Profit from a return to the office with Workspace

Workspace is an unloved play on the real estate investment trust sector as demand for flexible office space rises

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Listed real estate investment trusts (REITs) are starting to get their mojo back. Nowhere is this more apparent than in the office sector. In the immediate years following the pandemic, office values across the UK struggled as investors tried to grapple with the future of work and the implications for office buildings. However, over the past 24 months, the return to offices has accelerated and supply is struggling to keep pace with demand.

Total returns – ie, including rents and valuation – for the UK office sector were 2.7% in 2024, according to real-estate firm CBRE. That lags the overall return for UK commercial property at 7.7%, but there are growing signs of momentum. Take-up of office space across the UK reached 20.3 million square feet in the second quarter of 2025, the highest rolling 12-month level since the third quarter of 2022.

Market dynamics suggest some level of hoarding. Between 2019 and 2024, the number of people employed in office jobs is estimated to have increased by 2.4%, while occupied office space has decreased by 1.3%. Space per person has fallen by around 20%. To restore office space to 2019 levels, companies in London would have to acquire 39 million sq ft more space, reckons CBRE.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

To put that into perspective, 1 Undershaft – currently the largest office tower under construction in the City of London – will provide just 1.7 million sq ft of office space across 73 floors.

The lack of space, coupled with a growing desire for remote working, means there’s a rising demand for flexible workspaces. Demand for this space has surpassed pre-Covid levels by more than 200%, according to Savills. This market was dominated by the likes of Regus (part of IWG) until WeWork disrupted the market. WeWork’s model failed, but it’s left a lasting legacy. A fifth of London’s offices are expected to be co-working sites by as early as 2030, according to CBRE.

Workspace's new strategy is working

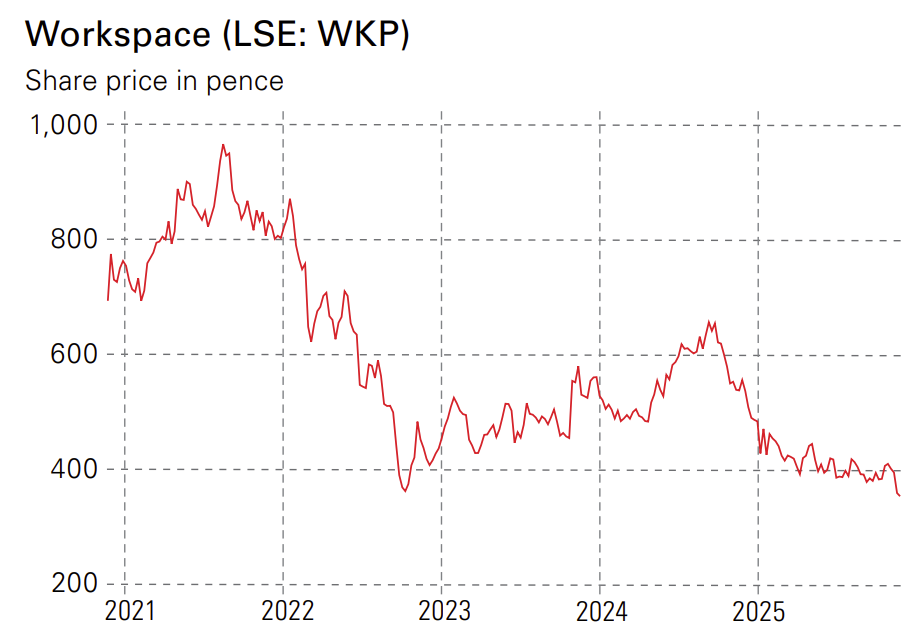

This brings us to Workspace (LSE: WKP), whose portfolio comprises approximately 4.2 million sq ft of flexible work space in more than 60 properties in London and the South East, renting to over 4,000 customers. The group was founded in 1987, grew through acquisitions, and nearly collapsed due to excessive debt during the 2008 financial crisis. However, the near-death experience taught the company a valuable lesson: do not underestimate the value of having unleveraged freehold property (something WeWork overlooked). Workspaces’s loan-to-value (LTV) ratio is around 35% and is projected to fall to 30% by the end of the decade, according to Berenberg.

The share price took a hit last week when it said that uncertainty around the Budget has led businesses to delay leasing decisions – a theme echoed by other REITs – as well as reporting a first-half loss on the basis of falling valuations. Occupancy at the end of September was close to 80%, which is the crunch point for the group. Historically, rents have started to come under pressure at this level.

However, Workspace is now implementing a “fix, accelerate and scale” strategy under Lawrence Hutchings, the new CEO who joined from Capital & Regional in November 2024. The overarching goal of the new strategy is to sell underperforming assets, upgrade existing assets, keep leverage low and return cash to investors. Last quarter, the group completed £52.4 million of disposals against a £200 million target, at an aggregate discount of 1.6% to recorded value. Berenberg forecasts Workspace will have net tangible asset value (NTAV) of 754p per share for the 2026 fiscal year, suggesting the REIT is trading at a near-50% discount to the value of its property given the current share price of 362p.

This appears unwarranted. The fundamentals of the office market, particularly in and around London, remain robust, and Workspace has laid out a clear strategy to unlock value.

Workspace Group debt

Still, one cloud hanging over the group is the cost of debt. REITs are required to distribute 90% of their net property rental income to shareholders to maintain their Reit tax benefits. That can put pressure on cash flow if other costs, such as capital expenditure (capex) and interest charges, rise. More than one Reit has fallen foul of these restrictions in the past and has either been forced to borrow more or sell assets to fill the gap.

Workspace has 82% of its debt on fixed or hedged rates, with the average interest rate on this being 3.3%. However, 75% of Workspace’s fixed-rate debt is set to mature in the next three years. There’s only one other REIT (New River REIT) that has a higher volume of debt maturities over the same period. As debt is likely to be refinanced at higher rates, the cost of financing is expected to increase by nearly 30% by the end of the decade.

Still, rental income growth is expected to offset most of this growth, with interest coverage falling to a low of 2.6 times in 2028 before rising to 2.8 times in 2029. Disposals will cover most of the cost of refurbishing old assets and additional capex, meaning debt shouldn’t increase materially from current levels. So the changes shouldn’t force a material change to the strategy.

That would be good news for Workspace’s dividend. The stock currently yields just shy of 8%, which is one of the most attractive yields in the UK Reit sector. So Workspace has all the hallmarks of a traditional value play. It’s trading at a near 50% discount to the value of its underlying assets, offers a market-beating dividend yield and is suffering from cyclical, not structural headwinds.

There’s little to no financing risk. In the worst-case scenario, the balance sheet is full of freehold property. As the REIT works through its near-term issues, there’s scope for decent upside from current levels. Investors will be paid to wait.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is the former deputy digital editor of MoneyWeek. He's an active investor and has always been fascinated by the world of business and investing. His style has been heavily influenced by US investors Warren Buffett and Philip Carret. He is always looking for high-quality growth opportunities trading at a reasonable price, preferring cash generative businesses with strong balance sheets over blue-sky growth stocks.

Rupert has written for many UK and international publications including the Motley Fool, Gurufocus and ValueWalk, aimed at a range of readers; from the first timers to experienced high-net-worth individuals. Rupert has also founded and managed several businesses, including the New York-based hedge fund newsletter, Hidden Value Stocks. He has written over 20 ebooks and appeared as an expert commentator on the BBC World Service.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems