Profit from MSCI – the backbone of finance

As an index provider, MSCI is a key part of the global financial system. Its shares look cheap

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The world’s first stock market index, the Dow Jones Transportation Average, was created in 1884 by Charles Dow. It consisted of just 11 companies. Dow didn’t know it at the time, but he had created what would later become the backbone of the global investment market.

Dow and other index pioneers set out to make the chaotic movements of Wall Street and the City of London understandable to the average person and today indexes dominate the investment world. Tens of trillions of dollars are benchmarked to key indexes and every quarter investment managers all over the world publish their results and judge themselves against the performance of these vital financial indicators.

As a result, the companies that calculate and administer the most important indexes have become gatekeepers of the global financial markets.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

MSCI is one of three main index providers

There are three main index providers: S&P Dow Jones, FTSE Russell and MSCI. Each index has its own strengths and weaknesses and some are better known than others in key markets. For example, most UK investors are aware of the FTSE 100, managed and owned by FTSE Russell, which itself is owned by the owner of the London Stock Exchange, LSEG. S&P Dow Jones runs the two main US market indexes, the S&P 500 and Dow Jones Industrial Average. MSCI manages the world’s global stock benchmarks.

These companies provide benchmarking data to fund managers. When a company such as BlackRock (iShares) or Vanguard launches a fund, it signs a licensing agreement with the index provider. The index provider then tracks every dollar that flows into that fund to calculate the “licensing fee” they are owed, while providing up-to-date data on changes to the index. The fund managers could do this themselves, but using a third-party removes any conflicts of interest and allows investors to compare performance across different fund providers.

