RTX Corporation is a strong player in a growth market

RTX Corporation’s order backlog means investors can look forward to years of rising profits

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Donald Trump’s desire to acquire Greenland for the US may be an issue now close to resolution, but there are lots of other uncertainties in the world that could affect equity investors – the imposition of further tariffs by the US, a Chinese invasion of Taiwan (more likely now that president Xi Jinping has strengthened his position), war in Iran and further Russian attacks in Europe now that the US is giving Europe and Nato lower priority.

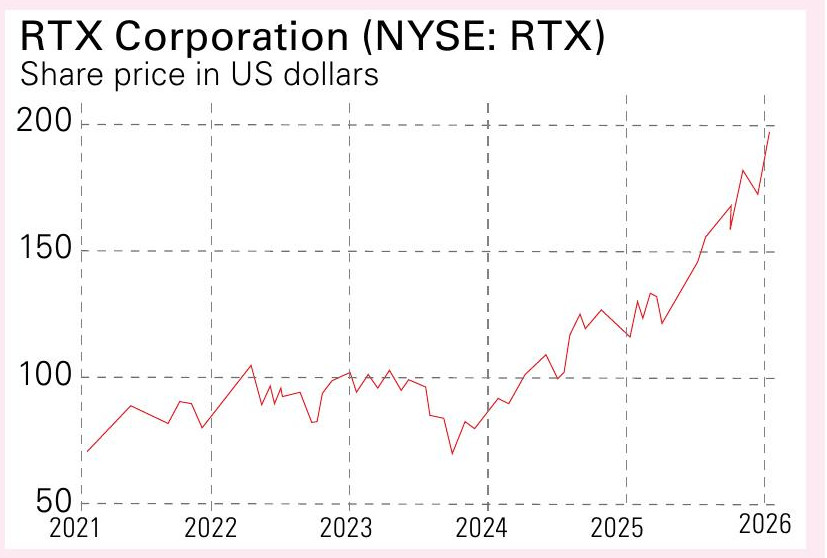

Investors have to weigh the influence of these factors on markets as well as deciding whether AI is in a bubble or is a continuing growth story. Investors are therefore looking for strong companies with substantial market share in predictable and profitable growth markets. A good example is American firm RTX Corporation (NYSE: RTX).

RTX has a market capitalisation of $268billion and operates in both the civilian aerospace sector and defence, where it makes munitions, missile systems, fighter and bomber engines, and aircraft components. These are growth markets. Civilian aerospace is predicted to grow at a compound annual growth rate of 5%-8% or more over the next five years. Defence is also expected to grow strongly as European countries raise defence budgets. Trump also wants the US to raise its defence budget from $900billion in 2026 to $1.5trillion in 2027.

Article continues belowTry 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

RTX is the force behind the F-35

RTX has three divisions of comparable size – Collins Aerospace, Pratt & Whitney, and Raytheon (missiles and munitions). Collins provides products and services for commercial and military aerospace (cockpit and cabin interiors), helicopters, space systems, and airport and air-traffic management systems.

Pratt & Whitney is the second-largest of the three global aero-engine suppliers and provides engines for all types of commercial aircraft, with the major share of regional jet engines. Raytheon makes missiles, Patriot anti-missile systems, “iron dome” protective systems, radars, sensors and high-powered laser systems. The F-35 fifth-generation stealth fighter contains components and systems from all three RTX divisions. Pratt & Whitney provides the engine, Collins provide both the helmet-mounted display and the enhanced power and thermal management system, while Raytheon provides medium-and short-range missiles, smart bombs and laser-guided precision bombs.

RTX’s 2024 turnover was $80.7billion, which represented 11% organic sales growth from 2023, with an order backlog of $218 billion. In the company’s words, this represents “unprecedented demand”. Adjusted sales for the full year of 2025 were projected, in January 2025, to be $83 billion to $84 billion, with adjusted earnings per share (EPS) of $6.00 to $6.15. In the event, the 2025 results announced on 27 January delivered turnover of $88.6billion and adjusted EPS of $6.29 and the shares rose nearly 4%. The adjustments allow for the divestment of a non-core business from Collins. The January 2026 order backlog had increased to $268billion.

RTX’s four drivers of growth

RTX’s product range makes its growth more predictable since it serves both commercial and military customers across three large segments. It has four main growth drivers. The first is its large and expanding backlog, which gives clear visibility of future revenues. And, as production ramps up to reduce the backlog, RTX benefits from scaling up, which cuts costs and, alongside internal efficiency drives, expands margins so earnings grow faster than sales.

Secondly, the commercial aerospace aftermarket is recovering post-Covid. This boosts demand for spare parts, maintenance and retrofit work for Collins and Pratt & Whitney. This aftermarket has higher margins and has been growing recently at double-digit rates. Thirdly, global defence budgets are expanding and driving demand for missile systems, radar and electronic warfare technology. Fourthly, RTX invests heavily in research and development, and this is driving next-generation aircraft propulsion systems, advanced materials and AI data analytics to enhance efficiency.

A look under the bonnet

RTX’s large order backlog and four growth drivers suggest the firm can look forward to several years of profits growing faster than sales.

The 2025 results to the end of December show sales of $88.6billion, operating profit of $10.85 billion, adjusted earnings per share (EPS) of $6.29, free cash flow of $7.9billion and an order backlog of $268billion.

A total of $138billion of new orders were added in 2025. These results show organic growth of 11% for sales and 10% for EPS. The company’s guidance for 2026 is for sales of $92billion to $93billion, EPS of $6.60 to $6.80 and free cash flow of $8.25billion to $8.75billion.

The fourth quarter of the 2025 financial year was exceptional, with sales of $24.2billion, up 14% organically. Pratt & Whitney was the star division, with sales up 25%; this was driven by a 21% rise in commercial aftermarket sales, a 28% rise in commercial original equipment sales and a 30% rise in military sales due to higher production of F-35s.

Growth pointers in the 2025 results include investment in future innovative growth, with $2.63billion in capital expenditure, $7.4billion for research and development and a 20% rise in munitions sales. Munitions include the GEM-T guided tactical missile, the AMRAAM medium-range air-to-air missile and the Coyote small anti-drone missile.

RTX is in the enviable position of having all three divisions growing profitably, with clear growth drivers and an order backlog of three years of sales. At the recent share price of $199.3, the p/e for 2026 is 29.3, falling to 24.2 for 2028. The forward dividend yield is 1.4% and the dividend has been rising since 2021. The shares are up 59.7% over the past year and should continue rising.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.