Card Factory is a stand-out small-cap going cheap

In a digital world, we still value the personal touch. That’s good news for Card Factory, whose unique business model is suited to weather all economic storms

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In an era where digital communication dominates, the enduring appeal of a handwritten card might seem quaint. Yet, for Card Factory (LSE: CARD), the UK’s leading specialist retailer of greeting cards, gifts and celebration essentials, this personal touch is the cornerstone of a surprisingly resilient business. Despite the rise of online cards, enough customers still value the sentiment of a physical card to keep Card Factory’s model relevant. Combine this with low-priced products, a repeatable purchase cycle and a remarkable recovery from the pandemic, and you have a company that’s not only surviving but flourishing.

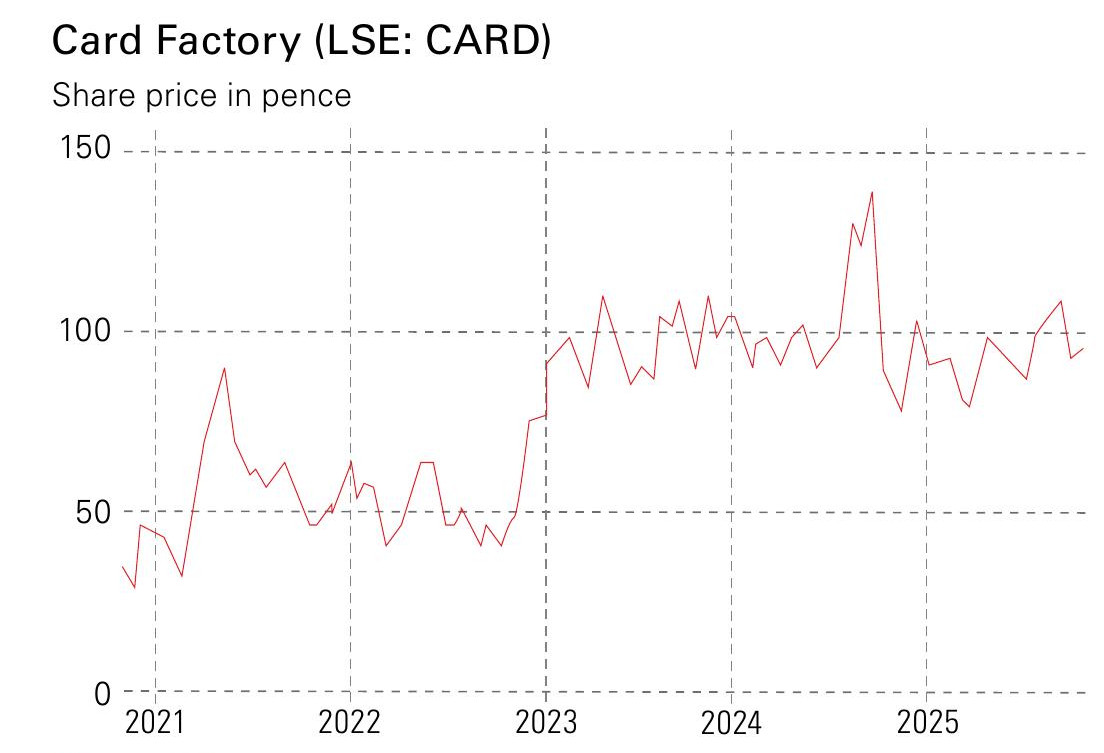

Despite these qualities, the shares look good value too; trading on a price-earnings (p/e) ratio of less than seven – a standout bargain even among the UK’s undervalued small-cap stocks. For investors, this could be a rare chance to buy into a business with solid fundamentals and decent growth prospects at a deeply discounted price.

Card Factory is a high-street mainstay

Founded in 1997 by a Yorkshire entrepreneur as a market stall, Card Factory has grown into a high-street mainstay, with more than 1,000 stores across the UK and Ireland. It also operates an online platform, which competes with Moonpig and Funky Pigeon. Its core offering of affordable greeting cards, balloons and party supplies taps into a cultural habit that shows no sign of fading. While online platforms such as Moonpig have gained traction, particularly during the Covid lockdowns, Card Factory’s success hinges on the fact that many consumers still prefer choosing and sending a physical card. A handwritten note for a birthday, anniversary or condolence carries an emotional weight that an online printed card does not.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This preference is reflected in the numbers. The UK greeting-card market, while slow-growing, remains stable. Card Factory’s value proposition – offering cards starting at under £1 and gifts priced to suit tight budgets – ensures it captures a significant share of the market. Its vertically integrated model, with in-house design, printing and warehousing, keeps costs low and margins healthy.

Card Factory’s business model is uniquely suited to weather economic storms. Its low-price goods are affordable even when household budgets are squeezed. The repeatable nature of its products, tied to recurring occasions such as birthdays, Mother’s Day and Christmas, ensures steady demand regardless of the economic climate. Unlike discretionary retailers selling big-ticket items, Card Factory benefits from consumers’ reluctance to skip small, sentimental purchases, even during downturns. This resilience was evident in the firm’s performance during recent economic challenges.

While rising energy costs, freight inflation and National Living Wage increases have pressured margins, Card Factory has offset these through targeted price increases and tight cost control.

Card Factory's remarkable dividends

The only time Card Factory genuinely faltered was during the Covid pandemic, when high-street footfall plummeted. The company took a brutal hit. Dividends have been a hallmark of Card Factory’s shareholder-friendly policy since its 2014 flotation, but they were suspended during the pandemic.

The recovery coincided with a return to normality. By 2023, sales had surpassed pre-pandemic levels. Store transaction volumes, while still below pre-pandemic levels, have rebounded strongly, driven by high-street footfall and click-and-collect services. Online sales, although slightly down post-reopening, remain significantly ahead of pre-pandemic figures, reflecting a lasting shift in consumers’ behaviour. Most tellingly, Card Factory reinstated its dividend in 2024, declaring an interim payout for the first time in five years, a clear signal of confidence in its cash flow and long-term outlook.

Despite this turnaround, Card Factory’s shares remain extraordinarily cheap for a business with stable revenues and reinstated dividends. Even in a UK market brimming with undervalued small-cap stocks this valuation stands out and, with a high dividend pay-out, investors earn a return even while waiting for the market to wake up to the potential.

Card Factory’s growth prospects add to its appeal. The firm is expanding, with new openings planned, and it is enhancing its online platform. A recent $25 million acquisition of Garven, a US-based card retailer, signals ambition to tap the potentially lucrative US market, although investors are watching closely for its financial impact. Partnerships, such as with Aldi, and a focus on higher-ticket items such as balloons and party supplies, are expected to drive revenue growth of 5%-7% annually over the next few years.

No investment is without risks. Card Factory’s reliance on physical stores makes it vulnerable to shifts in consumers’ behaviour.

Inflationary pressures, especially in freight and labour, could continue to squeeze margins, and the company’s debt pile, while manageable, requires careful monitoring. Yet these risks seem more than priced into the current valuation. With a strong cash flow and a diversified revenue stream, Card Factory is well-positioned to navigate challenges. Its ability to outperform competitors in key trading periods, such as Valentine’s Day, underscores its market strength.

Card Factory may not be glamorous, but its resilience makes it a compelling opportunity. Its recovery from the pandemic has been robust, with revenues above pre-pandemic levels and dividends back on the table. Trading at a historically low valuation, with decent forecast growth, the shares are a bargain in a market full of cheap stocks.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jamie is an analyst and former fund manager. He writes about companies for MoneyWeek and consults on investments to professional investors.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China