Shares in focus: Tobacco stocks have life in them yet

Doom mongers have been predicting the death of the tobacco industry for a while now, says Phil Oakley. But this tobacco company is still in great shape.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

News of the death of big tobacco firms has been exaggerated, says Phil Oakley.

Up until quite recently, shares in British American Tobacco (BATS) have proved to be a very good long-term investment. BATS has been able to grow nicely, despite governments around the world trying very hard to discourage people from smoking.

A strategy based around premium cigarette brands, buying other companies and cutting lots of costs turbocharged profits, dividends and the share price over the last decade.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Now life seems to be getting a little tougher for BATS and the tobacco industry in general. Governments are still looking for their pound of flesh, while changes in smoking habits such as e-cigarettes have created fresh threats to their business models.

Investors have become more nervous about the company's prospects and BATS's shares have gone nowhere for the past year.

Calling the death of the big tobacco companies is nothing new. But could the doomsters be right this time? Or is BATS an unloved bargain?

The rise of the e-cigarette

Now some analysts are worried that the introduction of e-cigarettes will decimate the tobacco industry, particularly in Western markets. While the market for e-cigarettes is at a very early stage and makes up less than 1% of the total number of cigarettes smoked worldwide, it's growing quickly.

E-cigarettes don't contain tobacco, but are based on inhaling nicotine vapours (instead of smoking, you vape'). They are not subject to tobacco duty and are therefore much cheaper than traditional cigarettes and are also marketed as a healthier alternative.

How much cheaper e-cigarettes are is a matter of debate, as it depends on how people smoke (how many puffs they get out of each cigarette). Research by the Electronic Cigarette Quality Organisation reckons on an average of nine puffs per cigarette, compared with 300 puffs per ml of liquid nicotine. When you crunch the numbers, smoking e-cigarettes can work out at 6p for an equivalent normal cigarette.

The cheapest packet of 20 cigarettes works out at 30p a cigarette, or over 40p for premium brands. Someone smoking 20 a day could save £1,750 per year. You can see why some people are worried for the tobacco companies.

But it might not be that simple. From 2016 e-cigarettes will be regulated as a medicine. Will the small companies selling them be able to cope with the burden and costs of this?

The big tobacco companies have been dealing with regulation for ages and are well placed to cope with it.

They are also developing their own e-cigarettes. BATS has launched one called Vype, but it's difficult to work out whether this will make as much money as normal cigarettes over the long run.

Is there profit in the pipeline?

Taxes on tobacco will keep on going up, which will increase competition from illegal sources. More countries will look to introduce smoking bans in public places.

While there's lots of uncertainty, it's easy to overlook the fact that BATS still has a lot of things going for it. Its strategy of focusing on four premium brands (ones with flavours, or slimmer cigarettes) continues to keep profits growing.

Despite demand for cigarettes falling, tobacco companies retain their tremendous ability to keep on raising prices without too many people switching brands. That's because for years they have been increasing prices at the same time as the government increases taxes, so customers don't really see the full extent of the company's actions.

This keeps profit margins high for now. In fact, BATS remains one of the most profitable businesses out there. Profit margins were 37.4% in 2012 and are still increasing. Return on capital employed (ROCE) is an impressive 30%. The company doesn't have too much debt and is very good at turning profits into surplus cash in order to pay higher dividends.

Should you buy the shares

The fact that there are worries about the future means that BATS's shares have missed out on this rally.

This left the shares looking a bit cheap on just over 13 times this year's expected profits. BATS is expected to announce a dividend increase of 6% for 2013 at the end of next month, with analysts expecting another 5% increase for 2014.

This puts the shares on a prospective dividend yield of nearly 5%, which is not too shabby. After that, I think that a dividend cut is unlikely for the foreseeable future and that dividends can probably still increase in line with inflation for a good while yet.

Verdict: buy for income

British American Tobacco (LSE: BATS)

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

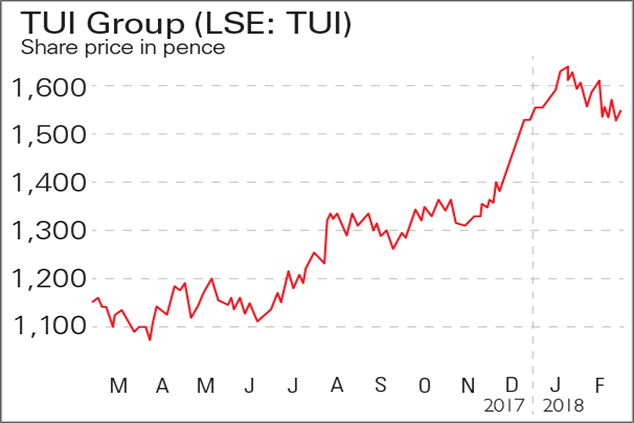

If you’d invested in: TUI Group and BAT

If you’d invested in: TUI Group and BATFeatures Tui revealed an 11.7% rise in annual turnover to €18.5bn, as well as 12% growth in underlying earnings to €1.1bn.

-

Holding tobacco stocks for income? Neil Woodford is too – but maybe you should both sell

Holding tobacco stocks for income? Neil Woodford is too – but maybe you should both sellMerryn's Blog Tobacco stocks have long provided some of the best and most regular dividend payments around. But, says Merryn Somerset Webb, that may not last much longer.

-

Shares in focus: How our tips have fared this year

Features It's been a tough year for stocks. Phil Oakley looks back over the share tips he made in 2014 to see how they have fared, and what investors should do next.

-

Neil Woodford may be a star fund manager – but he’s wrong about tobacco stocks

Neil Woodford may be a star fund manager – but he’s wrong about tobacco stocksFeatures Star fund manager Neil Woodford recently revealed that of his top ten holdings, three are tobacco stocks. But that doesn't mean you should follow his lead. Ed Bowsher explains why.

-

Retreat from risk: buy stocks with moats

Features A moat represents a castle’s first line of defence against intruders. An ‘economic moat’ does the same thing for a company – and it’s a critical feature to look for before you invest in any stock, says Phil Oakley.