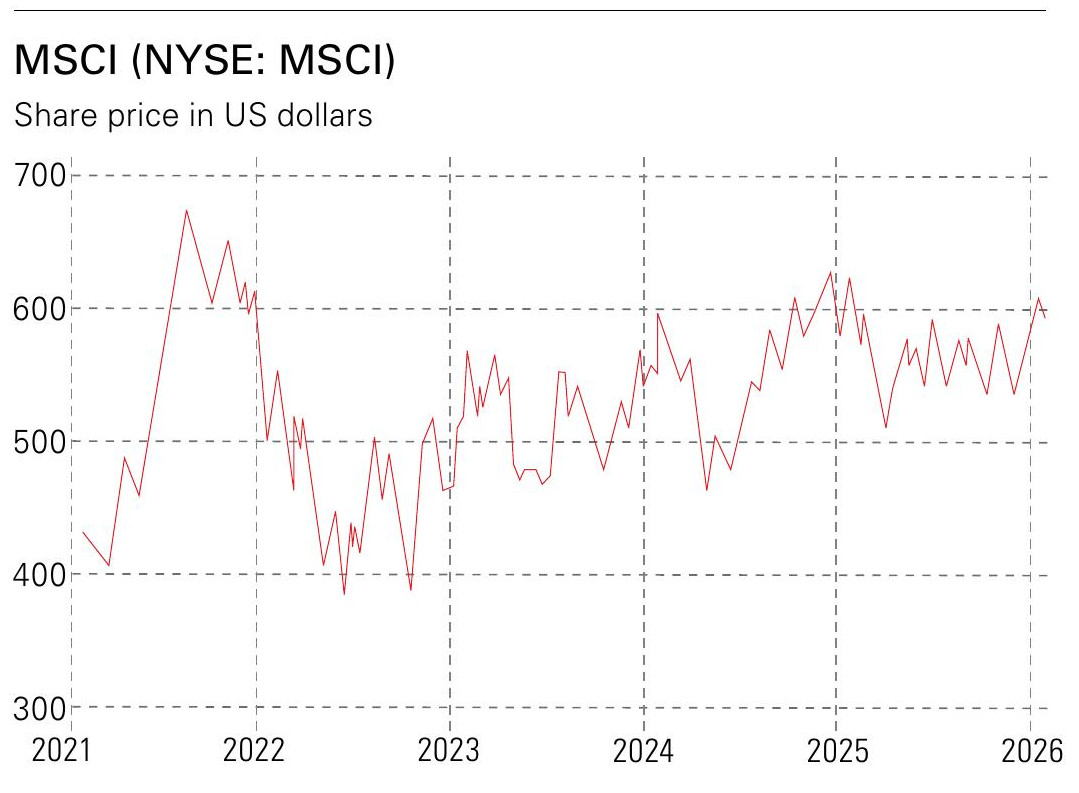

The flagship product of MSCI (NYSE: MSCI) is its MSCI World index, which covers the world’s 23 biggest and most important developed equity markets. The 1,320 constituents account for around 85% of global equity market capitalisation. The size and scale of this index means the company has become one of, if not the most important index provider in the world. According to its latest results, MSCI officially reported about $18.3trillion in total assets benchmarked to its equity indexes. Of that, $12trillion is in indexed (passive) products and $6.3trillion is in actively managed strategies. It also noted a record $2.2trillion specifically in ETFs linked to their indexes.

The scale of the company’s reach means that receiving its approval can be a make-or-break decision for companies and countries. Towards the end of January, shares on Indonesia’s Jakarta Composite index plunged 8% in a single day as MSCI warned that deteriorating liquidity could lead to the country’s removal from its leading developing-markets index.

MSCI is a profit engine

MSCI has four main business segments. Its index business is the flagship division. Revenue is generated through recurring subscriptions and asset-based fees tied to products, such as ETFs and open-ended unit trusts. It also has an analytics business that sells portfolio and risk-management tools. A sustainability division provides data and ratings to help investors address emerging environmental and social risks, which in turn has some overlap with the index division, as these ratings can help managers benchmark against environmental indexes. Finally, there’s the group’s private asset division, which provides performance data for private equity and real-estate managers.

Virtually all of the company’s revenue comes from subscriptions, either fixed-fee or asset-based subscriptions that asset managers essentially have to pay in order to maintain access to MSCI’s data and use its indexes as benchmarks. In many respects, this is a perfect business model. The industry is consolidated across three major players, revenue is recurring and the actual construction and maintenance of indexes has almost zero marginal cost.

In the fourth quarter of 2025, MSCI recorded subscription run-rate growth of 9.4% in its index business, with subscriptions growing 16% year-on-year in the custom index division. Analysts at UBS believe the overall growth rate could return to double digits in 2026, driven by rising demand for global passive trackers and the continued growth of private markets. Asset-based fees, mainly tied to ETFs, rose 21% year-on-year in the fourth quarter, while revenue from private markets rose 7%.

Management is also focused on reducing costs, leveraging AI to speed up processes while benefiting from economies of scale. UBS calculates the company’s Ebitda margin will expand by 170 basis points in fiscal 2026 to 62.5% and a further 60 basis points in the following year to 63.2%. These high margins reflect the fact that the business is a data company with substantial economies of scale, high switching costs for customers and long-term contracts. Indeed, last year the group extended its partnership with BlackRock until 2035.

UBS expects net income of $1.5billion for fiscal 2026, up from $1.3billion in 2025. As the global asset-management industry continues to expand, it could hit $2.4billion by 2030. Despite this growth, MSCI’s shares are trading at only 26 times estimated 2027 earnings, compared with its five-year average of 40 times. It’s also trading one standard deviation below its long-term valuation relative to the wider S&P 500. That seems cheap considering the firm’s global dominance.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is the former deputy digital editor of MoneyWeek. He's an active investor and has always been fascinated by the world of business and investing. His style has been heavily influenced by US investors Warren Buffett and Philip Carret. He is always looking for high-quality growth opportunities trading at a reasonable price, preferring cash generative businesses with strong balance sheets over blue-sky growth stocks.

Rupert has written for many UK and international publications including the Motley Fool, Gurufocus and ValueWalk, aimed at a range of readers; from the first timers to experienced high-net-worth individuals. Rupert has also founded and managed several businesses, including the New York-based hedge fund newsletter, Hidden Value Stocks. He has written over 20 ebooks and appeared as an expert commentator on the BBC World Service.

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

Pensions vs savings accounts: which is better for building wealth?

Pensions vs savings accounts: which is better for building wealth?Savings accounts with inflation-beating interest rates are a safe place to grow your money, but could you get bigger gains by putting your cash into a pension?

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward

-

A niche way to diversify your exposure to the AI boom

A niche way to diversify your exposure to the AI boomThe AI boom is still dominating markets, but specialist strategies can help diversify your risks

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits