Why a copper crunch is looming

Miners are not investing in new copper supply despite rising demand from electrification of the economy, says Cris Sholto Heaton

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

You can’t blame BHP for having another crack at buying Anglo American, but its decision to walk away again so quickly raises big questions. It is widely acknowledged that there is a looming supply shortfall for copper, the metal at the heart both of a putative BHP-Anglo deal and of the much better Anglo-Teck Resources merger that investors prefer. Yet BHP and its peers remain reluctant to put up serious money to solve that.

The copper bull case is simple. The world is using more electricity: it is replacing fossil fuels (eg, electric cars), it is meeting new demand (eg, emerging markets) and – at the margin – it is critical to new technologies (eg, data centres are a small but fast-growing share of consumption).

In total, electricity will grow from 21% of final energy demand now to more than 50% by 2050 in some scenarios, reckons the International Energy Agency. This implies a lot of copper for wires and other components – generators, transmission cables, vehicles, appliances, in buildings, in networks and so on.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Can copper supply keep up with rising demand?

Copper supply is not on track to keep up with this. Total demand will grow by roughly 24% to almost 43 million tonnes per annum (mtpa) by 2035, reckon analysts at Wood Mackenzie. Meeting it will require eight mtpa of new mined supply and 3.5 mtpa of additional scrap supply. There is no shortage of copper reserves around the world to mine, although ore grades have been dropping over the long term (this means more rock must be mined to produce the same amount of metal, pushing up costs). However, there has been a lack of investment in major new mines. Meeting demand will now take over $210 billion in investment, says Wood Mackenzie. This is a huge increase from the $76 billion invested in the past six years, and about half of that came from Chinese miners, which adds a further wrinkle. Securing copper supplies may become a geopolitical imperative.

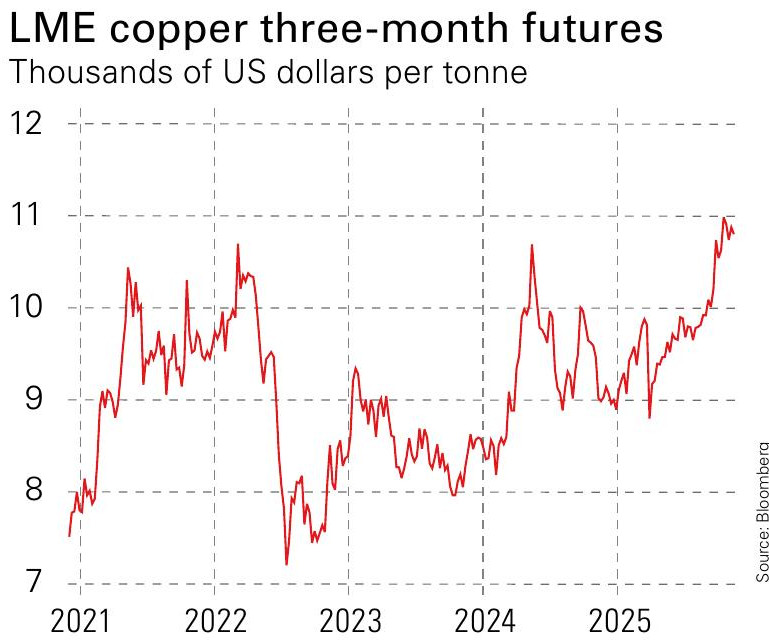

There may already be hints of tightness in the market, with prices reaching record highs. Steady demand growth has combined with supply disruptions at mines in Chile, the Democratic Republic of Congo and Indonesia to create a probable mined supply deficit by next year. However, there are other factors at play as well. The threat of tariffs on refined copper imports pushed US prices to a premium, causing metal to be stockpiled there and shrinking stocks elsewhere in the world. If demand forecasts are correct, the fundamental crunch is yet to come.

Some substitution is possible. Aluminium has lower conductivity and is less durable, but works well for some power applications. Fibre-optic cable has replaced copper for data transmission. More speculatively, carbon nanotubes may eventually offer another alternative. Still, for the most part, copper will be crucial for the foreseeable future. A basket of some of the most pure-play copper miners – eg, Anglo-Teck, Freeport McMoRan, First Quantum Minerals, Antofagasta, Southern Cooper – is one of the most compelling ideas in natural resources.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?