If you’d invested in: TUI Group and BAT

Tui revealed an 11.7% rise in annual turnover to €18.5bn, as well as 12% growth in underlying earnings to €1.1bn.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

If only...

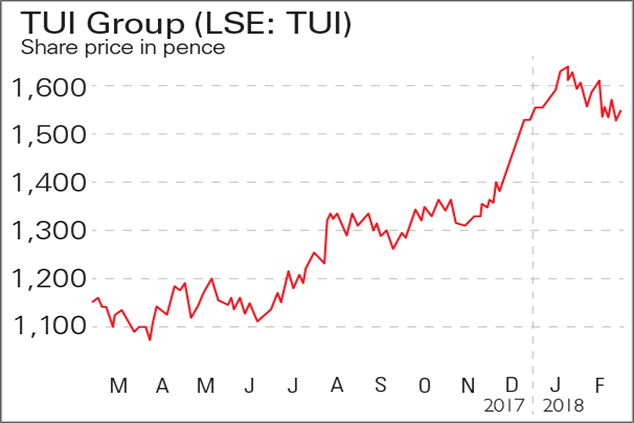

TUI Group (LSE: TUI) operates airlines, travel agencies, cruise ships, resorts and hotels. In December, it revealed an 11.7% rise in annual turnover to €18.5bn, as well as 12% growth in underlying earnings to €1.1bn. The figures were driven by its new strategy of owning hotels and cruise ships.

Last month, it announced turnover in its first quarter to 13 December had risen to €3.5bn, from €3.2bn the year before. It also noted that it had sold 35% of holidays for this summer already, with revenues up 8% and bookings up 6%. TUI expects at least 10% earnings growth in the year to September 2018.

Be glad you didn't...

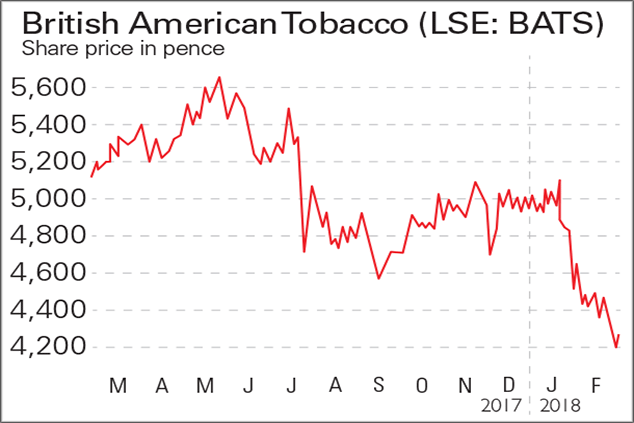

British American Tobacco (LSE: BATS) is the largest listed tobacco company in the world with operations in 180 countries. Its share price has fallen by roughly 18% in the last year, as uncertainty surrounding the US tobacco industry has caused investor sentiment to decline.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Its shares plunged in July last year, after the US Food and Drug Administration revealed plans to cut nicotine levels in cigarettes to "non-addictive levels". The firm recently increased its exposure to the US following its $49bn acquisition of Reynolds. Meanwhile, its operating profit increased by 3.7% to £5.68bn in 2017.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

Holding tobacco stocks for income? Neil Woodford is too – but maybe you should both sell

Holding tobacco stocks for income? Neil Woodford is too – but maybe you should both sellMerryn's Blog Tobacco stocks have long provided some of the best and most regular dividend payments around. But, says Merryn Somerset Webb, that may not last much longer.

-

Shares in focus: How our tips have fared this year

Features It's been a tough year for stocks. Phil Oakley looks back over the share tips he made in 2014 to see how they have fared, and what investors should do next.

-

Neil Woodford may be a star fund manager – but he’s wrong about tobacco stocks

Neil Woodford may be a star fund manager – but he’s wrong about tobacco stocksFeatures Star fund manager Neil Woodford recently revealed that of his top ten holdings, three are tobacco stocks. But that doesn't mean you should follow his lead. Ed Bowsher explains why.

-

Retreat from risk: buy stocks with moats

Features A moat represents a castle’s first line of defence against intruders. An ‘economic moat’ does the same thing for a company – and it’s a critical feature to look for before you invest in any stock, says Phil Oakley.

-

Shares in focus: Tobacco stocks have life in them yet

Shares in focus: Tobacco stocks have life in them yetFeatures Doom mongers have been predicting the death of the tobacco industry for a while now, says Phil Oakley. But this tobacco company is still in great shape.