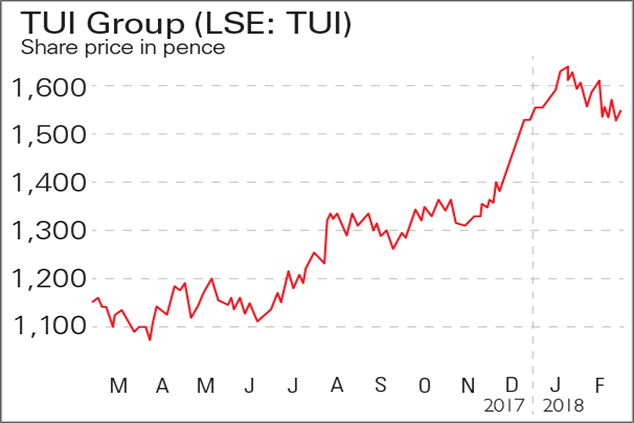

If you’d invested in: TUI Group and BAT

If you’d invested in: TUI Group and BATFeatures Tui revealed an 11.7% rise in annual turnover to €18.5bn, as well as 12% growth in underlying earnings to €1.1bn.

-

Holding tobacco stocks for income? Neil Woodford is too – but maybe you should both sell

Holding tobacco stocks for income? Neil Woodford is too – but maybe you should both sellMerryn's Blog Tobacco stocks have long provided some of the best and most regular dividend payments around. But, says Merryn Somerset Webb, that may not last much longer.

-

Shares in focus: How our tips have fared this year

Features It's been a tough year for stocks. Phil Oakley looks back over the share tips he made in 2014 to see how they have fared, and what investors should do next.

-

Shares in focus: Imperial Tobacco – a safe haven in a rocky market

Shares in focus: Imperial Tobacco – a safe haven in a rocky marketFeatures Imperial Tobacco is defying the sceptics, so is it worth paying up for the shares? Phil Oakley investigates.

-

US tobacco giants merge

News Reynolds and Lorillard, America's second and third-biggest tobacco companies, have agreed to merge.

-

Retreat from risk: buy stocks with moats

Features A moat represents a castle’s first line of defence against intruders. An ‘economic moat’ does the same thing for a company – and it’s a critical feature to look for before you invest in any stock, says Phil Oakley.

-

Shares in focus: Tobacco stocks have life in them yet

Shares in focus: Tobacco stocks have life in them yetFeatures Doom mongers have been predicting the death of the tobacco industry for a while now, says Phil Oakley. But this tobacco company is still in great shape.